DuPage County homeowners: Where do your property taxes go?

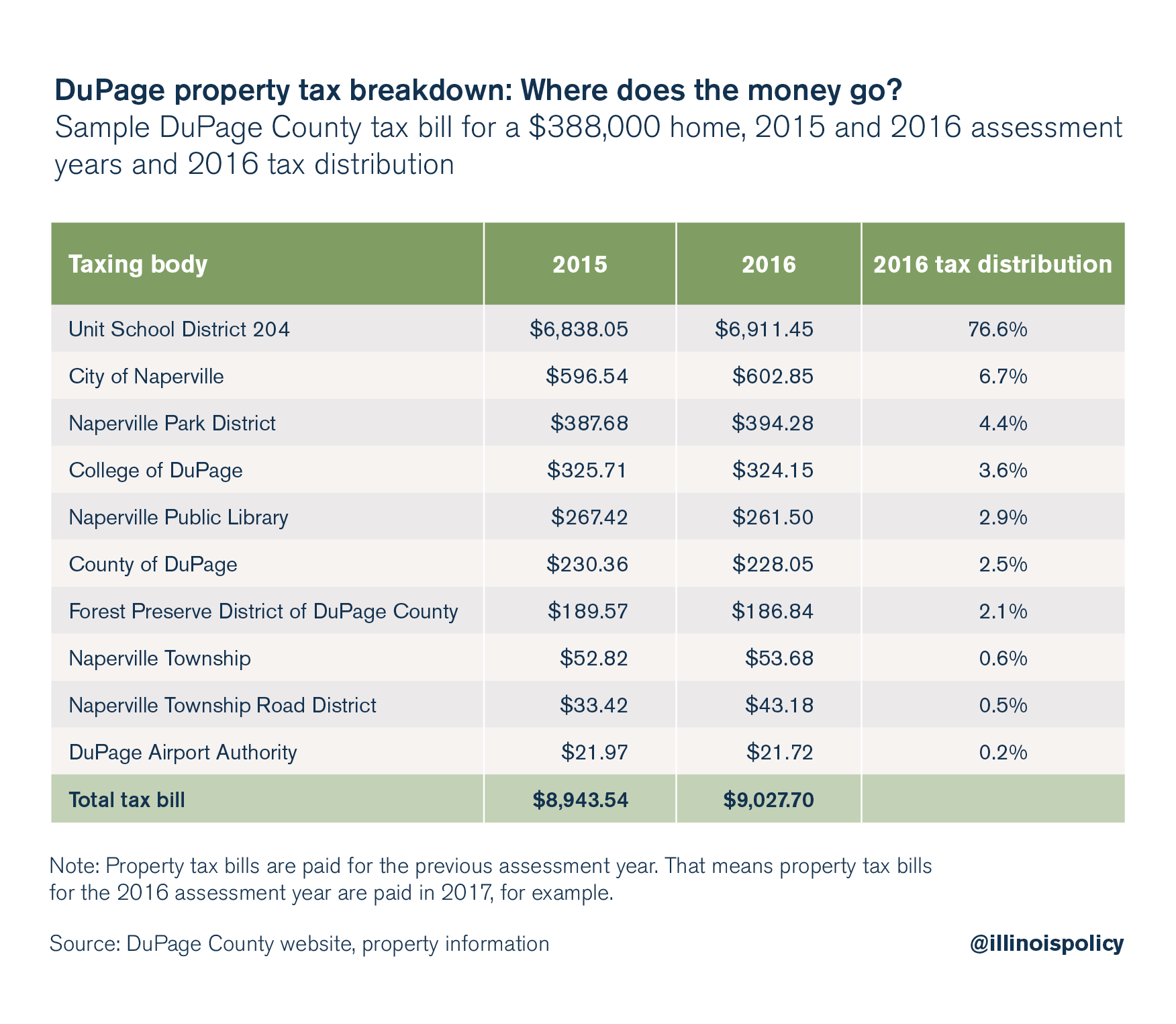

DuPage County billed property tax payers $2.74 billion for 2016; this meant owners of a median-valued home in Naperville worth $388,000 had a $9,000 property tax bill.

As the new federal tax bill in December 2017 grabbed headlines, its limitation of the federal deduction for state and local taxes sent many Illinoisans racing to pay their 2017 property taxes before the changes took effect Jan. 1.

That’s no surprise, as Illinoisans pay some of the highest property taxes in the country. And those bills grew six times faster than household incomes from 2008 to 2015.

DuPage County homeowners pay some of the highest property taxes in the state, and therefore the nation. In DuPage County alone, $2.74 billion was billed to property owners for 2016 property taxes. Property owners paid those bills in 2017.

So what happened to that money?

While the DuPage County treasurer sends property tax bills and collects payments from taxpayers, those tax dollars don’t all stay with the county – they are distributed to over 400 other taxing districts within the county.

A property tax bill for a home in Naperville in DuPage County shows where all those local tax dollars go.

The property tax bill on a home with a “fair cash value,” or assessor’s estimated market value, of $388,000 – the median home value in Naperville, according to the U.S. Census Bureau – totaled around $9,000 for 2016. The government units that would have received some of those property tax dollars include entities such as Unit School District 204, the city of Naperville and the Naperville Park District.

At the county level, DuPage property taxes help pay for things such as stormwater management, the DuPage County sheriff’s salary, the running of the circuit court, the county’s veterans assistance program and other services.

While DuPage County has taken steps to rein in costs by consolidating some units of government and government services, county and municipal officials’ hands are tied with respect to some of the most significant drivers of the cost of government – and therefore, property taxes.

DuPage County residents, such as those in Naperville, must look to state lawmakers to enact reforms that will provide relief from high property taxes and bring government costs down to a level taxpayers can afford. That means, at the very least, freezing local property taxes as a first step and enacting real pension reform, prevailing wage reform and collective bargaining reform. Until that happens, DuPage County taxpayers will be stuck with some of the highest property tax bills in the country.