Illinois budget deal should include eliminating outdated corporate franchise tax

The franchise tax is complicated and confusing, and compliance wastes the time and economic resources of Illinois’ businesses.

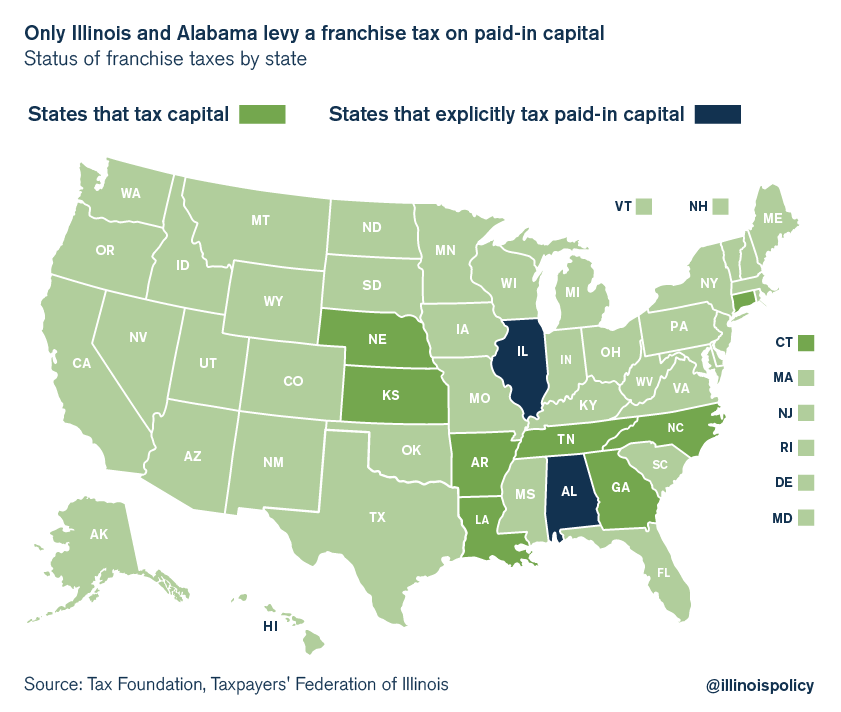

Mississippi Gov. Phil Bryant signed legislation on May 13 to phase out Mississippi’s corporate franchise tax. Now, Illinois and Alabama are the only states that still levy this outdated tax on “paid-in capital” (meaning the initial shares investors “paid in” to a company). With a budget deal between Gov. Bruce Rauner and the General Assembly possible before the end of May, Illinois lawmakers of both parties should consider House Bill 6153, which would repeal the franchise tax. Today, the franchise tax is strange and outdated, which is why almost every other state has eliminated the franchise tax on paid-in capital.

The corporate franchise tax is so convoluted that few people in Illinois understand what it is or how it works. Despite its name, the franchise tax is not a tax on the franchise locations of a larger business, such as Burger King or McDonald’s. Nor is the franchise tax based on income or sales or anything else with which a first-time entrepreneur might be familiar. Rather, it is a tax on an entrepreneur’s investments and business assets located in the state of Illinois. In fact, the tax’s name comes from the era before corporate income taxes.

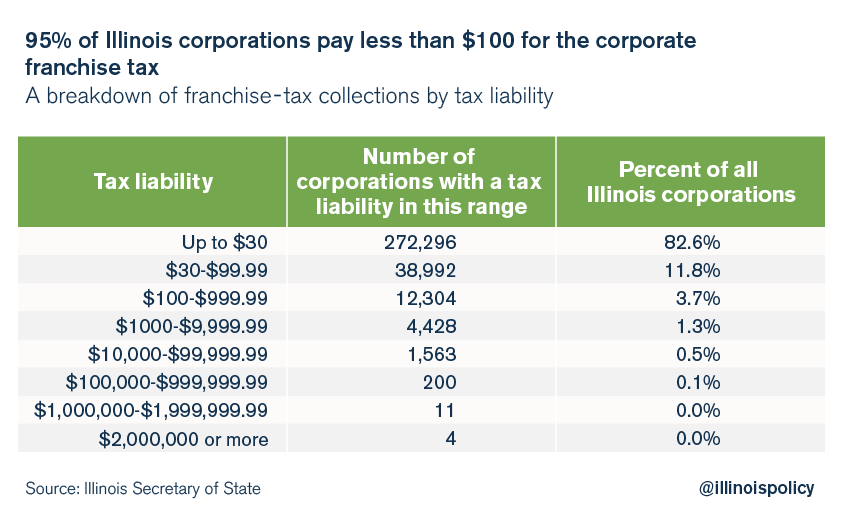

Despite all the convoluted formulas necessary to file the franchise tax, 95 percent of Illinois corporations have a tax liability under $100 per year. The franchise tax is a waste of time and squanders economic output.

The General Assembly is considering new tax sources, which would certainly cause economic harm. One of the ways to mitigate that harm would be to get rid of taxes that are particularly convoluted and wasteful of economic resources, such as the corporate franchise tax. Franchise tax revenues amount to around $200 million per year, and should be at the top of the list for taxes to repeal as a part of any budget deal.