CPS budget breakdown: Where has the money gone?

Unaffordable salaries and pension benefits on top of a structurally unstable retirement system have pushed CPS to the brink of insolvency despite record tax revenues.

Chicago Public Schools, or CPS, has a $1 billion deficit and has laid off teachers and called for other measures such as ending teacher pension pickups to save money. The Chicago Teachers Union has accused the city and state of inadequately funding CPS and the Chicago Teachers’ Pension Fund, or CTPF. But the financial crisis in CPS stems not from insufficient resources, but from the mismanagement of its taxpayer-funded revenues.

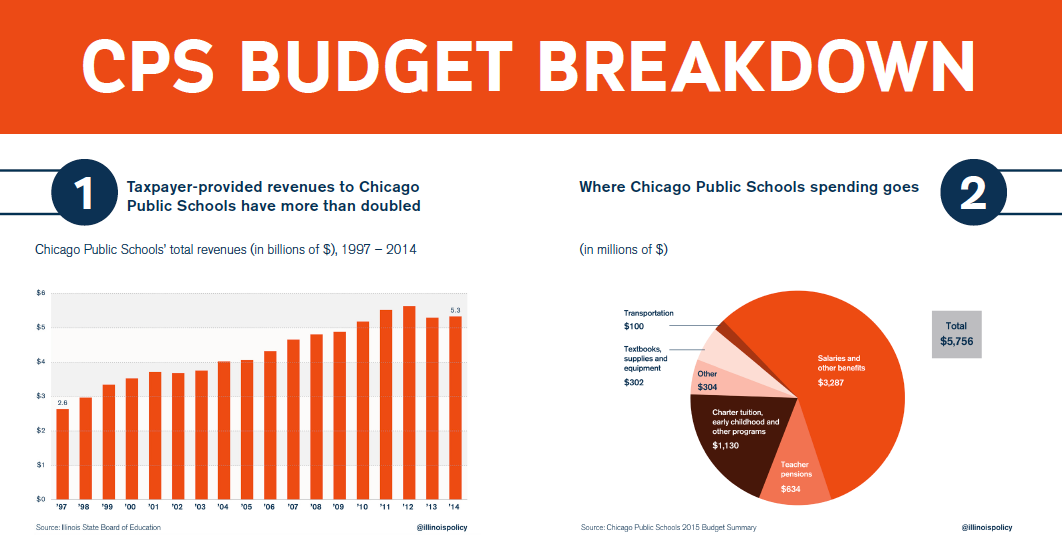

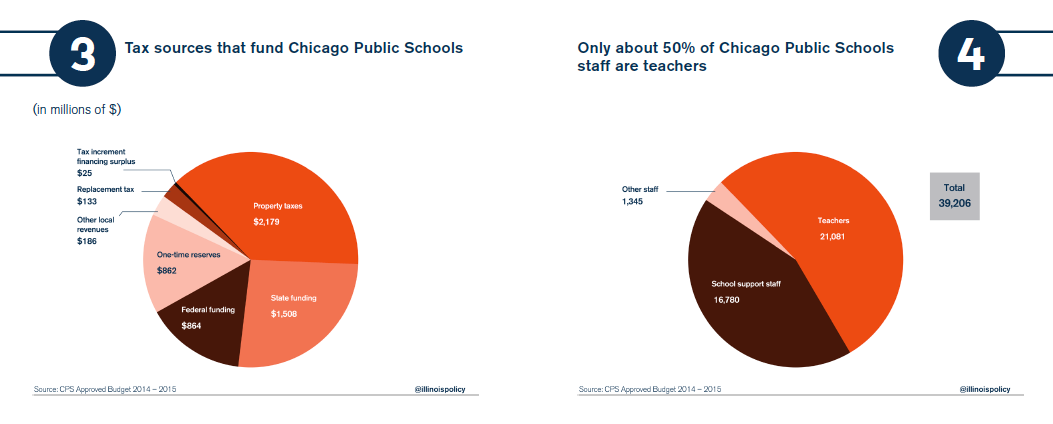

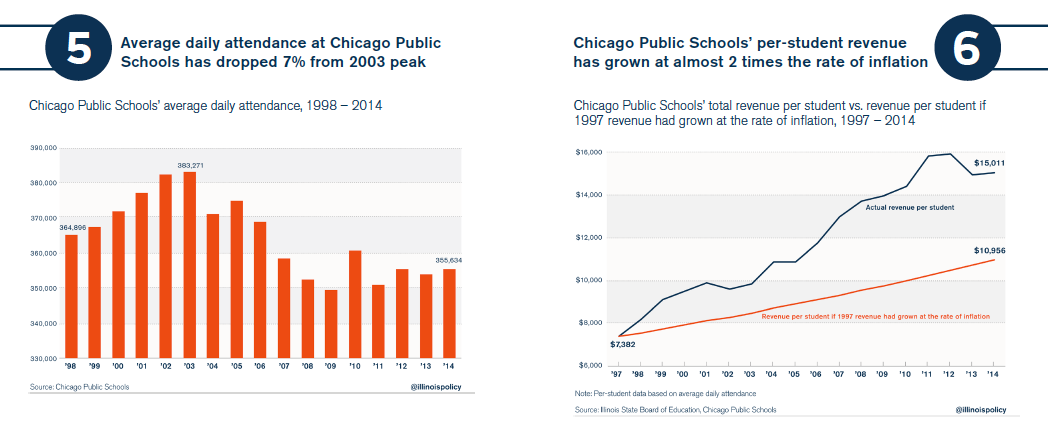

Tax revenues to CPS more than doubled between 1997 and 2014, to $5.3 billion in 2014 from $2.6 billion in 1997. The vast majority of these revenues come from local property taxes and Illinois and federal taxpayers. Per-student revenue at CPS has grown at almost twice the rate of inflation, to $15,011 per student in 2014, up from $7,382 in 1997.

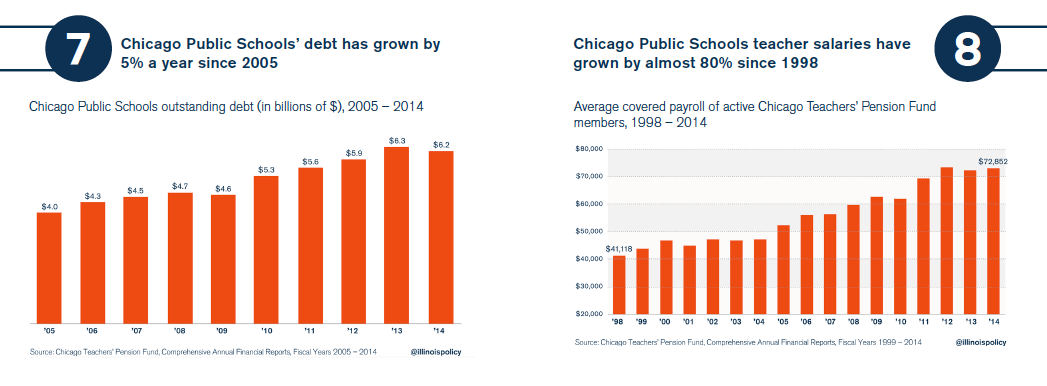

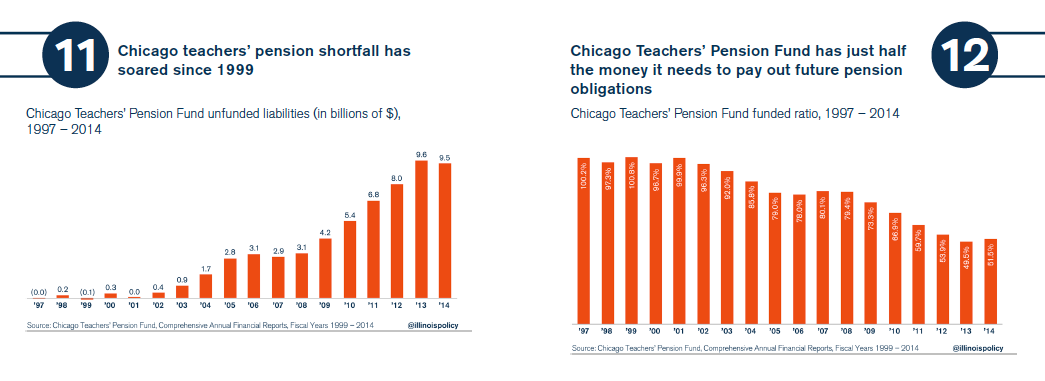

Yet CPS debt has grown by 5 percent per year since 2005, and as of 2014 stood at $6.2 billion. The CTPF’s funding shortfall had climbed to $9.5 billion by 2014: CTPF now has only half the money it needs to pay out future pension obligations.

Where has CPS’ money gone?

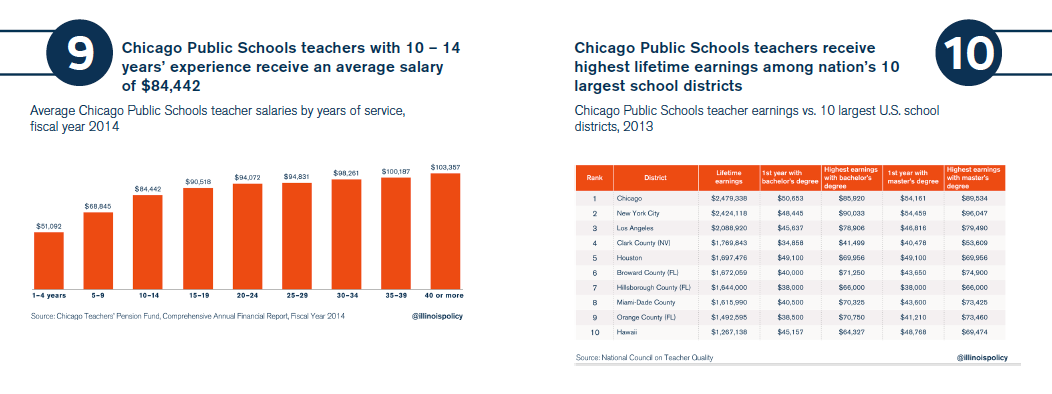

CPS has devoted most of its revenues to employee salaries and benefits, including pensions. CPS spent $3.3 billion of its $5.8 billion 2015 budget on staff salaries and other benefits. Teacher pensions consumed another $634 million of the budget. Chicago teacher salaries have risen 80 percent since 1998, and as of 2014, CPS teachers with 10 to 14 years of experience earned $84,442 per year. Chicago teachers enjoy the highest lifetime earnings among teachers in the U.S.’ 10 largest school districts.

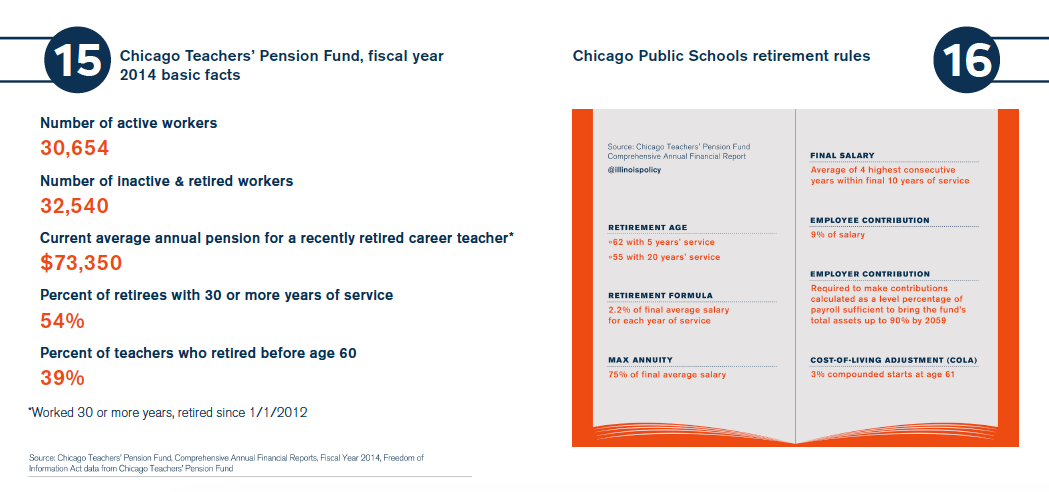

CPS employee pension benefits also rose between 1997 and 2014. Pension benefits grew 6 percent per year between 1997 and 2014, and the average pension for a recently retired career teacher is $73,350. CTPF, however, is actuarially upside down: There are now more retirees and inactive workers drawing pensions than there are active workers paying into the fund.

Unaffordable salaries and pension benefits and a structurally unstable retirement system – not a lack of taxpayer dollars – have pushed CPS to the brink of insolvency.

Here are the facts.