DuPage County shortchanged by Local Government Distributive Fund

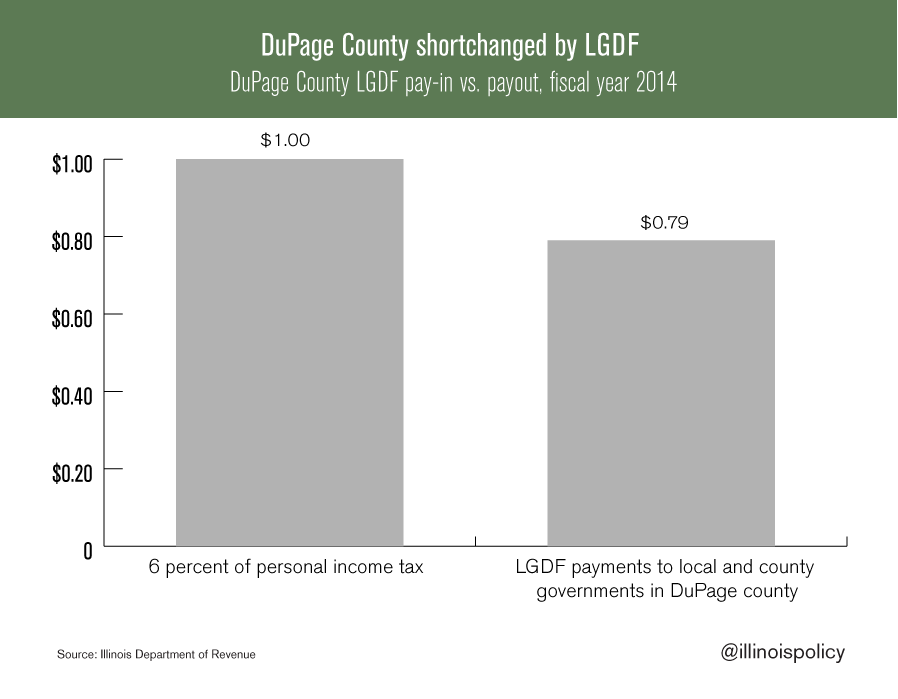

DuPage County gets back just 79 cents for every dollar it pays into LGDF.

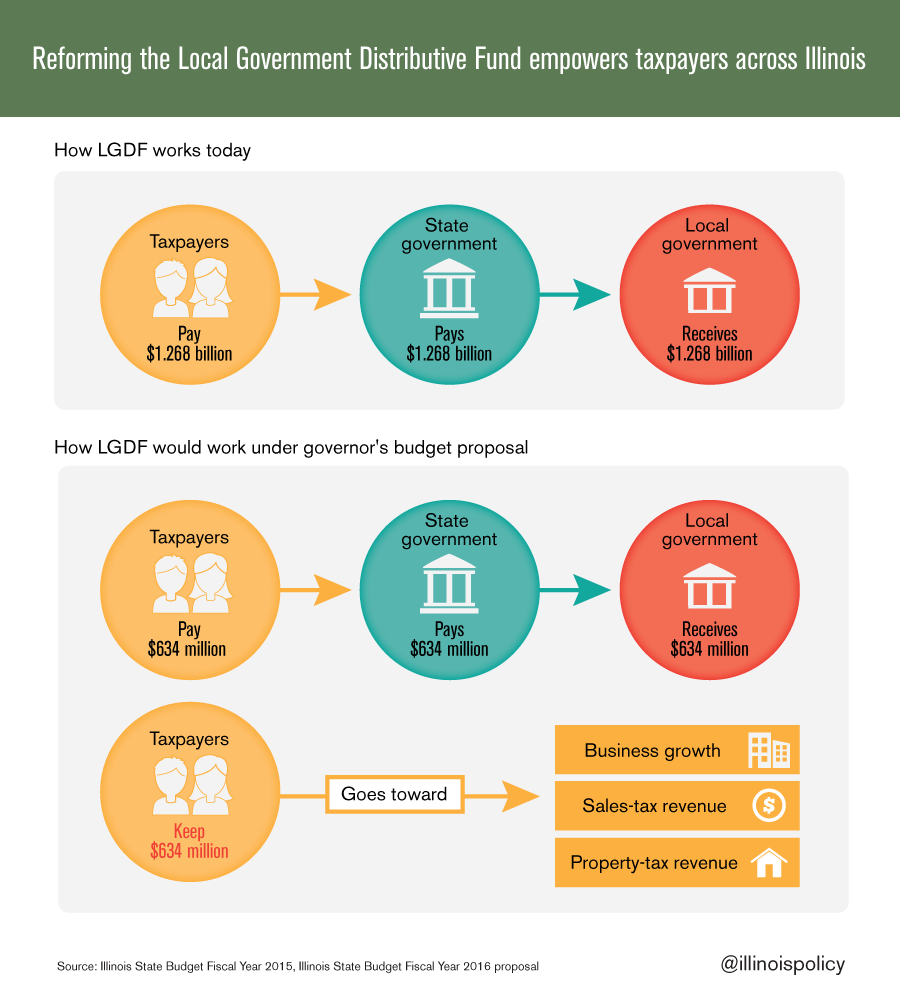

A behind-the-scenes budget battle is brewing over a proposal that would limit the amount of money siphoned from Illinois taxpayers to fill local government coffers. The Local Government Distributive Fund, or LGDF, takes a portion of Illinoisans’ state income taxes and then sends it to counties and municipalities.

As a result of this system, there are some clear winners and losers. That’s because the LGDF doles out money to counties and local governments based on population. In fiscal year 2014, the state took $1.25 billion in income-tax revenues – which was the equivalent of 6 percent of total income-tax revenues – from taxpayers to send to 102 counties and 1,298 municipalities in Illinois.

The state collected almost $103 million in personal income taxes from DuPage County taxpayers for the LGDF fund. But municipal-level governments across the county plus the county government received a combined total of just under $81 million in LGDF payments, according to the Illinois Department of Revenue.

That means DuPage County gets back just 79 cents for every dollar it pays into the LGDF. While DuPage County receives a smaller proportion of LGDF funding than its taxpayers contributed, other counties across the state receive more than their taxpayers contributed.

A recent proposal by Gov. Bruce Rauner would be an important first step in eventually doing away with this scheme and allowing Illinoisans to keep more of their hard-earned income.

The state income-tax rate is 3.75 percent (down from 5 percent in 2014) while the amount distributed via the LGDF is the equivalent of 8 percent of total income-tax revenues (up from 6 percent in 2014). Instead of putting 8 percent of state income-tax revenue into the LGDF, the governor’s proposed budget would distribute 4 percent to counties and municipalities.

No one wants to see their budget cut, but the state’s fiscal crisis is not going to leave any area of government immune from belt-tightening. This proposal represents an average amount equal to a 3 percent reduction in counties’ total general-fund budgets, but it also sets the stage for devolving power from Springfield back to units of local government.

In tandem with LGDF reform, local governments should insist upon reducing the burden of unfunded state mandates, more control over property-tax rates and other local tax rates, and generally returning more control to local governments – where they rightfully belong.

The question for DuPage citizens is: Should Springfield take Illinoisans’ hard-earned dollars through an income tax, send that money to Springfield, allow Springfield to take a cut off the top, and then send a chunk to counties and municipalities? Or should Illinois citizens support a more transparent and fair approach that would allow Illinois families to keep more of their own money?