Chicago’s pitch to pay down $32B in unfunded pension debt: A casino, state money for CPS and a pass on pension payments

None of these proposals would even begin to address the Chicago’s pension crisis. The city needs reform, not revenue.

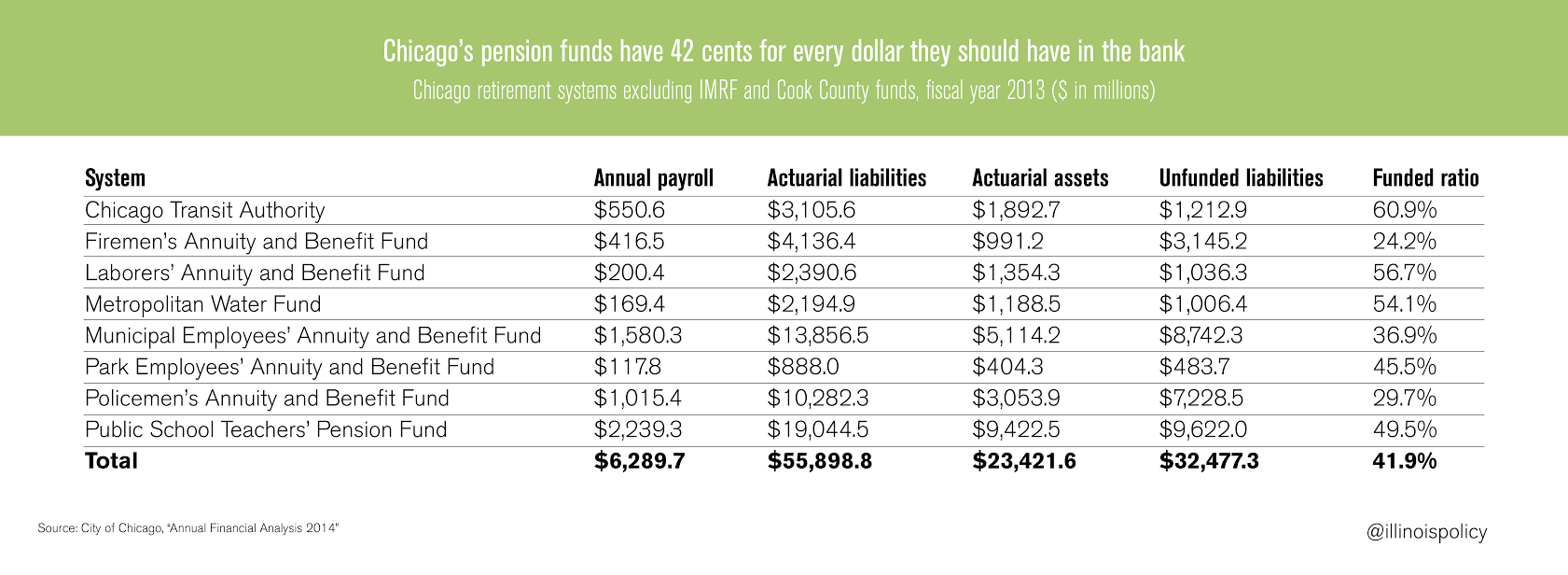

Chicago and its sister governments are officially on the hook for more than $32 billion in unfunded pension debt. With just over a million households in the city, that staggering figure totals $32,000 in pension debt for each Chicago household. City officials haven’t come out with any reasonable plans to tackle this debt – but they’ve put forth plenty of unrealistic proposals.

The city is doing everything it can to avoid tackling the problem itself by seeking help from the state. The city’s ask to state government includes a Chicago casino, more money for Chicago Public Schools pensions and changes that would allow the city to push increased pension payments into the future, according to the Chicago Tribune.

The hard truth is that Chicago’s pension funds collectively have only 42 cents for every dollar they should have in the bank today to pay for future benefits. The city’s police and fire pension funds are in the worst shape, each with funding levels below 30 percent.

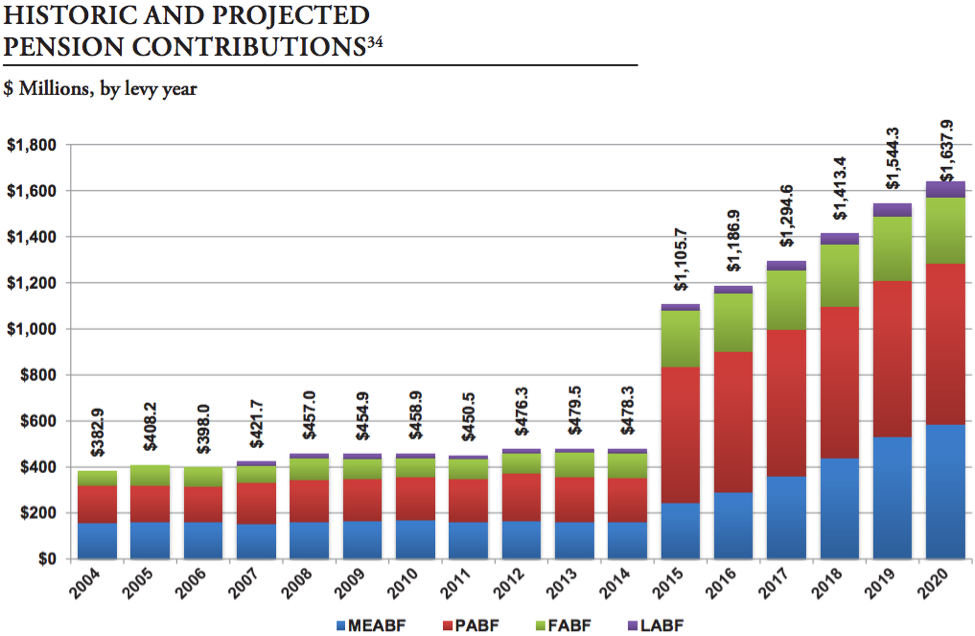

The payment for Chicago’s four city-run funds (excluding the city’s sister governments) is slated to double, increasing by more than $550 million. Although the city’s pension projections show the increase occurring during the current fiscal year, the city won’t have to pay the full increase until 2016, according to Alexandra Holt, the city’s budget director.

Source: City of Chicago, “Annual Financial Analysis 2014”

Chicago officials have known about the increased payment since 2010. And regardless of whether the full payment is due on the last day of 2015 or the first day of 2016, not planning for a known $550 million increase in pension costs is an injustice to the families, entrepreneurs and businesses that call Chicago home.

None of these proposals would even begin to address the city’s pension crisis.

Pushing pension payments into the future will only delay the day of reckoning for Chicago. Increased revenue from a new casino and additional state funding for CPS won’t do the trick, either. Chicago needs reform, not revenue. And with a credit rating teetering on the edge of junk-bond status, the city’s financial future depends on it.

The only way out of Chicago’s pension crisis is to structurally change how the city handles retirements. That means taking control of retirements away from politicians and putting it in the hands of city workers. A comprehensive reform package focused on giving city employees control over their retirements would do far more for the city’s finances than pushing the problem into the future again.