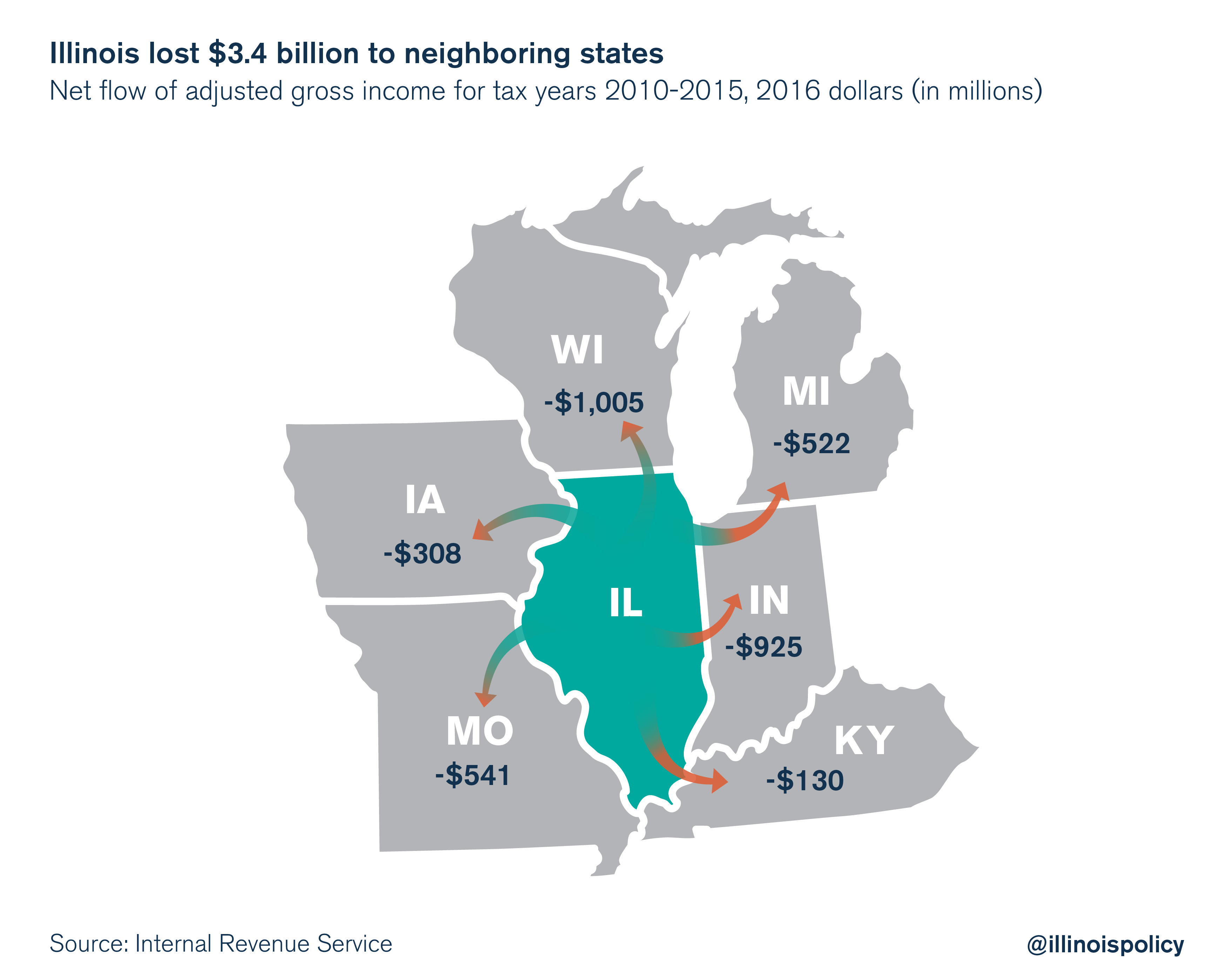

Giant sucking sound: Illinois lost $3.4B in income to neighboring states since 2010

Policy failures have resulted in a steady stream of income flowing to neighboring states.

When people relocate they take their wallets with them. That’s a big problem for Illinois, which is experiencing record-breaking losses of residents to other states.

Thankfully, the Internal Revenue Service measures these flows of adjusted gross income, or AGI. And the IRS data show the Land of Lincoln lost $3.4 billion in AGI to neighboring states on net from tax years 2010-2015, after adjusting for inflation.

In tax year 2015 alone (2015-2016), Illinois lost $4.75 billion in AGI on net to all other states. But more than 15 percent of those net losses went to neighboring states, totaling more than $720 million. In fact, Wisconsin and Indiana place among the top 10 gainers of Illinois income since tax year 2010.

Much of Illinois’ core tax base is increasingly hoofing it out of state. This presents a challenge for policymakers in Springfield who’ve neglected to get state spending under control, opting instead for quick-fix tax hikes to plug the state’s structural budget shortfall. Not incidentally, Illinoisans cite taxes as the No. 1 factor for wanting to leave the state, according to a 2016 poll from the Paul Simon Public Policy Institute.

And it’s not just the state level. Local governments across Illinois continue to hike property taxes to make up for budget shortfalls, to the point where property taxes have grown six times faster than household incomes in Illinois. That’s caused the property tax burden Illinoisans face to rise by 38 percent.

If lawmakers don’t take steps to reduce the largest tax Illinoisans pay – property taxes – residents can expect to see even more money walk out of the state.