More than 2,200 Cook County workers receive salaries over $100,000

More than 2,200 Cook County workers receive salaries over $100,000. For career county workers, that means pensions worth millions of dollars over the course of their retirements.

Television ads financed by former New York City Mayor Michael Bloomberg are trying to make Cook County residents believe the county’s new sweetened beverage tax will help fund better health care for its residents.

But the reality is, just like most of the recent tax hikes passed in Chicago and Cook County, most of the new tax dollars will never find their way toward improving Cook County’s government services. Instead, the new money will go to prop up Cook County’s collapsing pension plan.

Pension costs are draining operating funds from government coffers across Illinois, and Cook County is no exception. The Cook County pension plan has become too generous for workers to count on and too expensive for Cook County’s residents to afford.

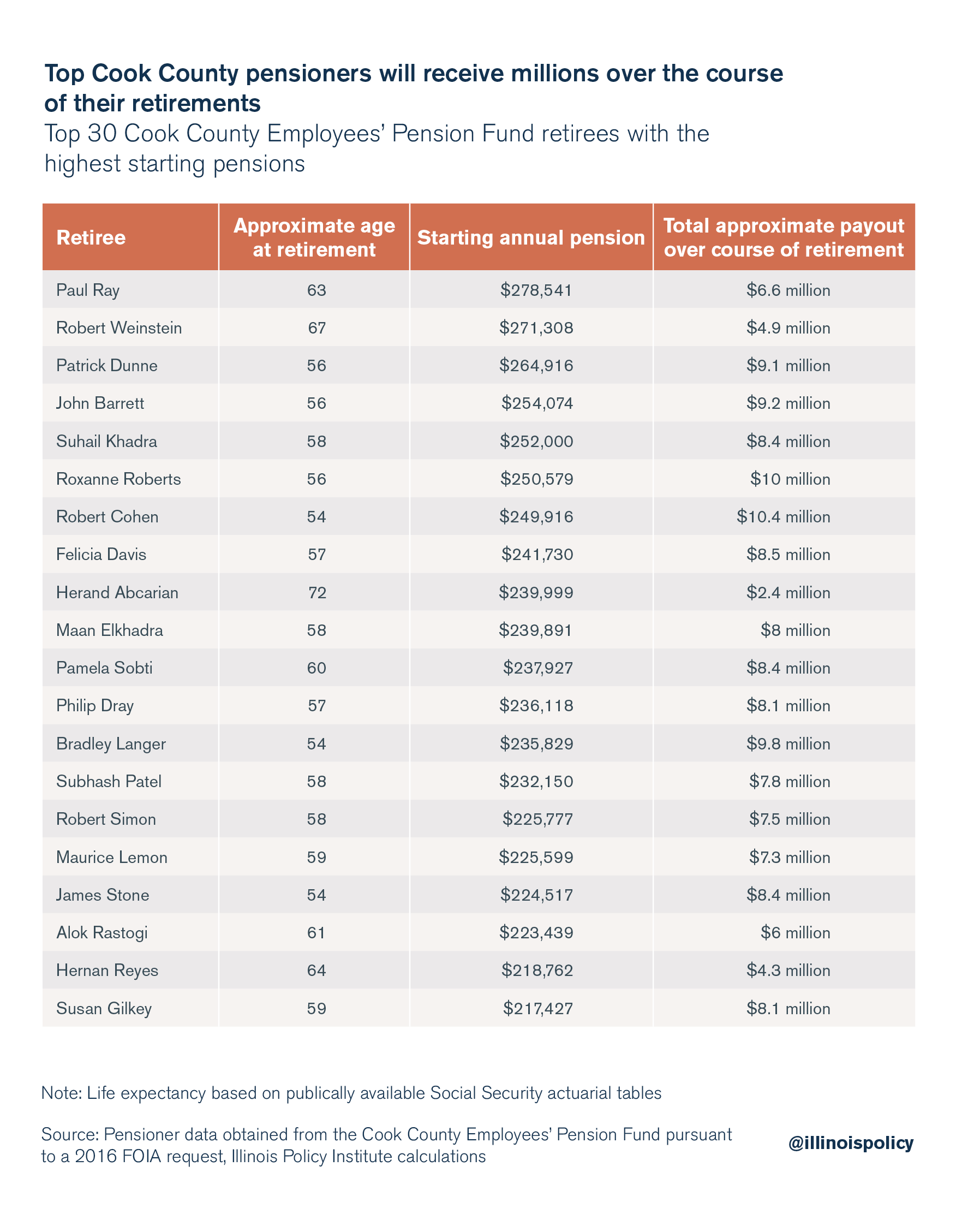

A review of the county’s payroll database finds that more than 2,200 Cook County workers receive salaries over $100,000. For career county workers – those who’ll work for 30-plus years – that means pension benefits worth millions of dollars over the course of their retirements.

Top Cook County pensioners can expect on average $6 million to $10 million in lifetime pensions, assuming the fund doesn’t run out of money first. Robert Cohen, for example, retired in 2013 at the age of 54. He received a starting pension of $250,000, and assuming a normal life expectancy, he’ll receive more than $10 million in pension benefits alone over the course of his retirement.

Career workers with final salaries close to $100,000 and who end up retiring around the age of 60 can expect to receive pension benefits worth about $3 million over the course of their retirements.

But it’s not just the top earners and pensioners that cost Cook County residents a great deal during their retirement. The average career county worker’s pension also demands lots of tax dollars.

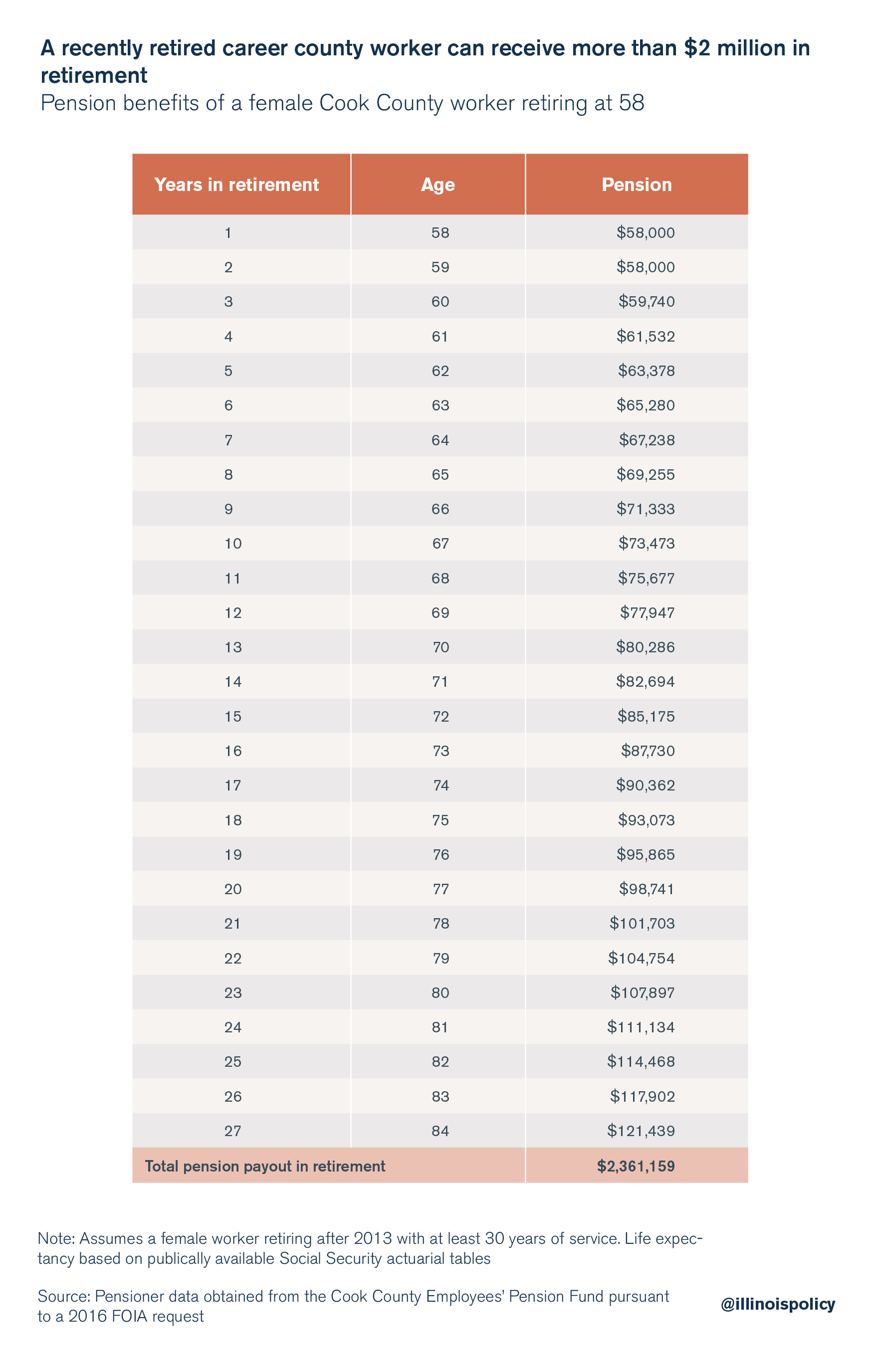

Recently retired career workers – those who retired after 2013 with 30-plus years of service – on average receive a starting pension of $58,000 a year. They’ll receive about $2 million in total benefits over the course of their retirement.

Much of those benefits are a result of the fund’s generous provisions, such as allowing workers to receive a maximum of 80 percent of their final salary as a starting pension and granting automatic 3 percent compounded cost-of-living adjustments, or COLAs, to pensioners every year after age 60.

Of course, many county workers are employed by the Cook County Health & Hospitals System. They deserve appropriate salaries and benefits. But the county seems to have forgotten about the residents who pay those costs.

Cook County pension benefits have been growing far faster than residents’ ability to pay. The average pension (when all workers are included, not just career workers) has grown nearly 5 percent per year since 2006. In contrast, median earnings for private sector workers in Cook County have grown at just 1.5 percent per year, according to the U.S. Census Bureau.

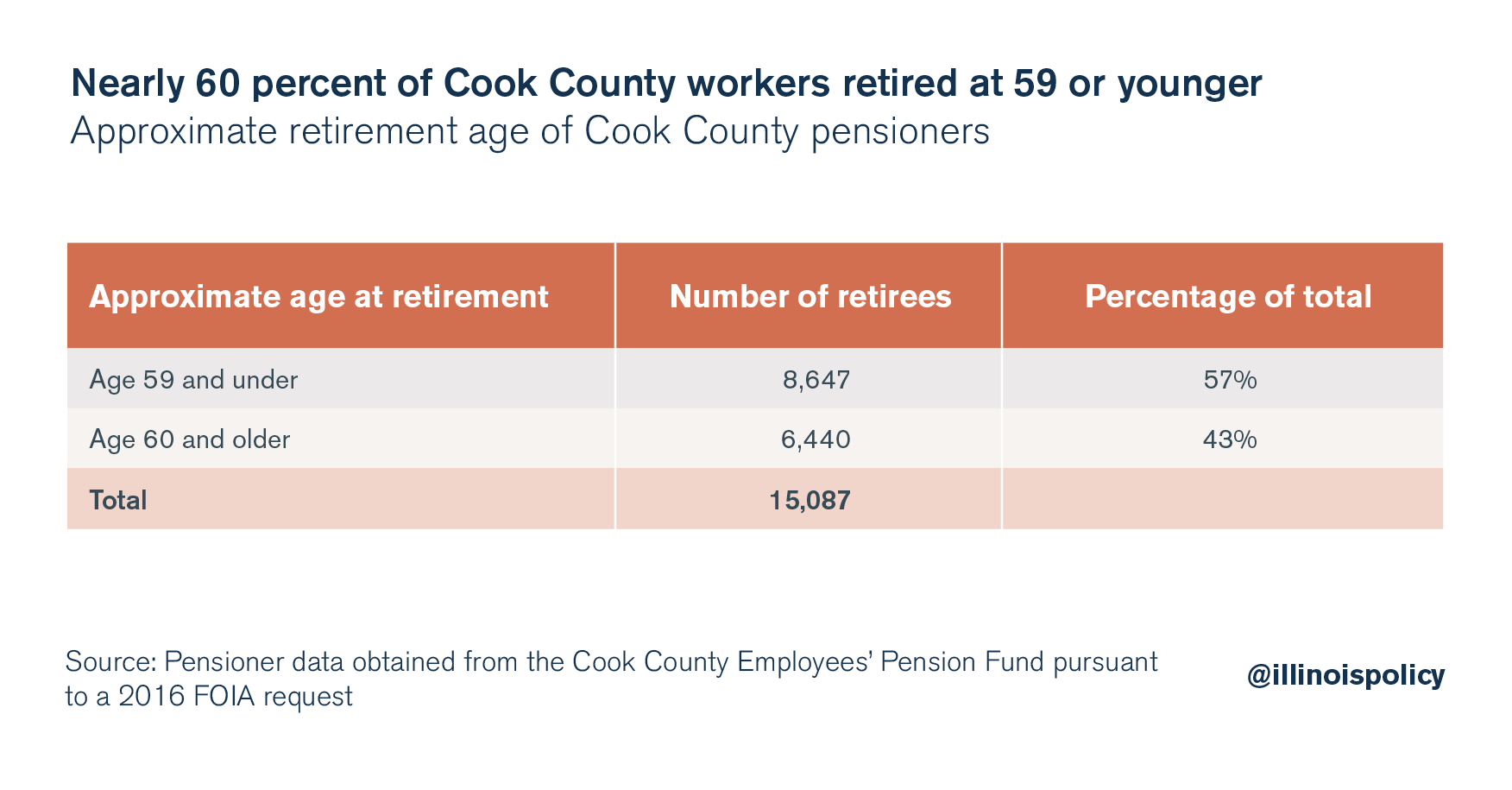

Career Cook County government workers also receive millions in benefits in part because they can draw pensions at an early age. Nearly 60 percent of current Cook County pensioners retired at 59 or younger.

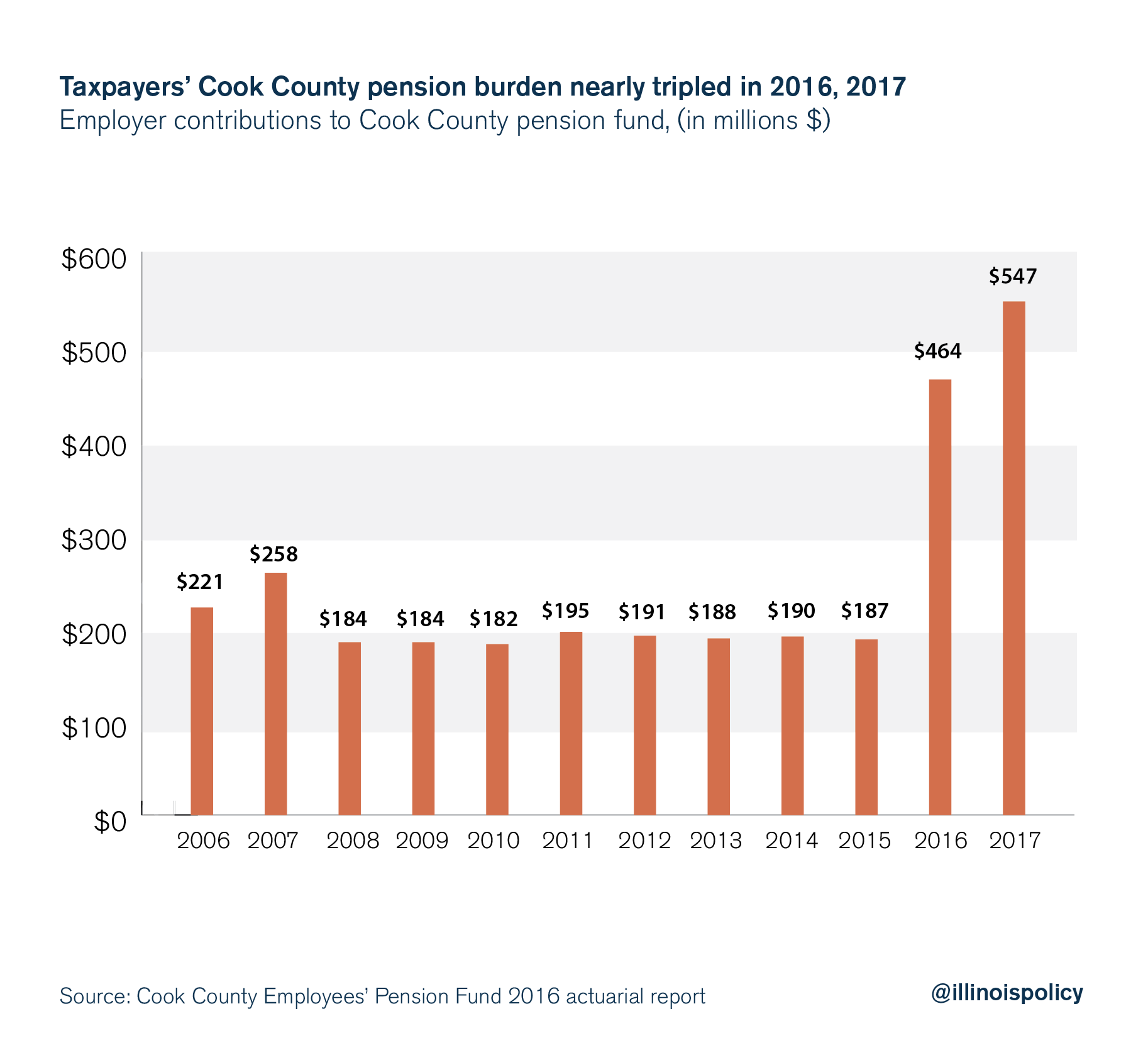

The true cost of those benefits has only recently hit Cook County residents. After years of ignoring their pension crisis, Cook County nearly tripled its contributions to its pension fund in 2016, and those contributions were even higher in 2017.

But hitting up taxpayers for increasingly higher contributions isn’t going to fix Cook County’s pensions. Taxing residents more and more to maintain a broken and overly expensive system will only result in more taxpayers packing their bags.

Government workers are at risk too

The pension crisis is about more than just the massive burden placed on local taxpayers. It also affects county workers themselves. Not only are workers not given a choice or a voice in their retirement, but they have no real retirement security despite the oversized promises made to them.

The funding ratio of Cook County’s pension system has collapsed over the past two decades. It was nearly 100 percent funded at the turn of the century, but today it has only 56 cents on hand for every dollar it needs to pay out pension benefits. If it were managed in the private sector, the county’s pension fund would be considered bankrupt many times over.

Part of the dysfunction comes from politicians offering benefits they can’t deliver. Three percent compounded COLAs that double pension benefits after 25 years in retirement, a majority of workers being able to draw pensions while still in their 50s, and employee contributions that cover only a fraction of the total benefits an employee receives in retirement all add up to a system that is unsustainable.

For a private sector worker to receive the same guaranteed $2.3 million in retirement benefits as career Cook County pensioners do, he or she would have to have $1.8 million in a savings account at retirement.

Few private sector workers earning the Cook County median of $36,000 per year have that kind of savings. It’s no wonder that despite funding pensions for years, the pension liabilities have outpaced the ability of taxpayers to fund them.

Pension crisis needs comprehensive reforms, 401(k)s

The pension crisis that’s consuming every level of government has been building for decades. Illinois politicians have long ignored the reforms necessary to begin an end to the state’s collective pension crisis. Instead, they’ve spent time papering over the crisis with higher taxes and borrowing. They’ve passed “reforms” that turned out to be minor, unconstitutional, or unfair. And many times they’ve even made the crisis worse.

And what should infuriate Cook County residents the most is that a solution to the county’s pension crisis has been right under their politicians’ noses for nearly two decades.

A successful, standalone 401(k)-style plan for state university workers has been operating in Illinois for nearly 20 years and has more than 20,000 members. Cook County, and every other government in Illinois, can begin an end to the current pension crisis if they simply expand a similar 401(k)-style plan to all workers.

That first step will help to stop the bleeding of taxpayer dollars into the broken pension funds, but much more will have to be done going forward. Other key changes – from authorizing municipal bankruptcies to collective bargaining reform to changes to the state constitution – must also be enacted to help reduce the massive $267 billion in pension and retiree health care debts that Illinois governments collectively owe.

A new sweetened beverage tax and sales tax hikes won’t solve Cook County’s pension problems. 401(k)s and other reforms that address the $7.2 billion shortfall will.