Gas taxes nearly equal to cost of gas in Illinois

Illinois’ taxes and fees on gasoline keep the pump price high, even when oil producers are paying for someone to take excess crude. The state gas tax is set to rise again in July.

U.S. oil futures fell to -$37.63 a barrel on April 20, meaning some producers were willing to pay others if in May they will bring at least five tanker trucks to Oklahoma.

That means cheap gas for motorists nationwide. But in Illinois, it means customers may soon be paying more for gas taxes than for the gas itself.

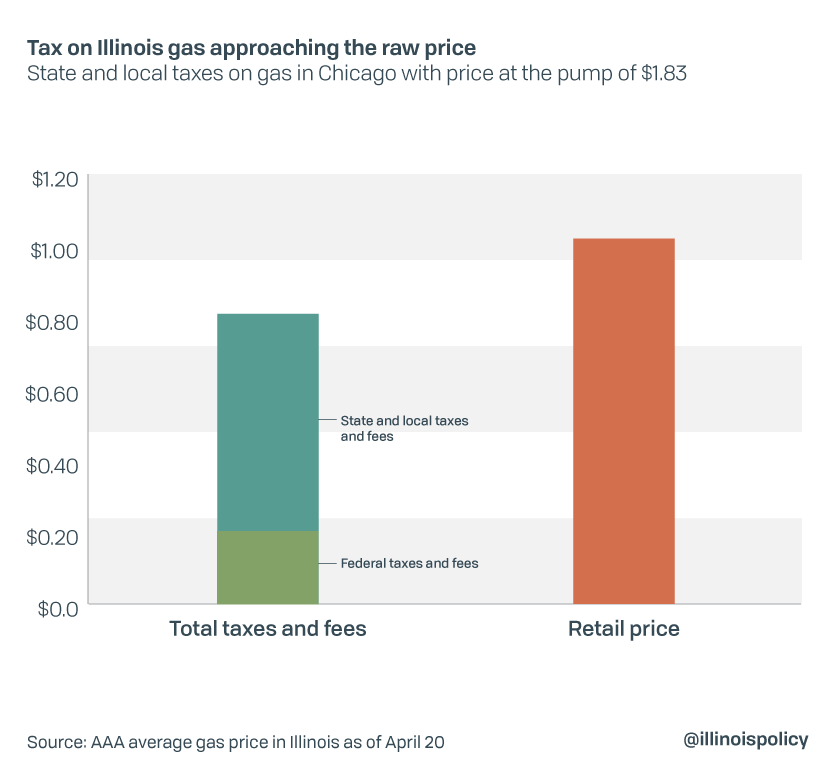

Illinois’ statewide gas average was $1.828 a gallon April 21, on which a motorist in Chicago paid 81 cents in taxes. That’s 44% of the price of that gasoline.

If the price at the pump hits $1.57, gas taxes will be equal to the raw price of gas in Chicago.

Each gallon of gas includes the 38-cent state gas tax as well as a little more than 18 cents for the federal fuel fee. Cook County adds 6 cents per gallon and Chicago adds 5 cents. Everyone is charged just more than a penny for the underground fuel storage tank clean-up fee.

State, county and municipal sales taxes are then added atop the fees, making Illinois one of the few states that taxes its taxes on gas. Double taxation plus fees added up to make Illinois the third-highest for total state taxes and fees in the nation at just shy of 55 cents on the gallon, according to the Tax Foundation’s 2019 survey.

The COVID-19 pandemic combined with a price war involving Russia and Saudi Arabia are filling up U.S. storage facilities. The main terminal at Cushing, Oklahoma, is within weeks of filling up, leading to the offer April 20 to pay $37.63 per barrel to anyone who could show up in May and haul off at least 1,000 barrels, or about five tanker trucks worth.

Even if a retailer were able to offer free gas, Illinois adds a fee per gallon of 38 cents. That fee doubled in July to support Gov. J.B. Pritzker’s $45 billion capital plan, which was criticized for funding pork projects such as dog parks, pickleball courts and renovation of a privately owned, derelict Chicago theater.

When state lawmakers doubled the gasoline fee, they built in hikes at the rate of inflation – up to a penny – each July, meaning the fee could rise to as much as 39 cents this July. The Illinois gas tax is projected to hit nearly 44 cents per gallon in 2025 – tax hikes on which lawmakers can avoid an unpopular vote because they are “automatic.”

The average Illinois driver is spending an extra $100 a year as a result of the gas tax doubling. If the fees increase as estimated, that amount will be $130 in 2025.

It doesn’t need to be that way, and state lawmakers can take responsibility for the automatic gas fee hike coming in July. Repealing it would at least tell Illinoisans their leaders understand a pandemic-fueled economic crisis is exactly the wrong time for higher taxes.