Dear Illinois Supreme Court: 8 things to know about Chicago’s pension-reform law

Regardless of the outcome of the case, the burden Chicagoans face from the government-worker pension crisis won’t be going away any time soon.

The Illinois Supreme Court heard oral arguments Nov. 17 in a lawsuit that challenges the constitutionality of Mayor Rahm Emanuel’s 2014 reform plan for Chicago’s municipal workers’ and laborers’ pension funds. The Illinois Supreme Court took up the case after the Circuit Court of Cook County declared Chicago’s reform plan unconstitutional in July.

Regardless of the outcome of the case, the burden Chicagoans face from the government-worker pension crisis won’t be going away any time soon. The city is $34 billion in debt to its six city-run and sister-government pension funds.

On Oct. 28, the Chicago City Council passed a 2016 budget that hikes property taxes by over $543 million to pay for police and fire pensions alone. And without significant pension and spending reforms, the city is likely to hit Chicagoans with billions in additional tax increases to pay for municipal employees’, laborers’ and teachers’ pensions.

If the reform plan is upheld by the Illinois Supreme Court, the city of Chicago, Chicago Public Schools and other sister governments will have a tax-heavy, reform-lite model to address other struggling government-worker pension systems.

If the plan is struck down, Chicago politicians will have to make a choice. City officials can spurn fundamental reforms and burden Chicagoans with billions in additional taxes to pay for government-worker pensions. Or they can enact real spending and pension reforms, such as moving all new workers into 401(k)s and ending pension “pickups” for Chicago teachers.

The Emanuel administration argued that its reforms are constitutional because the plan guarantees additional funding to the municipal and laborers’ funds – increasing the retirement security for city workers. However, the plaintiffs – the American Federation of State, County and Municipal Employees and the Municipal Employees Society of Chicago, among others – argued that the reform law violates the Illinois Constitution’s pension-protection clause because it would reduce workers’ pension benefits.

Here are eight details about Chicago’s reform law that should be considered by the Illinois Supreme Court:

1. Chicago’s pension-reform plan only affects half the city’s workers

The law applies to city employees who are members of the municipal and laborers’ pension funds. The city’s fire and police pension systems, as well as the sister-government pension systems that include teachers and park workers, are not included.

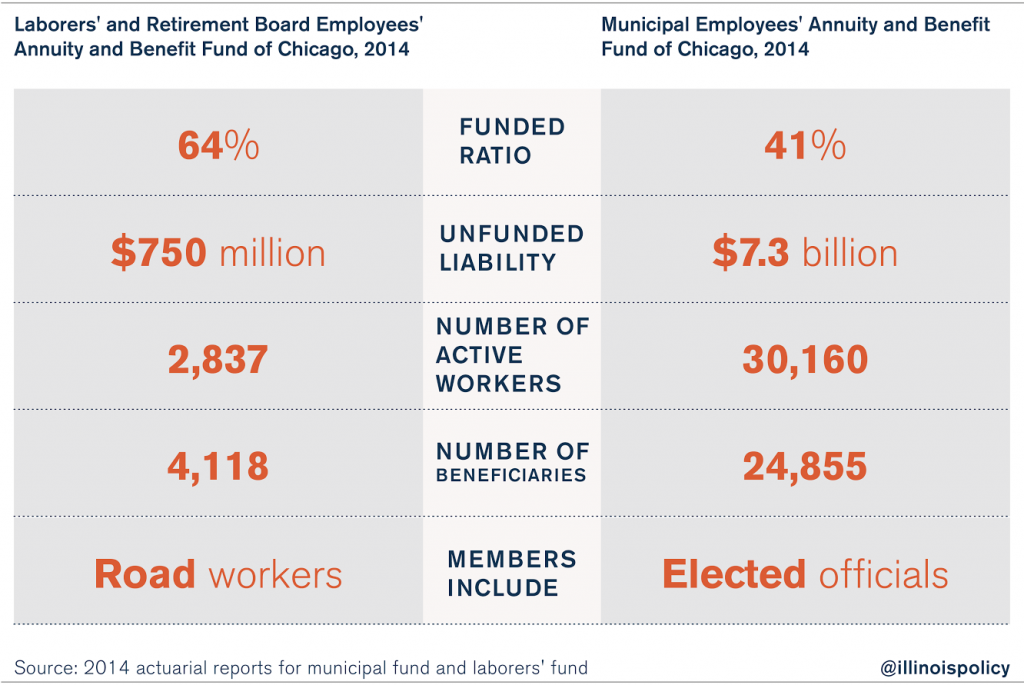

In all, Chicagoans are on the hook for more than $34 billion in unfunded pension liabilities, of which only $8.3 billion comes from the municipal and laborers’ systems.

2. The plan would increase employee contributions to their pensions

Under the terms of the law, employee contributions to the pension funds would grow incrementally to 11 percent by 2019, from the current 8.5 percent contribution level.

3. Employee cost-of-living adjustments, or COLAs, go down

The law freezes retiree COLA benefits in 2017, 2019 and 2025. The bill also alters the COLA calculation to the lesser of 3 percent or half of inflation, noncompounded. Currently, municipal and laborers’ COLAs are automatically compounded at 3 percent.

4. Retirement age for Tier 2 workers drops to 65

Rather than increasing retirement ages for Tier 1 employees, workers enrolled in the less generous Tier 2 pension system have the age at which they are allowed to retire lowered to 65 from 67.

5. The plan would establish a pension-funding guarantee

The law requires the city to pay its annually required pension contributions to the municipal and laborers’ funds. If the city does not contribute the full amount, the pension systems can demand the payment in court, and the city’s share of state grants may be garnished by the systems. In 2016, one-third of state grants may be garnished; in 2017, two-thirds; and in 2018 and every year after, all state grants may be garnished.

6. Chicago’s pension proposal would extend the amortization periods of the fund’s pension debt

Under the law, the pension funds’ debt repayment schedule is pushed further into the future by 15 years, to 2055 from 2040.

7. The plan would increase city contributions in the form of a ramped payment schedule

The law calls for the city to increase its annual contributions to the municipal and laborers’ pension fund between 2016 and 2020. In 2021, the city will begin paying its annually required contribution to the pension fund. In that year, the city’s annual contribution will be an estimated $450 million higher than it would have been under current law. By 2025, the difference will grow to an estimated $530 million.

8. Chicagoans are facing hundreds of millions of dollars in tax increases

The original pension bill called for a $750 million property-tax hike on Chicagoans over five years to pay for increased contributions to the municipal and laborers’ pension systems. However, that language was dropped from the final bill due to objections from the General Assembly and former Gov. Pat Quinn.

Even though the language mandating a property-tax increase no longer exists, the law still says the city can use other current taxes and revenues to make payments: “The city’s required annual contribution to the fund may be paid with any available funds and shall be paid by the city to the city treasurer.”

That means Chicagoans would still be on the hook for hundreds of millions in eventual tax increases needed to pay for the city’s increased contributions to the municipal and laborers’ pension systems.

Those taxes would be in addition to the record $543 million property-tax increase City Council has already passed to pay for the city’s police and fire pension funds.

The Supreme Court’s decision will set a precedent for future reforms

It’s likely the Illinois Supreme Court will find Chicago’s reform plan unconstitutional.

The court has already struck down the state’s own reform effort, Senate Bill 1, declaring that pension benefits cannot be “diminished or impaired,” which sets a precedent under which Chicago’s pension-reform law could be held invalid.

If the Illinois Supreme Court does end up striking down the plan, Chicago and other governments will be back at square one with respect to a model for pension reform. And Chicago will be on the hook for larger and larger contributions to the municipal and laborers’ pensions in the coming years. Those increased contributions are in addition to the growing police and fire contributions that have already led to a $543 million property-tax increase for struggling Chicagoans.

Instead of passing massive tax hikes that only serve to burden residents, it’s time the city focused on passing real reforms that can help fix the pension crisis in the long run.

Positive reforms for the city include moving all new city employees into 401(k)-style plans, offering optional 401(k)-style plans to current workers, and freezing city employee salaries to shrink the growth in accrued pension benefits.

In addition, Chicago should end teacher pension “pickups” – under which Chicago Public Schools pays for a majority of its teachers’ required employee pension contributions as a special benefit.

And if all these reforms ultimately prove unsuccessful in slowing the growth of Chicago’s government-worker pension liabilities, the city should be given the option to declare bankruptcy.