‘Grand bargain’ would cut private sector pay and continue government worker perks

Illinois state government works to prioritize special interests over taxpayers – and the budget deal being negotiated in the Senate would continue that.

Tax increases cannot solve Illinois’ fundamental debt and spending problems, but Illinois senators still want to give it a shot. State Sen. Christine Radogno, R-Lemont, along with Senate President John Cullerton, D-Chicago, are fighting for yet another tax increase on Illinois families – without reforming government spending – with the Senate’s “grand bargain” budget plan. More taxes will reduce the take-home pay and standard of living for Illinois workers, and polling shows that Illinoisans are fed up with the deluge of tax hikes they’ve faced since the Great Recession.

It’s time for a role reversal: Illinois government should find ways to reduce its spending so families can keep their hard-earned dollars. And politicians should stop raising taxes on private sector workers to continue appeasing special interests, such as influential government unions.

Illinois politicians should prioritize private sector taxpayers and those most dependent on social services. That means reforming the pay and perks of government unions, local governments, the education and health care bureaucracy, road builders and trades unions, tax credits for big businesses and bankers looking for a bailout. The Senate deal goes in the wrong direction and will harm the state.

Illinois needs to stop taxing away private sector wages and instead reform sweetheart deals for government unions and other special interests. The facts speak for themselves:

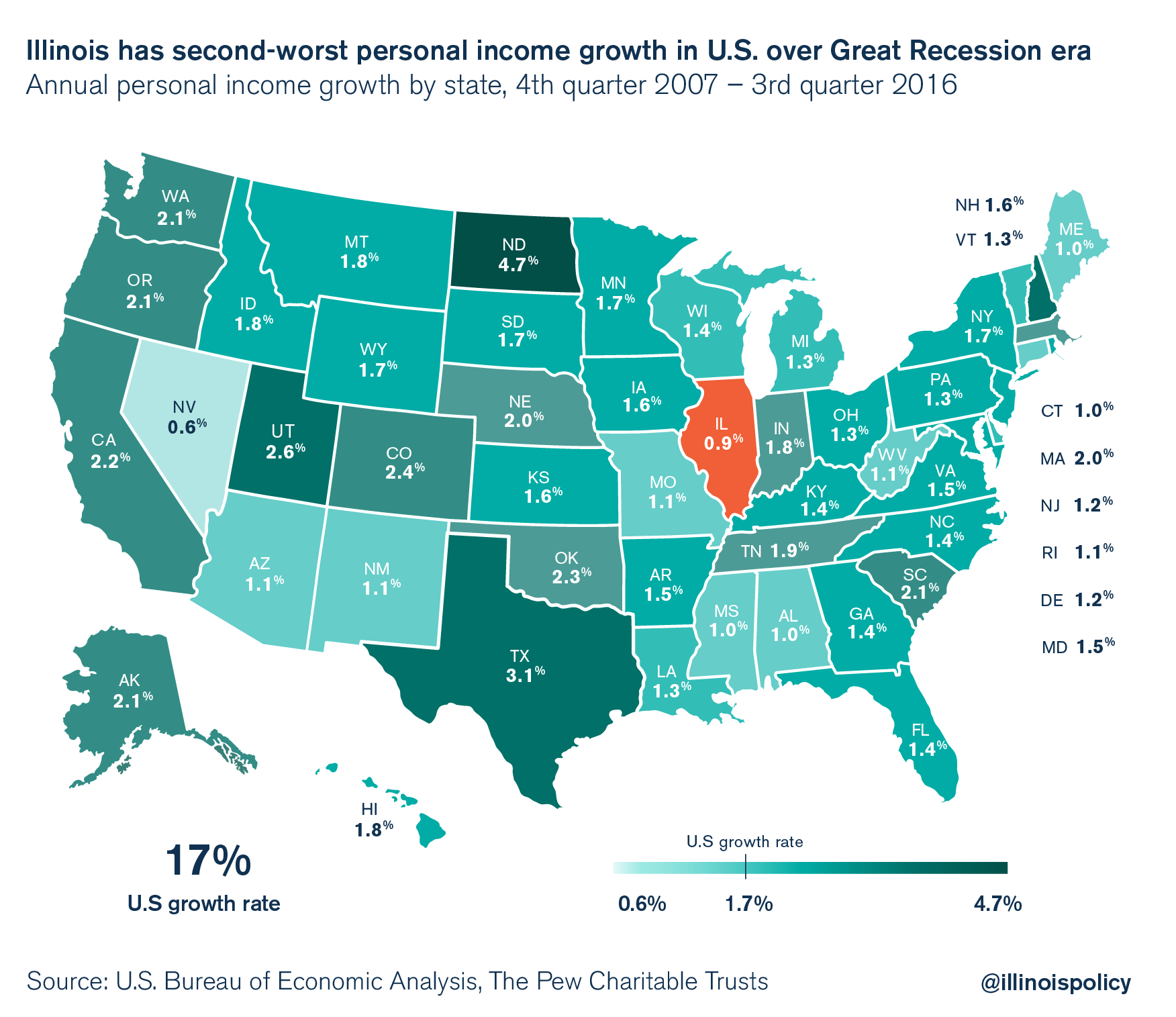

- Personal income is growing painfully slowly in Illinois, and tax hikes are eating it away. Since the Great Recession, Illinois has had the second-worst personal income growth in the U.S., better than only Nevada. And Illinois has seen major state and local tax hikes since the Great Recession, wiping out even the weak income growth working families have earned.

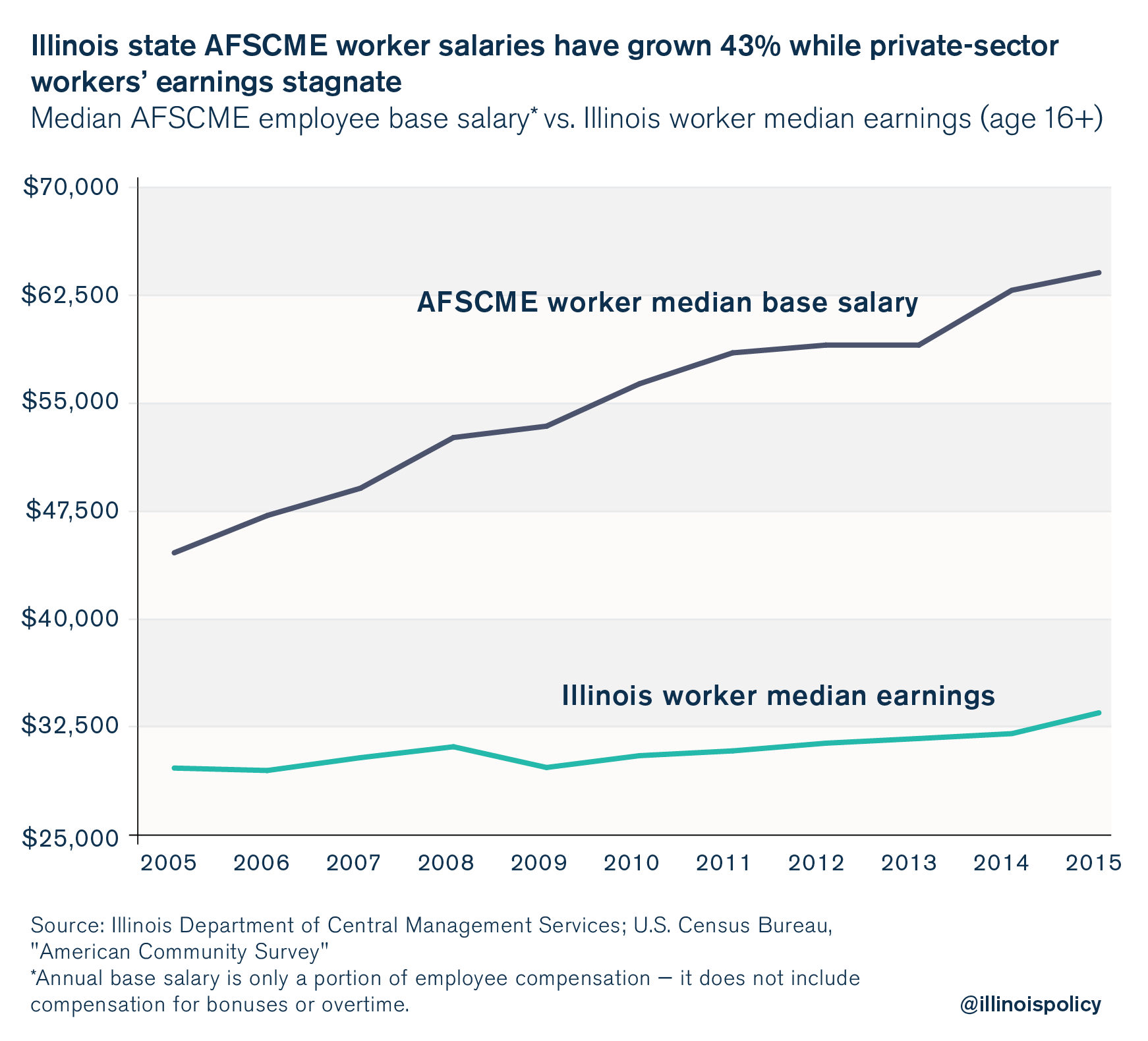

- Illinois state worker pay increases have dramatically out paced median pay increases in the private sector.

Illinois state workers are the highest-paid in the nation, after adjusting for cost of living, and they retire with free health insurance and $1.6 million in pension benefits courtesy of suffering private sector taxpayers.

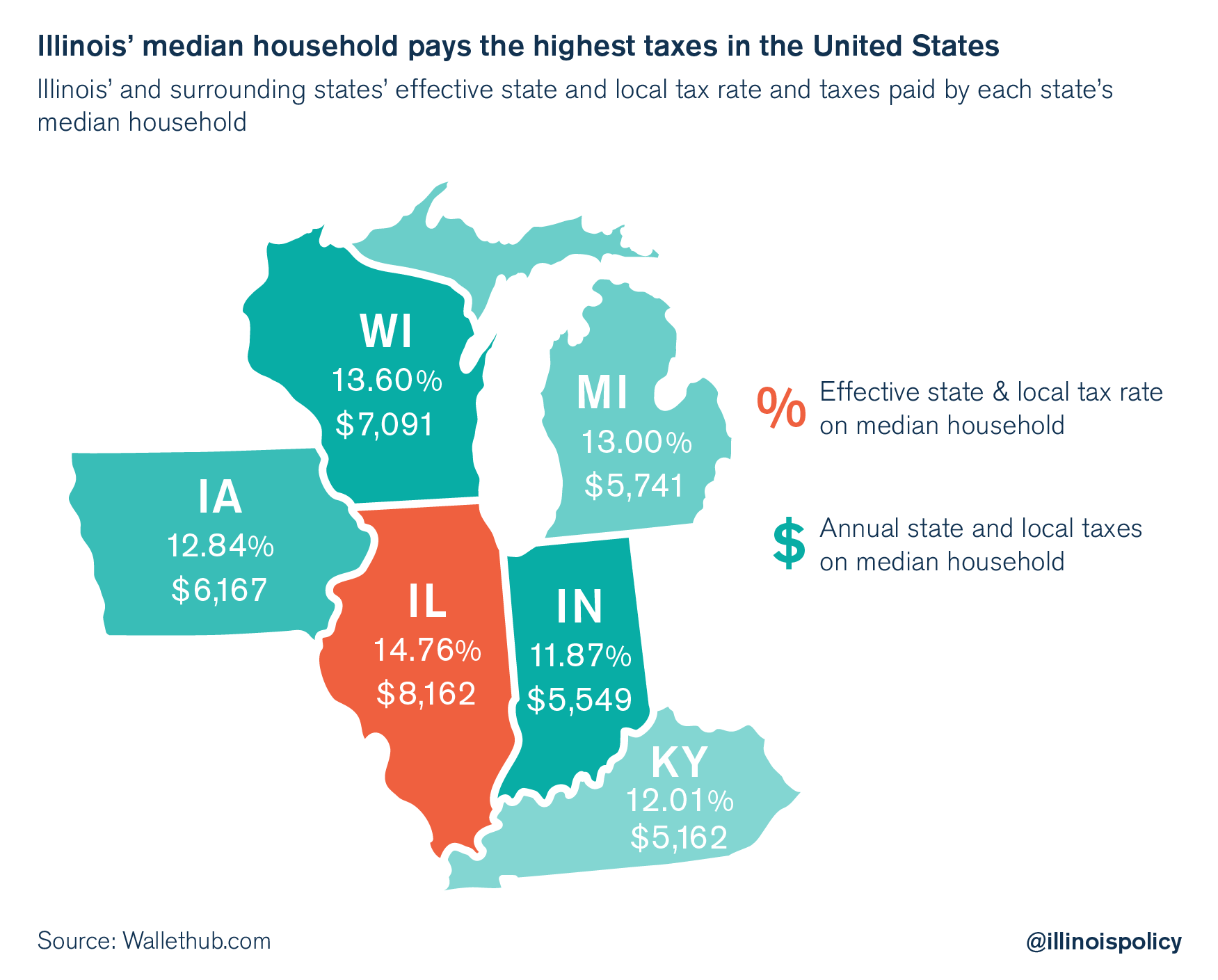

- While the average Illinois government worker is the highest-paid in the nation, the median Illinois household is the highest taxed in the nation.

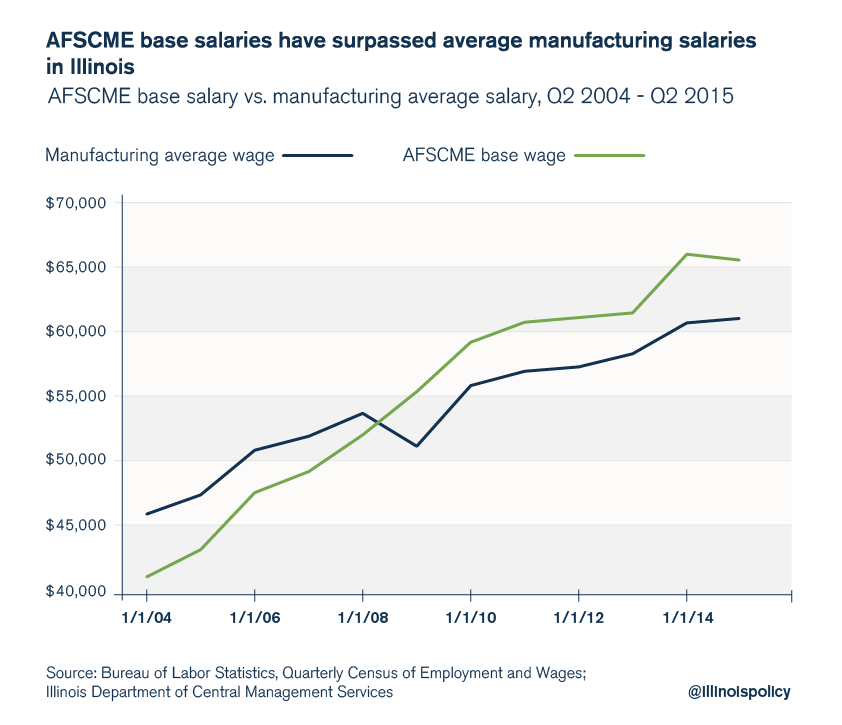

- State worker base wages have surpassed even the average wage of Illinois manufacturing workers, an industry that creates Illinois’ middle class. Meanwhile, middle-class manufacturing workers have been hemorrhaging tens of thousands of jobs in part because of the state’s tax and regulatory policies.

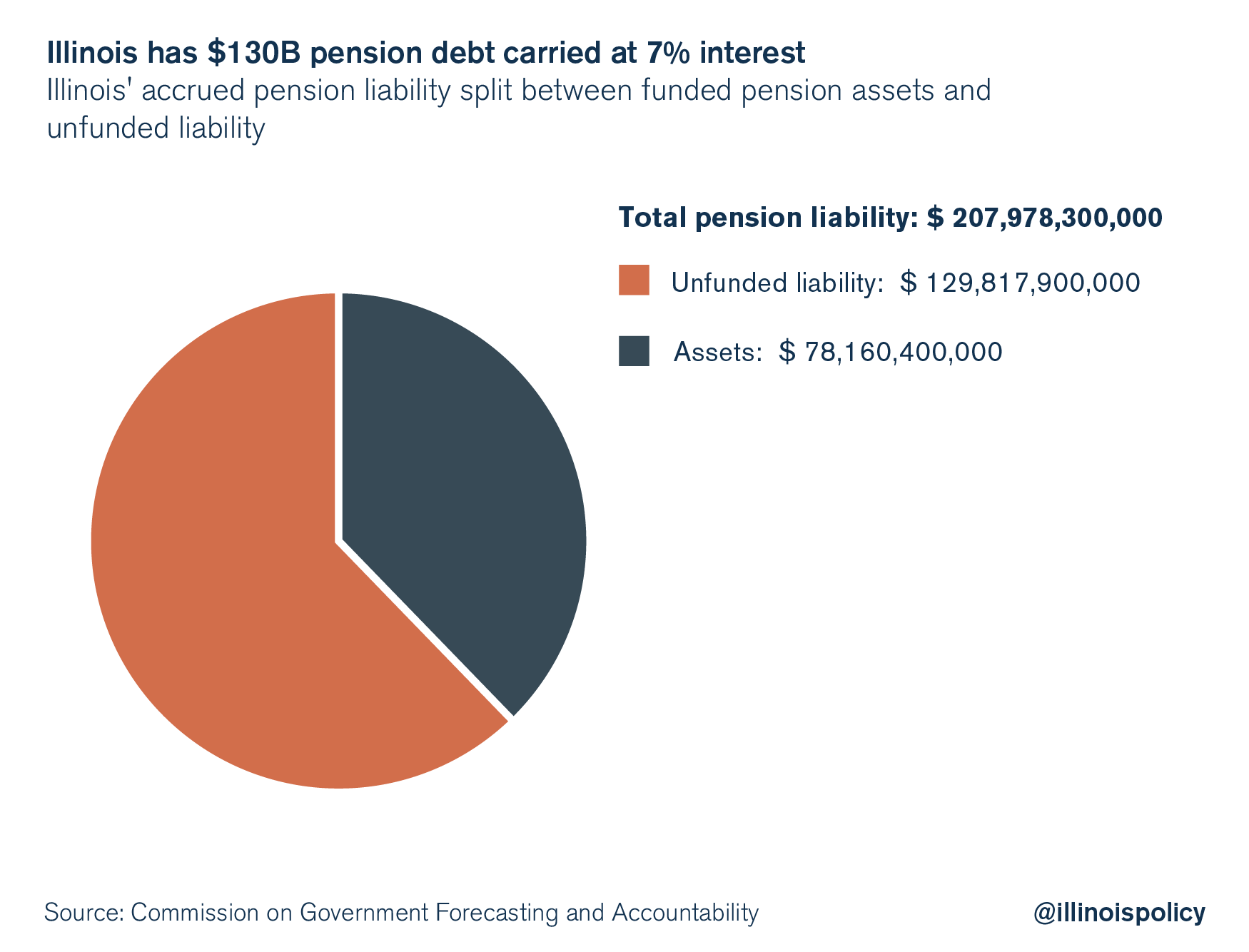

- Debt and pension costs are spiraling out of control and driving up taxes on middle-class families. Just the interest cost on Illinois’ pension debt is $9 billion per year, and current pension payments don’t even cover that. Yet lawmakers do not even discuss changing the constitution to make reasonable reforms to pensions that prioritize taxpayers.

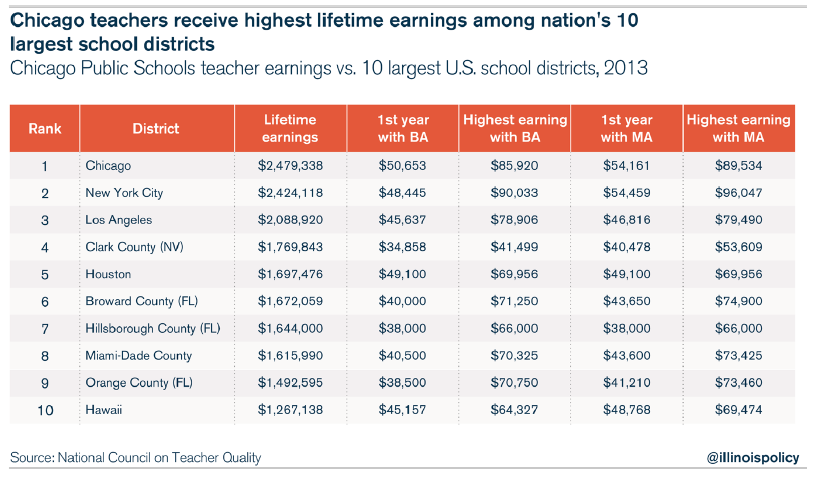

- Taxpayers are being treated unfairly at the local level, too, stemming from pension promises and the extraordinary powers Illinois gives to government unions. For example, the median wage of a Chicago taxpayer was $31,096 between 2009 and 2013. The median salary for a CPS teacher, on the other hand, was $78,910. On top of that, the average Chicago teacher pension is nearly $70,000 per year. Such examples of unfairness are widespread across Illinois.

Chicago teachers are the highest paid of the 50 largest school districts in the U.S. despite the fact that Chicago’s population and CPS’ student body are both shrinking. Yet, the Chicago Teachers Union repeatedly threatens to go on strike unless it gets to extract more from private sector taxpayers.

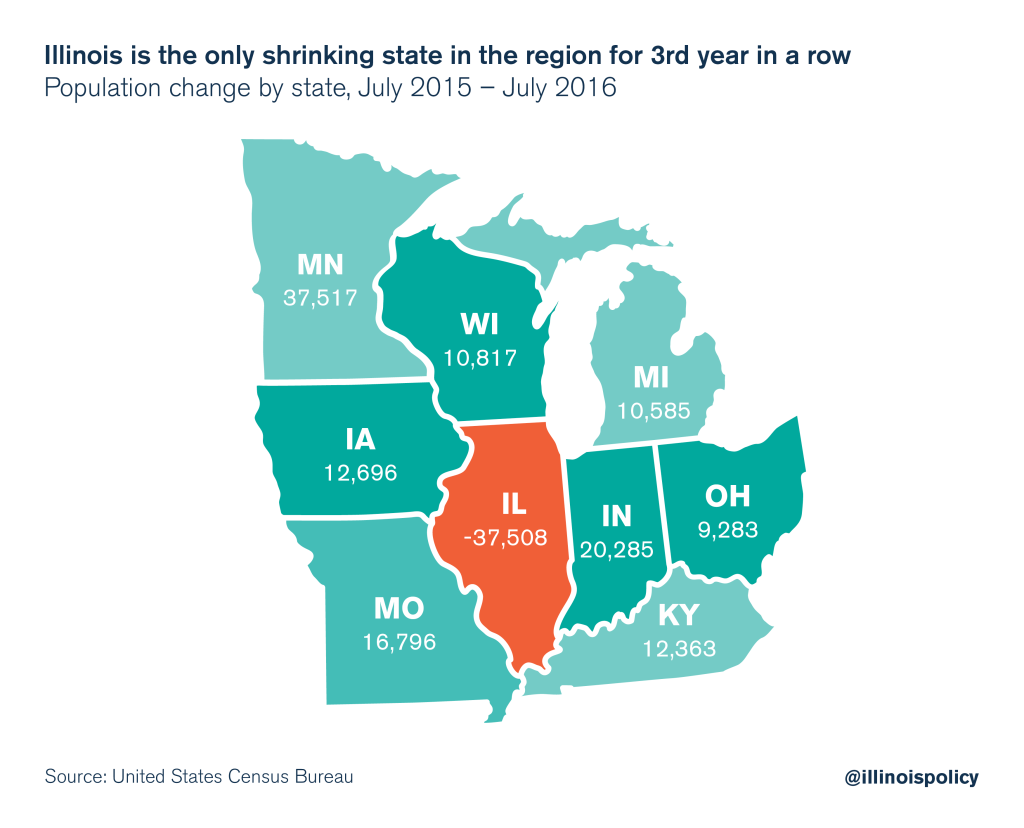

- Illinoisans cite taxes as the top reason for wanting to leave the state, and Illinois is losing one person to another state every 4.6 minutes, causing the state population to shrink for the third year in a row. The raw deal taxpayers get is driving working families out of the state.

Illinois politicians need to stop cutting into family savings and instead reform the sweetheart deals they give out to politically powerful special interests. Governments across Illinois have been raising taxes since the Great Recession. Radogno and other senators are proposing billions of dollars in new taxes without reforming the fundamental unfairness of how Illinois government works. The Senate deal would mean more pay cuts for Illinois families, and more pay and perks for the politically connected.

Every time Illinois lawmakers raise taxes they are prioritizing government unions, multi-million dollar pensions, free government retiree health insurance, local government subsidies, education and health care bureaucracy, special business tax credits, road builders and trades unions and now even banker bailouts over Illinois families.

Illinois’ system is deeply unfair. Illinois government favors the politically connected over regular taxpayers. The Senate deal will make this unfairness worse. Senators should drop the ‘grand bargain’ and instead fight for Illinois families and homeowners.