Exemptions and deductions give low-income Illinoisans less than half tax rate of ‘rich’

Illinois’ tax code already protects the poor and middle class from paying as high a rate as billionaires, meaning the ‘fair tax’ is really about lawmaker taxing power.

Supporters of Gov. J.B. Pritzker’s progressive income tax amendment have been using ads to claim state lawmakers need new taxing power to ensure low-income and middle-class taxpayers aren’t paying the same as millionaires and billionaires.

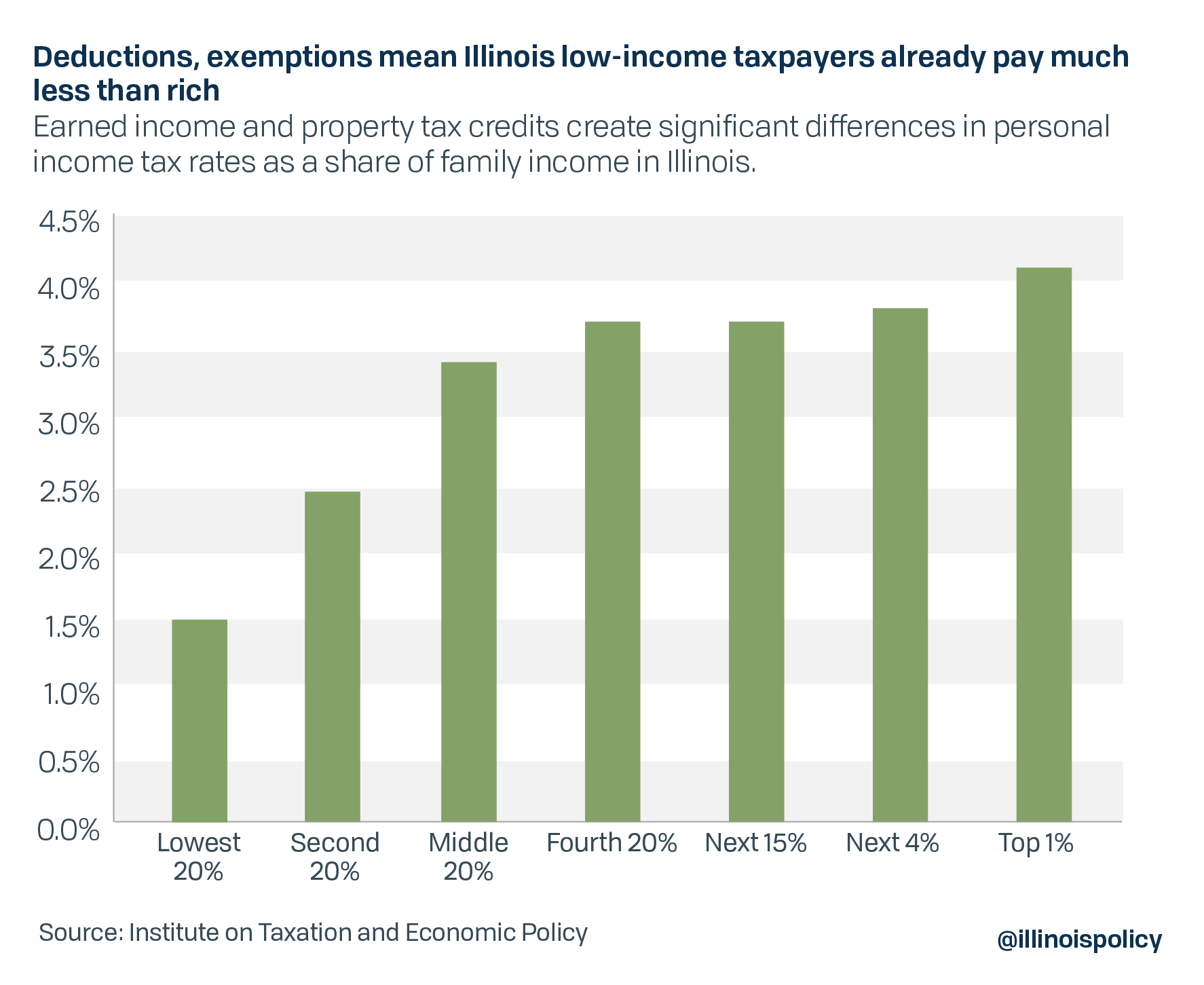

But thanks to exemptions and deductions already in the tax code, the lowest 20% of income earners already pay less than half the rate of the top 20% of earners.

Like progressive tax supporters want, Illinois’ poorest taxpayers pay the lowest rate: just 1.5% of their income. Illinois’ richest 1% pay the most at 4.1% of their incomes, according to research from the left-leaning Institute on Taxation and Economic Policy.

While Illinois has a “flat” income tax system that currently collects 4.95% of incomes, exemptions and deductions in the tax code such as the Earned Income Tax Credit and Property Tax Credit disproportionately benefit Illinoisans with lower incomes. That significantly shifts the tax burden toward the higher earners, who often don’t qualify for many of the largest exemptions and deductions or whose exemptions and deductions do little to reduce their state income tax burdens.

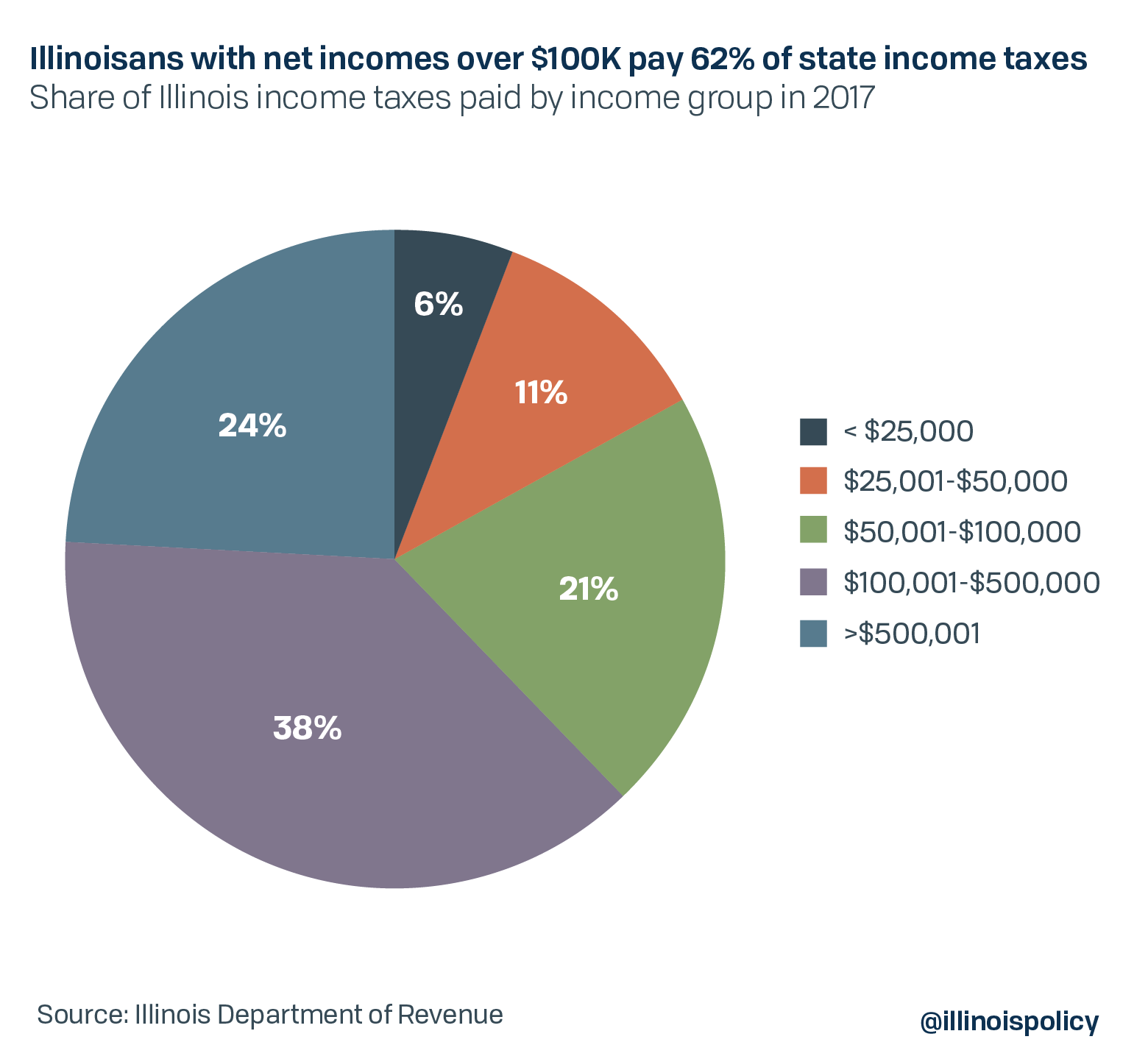

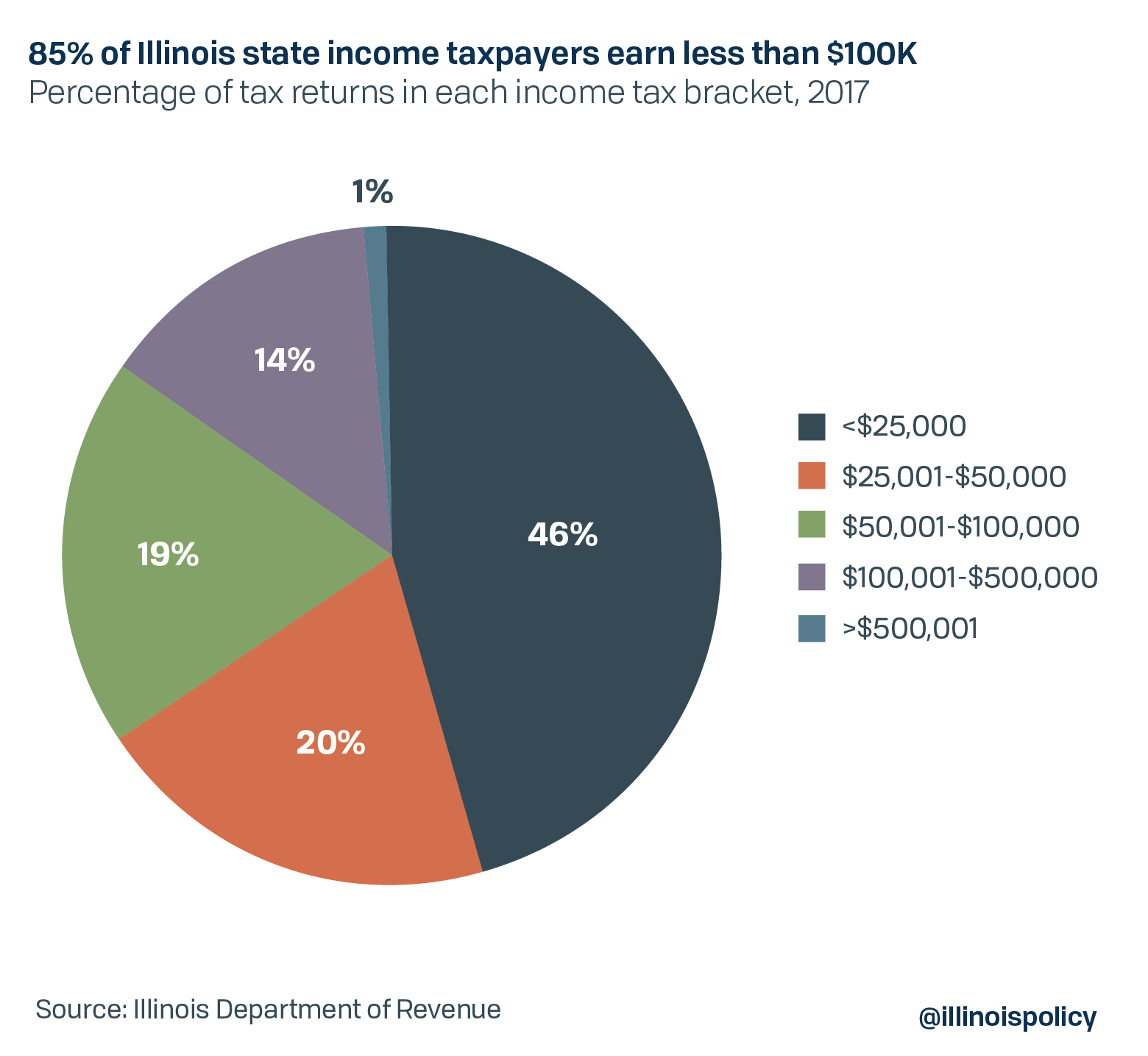

Illinoisans with net incomes over $100,000 are 15% of the taxpayers. They earn 54% of the state’s income but pay 62% of the state’s income taxes. Those earning less than $25,000 are 46% of the taxpayers. They earn 14% of the state’s income and pay 6% of the income taxes.

Those making over $500,000 account for 1% of Illinois’ taxpayers. They make 20% of the income and pay 24% of the taxes.

So, the push for a progressive tax really isn’t about making a fairer system in which the rich pay more and the poor pay less: They already do. It’s about giving state lawmakers more power to change tax rates and impose new taxes.

The drafters of the Illinois Constitution in 1970 built in a flat tax to give taxpayers protection against tax increases. Lawmakers now are forced to raise everyone’s taxes, meaning voters can hold them accountable at the ballot box. The latest tax increase in 2017 was costly for lawmakers, causing about 30% of them to either retire or be defeated.

To impose progressive taxes, lawmakers must first convince voters on Nov. 3 to give up their constitutional flat tax protection. While lawmakers have passed initial progressive rates that will take effect if the amendment passes, there is nothing to stop them from changing those rates the day after the election.

Lawmakers will have gained the power to tax any group any amount. Because they will be able to isolate small numbers of taxpayers for rate hikes, they will avoid angering all voters and the backlash that now keeps them in check.

One group already in the crosshairs is retirees, who currently pay no state income tax.

All 32 states with a progressive income tax also tax retirement income in some form. Illinois Treasurer Michael Frerichs admitted Illinois should also consider a retirement tax if the progressive income tax passes. Those over 65 are currently the least likely to join the Illinois exodus, but a retirement tax would strengthen the No. 1 reason Illinoisans already consider leaving Illinois.

The progressive income tax also removes protections against double taxation that Illinois currently has. The new amendment would remove language that protects taxpayers from having their income taxed twice, once by the state and a second time by a city such as Chicago.

Connecticut was the only state in the past 30 years to pass a progressive tax, which it did by telling voters the rich would pay more. Well, state lawmakers went where the taxable income resided and middle income taxes rose 13%, property taxes rose 35% and 362,000 jobs were lost.

There’s nothing “fair” about any of that.