City of Springfield passes unbalanced budget despite bevy of new tax hikes

The city's budget for fiscal year 2019 was accompanied by increases in sales and telecom taxes. But local officials still anticipate a deficit.

The city of Springfield has a budget for fiscal year 2019, and the residents of Springfield have inherited a bouquet of new tax increases. But that additional revenue likely won’t be enough to balance the budget.

Following weeks of dispute and uncertainty, Springfield City Council convened Feb. 20 for a vote on Mayor Jim Langfelder’s proposed budget with additional spending cuts. Lawmakers passed the mayor’s budget by a 10-1 vote.

The budget proceedings dovetailed with another vote: a revived sales tax hike proposal rejected by aldermen weeks earlier. Aldermen approved the sales tax hike this time, bringing residents’ combined state and local sales tax rate to 8.75 percent from 8.5 percent, pushing the burden above the state average.

This wasn’t the only tax increase lawmakers have passed in an effort to shore up city finances, however. City lawmakers approved an increase in the city’s telecommunication tax last month, raising the levy to 6 percent from 4 percent, as well as an expansion in the hotel-motel tax to include short-term room rentals through digital lodging services such as Airbnb.

But revenues from the recent tax measures, combined with an additional $3.7 million in cuts and a dip into the city’s emergency fund, failed to close Springfield’s budget shortfall. City Budget Director Bill McCarty still anticipated a possible $4 million deficit, according to The State Journal-Register.

Langfelder has proposed a 4 percent tax on natural gas to address the lingering deficit.

Taxpayers already shouldering a heavy burden

Springfield lawmakers have been testing taxpayers’ financial endurance since well before the City Council’s latest marathon of tax hikes. Property taxes have weighed heavily on residents of Springfield.

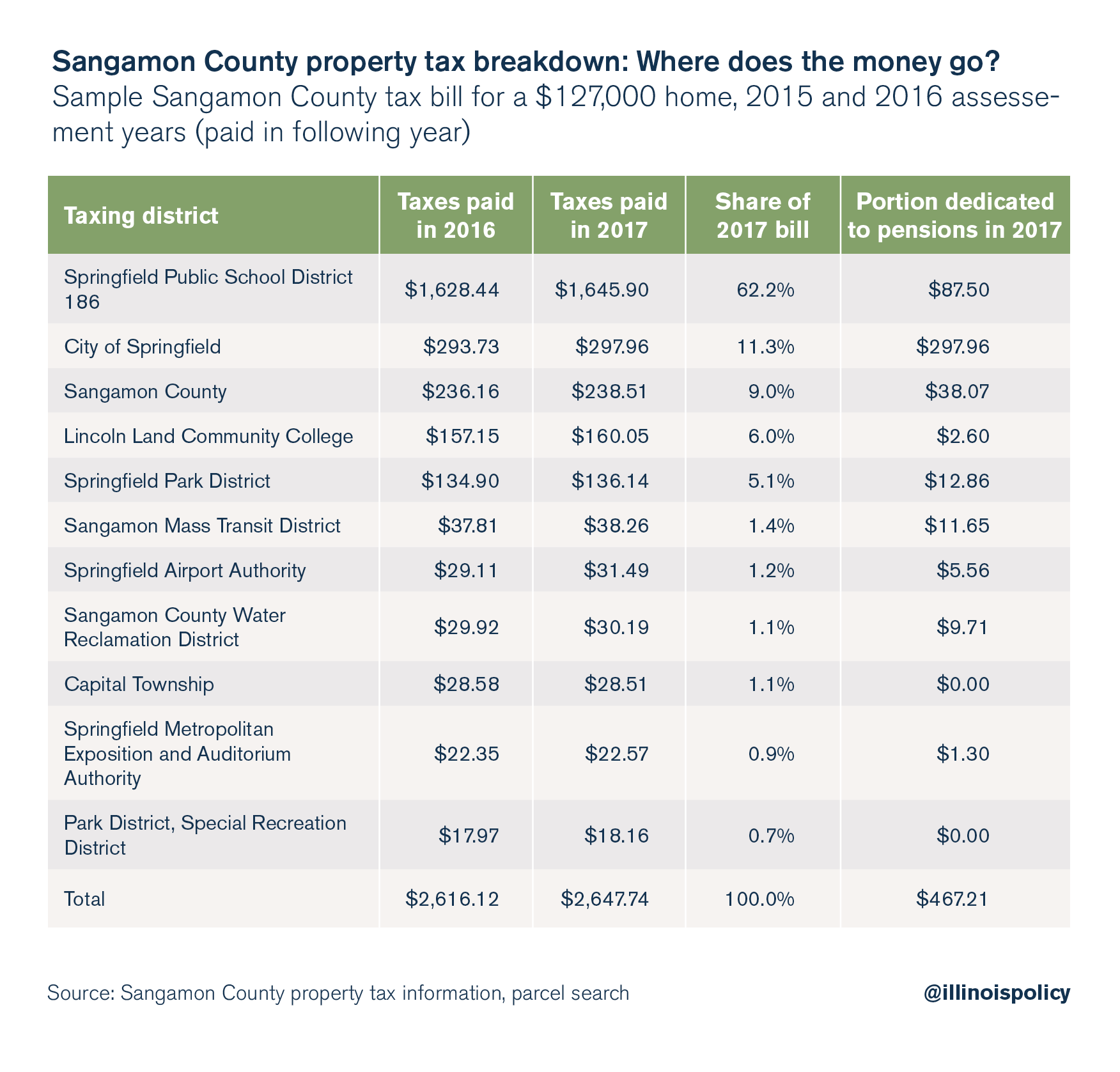

A home in Springfield listed around $127,000 – slightly above the county’s median home value – owed more than $2,600 in property taxes in 2017.

These property tax revenues flowed to 10 different units of local government, including Springfield Public School District 186, the Springfield Park District and the city of Springfield. One-hundred percent of the amount paid to the city went toward government-worker pensions. Even then, this appropriation and others have proven incapable of taming the city’s unfunded retirement liabilities.

Fragile finances

The medley of tax proposals surrounding the passage of the city’s budget is a testament to Springfield’s fragile fiscal condition. Standing in the shadow of an $11.4 million deficit, lawmakers are desperate for new sources of revenue as government-worker pension costs balloon. And with the city’s credit rating in decline, borrowing is starting to look like an increasingly risky option.

In 2016, Moody’s Investor Services downgraded the city’s credit rating two notches, citing “considerable growth” in pension liabilities, according to The State Journal-Register. The agency had noted that, over the course of a year, unfunded pension obligations had grown by more than $200 million, to $707 million in 2016 from $503 million in 2015.

A subsequent report issued by Moody’s in 2018 reinforced the cause for alarm. The report, released Jan. 11, reasserted the city’s downgraded rating, this time revising the account’s outlook from “stable” to “negative.”

Rather than hiking taxes in response to spiraling deficits, lawmakers need to address what causes such deficits in the first place. Absent structural spending reform, Springfield’s credit rating only risks sliding further, therefore driving up the cost of debt – and further squeezing taxpayers.