Illinois gas prices show 2nd-highest increase in nation

While Illinois motorists have seen the country’s second-highest increase in gas prices, Chicagoans pay even higher prices at the pump due to multiple layers of city, county and state taxation.

Illinois gas prices have jumped $0.18 in the past week, according to AAA.

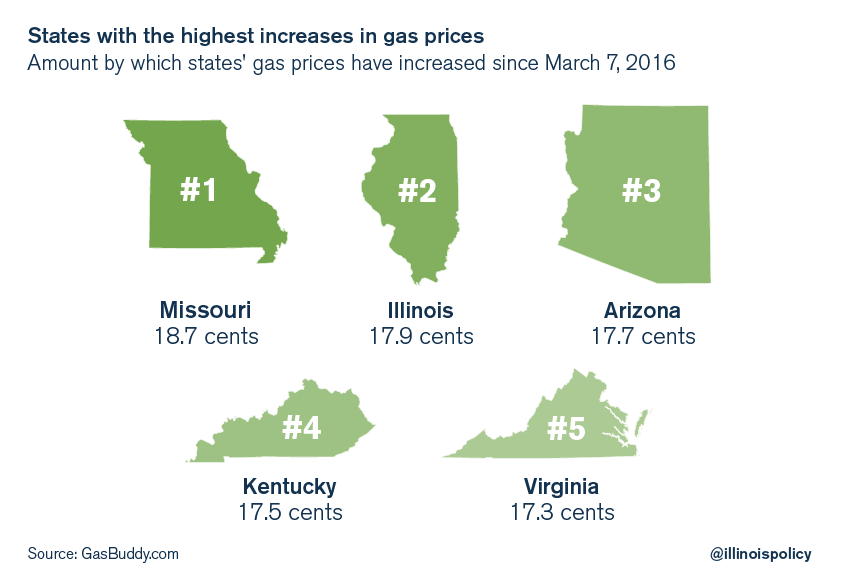

GasBuddy.com, which reports all state prices and increases, also spread the word that March 7-14 saw the biggest spikes of the year in gas prices nationwide. Illinois ranked second among the top five states with the biggest price increases:

GasBuddy.com estimated that prices will continue to increase $0.20-$0.55 across the country, hitting a peak in April or May.

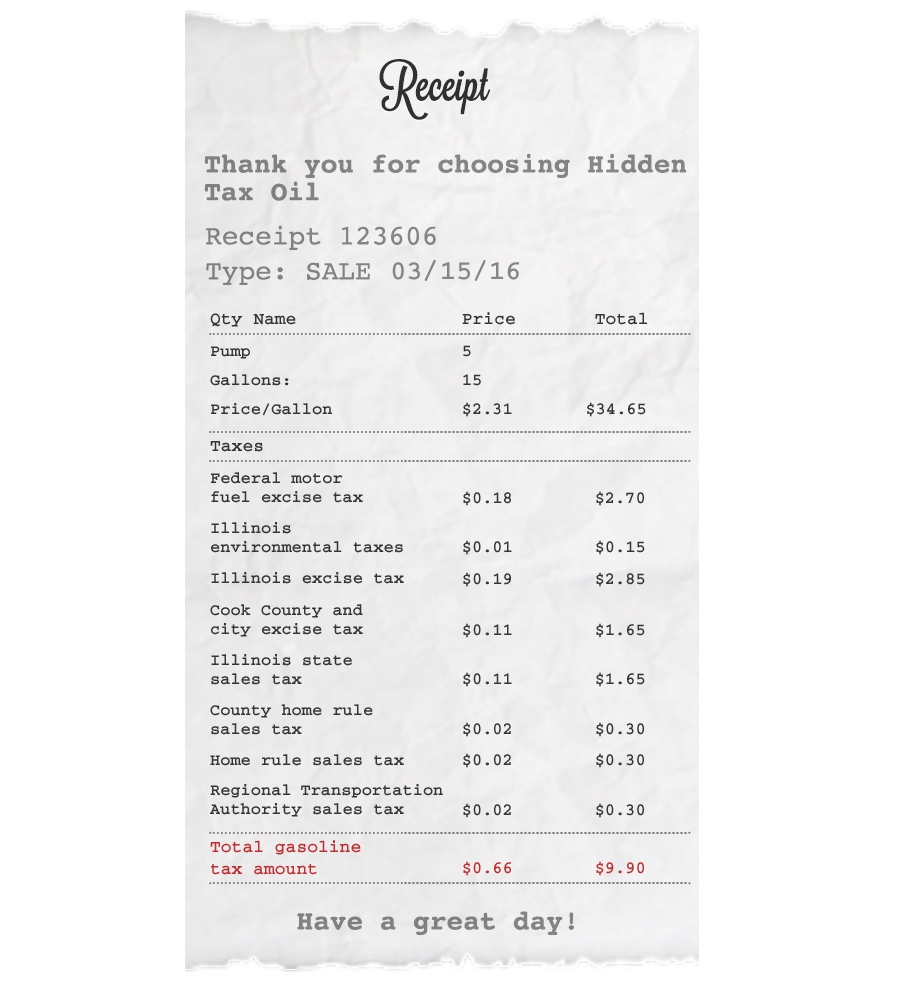

Illinois’ state average price per gallon was $2.06 as of March 15, putting it $0.11 higher than the national average. But that pales in comparison with Chicago, where drivers are paying $2.31 per gallon of gasoline: $1.65 comes from the raw price of gas, and $0.66 comes from local, state and federal taxes. That means Chicago drivers are paying a 40 percent tax rate at the pump.

Of this, only $0.37 comprises federal and state excise taxes. The remaining $0.29 is composed of: Illinois’ 6.25 percent sales tax, the county and city excise tax, an Illinois environmental tax, additional county and other home-rule sales taxes, and a Regional Transportation Authority tax.

Traditional motor fuel taxes are a fixed amount per gallon. These federal and state taxes generally pay for road maintenance and other transportation expenses – motorists in all states pay these taxes. Illinois, however, is one of only a handful of states that tack on additional gas taxes beyond the motor fuel taxes. Most consumers don’t realize that, because these costs don’t show up on their receipts – these taxes are built into the advertised price.

And unlike most states, where gas-tax dollars fund roads and transportation services, the revenue Illinois’ sales taxes generate goes to the state’s General Fund.

Even when drivers across the country see gas prices shoot up at a record clip, Chicagoans will still be worse off – stuck with higher bills thanks to multiple layers of city, county and state taxation.