DCEO’s flagship program is a total failure

The DCEO started handing out EDGE tax credits in 2001. Nearly $1 billion later, Illinois is one of only seven states to be down jobs.

If you measure Illinois’ Department of Commerce and Economic Opportunity, or DCEO, based on results, it has failed miserably.

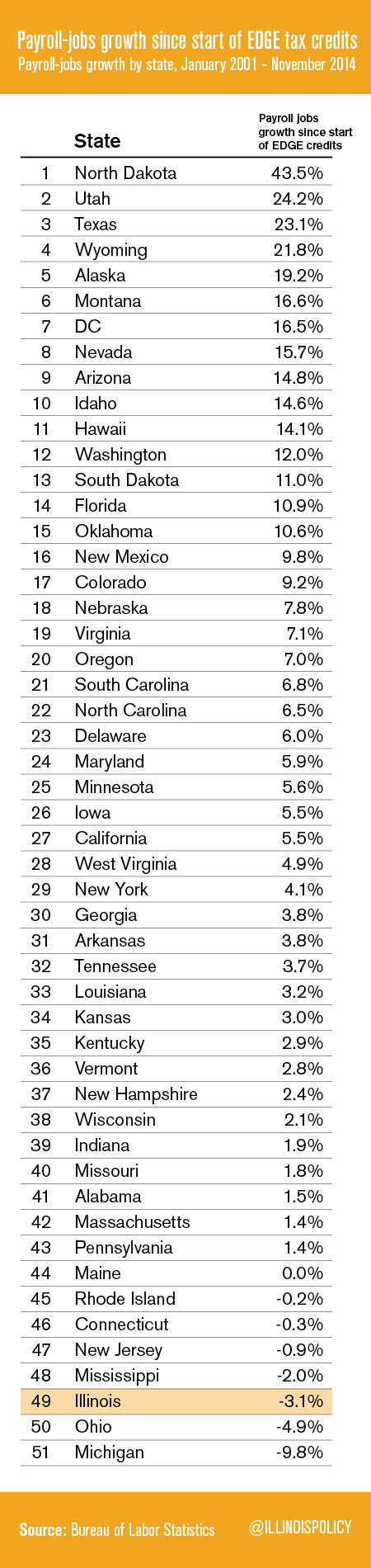

The largest DCEO tax-credit program is the Economic Development for a Growing Economy, or EDGE, tax credit, which began in 2001. The purpose of the EDGE tax credit is to incentivize businesses to create new jobs in Illinois. But after 13 years and nearly $1 billion in EDGE tax credits, Illinois is actually down 184,400 payroll jobs, or 3.1 percent, a stunning record of failure. This puts Illinois 49th in the U.S. for growth of payroll jobs, one of only seven states to be down jobs over the period.

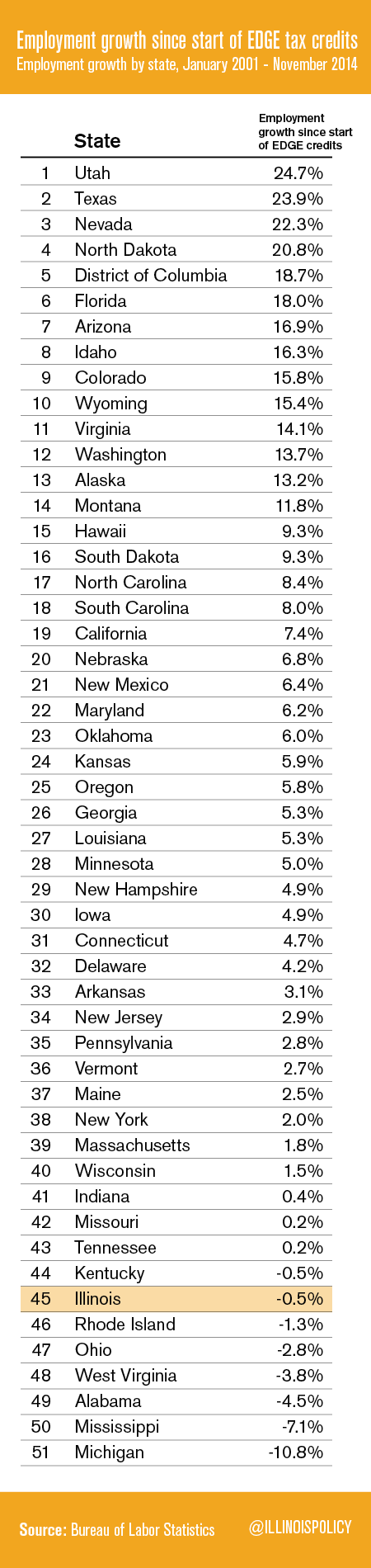

There are also 32,000 fewer Illinoisans working since the start of the EDGE tax credit program. This puts Illinois 45th for employment growth, down 0.5 percent, one of only eight states with fewer people employed over the period.

So why do politicians use it?

The DCEO’s programs are like a bandage on an economic cancer. They address Illinois’ overwhelmingly bad business environment on a case-by-case basis by exempting favored companies from taxation. This does nothing to address the overall business climate, and actually makes the situation worse by adding the smack of cronyism to a suffocating regulatory and tax environment. It also divides companies into a minority of winners (the politically connected) and a majority of losers (those who can’t get a special deal).

This piecemeal approach to economic development has been going on for decades in Illinois, and ultimately puts off the day of real reform. The original incarnation of the DCEO, dubbed the Department of Commerce and Community Affairs, was created in 1979 to offset Illinois’ costly regulatory environment through other means. As business owners said, until “workers’ compensation and unemployment insurance costs [were] reduced to a competitive level”, they wanted “aid from the state to offset them.”

Nearly four decades later, the state has still not addressed its costly business environment. The need for Illinois to transform itself from a crony state to an opportunity state could not be clearer. Illinois needs a lot less DCEO favoritism, and a lot more real economic reform, with a focus on entrepreneurship.