Illinois’ April 30 Tax Freedom Day tied for latest in Midwest

When it comes to taxes, everyone works for the government. Illinoisans worked 120 days – from Jan. 1 until April 30 – to pay the taxes they owe to federal, state and local governments.

If Illinoisans were to pay the government up-front for all the federal, state and local taxes they owe for 2017, they’d have to work 120 days before they get to keep any of the money they earn, according to a new report by the nonpartisan Tax Foundation.

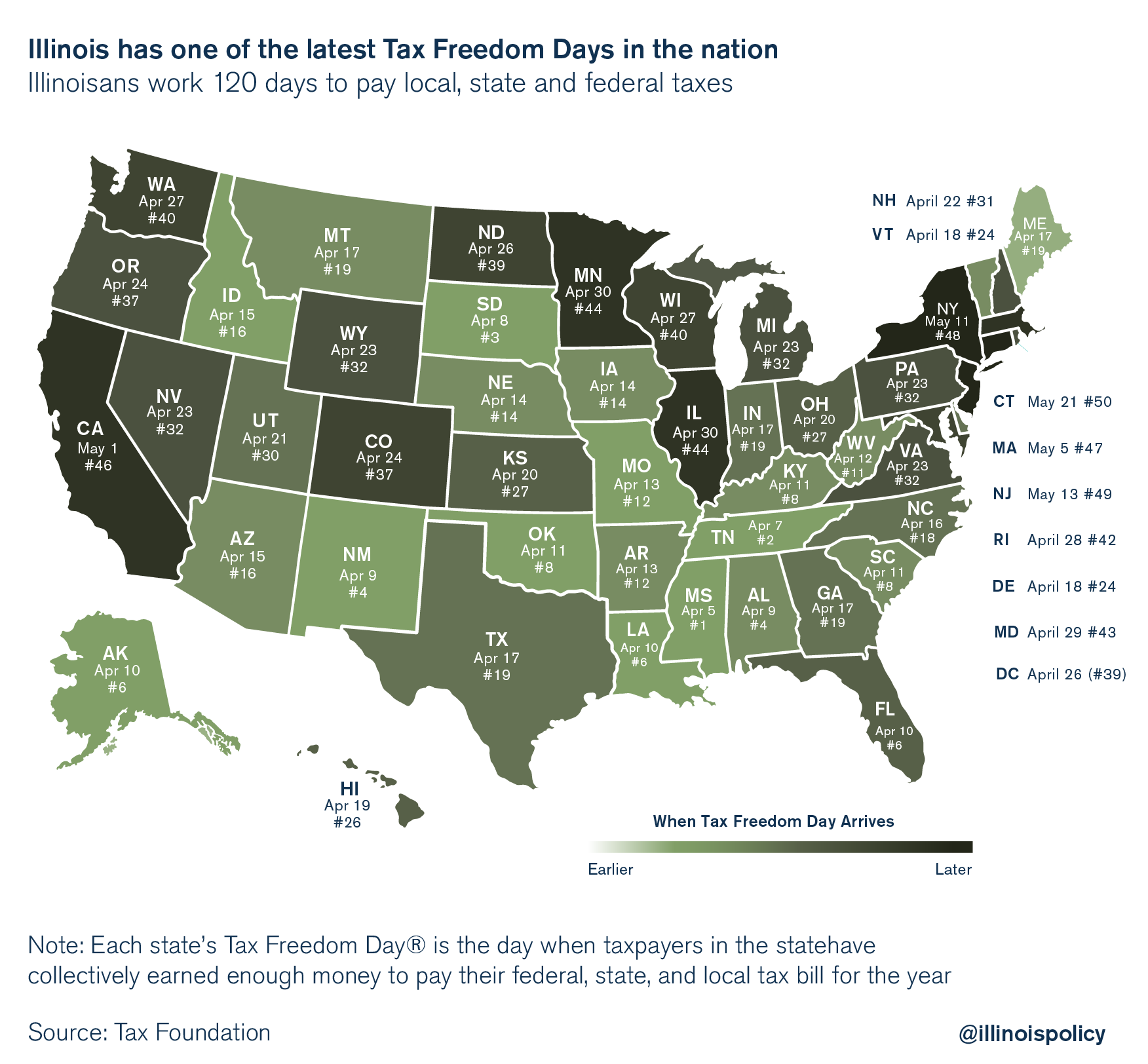

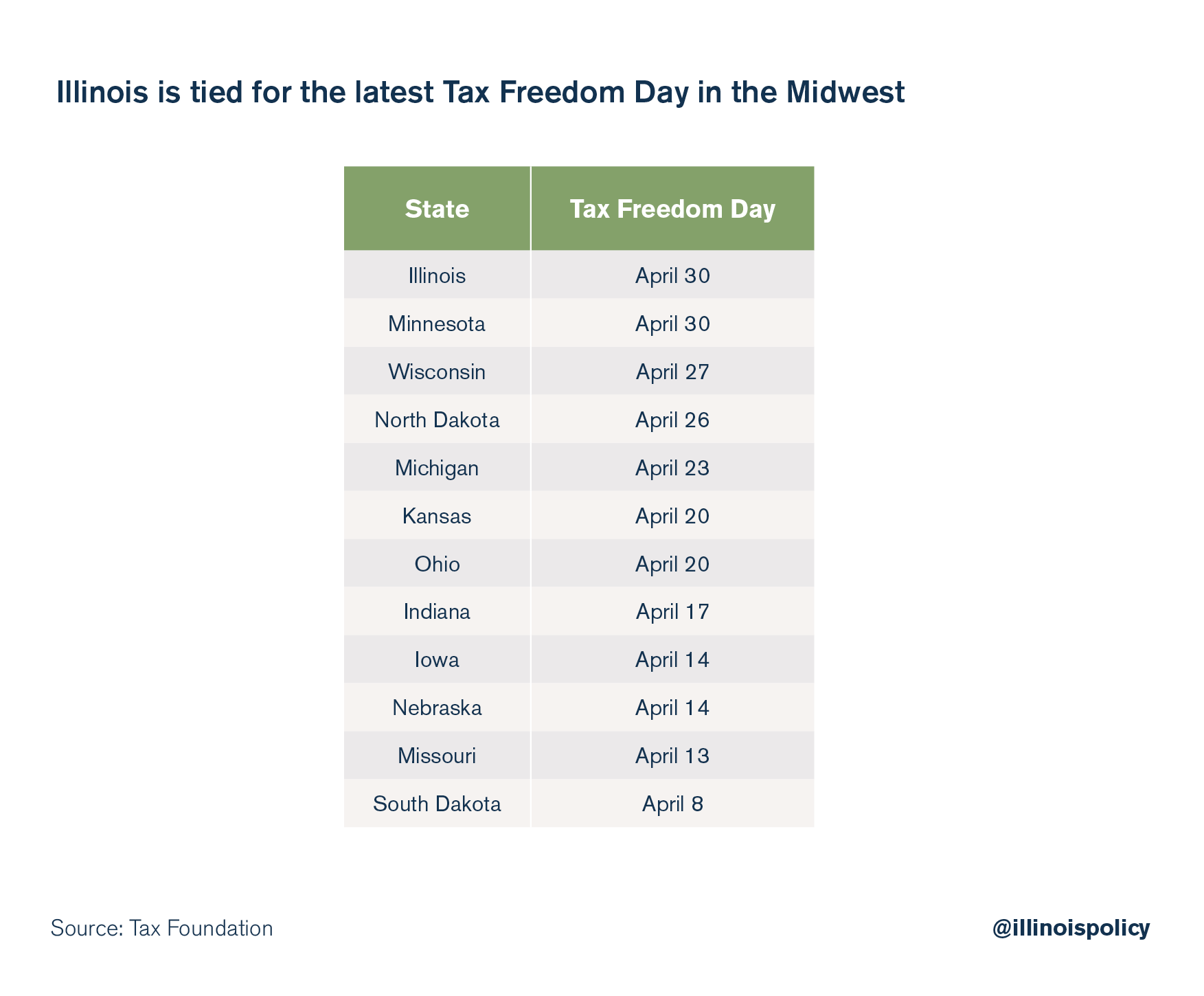

Taxpayers in Illinois have to work until April 30, or 33 percent of the year, before they keep a dime for themselves – seven days longer than the national average and 10 days longer than the average taxpayer in any Midwestern state. In fact, the Tax Foundation’s calculations show Illinois’ Tax Freedom Day is tied for the latest in the Midwest, along with Minnesota’s.

Despite the state’s dismal ranking, state politicians continue to call for a massive income tax hike to fill Illinois’ estimated $7 billion deficit in 2018. If that weren’t bad enough, lawmakers also want to charge a brand new sales tax on services such as landscaping, video streaming services and automobile repair.

But Illinois taxpayers need to know that state government can close the budget gap without any new or increased taxes.

Tax Freedom Day across the country

The Tax Foundation annually calculates Tax Freedom Day as the day when the nation as a whole has earned enough money to pay its total tax bill for the year. The analysis takes all federal, state and local taxes – individual as well as payroll, sales and excise, corporate and property taxes – and divides them by the nation’s income.

According to the report, the national Tax Freedom Day is April 23 – 113 days into the year.

Americans on the whole will work 46 days to pay their federal, state and local individual income tax bills. They will spend 26 days working to satisfy their payroll tax obligations, and 15 additional days to pay sales and excise taxes. Property taxes eat up another 10 days. Estate and inheritance taxes, customs duties and other taxes take another 16 days to pay off.

The report also provides Tax Freedom days for all 50 states. The data show some individual state tax burdens are much worse than the national average.

Illinois is tied with Minnesota as having the 44th-latest Tax Freedom Day of any state. That means residents of 42 other states have a lower tax burden than people living in the Land of Lincoln.

And Illinois ties with Minnesota for the highest tax burden across the entire Midwest. Illinoisans have to work a full three weeks longer than people in South Dakota just to pay taxes.

And Illinois ties with Minnesota for the highest tax burden across the entire Midwest. Illinoisans have to work a full three weeks longer than people in South Dakota just to pay taxes.

That’s a lot of days spent working for the government.

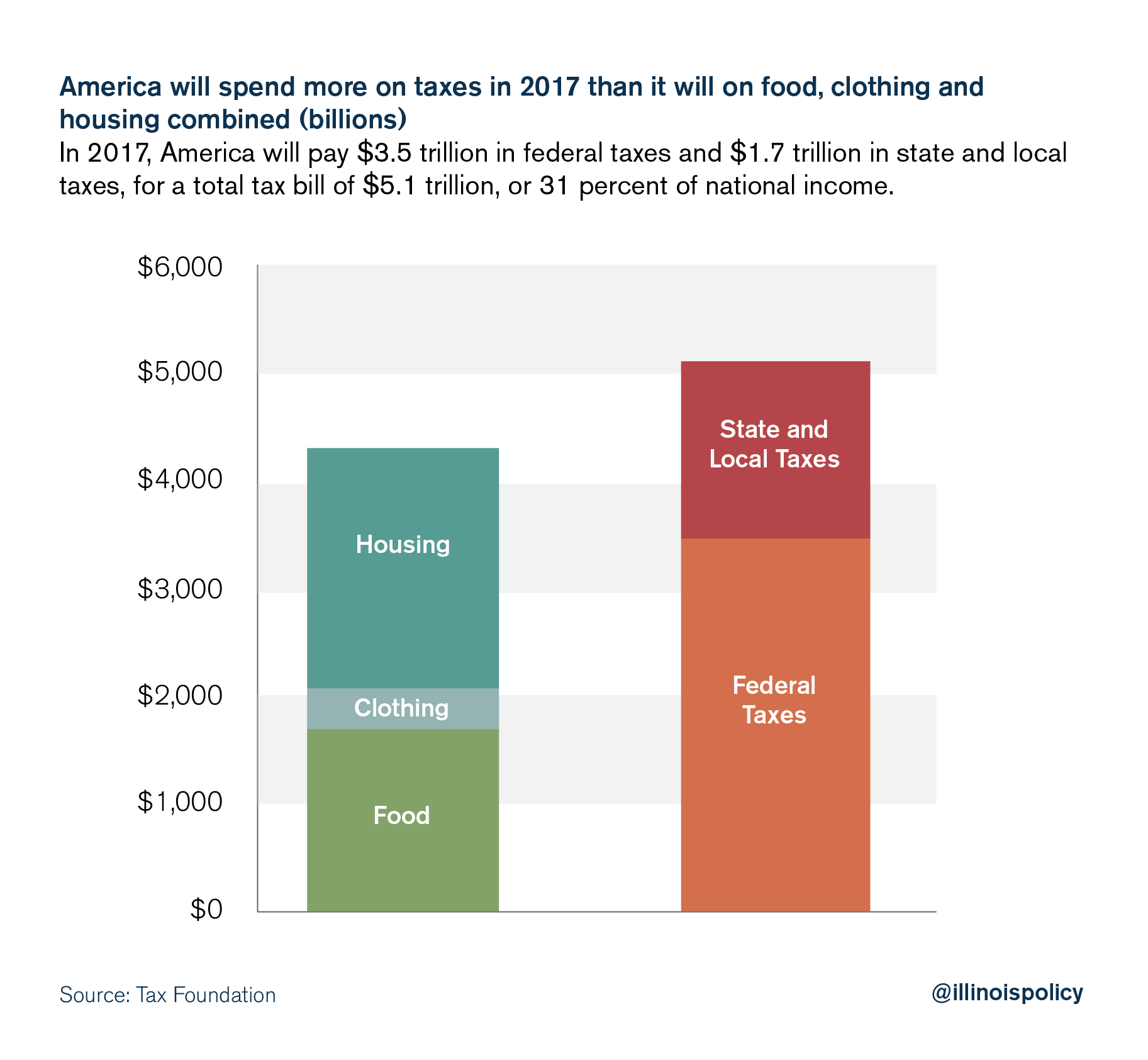

Illinoisans handing over 120 days’ worth of paychecks means that taxes make up one of the largest household expenses. The Tax Foundation reports that the average taxpayer pays more in taxes than on food, clothing and housing combined.

Recent polls reveal that Illinoisans feel the weight of this heavy tax burden – one of the highest in the nation – and they’ve had enough of it.

According to a poll released in October 2016 by the Paul Simon Public Policy Institute, 47 percent of the Illinois registered voters surveyed said they want to leave Illinois. The single biggest reason? Taxes.

Another poll, commissioned by the Illinois Policy Institute and conducted by Fabrizio, Lee & Associates in February and March 2017, found that 60 percent of respondents said state taxes are already too high. A full 70 percent said their property taxes in particular were too high. And nearly 80 percent of those polled agreed that “Illinois state lawmakers should pass major structural reforms before passing any tax increase” to resolve the state’s budget deficit.

In other words, Illinoisans don’t want a multibillion-dollar tax hike.

That’s why state lawmakers need to stop the conversation about how high to raise taxes and instead focus on spending reforms that could balance the state’s budget without taking an even larger bite out of workers’ paychecks.

The Illinois Policy Institute has created a blueprint to do just that. Budget Solutions 2018 shows how the state can implement real government spending reform through a property tax freeze, right-sizing state employee pensions, and holding schools accountable for their unaffordable pension perks – all while empowering local governments to control their costs.

Illinoisans are tired of working hard just to pay for government. It’s time for government to start working for them.