Federal Reserve throws credit lifeline to near-junk Illinois

The Federal Reserve announced unprecedented plans to directly purchase up to $500 billion in state and local government bonds. States with poorly managed finances, such as Illinois, stand to benefit most, but long-term threats loom without structural reforms.

On April 9, the U.S. Federal Reserve announced plans to purchase up to $500 billion in state and local government bonds to be repaid within two years. The new lending program marks a first for the Fed, which historically avoided the municipal bond market where state and local debt is sold.

The unprecedented action underscores the serious threat facing government finances. Entire sectors of the economy have been ordered to shut down in response to the coronavirus pandemic, which will pressure state budgets with a one-two punch of lost revenue and automatic spending increases in poverty assistance programs.

Illinois and other states with a history of fiscal mismanagement stand to benefit most from the Fed’s credit lifeline. The Prairie State’s credit rating is the lowest among U.S. states. Two of three major credit ratings agencies put Illinois at just one notch above non-investment “junk” status. Wary investors are pulling out of the municipal bond market at record levels, with Bloomberg reporting the $12.2 billion exodus in March was almost three times larger than any previous weekly pull back. As a result, Illinois may need to rely on the Fed’s new program to meet its basic financial obligations.

The Prairie State has essentially nothing saved in a rainy day fund, which states are supposed to use to maintain spending levels during recessions and emergencies. Raising taxes during or shortly after a recession would devastate the economy when it is most fragile, especially in an already high-tax state. And borrowing is also problematic for Illinois, as private investors may prove unwilling to accept the risk of lending Illinois money given the state’s already enormous debts, which left the state paying bond yields roughly 3.4 percentage points higher than top rated states as of April 3. If Illinois is able to borrow more from private markets, interest rates could become even more unaffordable.

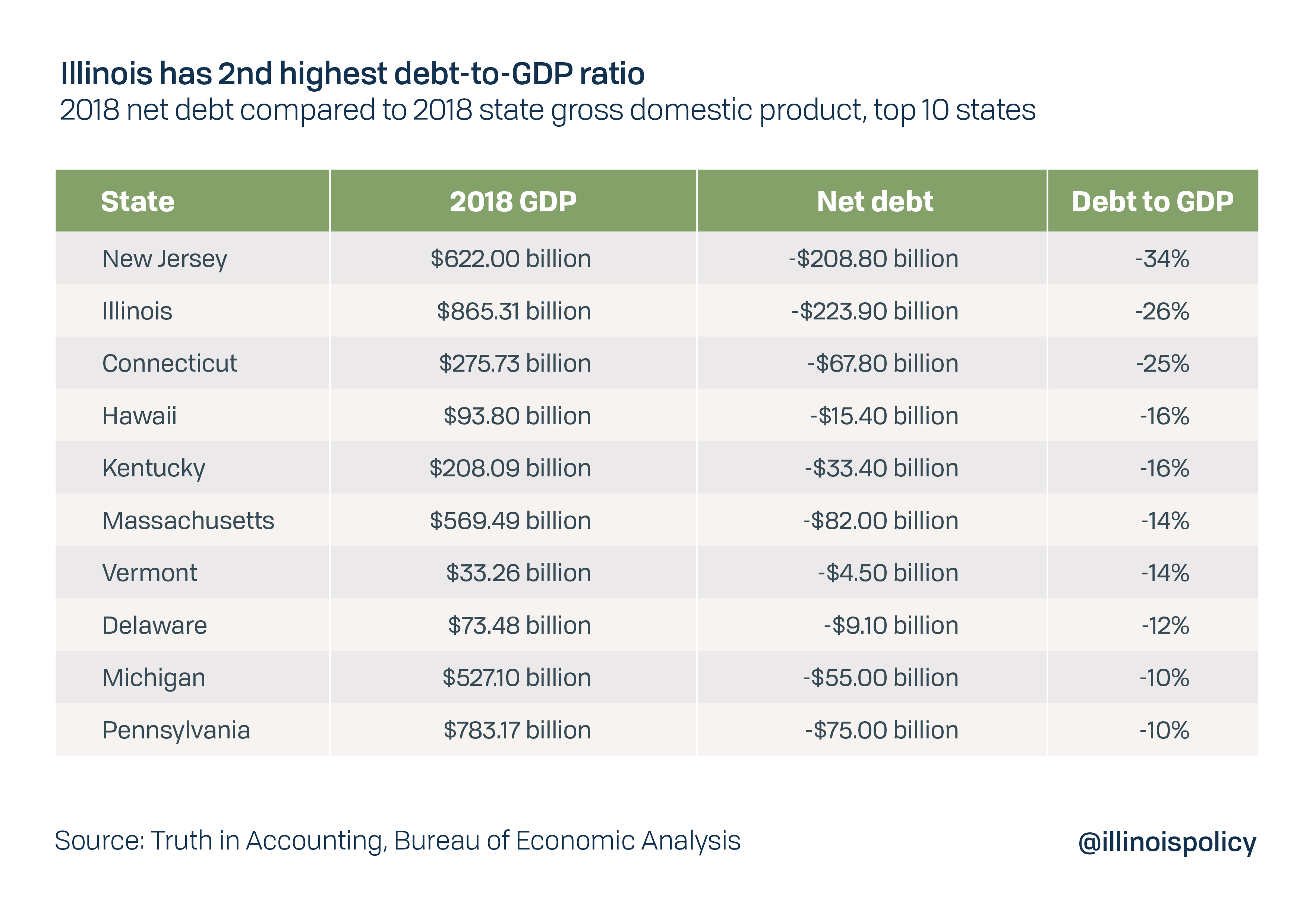

At the end of 2018, the most recent year of audited financial data available, Illinois had the nation’s second-worst overall debt burden compared to the size of the state’s economy.

The largest portion of Illinois’ debt burden comes from its worst-in-the-nation pension crisis. Even before COVID-19 sent financial markets reeling, Illinois’ five state-run systems had at least $137 billion in unfunded pension liabilities according to the state’s own estimates. Credit ratings agency Moody’s Investors Service estimates that, under more realistic assumptions, actual state pension debt was $241 billion.

Under the new Federal Reserve program, the state of Illinois would be able to borrow up to 20% of own source revenues as reported for federal fiscal year 2017. That would equal more than $9.6 billion that could be used to cover tax delays, lower than expected revenues and unexpected spending increases. The Fed announced that interest rates would be based on states’ credit ratings at the time bonds are purchased, meaning Illinois will have to pay more than other states with better balance sheets.

The Fed program will lend to large cities with populations over 1 million and counties over 2 million, meaning Chicago and Cook County would be eligible for additional borrowing separate from state borrowing.

Illinois is already set to receive $4.9 billion in grants from Congress to cover state and local costs associated with the COVID-19 response effort. The money does not have to be repaid but cannot be used to offset lost revenue or cover unrelated expenses. The size of the uncovered budget hole could be $6.3 billion this year, or more depending on the severity of economic harm.

The ability to borrow money from the Fed is a double-edged sword for Illinois’ mid- to long-term financial outlook. Because Illinois has so few other options to cover essential spending, the ability to sell bonds to the central bank could give the state some breathing room to get through the immediate crisis. However, taking on even more bond debt today will further restrict Illinois’ cash flow until the bonds are repaid.

Without a constitutional amendment to allow for pension reform, contributions to government worker retirement systems will continue to grow beyond taxpayers’ means to pay. Unsustainable pensions will continue to crowd out spending on core services such as public safety, education and health and human services. Interest payments on new bond debt would add another demand on limited public resources.

For two decades, Springfield politicians have consistently spent more than state residents could afford on items that generate little to no benefit for most Illinoisans, such as unsustainable levels of pension and health care benefits for state workers. This overspending ensured Illinois was the worst-prepared state, financially, to deal with the coronavirus.

To put Illinois in a position for a strong economic recovery and healthier state finances, elected leaders must adopt bold reforms to protect struggling residents and overburdened taxpayers.