Fact-checking BGA’s claims on ‘low-spending’ Illinois

While the Better Government Association has claimed Illinois’ budget contains no fat to trim, a deeper analysis reveals the state has many areas of expensive inefficiency to reform in state and local government costs, the Medicaid program and K-12 education.

The Better Government Association, or BGA, an Illinois government watchdog, recently said Illinois government is lean, with no meaningful options for spending cuts. The group claims three barriers prevent the state from pursuing major spending reforms, and implies tax hikes are the only solution to Illinois’ budget crisis.

But while BGA’s claims are correct on the surface, a deeper fact check finds those claims faulty and misleading to taxpayers and policymakers.

Compared with other states, the BGA says Illinois:

- Has fewer state workers per capita

- Spends less on Medicaid per patient

- Has a worst-in-the-nation record for supporting local schools

Based on BGA’s analysis, there is nothing to cut because Illinois’ spending is either efficient or the state already spends too little on services to allow for any spending reforms.

Neither of these options is true, however. Illinois has major opportunities to enact reforms that would save the state and taxpayers billions of dollars. And it is possible to balance the budget without hiking taxes on struggling Illinoisans.

The BGA ignores that Illinois has one of the largest state-local bureaucratic webs in the nation

Ignored by the BGA in its analysis is the fact that Illinois state government spends billions in subsidies to prop up the most numerous units of local government of any state in the nation, plus the bureaucracies that run them. Local governments serve just 1,800 people per unit in Illinois, while in Texas they serve 2.5 times more people per unit, and in Florida they serve six times more people.

Local governments could not support that infrastructure were it not for billions in state subsidies that inflate local pensions, prevailing wages and collective bargaining agreements.

The BGA analysis also ignores that Illinois state workers are the highest-paid in the nation when adjusted for cost of living, and that these workers receive free retiree health insurance and Cadillac health care benefits. Moreover, Illinois state workers represented by the American Federation of State, County and Municipal Employees average nearly $110,000 in total yearly compensation.

Illinois government is not the example of efficiency the BGA implies. State worker compensation must be brought in line with what taxpayers can afford.

Illinois’ bloated Medicaid system spends more per capita than neighboring states

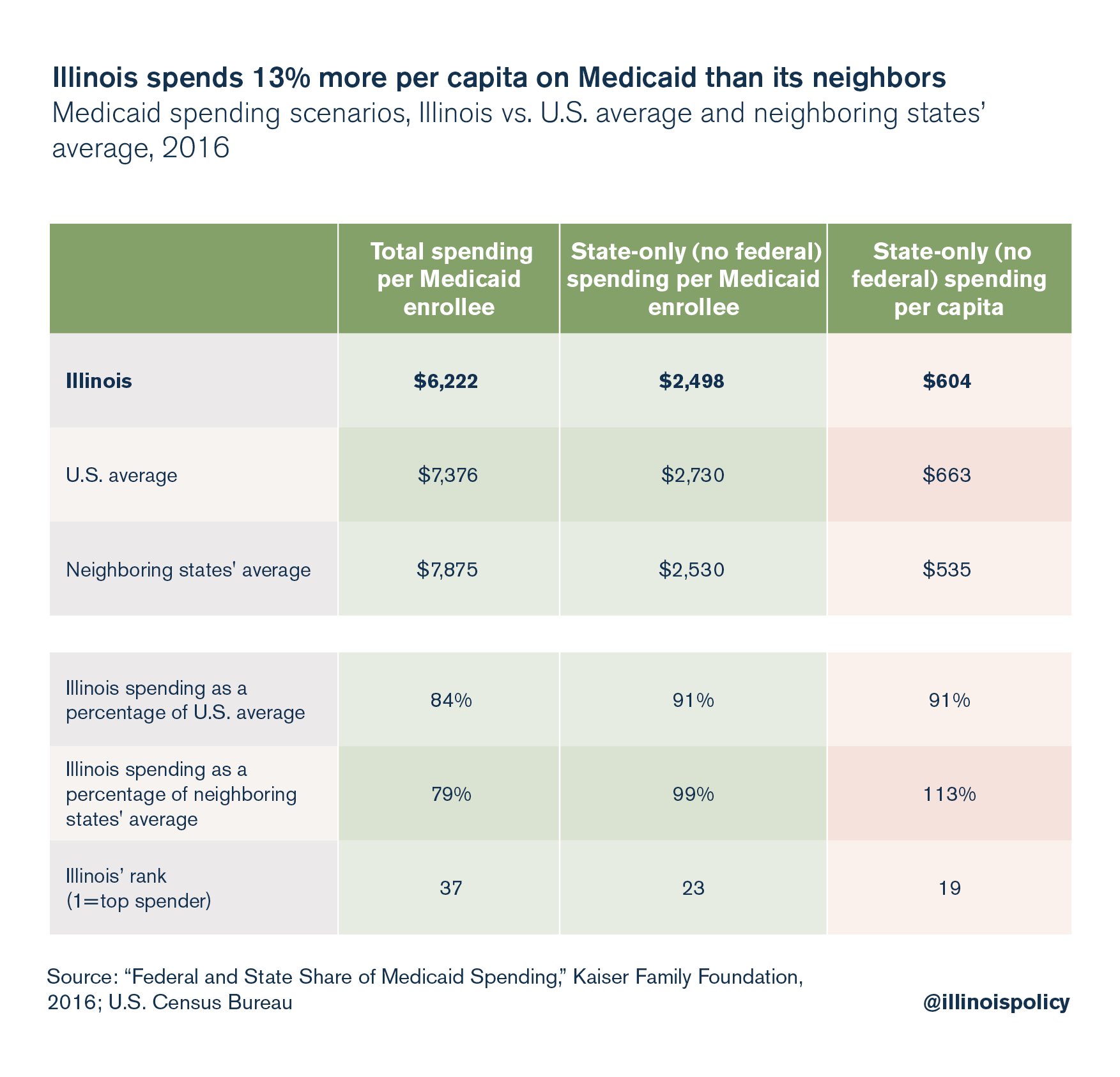

When it comes to Medicaid spending, the BGA missed the mark. The organization failed to adjust for the subsidies each state receives from the federal government. A more appropriate, apples-to-apples comparison ranks Illinois 19th in the nation in state-only spending on Medicaid – not 37th as the BGA methodology implied. And when compared with its neighboring states, Illinois spends 13 percent more on a per capita basis.

Medicaid, which was originally meant to be a safety net for the poor, is now so bloated it enrolls 25 percent of Illinoisans but fails to provide health care access to those who need it most. Medicaid is ripe for reforms that provide Illinois’ most vulnerable true access at a lower cost.

Illinois spends the most per student in the Midwest, and billions in funding are trapped in Illinois’ education bureaucracy

The BGA also ignored the fact that in education Illinois spends the 13th-most per student in the nation and the most in the Midwest – far more than its neighbors. The real problem in Illinois education is that billions of dollars are tied up in the state’s sprawling education bureaucracy. Pension costs consume 50 percent of what the state appropriates to education. And Illinois’ nearly 900 school districts and the highly paid administrators who run them drain money from students and classrooms.

Illinois education can reform itself through the consolidation of its many duplicative school districts, a reduction in executive-level pay for administrators, and the implementation of 401(k)-style retirement accounts going forward.

Illinois needs reforms, not tax hikes

The BGA analysis contradicts what most Illinoisans already know: that Illinois’ state and local governments are inefficient.

Nearly 80 percent of those polled in a 2017 survey conducted by Fabrizio, Lee & Associates and commissioned by the Illinois Policy Institute agreed with the following statement: “Illinois state lawmakers should pass major structural reforms before passing any tax increase.”

The BGA is wrong to imply there is nothing left to do but hike taxes to fix Illinois’ budget.

There are plenty of areas in government that need structural reforms. Enacting those reforms can balance the budget without resorting to tax hikes.

The Illinois Policy Institute has provided a full $7 billion reform road map for Illinois government. The Institute’s plan provides tax relief to struggling homeowners through a comprehensive property tax reform package, implements reforms that begin an end to the pension crisis, and enacts major reforms to spending on health care and government worker compensation.

The following detailed analysis explains why and how the BGA’s claims are faulty.

Claim: “On a per capita basis, no state government employs fewer people than Illinois.”

Why it’s misleading: The BGA ignores that Illinois has one of the largest state-local bureaucratic webs in the nation.

The BGA’s focus on state workers per capita makes it sound as if Illinois is an especially efficient state. But Illinois’ low number of state workers per person is a function of its big population, not government efficiency.

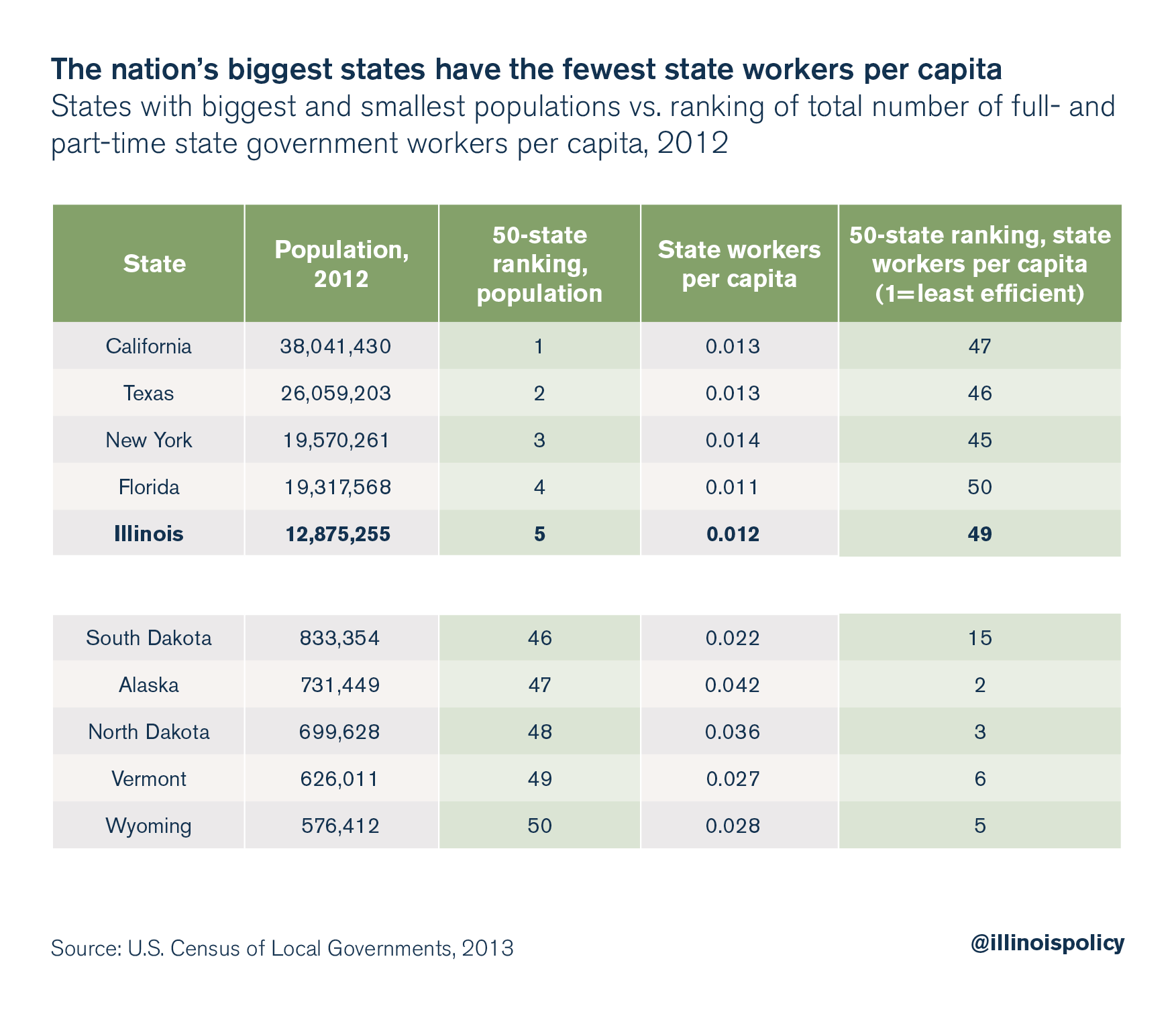

A 50-state comparison shows the nation’s five most populated states all have the lowest number of state workers per capita in the nation. Big states have to hire fewer state workers per capita than states with smaller populations simply due to their economies of scale.

At the other extreme, states with the most workers per capita are the smallest states in terms of population. For example, Alaska, North Dakota and Wyoming are some of the smallest states and have some of the highest numbers of state workers per capita.

State workers per capita heavily correlated with state population

The real problem: The web of local government bureaucracies

The BGA’s claim about state workers misses Illinois’ real problem: The state heavily subsidizes one of the most expensive and extensive webs of local government bureaucracies in the country.

Illinoisans pay the highest property taxes in the U.S. to fund nearly 7,000 units of local government – the most in the nation and more than the number of local governments in Indiana, Kentucky and Iowa combined.

But billions more in state subsidies fuel wasteful local spending, overly generous pension benefits, and salaries for too many administrators. These subsidies also prop up unaffordable collective bargaining, prevailing wage and workers’ compensation costs of these thousands of local governments.

It’s within these subsidies and waste that structural reforms are needed.

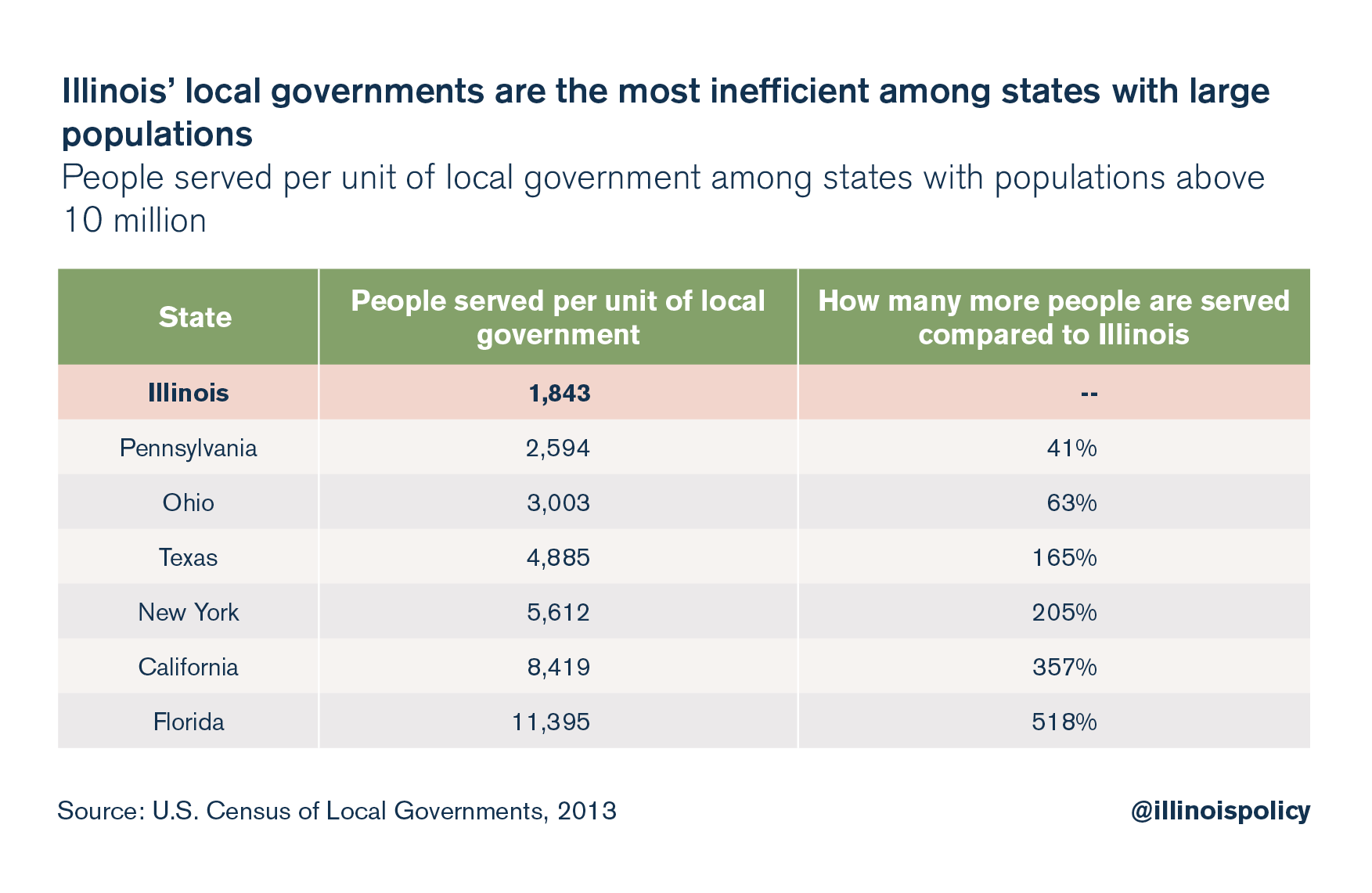

Local governments’ inefficiencies are more easily seen when comparing the number of people Illinois local governments serve with other large states. On a per capita basis, the average local government in Illinois serves just 1,800 people.

Local governments in other heavily populated states serve far more residents. For example, the average local government in California serves more than 8,000 people, or 360 percent more than Illinois does, while Florida’s local governments serve on average 500 percent more people than Illinois’ governments do.

Having thousands of local governments means having to pay for the bureaucrats those governments employ.

Top local administrators are particularly costly. Such government employees often receive six-figure salaries and millions of dollars in pension benefits over the course of their retirements.

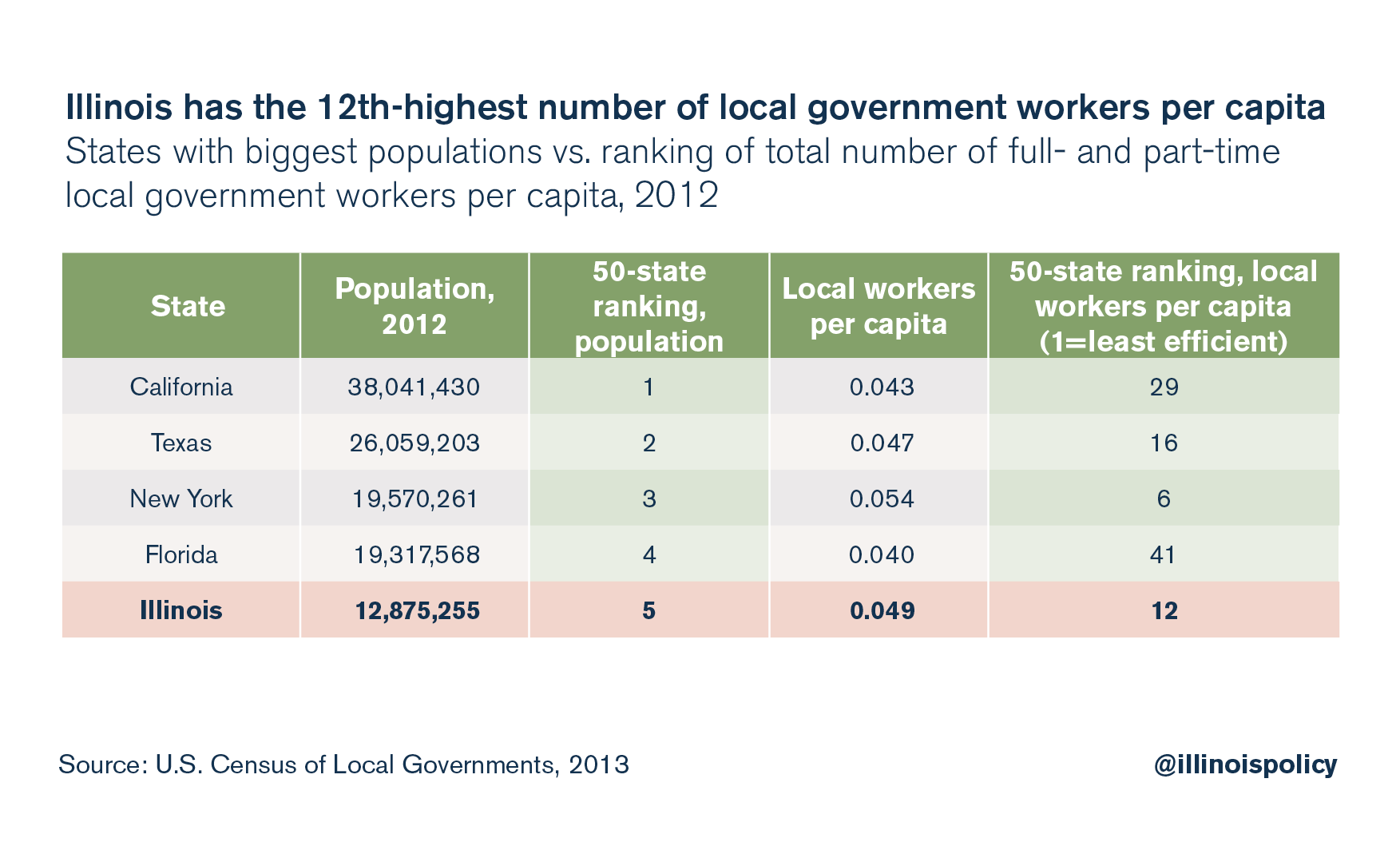

The fact that Illinois has so many local governments – and needs administrators to run them – means the state has one of the highest numbers of local government workers per capita.

Illinois has the 12th-highest number of local government workers per capita. Among the top five biggest states, only New York has more.

Illinois has the 12th highest number of local government workers per capita

Illinois can save nearly $3.5 billion annually by ending its tangle of subsidies and unfunded state mandates to local governments, which only serve to drive up local costs.

That means reforming revenue-sharing agreements that fuel excessive local spending. It means ending state pension subsidies that allow districts and universities to dole out higher pay, end-of-career salary hikes and pensionable perks. And it means ending special carve-outs and other preferential subsidies to school districts.

In addition, the state should dramatically reduce the number of overlapping and duplicative local governments in Illinois through consolidation.

The real problem: State worker compensation

The BGA ignores the large cost Illinois state workers impose on taxpayers.

Illinois state workers not only enjoy the nation’s highest state worker salaries when adjusted for the cost of living, but they also receive many benefits that are unheard of in the private sector.

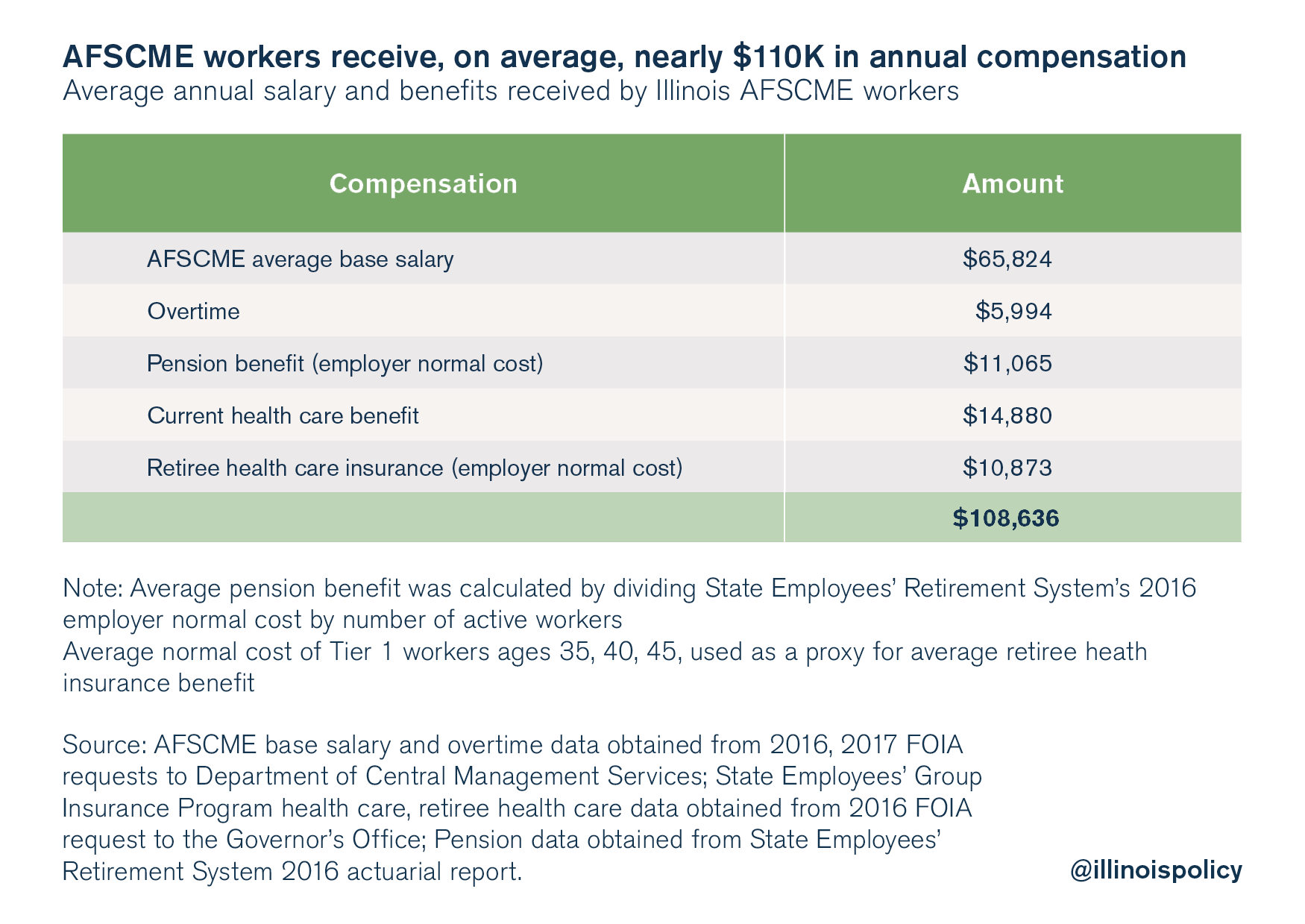

Those combined benefits – including heavily subsidized worker health care, generous pension benefits, and free retiree health insurance – help push up total compensation for the average Illinois state AFSCME worker above $100,000 annually.

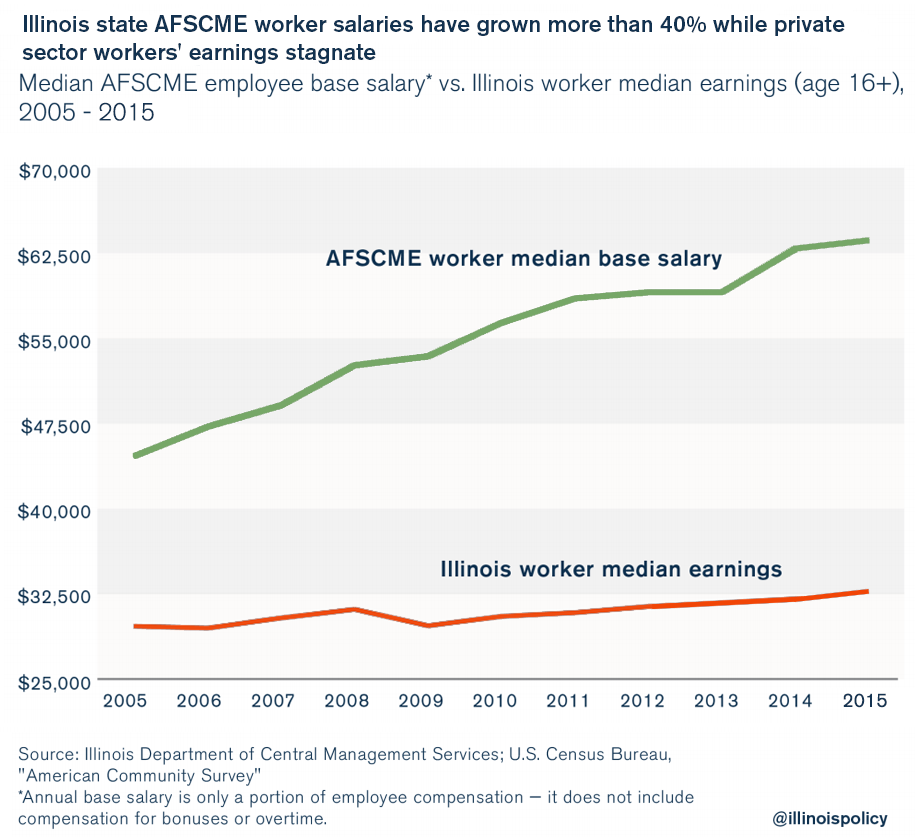

Base salaries alone have grown significantly over the past decade. The median state worker salary increased by more than 40 percent from 2005 to 2015. During that same period, median private sector earnings in Illinois remained virtually flat.

AFSCME workers receive platinum-level health care benefits as well. Taxpayers subsidize almost $15,000, or 77 percent, of each state worker’s health care costs, which total more than $19,000 per year.

The average career state worker also receives free retiree health insurance. The total cost of that benefit can be as high as $500,000 in today’s dollars, per employee.

The state can achieve significant budget savings by aligning workers’ health care benefits with what

Illinoisans can afford.

If the state can implement its last, best contract offer with AFSCME employees, it will save taxpayers approximately $600 million in government overtime and health care costs yet still provide affordable, flexible and fair health care options for state workers.

In addition, the state can further reform the costs of employee compensation by reducing the state’s payroll by several hundred million dollars.

Claim: “The amount Illinois spends per Medicaid enrollee stands at about $4,500, below the national average by about $1,400 a patient.”

Why it’s misleading: Illinois’ bloated Medicaid system spends more per capita than neighboring states.

The BGA claims that Illinois is an outlier on Medicaid spending, that it spends far less per enrollee than the national average.

However, the BGA’s numbers are misleading. They compared each state’s total Medicaid spending – including federal subsidies – per enrollee.

But that’s not a fair, apples-to-apples comparison.

The federal reimbursement rate for Medicaid varies widely from state to state. For example, Mississippi gets more than $3 from the federal government for every $1 it spends on Medicaid. Illinois, in contrast, gets just over $1 for every $1 it spends.

A fairer way to compare state efforts is to exclude the federal reimbursement and to compare state-only appropriations.

And since each state has different enrollment qualifications and programs, spending per enrollee can differ widely from state to state.

So, comparing state-only spending (excluding federal subsidies) on a per capita basis, instead of a per enrollee basis, can give a better view of each state’s commitment to Medicaid.

Under that comparison, Illinois spent the 19th-most on Medicaid in the nation and tied Wisconsin as the highest spender among Illinois’ neighbors.

In all, Illinois spent 13 percent more on Medicaid than the average of its neighboring states.

Illinois ranks in the middle of Medicaid spending

State spending per enrollee after federal reimbursement removed, 2016

The real problem: Medicaid is no longer serving those most in need

Illinois’ problem with Medicaid isn’t about what it spends. Approximately 25 percent of Illinois’ general fund budget goes to health care costs, including Medicaid.

The problem is Medicaid is overcrowded and inefficient. Recipients typically experience poor access to health care despite the more than the $13 billion spent on Medicaid annually.

That’s because of Medicaid’s rapid boom in enrollment. As more Illinoisans have entered Medicaid, the new enrollees have crowded out resources for those who truly need them.

In 2000, 1.37 million, or 11 percent, of all Illinoisans were enrolled in Medicaid. As of 2015, enrollment had swelled to 3.2 million – a 135 percent increase. With more than a quarter of all Illinoisans on Medicaid, it is no longer a safety net for Illinois’ neediest residents.

The most sweeping solutions to Illinois’ Medicaid problems will require federal action, including issuing Illinois a block grant instead of federal reimbursements. With a block grant, Illinois could transform Medicaid’s fee-for-services and managed care programs into an assistance program based on need, allowing the state’s most vulnerable the opportunity to purchase private health insurance and access to health care savings accounts.

However, there are some things Illinois can do on its own that will both save money and improve access to care for high-need Illinoisans. That includes more frequent eligibility checks, volume purchases, competitive bidding and the utilization of ambulatory surgical centers.

Claim: “In the funding of public schools, no state spends less in support of K-12 education than Illinois.”

Why it’s misleading: Illinois spends the most per student in the Midwest, and billions in funding are trapped in Illinois’ education bureaucracy.

BGA’s claim that Illinois provides little in state-only funding is misleading. In particular, the group implies that Illinois’ poorest districts are being shorted education funding.

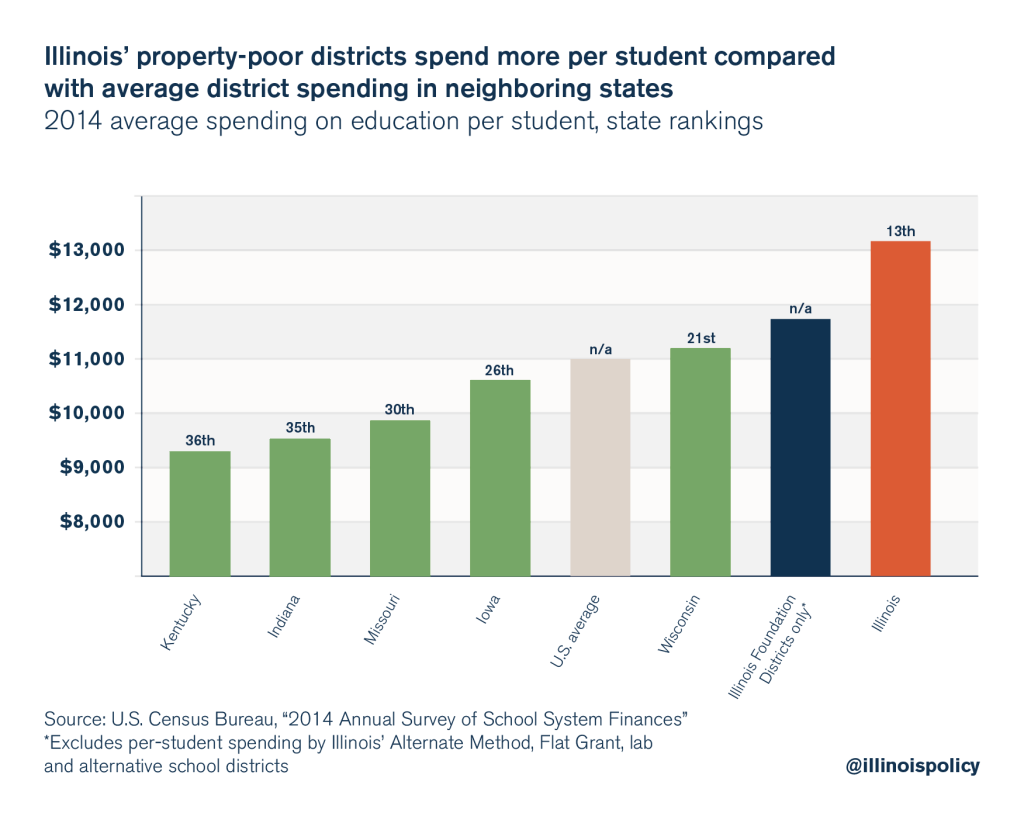

However, Illinois is one of the nation’s top-spending states on education. Even the state’s 500 poorest districts on average spend more per student than both the national average and that of Illinois’ neighbors. That’s largely due to the state’s funding system, which ensures that Illinois’ neediest districts get the state funding they require.

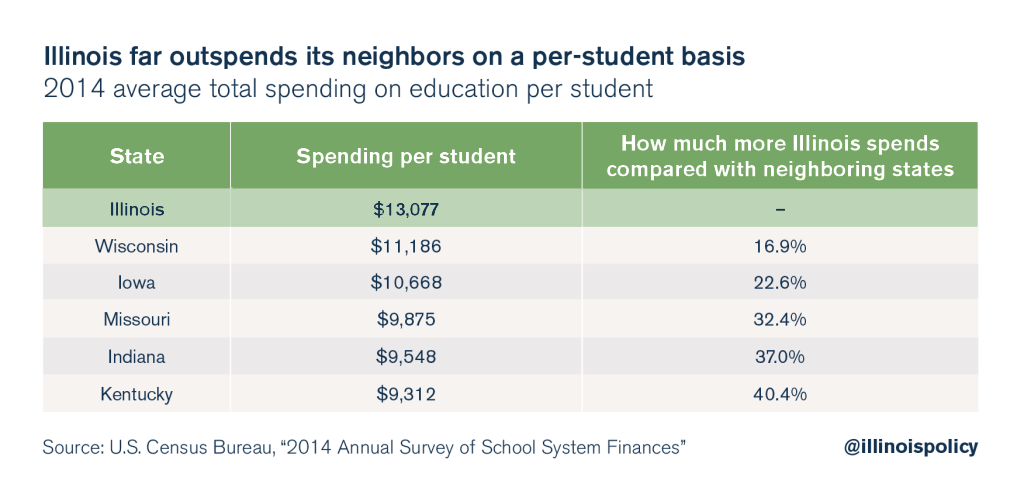

First, BGA’s claim ignores that according to U.S. Census data, Illinois spent an average of $13,077 per student in 2014, the 13th-most in the nation and the most in the Midwest. Illinois also spends far more per student on education than its neighbors do – 40 percent more than Kentucky, 37 percent more than Indiana, and 32 percent more than Missouri.

The same high spending applies to Illinois’ poor districts as well.

Illinois’ property-poor districts (the 500 foundation-level districts as defined by the Illinois State Board of Education, or ISBE) on average spend nearly $12,000 per student, more than the national average of all states. In addition, Illinois’ poorest districts on average also outspend every neighboring state.

Second, the BGA ignores the fact that state money for education goes to the districts that need it most.

Illinois’ education finance system requires the state’s most property-rich districts to largely self-fund education through local property taxes. That ensures that the overwhelming majority of state taxpayer funds can go toward districts that demonstrate actual need.

In fact, when spending by wealthy districts – that largely self-fund through local tax dollars – is excluded from Illinois’ total spending on education, property-poor districts actually receive on average nearly 45 percent of their funding directly from the state.

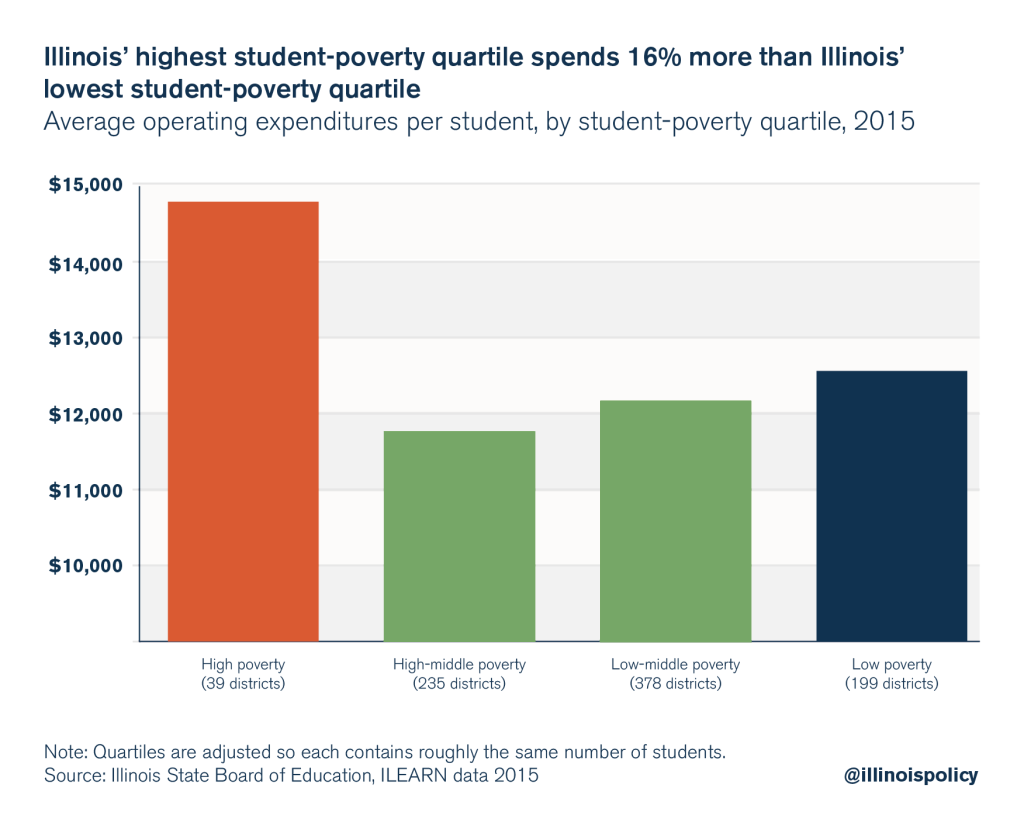

And when Illinois’ school districts are broken down into quartiles on the basis of percentage of students in poverty (with each quartile containing the same number of students), districts with the highest concentration of students in poverty spend more per student than districts with the lowest concentration of students in poverty.

The quartile with the highest concentration of poverty in Illinois spent over $14,700 per student in 2015, according to ISBE spending data.

In contrast, the quartile with the lowest level of poverty spent $12,600 per student, 16 percent less than the highest-poverty districts.

That’s not to say Illinois’ funding formulas are perfect. They do have problems that should be addressed. The state should eliminate special carve-outs for select districts and preferential block grants just for Chicago Public Schools.

The real problem: State money is trapped in Illinois’ education bureaucracy

Making changes to Illinois’ funding formula or having state taxpayers pour billions of additional dollars into education won’t change the structural problems in education. The real problem with state funding is that billions of dollars are tied up in Illinois’ sprawling education bureaucracy.

Teachers’ retirement costs, for example, already consume nearly 50 percent of all state appropriations to suburban and downstate education. As long as the pension costs continue to grow uncontrollably, pensions will deprive students of additional funding.

Illinois’ excessive number of school districts – and their redundancy – also drains money from students and classrooms. Nearly half of Illinois school districts oversee only one to two schools. More than one-third of all district offices serve fewer than 600 students. And many elementary and high school districts share overlapping borders. District consolidation is a key to freeing up funds for education.

And administrative compensation costs have taken money away from Illinois’ students as the number of administrators and staff in school districts has grown.

Between 1992 and 2009, the number of district administrators grew by 36 percent in Illinois, 2.5 times as fast as the growth in students. Today, there are 8,000 top school administrators making six-figures in total compensation, each of whom will receive $3 million or more in pension benefits over the course of retirement.

If the number of administrators in Illinois had simply grown at the same rate as students, Illinois would have nearly 19,000 fewer administrators and would be spending $750 million less in compensation annually.

Illinois needs to free up the billions of dollars already tied up in the state’s education bureaucracy so more funding can actually go to classrooms and students. That means introducing 401(k)-style plans for teachers, shifting the cost of employer pension contributions back to school districts, and encouraging the consolidation of school districts and cutting down on the state’s thousands of administrators.