Cook County soda tax goes into effect, despite appeal

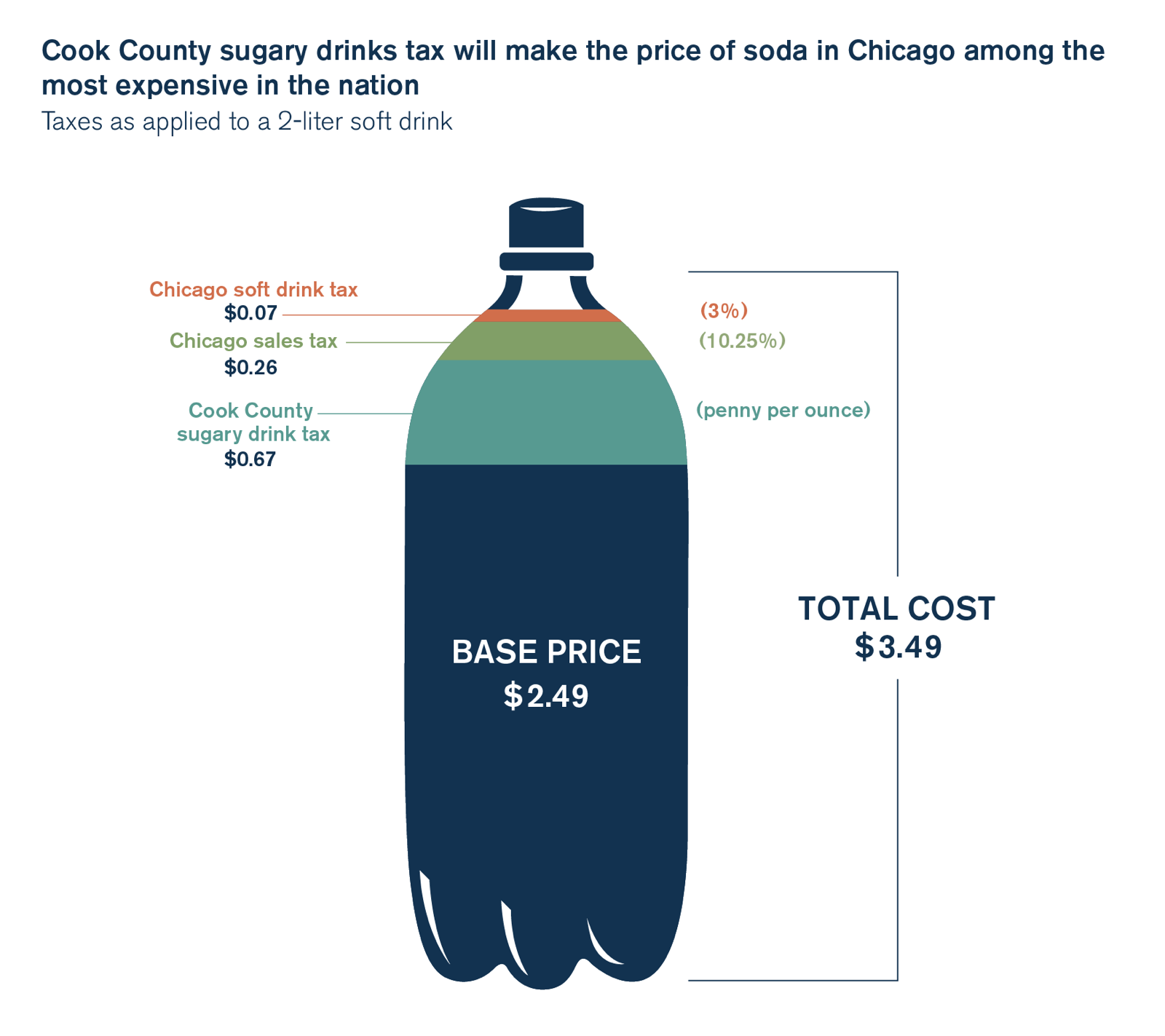

The new tax will make soda sold in Chicago among the most expensive in the country.

Starting Aug. 2, soda and other sugary drinks will cost a penny-per-ounce more due to Cook County’s new sweetened beverage tax. This tax is going into effect over a month later than its original July 1 date, which was postponed due to the Illinois Retail Merchants Association, or IRMA, filing a lawsuit against the county. A Cook County Circuit Court judge upheld the tax July 28.

Prices will go up despite IRMA’s Aug. 1 announcement, in which it declared it is appealing the Circuit Court’s decision to uphold the tax.

The new tax will be added on top of Chicago’s 10.25 percent combined sales tax and the city’s 3 percent tax on non-alcoholic beverages. With the new sugary beverage tax, soda in Chicago will be some of the most expensive in the nation as a $4 12-pack of soda will cost $5.97, an effective tax rate of nearly 50 percent.

The new tax on sugary beverages will also affect fountain drinks, energy drinks, ready-to-drink tea and coffee products, diet soda and juices that aren’t 100 percent fruit or vegetable juice.

Retailers argue the tax violates the state constitution by failing to tax similar drinks uniformly. Bottled or otherwise packaged drinks may be subject to the tax, but drinks prepared to order are not. Additionally, the group challenged how the county could tax fountain drinks uniformly when ice displacement and refills are difficult to account for.

Furthermore, retailers feared potential litigation arising from tax collection difficulties. Under the ordinance, sweetened beverages bought with food stamps will not be taxed, but retailers fear their cash register systems may not let them make this distinction, meaning they might accidentally overtax consumers.

Cook County expects to receive $67.5 million in soda tax revenue for the remainder of 2017 and another $200 million in 2018. The county has claimed 1,100 government workers would be laid off and 600 vacant positions would be terminated if the tax were not implemented.

A spokesperson for Cook County Board President Toni Preckwinckle said in an email to the Chicago Tribune that the county “always anticipated a long legal battle” and “will continue to vigorously defend the ordinance.”