Illinois’ economy shed 5,200 jobs in August, the first drop in 2018

Illinois experienced net job losses in August, while the rest of the nation saw continued growth on average.

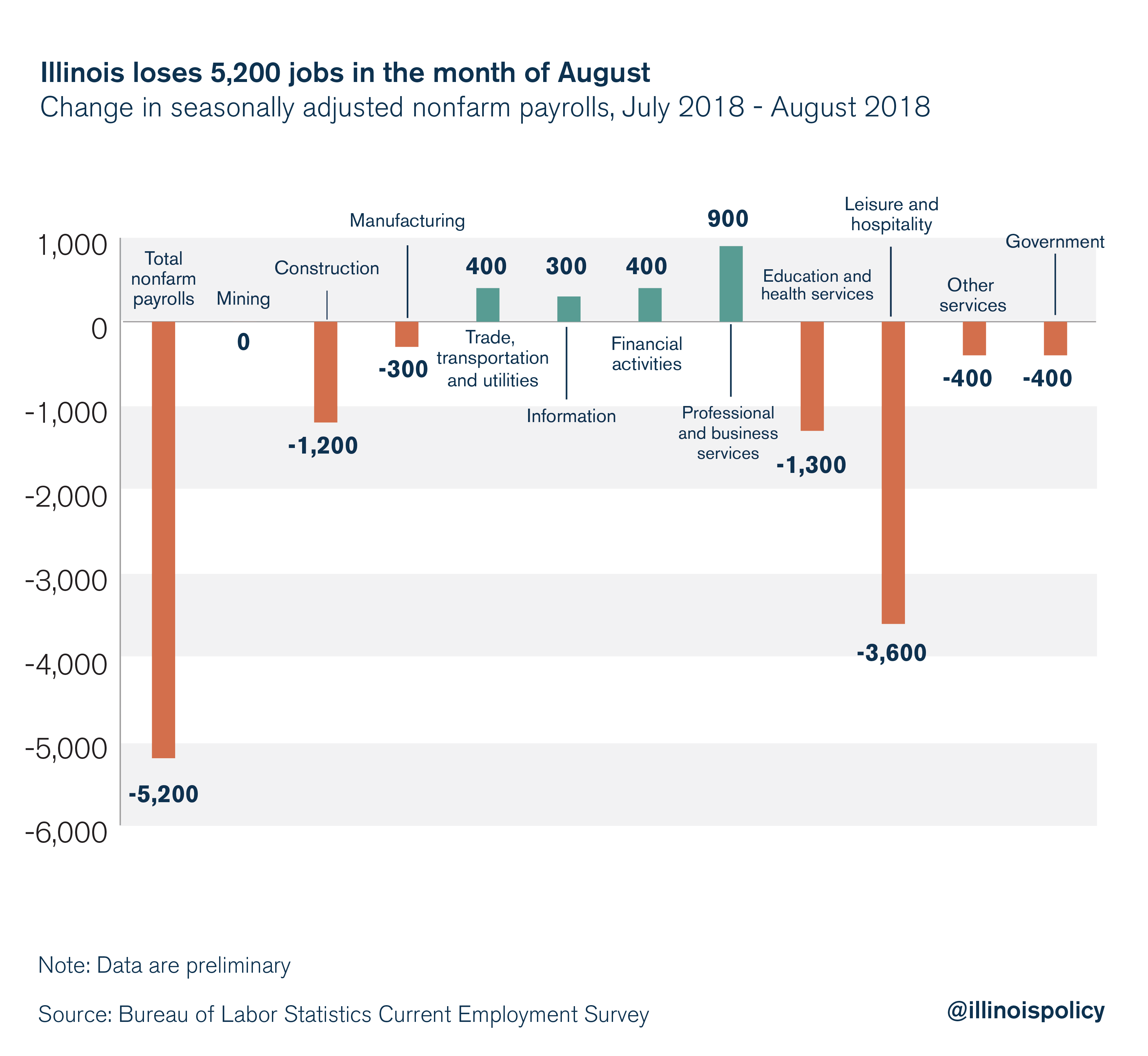

The Illinois economy lost 5,200 jobs in August, according to data released Sept. 20 by the Illinois Department of Employment Security in conjunction with the U.S. Bureau of Labor Statistics.

The preliminary data show Illinois payrolls dropped 0.08 percent over the month, making August the first month in 2018 to show job losses. July numbers were also revised down to show no jobs growth, instead of the 3,700 new jobs originally reported.

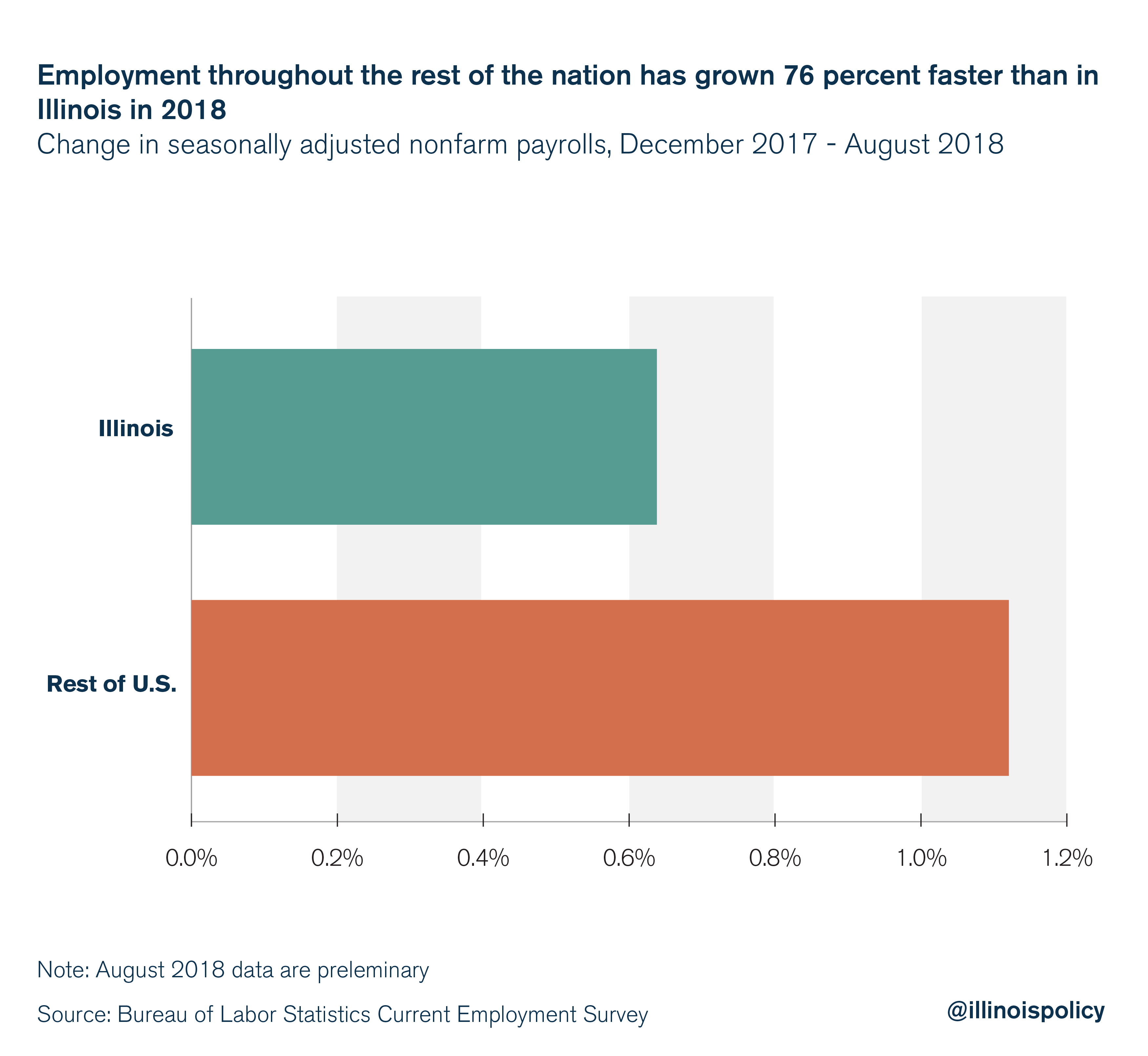

This implies that not only does Illinois still lag the rest of the nation in jobs growth for the year, but also that the gap is growing – Illinois lost jobs in August while the rest of the nation continued to grow (by 0.14 percent).

Illinois lost jobs in all but four sectors in August. The largest portion of August’s losses was driven by a contraction in the leisure and hospitality sector (-3,600 jobs), which erased nearly half of the jobs created in the sector this year.

After leisure and hospitality, the next largest losses came from the education and health sector, which lost 1,300 jobs, and the construction sector, which lost 1,200 jobs. The government and other services sectors’ payrolls each decreased by 400, while the manufacturing sector lost 300 jobs. Mining employment saw no change.

A handful of industries experienced gains in August. Professional and business services payrolls gained 900 jobs, financial activities and trade, transport and utilities added 400 jobs each, while the information sector added another 300 jobs.

Despite job losses, Illinois’ unemployment rate fell to 4.1 percent in August from 4.2 percent in July. This implies the state’s labor force is shrinking.

While the U.S. economy expands, Illinois continues to fall behind

August marks the first month of job losses for the state this year, while the rest of the U.S. continues its steady expansion. Since December 2017, the rest of the U.S. has expanded payrolls 76 percent faster than Illinois.

Closing the gap between Illinois and the rest of the country

Persistent underperformance relative to the rest of the nation has meant the gap between Illinois’ employment situation and worker opportunities available elsewhere is widening.

Illinois’ future remains uncertain. And when businesses perceive more volatility in the economy (whatever the source), they tend to err on the side of higher prices, which result in more inflation, higher markups and less economic activity.

In a recent statement to potential bond buyers, the Illinois Governor’s Office of Management and Budget reported the state’s budget shortfall stands at $1.2 billion. Investment expenditures are highly sensitive to expected changes in the tax climate, and the fear that lawmakers will pass tax hikes to narrow deficits can be enough to drive investment out of the state toward a more investment-friendly, fiscally sound climate.

If the Land of Lincoln is to close the gap with its peers, it must enact lasting and meaningful reforms that restore investor confidence in the state.

One such reform would be enacting a spending cap that prevents the need for future tax hikes. In spring 2018, state lawmakers lent bipartisan support to a constitutional amendment to impose a spending cap on the state budget. Although the spending cap amendment never made it to a vote, members of the Illinois House of Representatives and Senate have pledged to reintroduce the legislation next year. The spending cap would have tied the growth in state spending to the long-run average growth in the economy, avoiding the need for economically damaging future tax hikes.

In addition to a spending cap, pension reform would allow government to maintain core services while refraining from more punishing property and income tax increases.

Pensions for government workers are one expenditure that significantly burdens both state and local government budgets. But tax hikes to pay for pensions do nothing to improve the delivery of current services and can depress home price appreciation. Lower home values have also been associated with lower job creation. A greater tax burden has made housing in Illinois less affordable than the past, and a worse investment relative to other states.

To prevent pensions from crowding out services without resorting to harmful tax increases, Illinois must reform its broken pension system. The solvency of the current system continues to worsen despite taxpayers funneling billions of dollars more into the system each year. These enormous influxes of cash have not solved the problem and have not staved off recent income and property tax hikes.

Taxpayers must reject calls for a progressive income tax if Illinois is to prioritize its economic growth. State lawmakers have called for an end to Illinois’ constitutionally protected flat income tax in favor of a progressive income tax with differing rates set according to income levels. Although often sold as a tax on the rich, a progressive income tax proposal by Democratic state Rep. Robert Martwick from Chicago would hike taxes on Illinoisans making more than $17,300 per year – costing the state an estimated 34,500 jobs and $5.5 billion in economic activity in the first year alone.

The state’s economy cannot afford a progressive income tax hike – or any tax hike – if it is to ever close the economic growth gap with the rest of the nation. Policymakers must opt for pro-growth reforms instead.