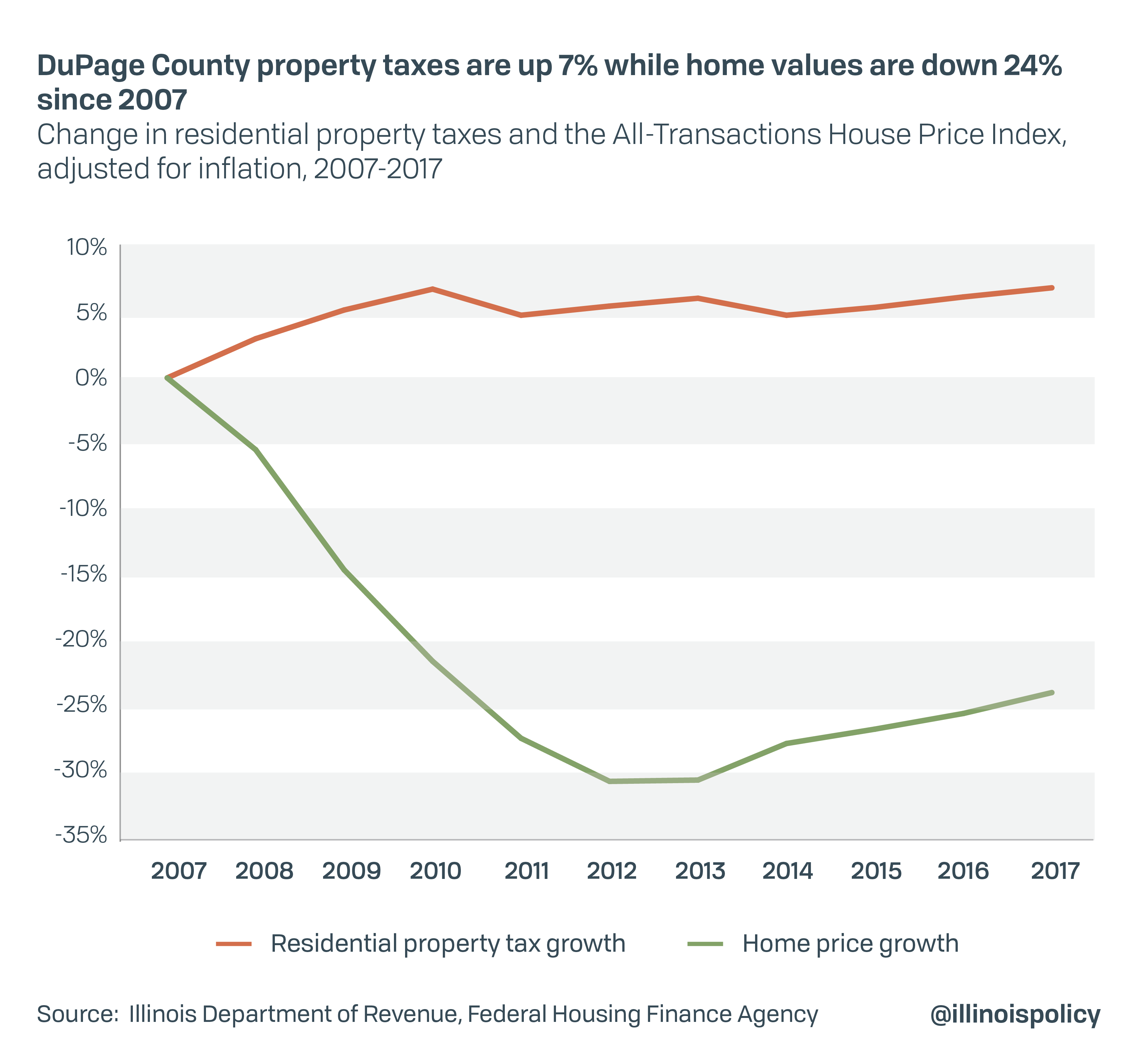

DuPage County home values down 24%, property tax up 7% since recession

Without true pension reform, property taxes are only bound to continue swamping DuPage County homeowners.

Many collar county homeowners have yet to recover much of the home value they lost after the 2007 housing market crash. But that hasn’t stopped county homeowners’ property tax bills from climbing.

Average home prices in DuPage County are 24% lower today than in 2007, adjusted for inflation, according to data from the Federal Housing Finance Agency.

Even though homes are worth less than they were prior to the Great Recession, DuPage County property tax bills have on average climbed 7%, after adjusting for inflation. Local homeowners felt this pinch June 3, when the first installment of property tax bills in DuPage County were due. They’ll feel it again when those bills’ second installments come due Sept. 3.

DuPage County’s poor housing recovery is a national outlier: While home prices nationwide have yet to return to their pre-recession peak, they were down just 9% from 2007 to 2017. To put DuPage County’s housing plight in perspective, its decline in average home values during that time period is an alarming 164% worse than the nation as a whole.

The biggest factor driving rising property taxes? Unsustainable growth in pension costs for government workers. Pension liabilities have risen faster than taxpayers’ ability to pay, forcing state and local governments to constantly scramble for new sources of revenue – often in the form of property tax hikes.

This diminishes homeowners’ standard of living, and potentially their home equity, while jeopardizing government workers’ retirement security.

With constitutional pension reform, Illinois can protect workers’ already-earned benefits while slowing the accrual of future benefits not yet earned – and eliminate the need for endless property tax hikes.