Illinois should join the crowdfunding revolution

Illinois needs to pass a law to create space for this financial innovation, allowing families to invest in local businesses through crowdfunding.

There are few things so American as going all in on a business of your own creation – pouring your heart, soul and bank account into an idea you believe in.

But even entrepreneurs can run into problems raising investment dollars. And that’s where the rest of us can lend a helping hand. Or, in this case, a helping kick.

An investment revolution is sweeping across the United States, inspired by online crowdfunding platforms like Kickstarter. The crowdfunding revolution is the future of local, sustainable, conscientious investing.

Illinois needs to pass a law to create space for this financial innovation, allowing families to invest in local businesses through crowdfunding. That way, small businesses can access millions of new investment dollars, and families can invest in the growth and success of their community.

The Kickstarter campaign for the beloved “Reading Rainbow” children’s T.V. show illustrates how this would work. In just eleven hours, small donors raised $1 million to get the Reading Rainbow TV show back into production. Reading Rainbow host LeVar Burton wept for joy.

Allowing crowdfunding for small businesses would work the same way. The only difference is that the donors would be investors who would own shares of the company.

Business owners and crowd-funders could access an online portal to exchange shares in a small business for precious investment dollars. This combines the concept of a stock exchange with the public accessibility of a Kickstarter campaign. But each state needs to create an exemption to allow this innovation within their borders.

That’s why Springfield needs to act. The 2012 Jumpstart Our Business Startups (JOBS) Act legalized investment crowdfunding in the United States. Now, individual states like Illinois must create their own investment rules before crowdfunding can take off within their borders.

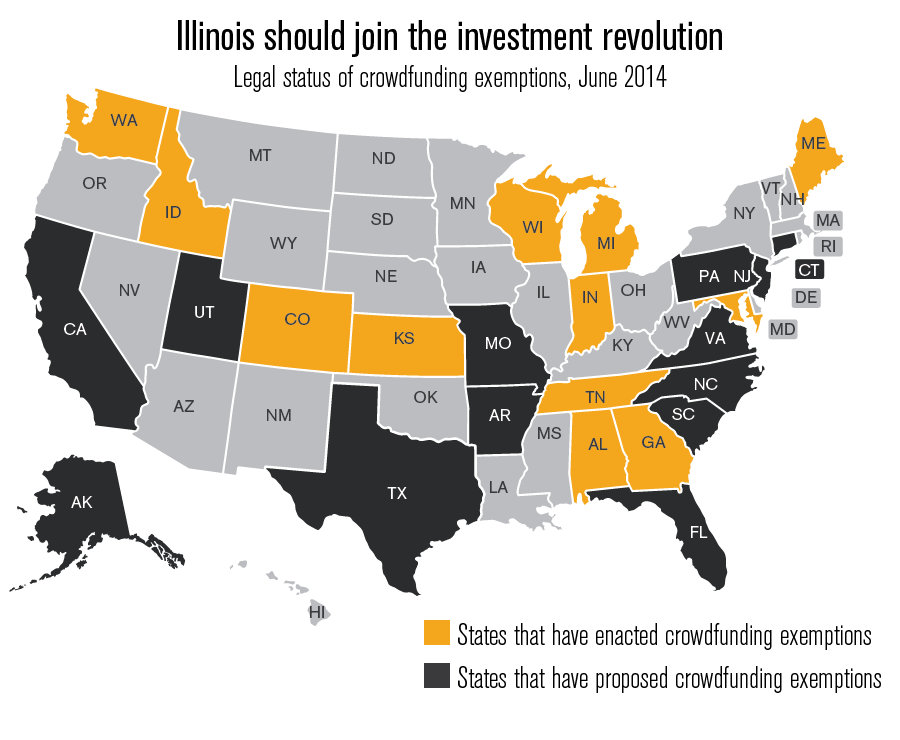

Other states are racing ahead. Thirteen states have already created the necessary exemption to allow crowdfunding within their borders, including Wisconsin, Indiana, Michigan and Tennessee. Thirteen more states are in the process of creating the necessary exemption.

Crowdfunding for investment purposes can only be done intrastate. That means Illinois companies can raise money only from Illinois families, and only after Springfield creates the necessary legal exemption.

Lawmakers need to make crowdfunding a reality for families and entrepreneurs in Illinois. If Illinois is too slow to act, small businesses could jump the border to tap into funds in Indiana or Wisconsin.

The choice on crowdfunding is clear. Illinois can lead the way by creating the best legal framework in the Midwest, or it can lose more businesses to border states.