Fighting for Illinois entrepreneurs: 2 huge reforms for the price of none

Illinois can pay for cutting LLC fees by enacting workers’ compensation reform.

Manufacturers and construction companies in Illinois are paying millions of dollars more for workers’ compensation insurance compared with neighboring competitors, making those industries uncompetitive in the state.

But reform is within reach. And with the right tradeoffs, lawmakers could double down on unleashing the state’s entrepreneurial spirit without spending a dime.

Gov. Bruce Rauner introduced the legislative proposals for his “Turnaround Agenda” on May 22. One of the governor’s leading economic-reform proposals is to overhaul Illinois’ workers’ compensation system, which would provide a tremendous stimulus to Illinois’ manufacturing and construction sectors.

Entrepreneurs are in dire need of workers’ compensation reform as well. While established companies can lower insurance costs by earning a solid track record of workplace safety, entrepreneurs are hit with much higher insurance premiums that reflect the uncertainty of a new enterprise. Thus, workers’ compensation reform would provide a much more stable and affordable insurance market for entrepreneurs. In addition, Rauner’s workers’ compensation reform can save state government enough money to allow for another pro-entrepreneur reform: cutting startup and annual fees for small businesses.

Here’s how it would work: Rauner’s workers’ compensation proposals are in House Bill 4223, filed by House Minority Leader Jim Durkin, R-Burr Ridge. If enacted, the reforms would cause insurance premiums for workers’ compensation to fall.

The biggest employer that would receive relief? The state of Illinois itself. This is where Rauner can find an unlikely ally in his push to reform the system: Attorney General Lisa Madigan. Three years ago, Madigan wrote a letter to urge legislative leaders to enact further reforms to Illinois’ workers’ compensation system, saying:

“The current law and decisions interpreting the law…make it extremely difficult for employers, including the State, to successfully defend these cases and limit the costs”

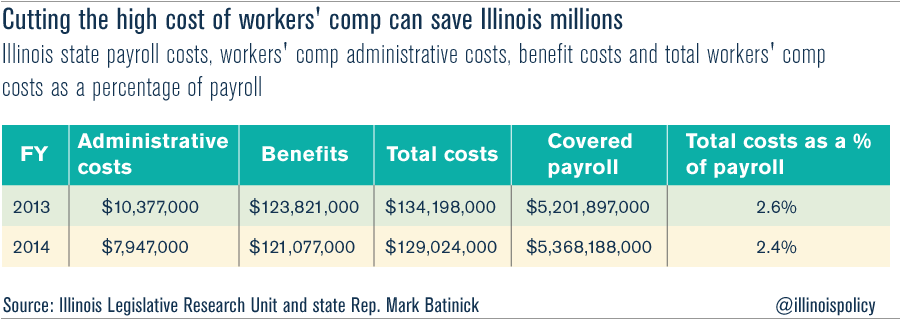

According to Illinois’ Legislative Research Unit, the state self-insures over $5 billion in payroll costs and pays out over $120 million per year in workers’ compensation benefits, amounting to about 2.5 percent of total payroll costs.

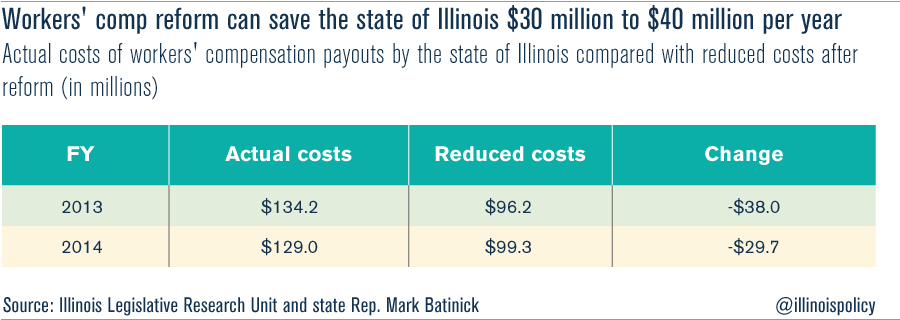

Enacting reforms that could bring Illinois’ workers’ compensation system in line with the median level of all states would save state government tens of millions of dollars. According to the Legislative Research Unit, the savings for the state would fall between $30 million to $40 million each year.

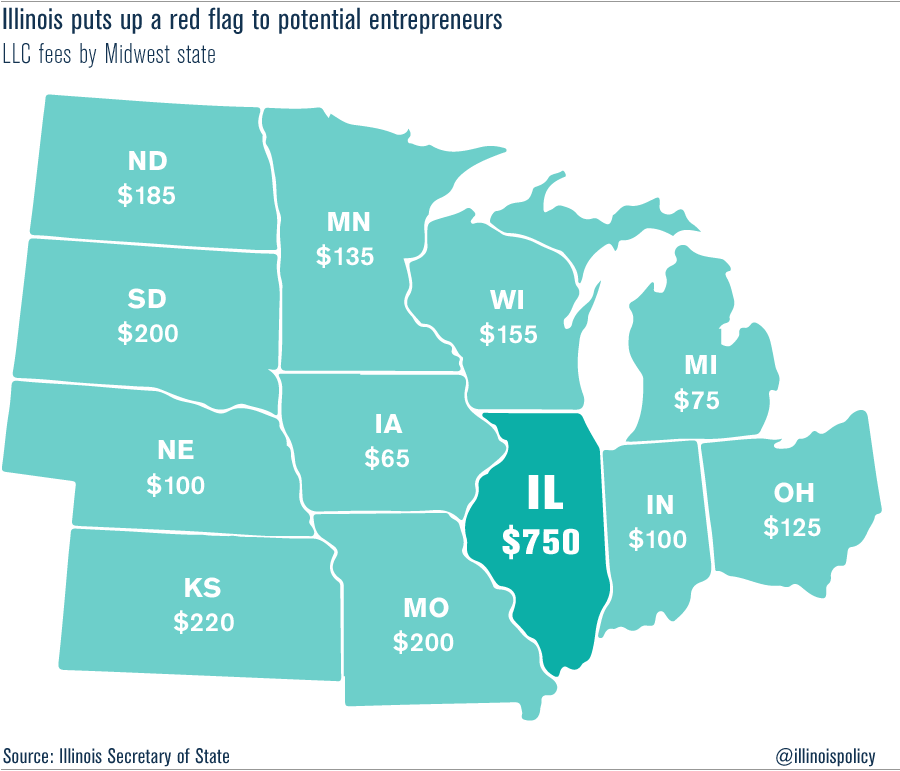

These savings, although modest in terms of the state budget, would be enough to finance another critical pro-entrepreneur reform: lowering startup costs for Limited Liability Companies, or LLCs, by 75 percent. The startup fee for a new LLC in Illinois is $500 – the highest fee in the entire country. The annual filing fee is also especially high at $250 per year for all existing LLCs. These combined startup and annual fees are completely out of line with surrounding states.

House Bill 325 would address Illinois’ high LLC fee schedule by reducing fees by 75 percent, and could be paid for through the state savings from workers’ compensation reform. The cuts to startup fees in HB 325 would reduce state revenue by about $39 million, according to analysis from the Office of the Secretary of State. The workers’ compensation reform would likely save the same amount, along with spurring new tax revenues through increased economic growth.

Rauner’s workers’ compensation reform is critical for rejuvenating growth, especially in Illinois’ manufacturing industry, which has lost jobs in every month of 2015. And Rauner’s proposal provides a great example of how one good reform can help finance another, in this case providing double the positive impact for Illinois’ entrepreneurial community.

Image credit: David Wilson