Illinois’ $241B pension debt still worst in nation despite record income tax hike

A new report shows Illinois’ unfunded pension debt liability remained highest in the nation despite the 2017 income tax hike.

Despite passing a record income tax hike in 2017, Illinois’ pension health remains the nation’s worst, according to one of the world’s leading credit rating agencies.

A new report from Moody’s Investors Service shows in fiscal year 2018, Illinois’ unfunded pension liability stood at nearly $241 billion, leaving each Illinoisan on the hook for $18,896 in pension debt.

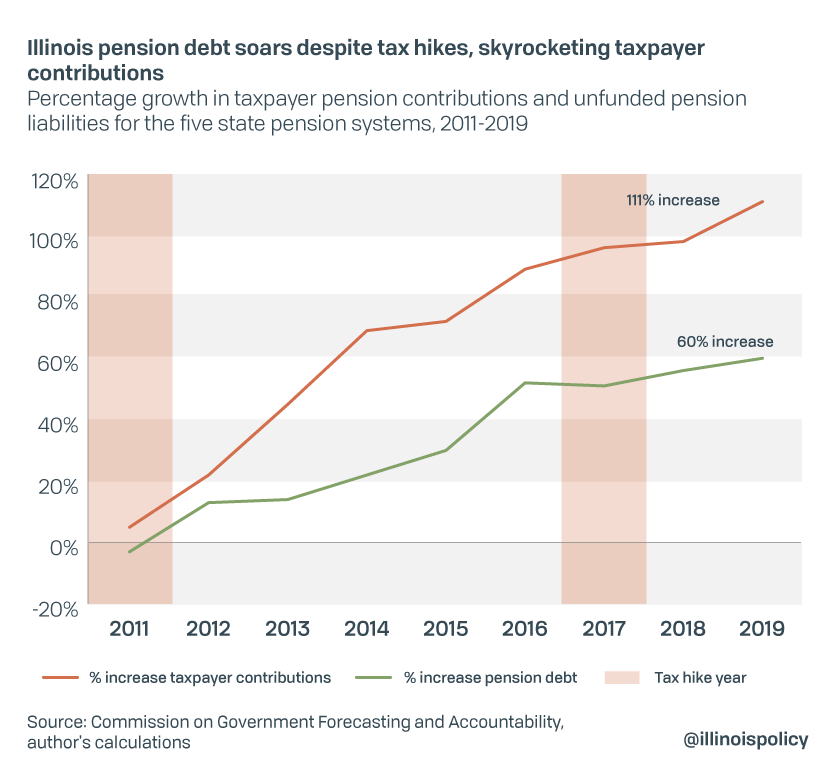

These findings follow Illinois Policy Institute research, which has found Illinois’ pension debt has continued to balloon since 2011 after an income tax hike that year and another in 2017.

The size of Illinois’ pension debt amounts to more than 500% of state revenues, according to Moody’s, and nearly 30% of the state economy. That’s considerably higher than Kentucky’s 309% pension debt-to-revenue ratio, the nation’s second worst, according to Moody’s.

In line with the nationwide trend, Illinois’ $241 billion pension burden represented a slight decrease from $250 billion in fiscal year 2017, which Moody’s attributes to healthy investment returns. But the agency expects that to reverse, citing expectations for lower investment returns and interest rates going forward. Pension liabilities are on pace to rise by 20% nationwide in fiscal year 2020, according to Moody’s.

State lawmakers should recognize that any increases to Illinois’ already-painful total tax burden would only continue to depress the lagging state economy. That includes Gov. J.B. Pritzker’s proposed progressive income tax overhaul.

Lawmakers’ only responsible choice is to structurally reform pensions to control the growth of future, unearned benefits so they are in line with what taxpayers can afford. Or lawmakers can continue as they have for the past 20 years: Let pension spending grow more than 500% and crowd out one-third of spending on essential government services.

Reforming future pension benefits growth through a constitutional amendment is the only way to ensure the retirement security of government workers, protect taxpayers and provide the public services Illinoisans value.