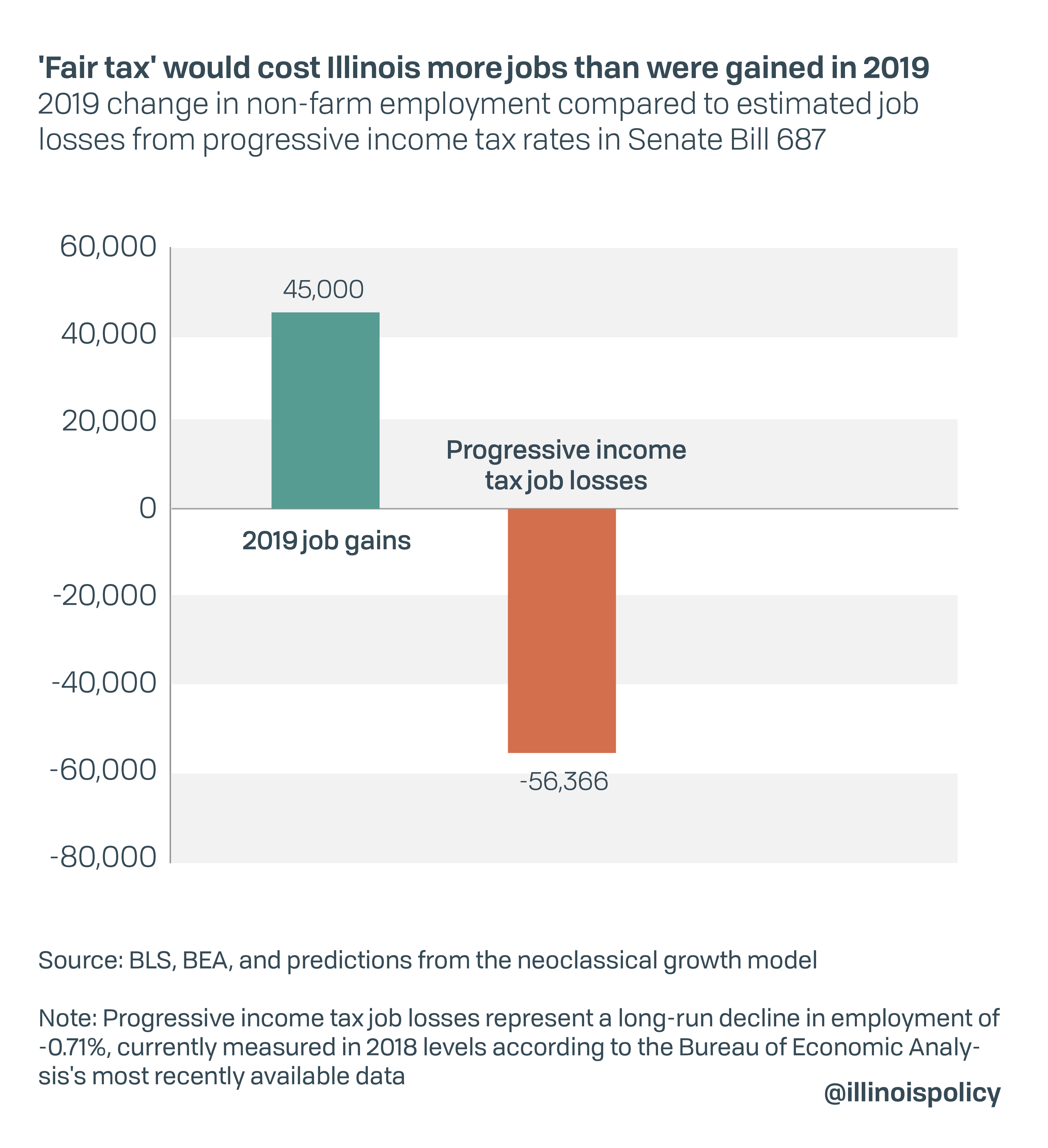

‘Fair tax’ would cost Illinois 56K jobs

Progressive income tax would essentially wipe out all 2019 employment gains in Illinois, and then some.

While Gov. J.B. Pritzker lauded his first year as a success for the state’s labor market, his priority “fair tax” proposal would more than erase his year of jobs gains and set back the state’s economy.

Illinois gained 45,000 jobs in 2019, a sluggish rate compared with the national average. If voters on Nov. 3 pass Pritzker’s signature policy proposal, a progressive state income tax he dubbed the “fair tax,” last year’s jobs gains would be more than wiped out. Illinois would lose 56,366, according to an analysis by the Illinois Policy Institute.

Pritzker touted job gains during his state of the state address. In reality, Illinois’ jobs market endured another sluggish year in 2019. The state added just 45,000 jobs (+0.7%), a rate that was half the national average of 1.4%. And despite Pritzker’s claim that all areas of the state are growing simultaneously, three metro areas experienced a decline in the number of jobs in their economies and seven other metro areas were below the national average. This poor jobs performance came as Illinois suffered its sixth consecutive year of population decline in 2019.

Additionally, the state’s unemployment rate – while reaching historic lows in 2019 – remains higher than the national average and those of most neighboring states. The rate has actually been the byproduct of a declining labor force rather than employment gains.

Now, Illinois’ fragile labor market is at even further risk of deteriorating, as lawmakers are asking voters to approve a $3.7 billion progressive income tax hike this November. The decision to scrap the state’s constitutionally protected flat income tax in favor of a progressive income tax would wreak havoc on the state’ s economy, resulting in an estimated 56,366 (-0.71%) fewer jobs – more than the entire Decatur metro area, which sustains 52,500 jobs – over the long run (see Appendix).

The lost jobs from the progressive income tax would be more than all of the job gains posted in 2019.

Because the tax increase would hurt the economy and yield less revenue than expected, the progressive income tax would likely result in far higher taxes on middle-class Illinoisans, causing even more disastrous effects.

Illinois’ labor market is in desperate need of a jump start. Pursuing more tax hikes won’t boost jobs growth. Instead, the state needs to pursue long-lasting reforms, such as constitutional pension reform. It needs to tie growth in state spending to what Illinois taxpayers can afford, such as growth in state gross domestic product or personal income. Texas and Tennessee have implemented similar spending restrictions, and both have budget surpluses, no state income tax and lower property tax rates than Illinois.

Ignoring the need for reform and opting for big tax hikes will only prolong slow growth in Illinois, and could bring job growth to a complete standstill.