Illinois added 4,700 jobs in April, but workforce continues to shrink

The state also saw a drop in the unemployment rate over the month, fueled by employment gains and labor force decline.

The Illinois Department of Employment Security released its monthly statewide employment data May 17 in conjunction with the Bureau of Labor Statistics, or BLS. Fortunately for the Land of Lincoln, the state rebounded from the dip in employment initially reported in March – this figure was revised to show a slight increase in payrolls.

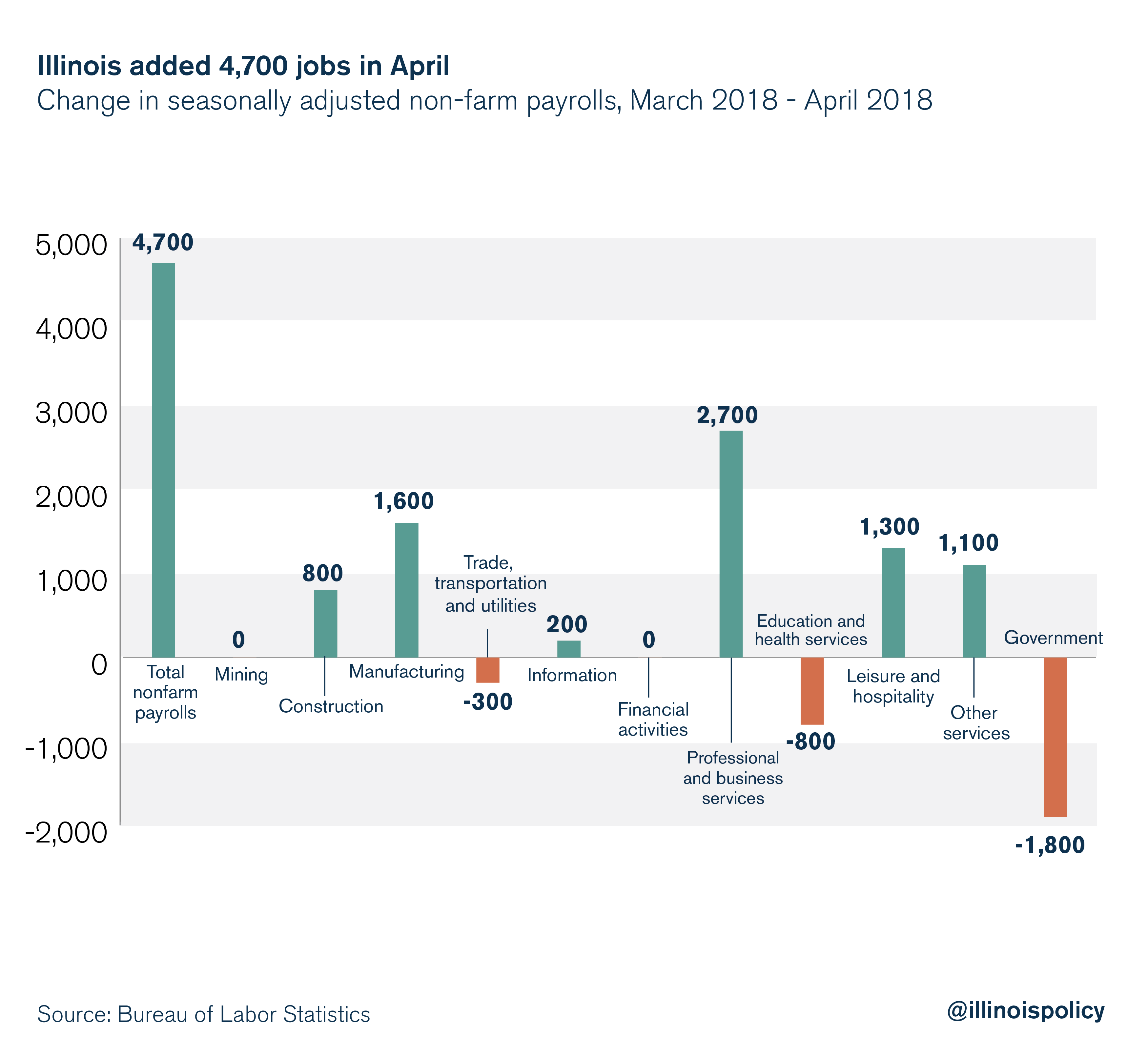

Preliminary data show Illinois added 4,700 jobs over the month of April, a 0.08 percent increase.

The professional and business services sector drove the majority of Illinois’ jobs gains over the month, picking up an additional 2,700 jobs, an increase of nearly 0.3 percent.

The other sectors that also expanded payrolls were: manufacturing adding 1,600 jobs (+0.3 percent); leisure and hospitality adding 1,300 jobs (+0.2 percent); other services adding 1,100 jobs (+0.4 percent); construction adding 800 jobs (+0.4 percent); and information adding 200 jobs (+0.2 percent). The mining sector and financial activities sector saw no change in payrolls.

Workforce dropout

Illinois’ unemployment rate continued to drop in April, hitting a 12-year low. But this news should be taken with a grain of salt.

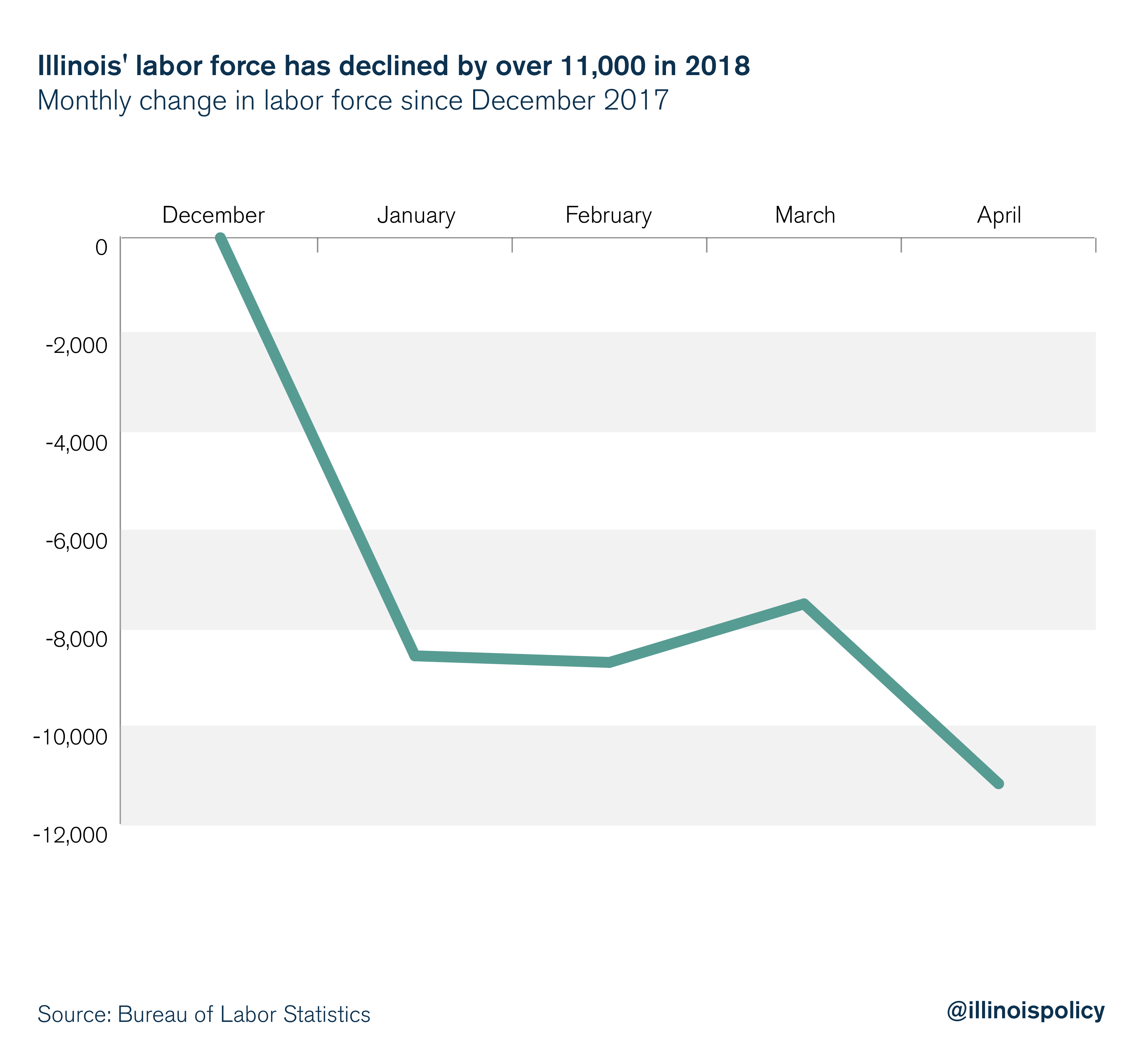

The drop in the unemployment rate and the decrease in the number of unemployed individuals in April was a result of not only payroll expansion, but also labor force decline. This data, taken in light of Illinois’ persistent outmigration, suggests that the decline in the state’s labor force is a result of working-age Illinoisans leaving the state.

In 2018 alone, Illinois’ labor force has declined by more than 11,000 people, or 0.17 percent.

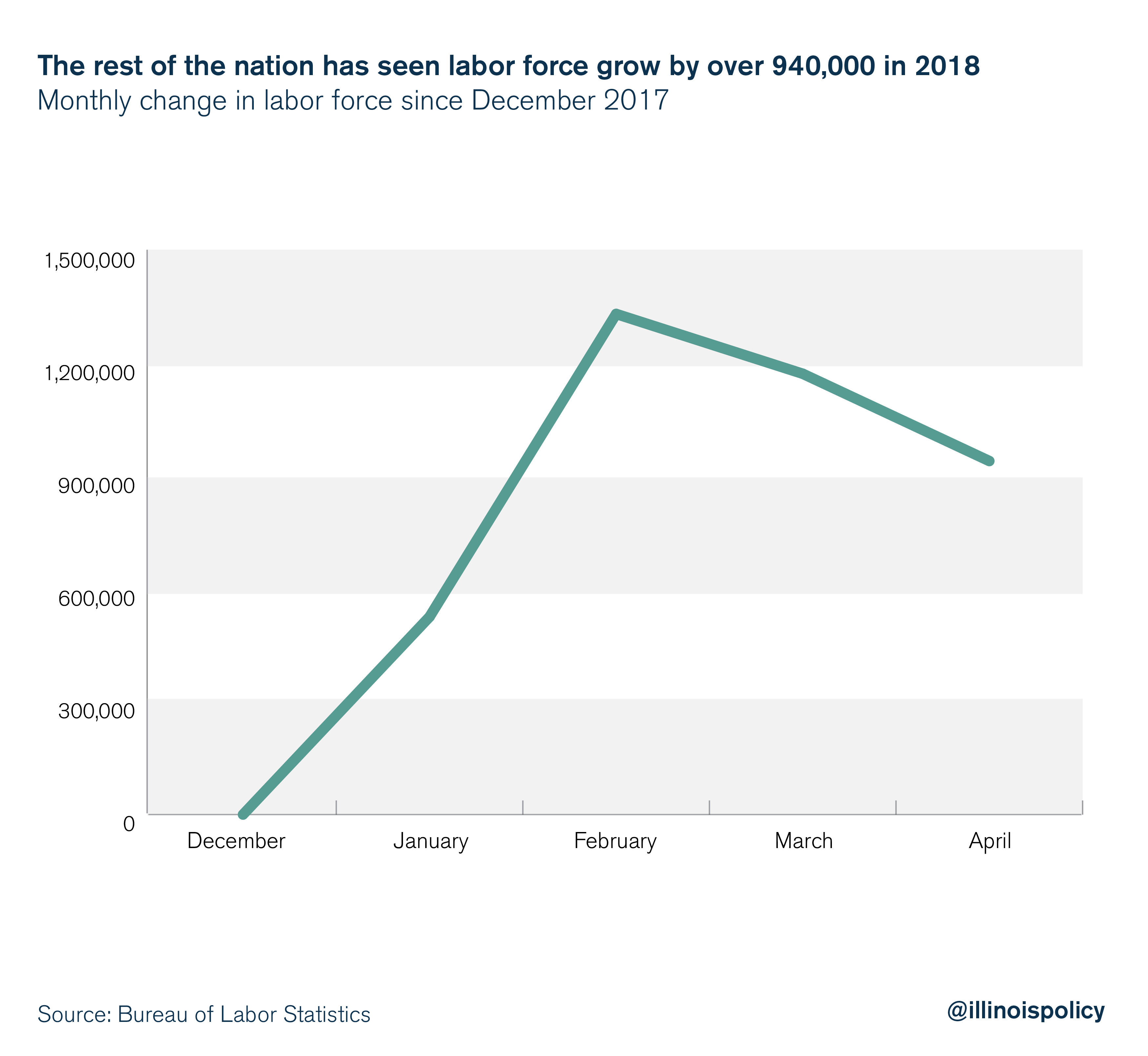

This is in stark contrast to the rest of the nation, where the labor force has grown by over 940,000 over the same time, or 0.61 percent.

Illinois needs drops in unemployment levels and the unemployment rate to stem wholly from Illinoisans landing jobs, not because the market is so discouraging that they give up or move elsewhere.

Improving Illinois’ labor market requires sound fiscal and labor policies that assure businesses and employees that market activity will not continue to be penalized with higher taxes each year. Illinoisans deserve a state where they can find jobs and flourish.

Instead of continuously hiking taxes, state lawmakers need to free Illinoisans from their enormous tax burden. A lower tax burden would stimulate investment and job creation, making the state a more attractive place for families and businesses to plant roots.

However, the only way to get lower taxes is to rein in government spending at the state and local levels. Without any news on whether the state will even have a budget this year, let alone a balanced budget, lawmakers have failed to give taxpayers certainty about future spending. A spending cap, on the other hand, could provide certainty about future government spending and help lawmakers avoid tax hikes to balance the budget.

If lawmakers voluntarily adopted spending cap amendments that have already garnered bipartisan support, the state could pass a balanced budget that doesn’t hike taxes and provides a long-term path toward relief.