COVID-19 potentially impacting one-fourth of Illinois workers

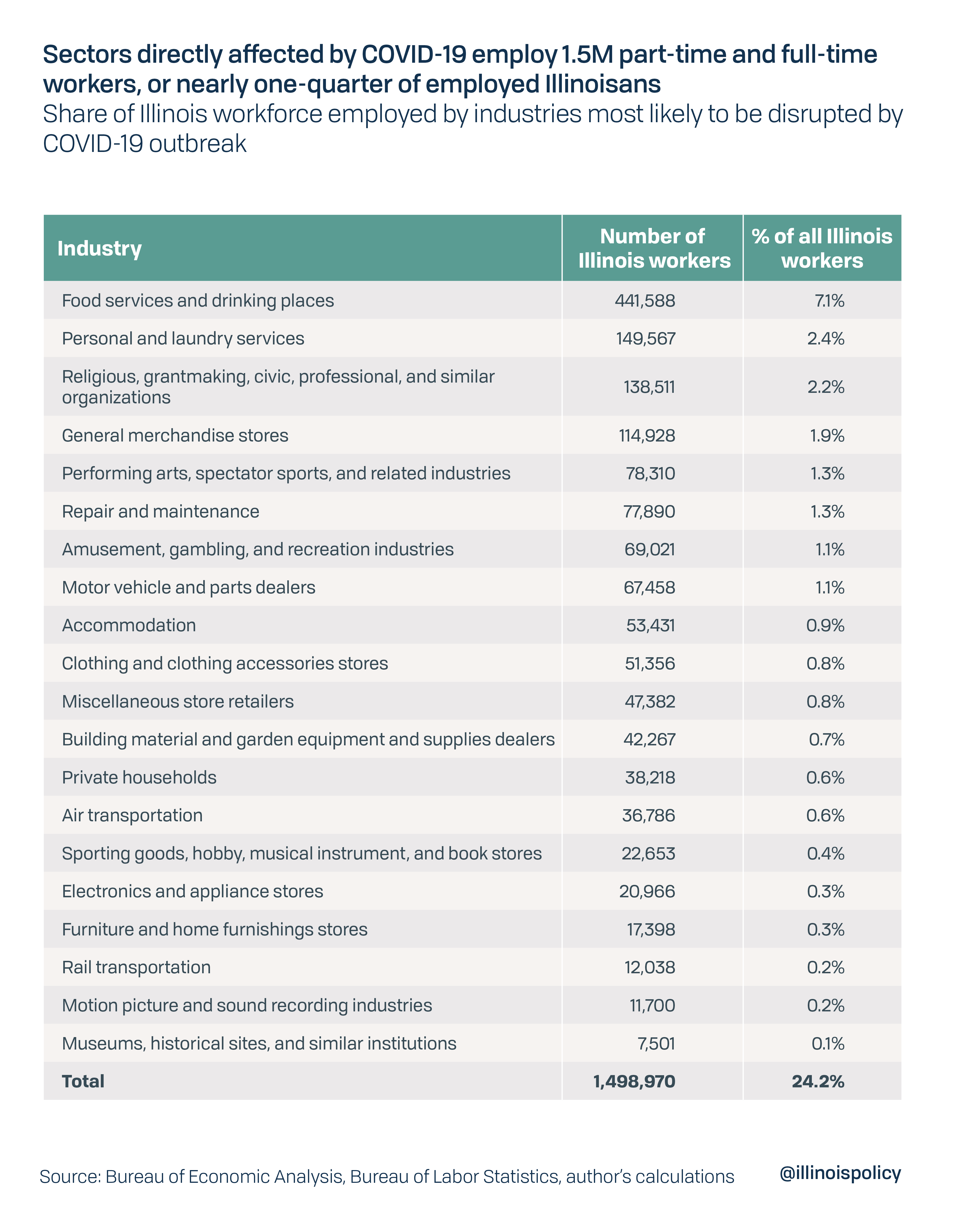

Business sectors directly affected by the coronavirus and mitigation employ 1.5 million Illinoisans. The longer the shutdown, the more industries and jobs face cuts.

Illinois has 24% of its workers in industries directly impacted by the COVID-19 outbreak and measures taken to contain the spread. That means 1.5 million workers in the state are facing potential threats of layoffs or reduced hours.

While very little data is currently available to confirm the magnitude of the economic fallout of containment measures, in normal times these industries produce roughly 11% of Illinois’ economic output. That is more than $100 billion in annual economic activity, or $278 million per day on average in 2019, according to data from the Bureau of Economic Analysis.

During the outbreak, contact-intensive services sectors, which were some of the only segments of the economy adding jobs in 2019, will be the most harmed as individuals are required to stay at home to avoid spreading the virus. As the lockdown continues, the negative impact is likely to spread to the manufacturing sector, the financial sector and other non-services sectors, which were already shedding jobs before the COVID-19 pandemic. New federal data revealed Illinois lost 13,100 manufacturing jobs on net in 2019 – more than double the losses of any other state. In percentage terms, this 2.2% decline in manufacturing payrolls was third worst in the nation behind Idaho and South Dakota.

The COVID-19 crisis will play out in two acts: the emergency and the recovery.

In the emergency phase, Illinois must do everything it can to provide relief for taxpayers, including following Chicago’s lead by delaying or canceling fines, fees and late penalties for non-safety violations, such as parking violations and unpaid tickets.

Despite having virtually no rainy-day fund, state leaders can still take action to provide Illinoisans with relief during this time. The Illinois General Assembly should pass emergency legislation delaying the collection of one-half of this year’s business property taxes for local governments to prevent businesses from going under. Local governments could still receive the revenue if financed by the state through short-term emergency borrowing. This would let Illinois provide tax relief where it is most needed without harming local government finances.

And to ensure the state recovers fully once the health crisis is contained, lawmakers should remove tax uncertainty by clearing the threat of tax hikes such as the proposed progressive income tax, which would hit small businesses when they are at their most vulnerable.

Smart policy solutions now would create a sense of stability even amid the chaos. Illinois leaders should limit the public’s uncertainty with a strong plan to ensure businesses can keep their workers, regain their footing and quickly help stabilize the economy.