QUOTE OF THE DAY

WSJ: What’s the Matter With Illinois?

If the states are laboratories of democracy, then a great comparative policy experiment is taking place in America’s Great Lakes region. Democrats in Illinois have been pursuing their blue-state model of higher taxes and union-dominated government. Neighboring states since 2010 have gone for lower taxes and union reform.

The comparison is especially apt because Illinois Democrats are doubling down on their strategy in this election year. Governor Pat Quinn has announced plans to make permanent the “temporary” tax hikes that were supposed to sunset at the end of this year. Illinois House Speaker Michael Madigan last month floated a 3% surcharge on income over $1 million, only to have it shot down by some in his own caucus. Yet Democrats are still flogging a progressive income tax, which Mr. Quinn all but endorsed last year.

All of which makes it an ideal moment to consider how the Quinn-Madigan policies are working. One way to judge is to compare Illinois with four other Great Lakes states that the federal Bureau of Economic Analysis (BEA) lumps together for its annual survey of economic performance by the 50 states.

Start with Illinois’s 8.7% jobless rate, which is the country’s second highest after Rhode Island’s 9% and has fallen by a mere 0.7 percentage points since Mr. Quinn began his second term in January 2011. That’s when Illinois increased its flat income tax to 5% from 3% and the corporate rate to 9.5% from 7.3%.

Greg Hinz: Rand Paul’s Chicago visit

Rand Paul, the libertarian-leaning GOP senator from Kentucky who’s been picking up a lot of press lately, is heading here for a school-choice forum next week.

Mr. Paul is scheduled to attend an event co-sponsored by the Illinois Policy Institute on April 22 at Josephinum Academy on Chicago’s West Side.

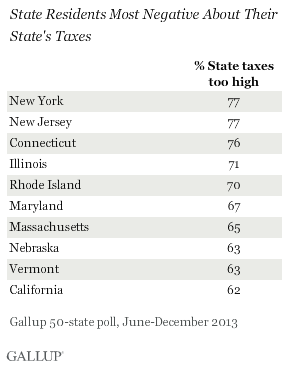

Gallup: 71% of Illinois residents say the amount they pay in state taxes is “too high”

Residents of New York, New Jersey, and Connecticut are the most likely of any state’s residents to say the amount they pay in state taxes is “too high.” Roughly three in four adults in each of these say their state taxes are too high, four times higher than the 19% saying this in Wyoming, whose residents are least likely to say their state taxes are too high.

While the states whose residents are most likely to say state taxes are too high include a fairly even mix of populous and less populous states, most of the states where residents are least likely to begrudge their taxes are small. The main exceptions to this are Florida and Texas, both highly populous U.S. states that boast no state income tax.

These findings are from a 50-state Gallup poll, conducted June-December 2013, that included at least 600 representative interviews with residents aged 18 and older in each state. They are based on respondents’ answers to the question: “Do you consider the amount of state taxes you have to pay as too high, or not too high?”

Daily Herald: Illinois gas station owners oppose fuel tax hike plan

Illinois gas station owners are speaking out against proposals for a fuel tax hike being floated in Springfield this year.

Retail gas station leaders will announce their opposition to such a plan at a news conference on Monday afternoon in the state Capitol. They say increasing the gas tax in a tough economy would hurt drivers and businesses owners.

Two weeks ago, a state transportation group unveiled their plan for funding road construction and public transit. The Transportation for Illinois Coalition’s proposal included increasing the gas tax by 4 cents. They also called for higher vehicle registration fees and ending the ethanol credit for gasoline.

American’s for Tax Reform: Obama has Proposed 442 Tax Hikes Since Taking Office

Since taking office in 2009, President Barack Obama has formally proposed a total of 442 tax increases, according to an Americans for Tax Reform analysis of Obama administration budgets for fiscal years 2010 through 2015.

The 442 total proposed tax increases does not include the 20 tax increases Obama signed into law as part of Obamacare.

“History tells us what Obama was able to do. This list reminds us of what Obama wanted to do,” said Grover Norquist, president of Americans for Tax Reform.

AEI: Do liberals really think an 80% top tax rate wouldn’t hurt the US economy?

Federal income taxes went up last year, a financial reality becoming ever clearer to many higher-earning Americans as tax day looms. But how much higher can Washington clip wealthier Americans before rising tax rates really weigh on US economic growth?

Quite a bit, some would argue. Despite those tax hikes, the American economy actually grew faster in 2013 than in 2012. Real GDP — measured fourth quarter over fourth quarter — accelerated to 2.6% from 2.0%. Another point: while the current top tax rate of 39.6% is the highest since the 1990s, the economy has done just fine with top rates double that level. Real GDP grew by 3.6% annually in the 1950s even with a 91% top rate. Going forward, progressive economist and inequality researcher Thomas Piketty recommends a top rate of 80% in his new book “Capital in the Twenty-First Century,” a work much praised on the left. Clearly, then, tax rates could go a lot higher both to reduce income inequality and raise more dough for government spending programs, right?

Actually, it’s far from clear that we’re not already at Peak Tax, or at least near the summit. First, fiscal austerity last year was offset by monetary stimulus as the Federal Reserve embarked upon its bond-buying program.

Chicago Tribune: Rauner would veto Chicago pension bill

Republican candidate Bruce Rauner said today that if he were governor, he would veto legislation lawmakers sent to Gov. Pat Quinn last week that would cut pension benefits for some city workers and allow aldermen to raise property taxes to shore up the retirement program.

A spokesman for Rauner said the Winnetka businessman believes the measure should include shifting workers to a 401(k)-style defined contribution plan and contends that “raising property taxes is not the way to go.”

“Unless Pat Quinn wants to raise property taxes, he should veto the legislation,” said Rauner spokesman Mike Schrimpf.

The American: Absurdities at the IRS

As Tax Day approaches and social media goes wild with messages extolling animosity towards the IRS, one would do well to remember the glory days of the IRS as an agent of good.

In 1930s Chicago, American gangster Al “Scarface” Capone led a Prohibition-era crime syndicate dedicated to bootlegging and other illegal activities, including bribery, prostitution, and execution of rival gang members. He made vast sums of money from his business ventures. In 1927, he brought in an estimated $100 million — more than $1 billion in today’s dollars. He was careful about keeping his illegal earnings hidden, and witnesses were unwilling to testify against him. There is no way of knowing how many people died by his hand or his command. But the crime that eventually landed this most notorious American gangster of the 20th century in Alcatraz federal prison was tax evasion. The IRS worked hand-in-glove with the Treasury and the FBI to convict him for not paying taxes on his ill-gotten wealth.

Had the IRS tried to target Al Capone in 1913 for federal tax evasion charges, instead of in 1931 as they eventually did, they may well have missed their mark. The 1913 Income Tax Act defined gross income as including “gains, profits and income derived from … the transaction of any lawful business” (italics added). Therefore, illegally earned income was not technically subject to taxation.

CARTOON OF THE DAY