If Illinois passes progressive income tax, retirement tax comes next

Passing the progressive tax would empower state lawmakers to go after seniors’ retirement income.

They weren’t supposed to say this part out loud.

Gov. J.B. Pritzker’s top priority is a progressive income tax hike. He is expected to spend millions of dollars on TV advertising to convince voters that scrapping the state’s flat income tax protection on Nov. 3 won’t hurt them.

What won’t the governor say? That passing the progressive tax would empower state lawmakers to go after seniors’ retirement income.

And Illinois state Treasurer Michael Frerichs made the mistake of saying so publicly.

“One thing a progressive tax would do is make clear you can have graduated rates when you are taxing retirement income,” Frerichs said at a June event in Des Plaines, according to the Daily Herald. Kudos to the treasurer for speaking the truth.

Illinois’ constitutional flat income tax is a critical protection for seniors.

Here’s how it works:

Illinois currently doesn’t charge a tax on retirement income. But if Springfield wanted a slice of that money, the flat tax protection would force lawmakers to tax retirement income at the same rate as regular income. That’s a towering political hurdle.

But passing Pritzker’s constitutional amendment would allow state lawmakers to tax retirement income at whatever level they want, making the tax easier to impose initially.

Frerichs is far from alone in suggesting a retirement tax in Illinois.

In 2019, Chicago Mayor Rahm Emanuel proposed taxing all retirement income above $100,000 per year and the Civic Committee of the Commercial Club of Chicago proposed taxing all retirement income above $15,000 a year. In 2018, second-place Democratic gubernatorial candidate Dan Biss said he would “only consider taxing retirement income once we’ve amended the Illinois Constitution to allow for a progressive income tax.”

But the groups backing Pritzker’s tax plan know slashing retiree income is a third rail in Illinois politics. Nearly 3 in 4 Illinoisans oppose taxing retirement income, according to a 2019 poll from the Paul Simon Public Policy Institute.

So, they quickly tried to cover for Frerichs.

The AARP and Pritzker’s progressive tax ballot committee – Vote Yes for Fairness – released statements assuring Illinoisans they only want more money from the rich, not from retirees. In fact, the official ballot language in favor of the progressive income tax, which will be published across the state ahead of November, explicitly states the proposal does not tax retirement income.

Of course, it doesn’t tax retirement income today. The worry is about tomorrow.

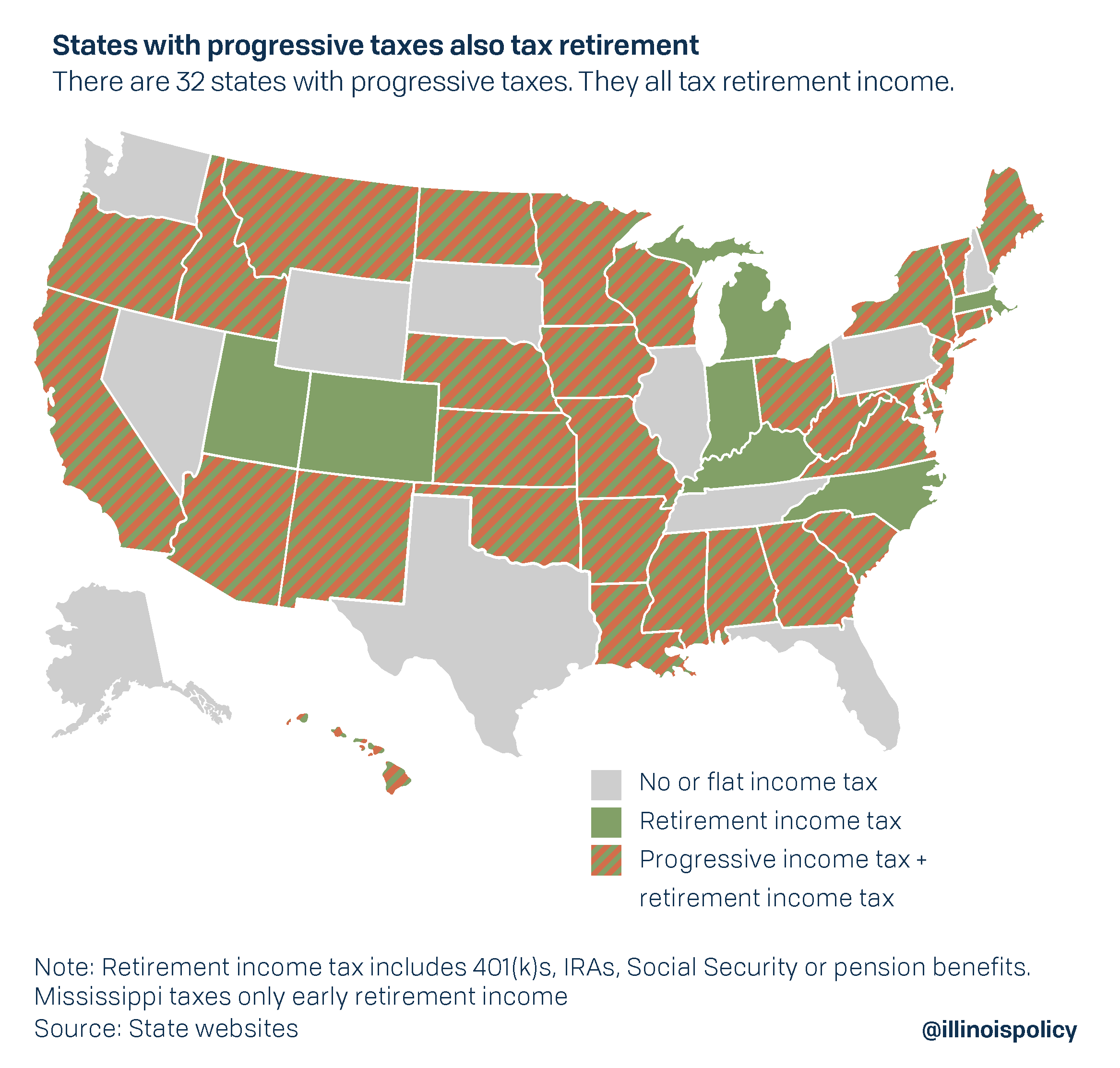

If Illinois passes a progressive income tax, it would only be a matter of time before seniors see a cut in their retirement checks. Thirty-two states have a progressive income tax system. And all 32 tax some form of retirement income.

The only state to pass a progressive income tax in the past 30 years, Connecticut, shows how Illinois’ retirement exemption serves as one of the only bright spots in an otherwise punishing tax code.

Since 2011, Illinois has been able to retain residents above age 65 better than every other age group, according to IRS data. Meanwhile, Connecticut for the past decade has taxed retirement income, including Social Security, above $50,000 for single filers and $60,000 for joint filers. The result? The outmigration rate for residents over age 65 is more than double the rate for prime working-age adults.

Taxing retirement income would be the breaking point for scores of seniors who still spend their money in Illinois.

Pritzker wants Illinoisans to think wealthy incomes are up for a vote on the Nov. 3 ballot.

If he succeeds, retirees are next.