Despite massive stock-market rally, Illinois’ pension liabilities go up and up and up

The fiscal crises caused by the state’s government-worker pension liabilities.

Illinois’ pension problems mount

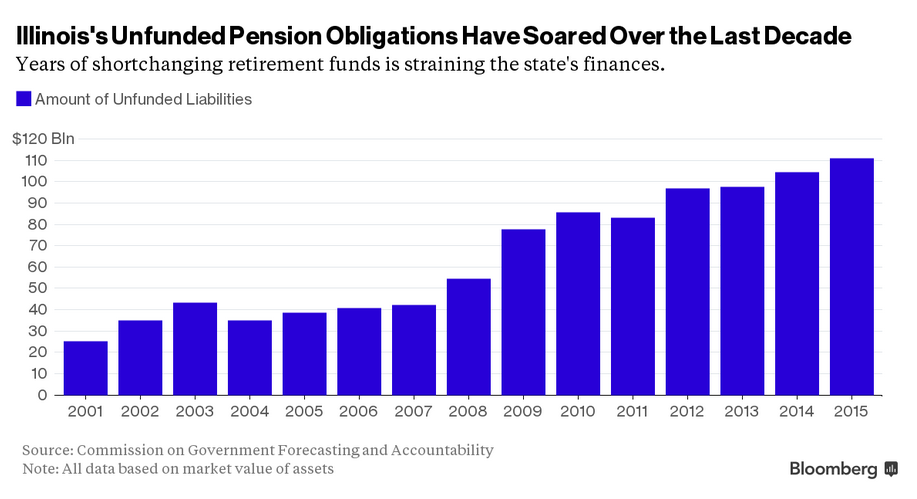

Illinois’ unfunded government-worker pension liabilities have risen 10 out of the last 11 years. The only exception was 2011. This was despite massive rallies in financial markets every year since 2009.

One of every 5 tax dollars from the state’s general fund goes to pensions, but that’s nowhere close to enough to stem the tide.

Illinois has the worst-funded pension plans in the nation. Those plans are a mere 42 percent funded in the aggregate.

That bleak estimate understates the problem because it assumes 7-7.5 percent annualized returns going forward. Those returns are not going to happen.

Returns of 3 percent are more realistic.

Still no budget

In October, Moody’s Investors Service cut Illinois debt to three steps above junk, and has specifically cited pensions as the “greatest challenge.” Lower ratings have driven up borrowing costs. In turn, rising borrowing costs mean less money to spend elsewhere.

The new year has begun, but Illinois still does not have a budget.

Bloomberg details the effects of the state’s budget gridlock in its report “Illinois Record Budget Impasse Makes It Worse for the State’s Pension Disaster”:

As 2015 draws to a close, Illinois marks half a year without a budget. No spending plan has driven up borrowing costs, sunk its credit rating, and perhaps worst of all, exacerbated the state’s biggest problem: its underfunded pensions.

Home to the least-funded state retirement system in the nation, Illinois has $111 billion of pension debt, which breaks down to more than $8,000 per resident. Partisan gridlock has produced the longest budget impasse in Illinois history. The stalemate has not only weakened state finances, it has kept lawmakers from finding a fix for those mounting liabilities. …

It’s been seven months since the Illinois Supreme Court rejected the state’s solution. Justices threw out the 2013 restructuring that took six attempts over 16 months to pass, despite one-party rule at the time. The measure was projected to save $145 billion over 30 years by limiting cost-of-living adjustments and raising the retirement age.

Illinois enters 2016 snarled in partisan bickering as Governor Bruce Rauner, the state’s first Republican chief executive in 12 years, and the Democrat-controlled legislature can’t agree on annual appropriations, much less an overhaul of a retirement system that must withstand an inevitable legal challenge. The state constitution bans reducing worker retirement benefits.

In July, Rauner laid out a plan to create a tiered system to cut retirement liabilities. At the time, he said it would save taxpayers billions of dollars. The proposal, which included a measure to allow municipalities to file for bankruptcy protection, was never introduced, according to Catherine Kelly, his spokeswoman. …

Illinois hasn’t sold bonds since April 2014, a record borrowing drought. The spread on its existing debt has widened. Investors demand 1.8 percentage points of extra yield to own 30-year Illinois bonds, the most among the 20 states tracked by Bloomberg. When the spread climbs, that’s reflecting that investors think the problem is getting worse, said Richard Ciccarone, Chicago-based chief executive officer of Merritt Research Services.

“What’s the root cause of why we’re in the problem we’re in?” Ciccarone said. “It’s down to the pensions.”

Illinois is like a patient in the emergency room, said Paul Mansour at Conning, which oversees $11 billion of munis, including Illinois securities.

Illinois needs municipal bankruptcy

Illinois is in trouble. Pension liabilities are too steep. The state is bankrupt morally, politically and monetarily.

However, there is no provision for state bankruptcy (something the U.S. Congress needs to address). Regardless, what cannot be paid, won’t.

Illinois’ massive debt is not just at the state level. Liabilities threaten cities far and wide.

Chicago Public Schools is already in a perilous financial state regardless of whether Mayor Rahm Emanuel acknowledges that in an announcement.

Tax hikes won’t help revive the effectively bankrupt state and its municipalities. Instead they will cause the healthy and able to flee Illinois.

Many Illinois cities are trapped by their bankrupt finances, but the current law will not let officials take needed action to remedy the problem.

The best way to help these local governments is to pass a law allowing municipal bankruptcies. Such a bill would let debt-burdened cities and taxing bodies regain control over their finances. That’s something the Illinois General Assembly can and should address.

Illinois Republicans, where is that bill?

Fresh start

Corrupt politicians in league with union officials have hollowed out the state beyond repair. No one should pretend otherwise.

Illinois needs the fresh start that the following reforms would facilitate:

- Bankruptcy at the municipal level

- A new Illinois Constitution that allows pension cuts at the state level

- Right-to-Work laws

- End of collective bargaining for government employees

- End of prevailing-wage laws

- Tax reform, especially property-tax reform

- Workers’ compensation reform

- Unemployment insurance reform

Until these changes are made, the state will continue losing workers and businesses – a fate worse than bankruptcy or default.

Sobering pension assessment

Illinois pension plans are 42 percent funded, and that’s with projected returns of 7-7.5 percent. If returns average 2 percent or even 5 percent, liabilities and underfunded amounts will soar.