Every state with a progressive tax also taxes retirement income

Illinois could be the next state to tax retirement income if voters approve the progressive income tax in November.

States with progressive income taxes are not friendly places for retirees: Each of them also taxes retirement income.

Illinois retirees could be next if Gov. J.B. Pritzker’s “fair tax” is approved Nov. 3, state leaders have already said.

All 32 states with a progressive income tax impose some sort of tax on retirement income from 401(k)s, IRAs, Social Security and pension benefits. Mississippi limits its retirement taxes to the income of those who retire before age 59.5.

Illinois state Treasurer Michael Frerichs last week raised the issue. Taxing retirees was also proposed by former Chicago Mayor Rahm Emanuel and Civic Committee of the Commercial Club of Chicago.

“One thing a progressive tax would do is make clear you can have graduated rates when you are taxing retirement income,” Frerichs said while speaking at an event hosted by the Des Plaines Chamber of Commerce. “And, I think that’s something that’s worth discussion.”

Frerichs said people he knows earn six-figure pensions, but pay no state income tax. He believes the current flat tax structure makes it impossible to differentiate between those who earn hundreds from those who earn little in retirement.

One of Illinois’ few bright spots has been the slower rate at which residents over 65 leave the state. Out of all age groups, they are the least likely to move out. Residents with jobs take their tax dollars with them in search of friendlier tax rates, but retired Illinoisans have been able to stay because they don’t feel the pressure of high income taxes. That could change under a progressive tax.

Connecticut’s progressive income tax hits single filers on $50,000 and joint filers on $60,000 of retirement income. As a result, Connecticut loses retired residents at a faster rate than Illinois.

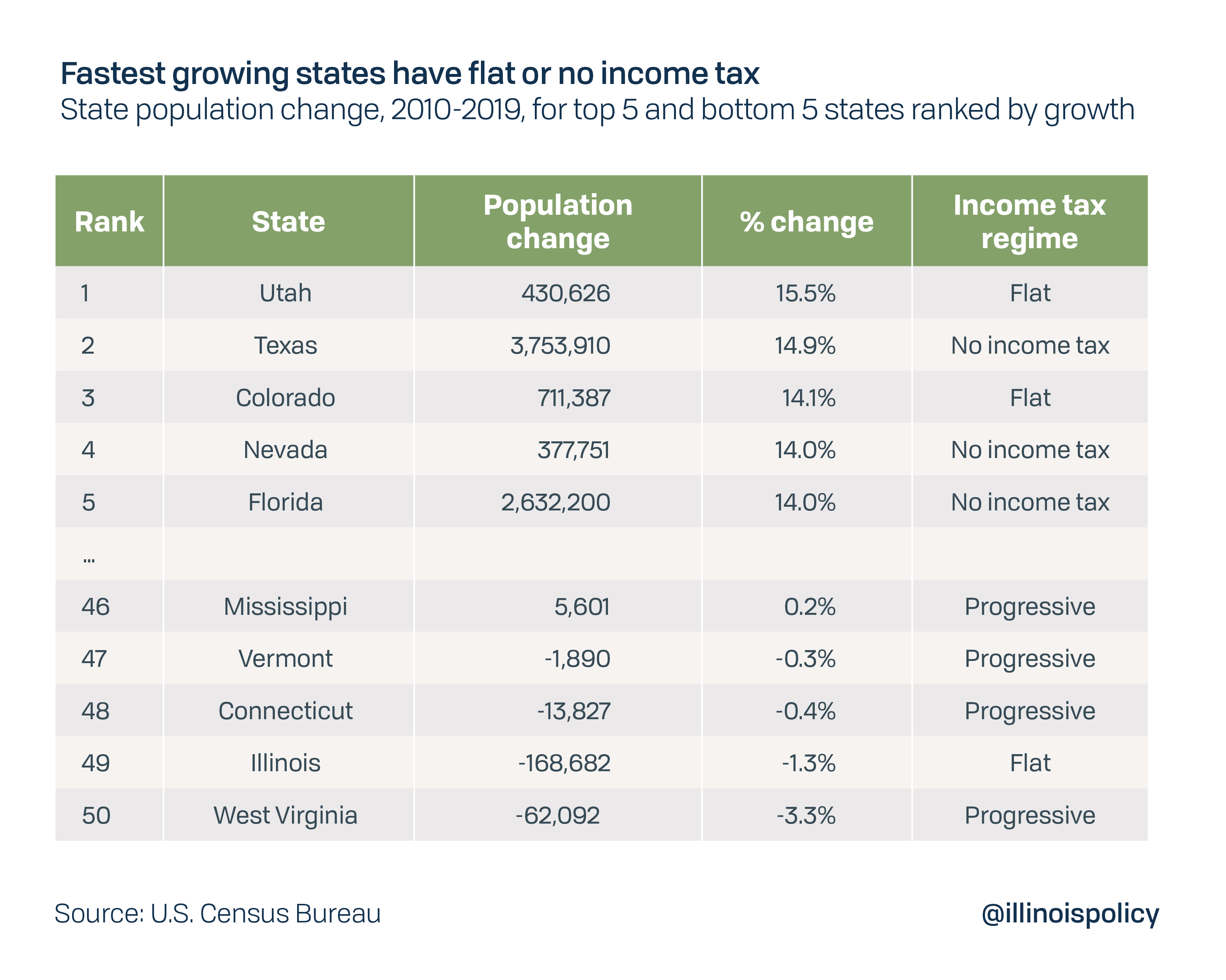

Another thing progressive income tax states have in common is low growth rates. Four of the five slowest growing states – West Virginia, Connecticut, Vermont and Mississippi – all have progressive income taxes, according to a study by the Illinois Policy Institute. The fifth state on the slow-growth list is Illinois.

The fastest growing states – Florida, Texas, Utah, Colorado and Nevada – have no state income tax or a flat tax.

In October, a poll found 61% of Illinoisans considered moving out of state in the past year, with state taxes being their top reason for considering a move. Add Pritzker’s push to get $3.7 billion more out of Illinois taxpayers through a progressive tax, then start taxing retirees and watch the moving vans head for the borders.

Pritzker is seeking that greater taxing power through a referendum Nov. 3, but Illinoisans who want to ensure fairness and economic recovery should protect the current flat tax structure enshrined in the Illinois Constitution. Denying state leaders the ability to tax more is the only way to force them to face the state’s spending problems.