Illinois businesses face another tax hike

Lawmakers in Indiana are pushing to cut the state’s corporate income tax rate to 4.9 percent in 2019 from 6.5 percent in 2015. If successful, the legislation would give Indiana one of the most competitive corporate income tax rates in the Midwest. Corporations in Illinois currently pay 9.5 percent of their income to the state...

Lawmakers in Indiana are pushing to cut the state’s corporate income tax rate to 4.9 percent in 2019 from 6.5 percent in 2015. If successful, the legislation would give Indiana one of the most competitive corporate income tax rates in the Midwest.

Corporations in Illinois currently pay 9.5 percent of their income to the state of Illinois — 7 percent in corporate income taxes plus a 2.5 percent personal property replacement tax. Illinois has the highest corporate income tax rate in the Midwest, and the fourth-highest in the United States. It also has the fourth-highest combined national-local corporate income tax in the industrialized world.

But businesses could be in for yet another tax increase if the proposed progressive, or “fair” tax, is made law.

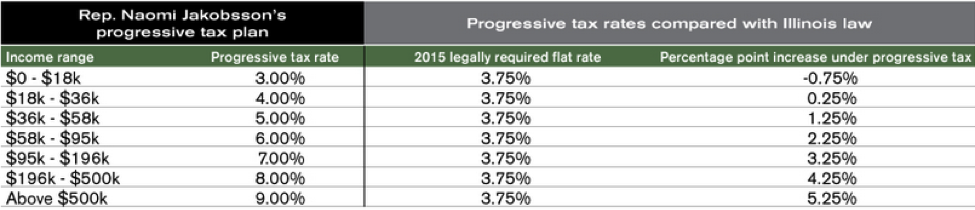

Often, the debate over the progressive tax centers on making the “rich” pay more in taxes by raising the personal rate. State Rep. Naomi Jakobsson has proposed the following rate structure:

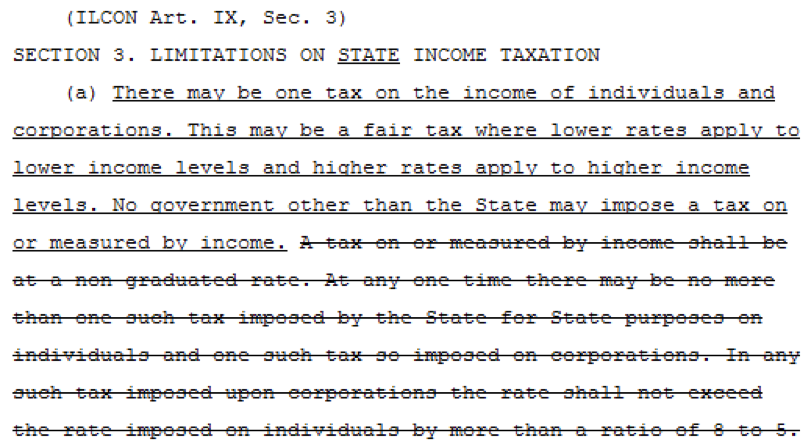

Here’s the actual language of Jakobsson’s proposal. She calls for progressive rates on individuals and businesses:

That means if you are a small business, you will be hit with a progressive tax increase when paying your taxes on the personal rate schedule. If you are a corporation, you will be hit by a progressive income tax on the corporate rate schedule (Jakobsson has declined to provide her ideal corporate rate structure).

Corporations are having a hard enough time competing nationally and internationally in Illinois’ high-tax environment. The already sky-high corporate rates are one reason why there are more than 1 million people unemployed or underemployed in Illinois today.

The last thing Illinois needs is a progressive income tax on corporations and small businesses.