Chicago’s dizzying alcohol taxes

The combined burden of municipal and state taxes on alcoholic beverages might make Chicagoans think they’re seeing double.

“If it moves, tax it,” the adage goes. And the city of Chicago can move liquor. With a nightlife scene that encompasses legendary sports venues, a famed theater district and nationally renowned comedy and improv clubs, there’s no lack of demand for alcoholic beverages in the Windy City. And overseen by a local government never too shy to tax, the city makes sure it gets its cut.

But you needn’t spend an evening out on the town to feel the sting of Chicago’s onerous alcohol taxes. On a quiet night in, you can also run up a steep tab.

Consider this example: A person buys a fifth of Absolut vodka for a home liquor cabinet. Collectively, the cocktail of sales and excise taxes amounts to a total, effective tax rate of 28 percent – more than a quarter of the price of the liquor.

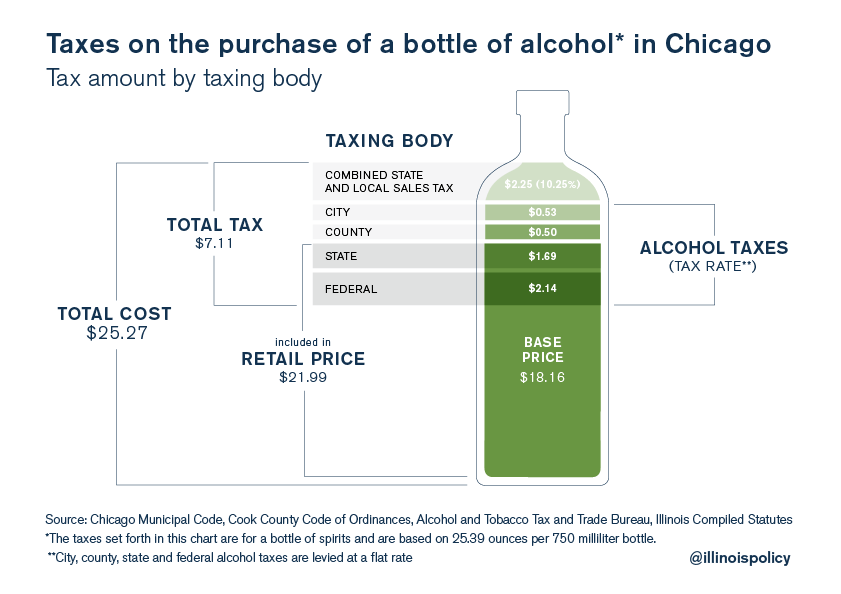

One standard 750-milliliter bottle (40 percent alcohol by volume) of this spirit lists at $21.99 in some stores in Chicago. State and federal alcohol taxes are embedded in the $21.99 list price, masking a $3.83 pinch. The total price, however, is only fully calculated after pouring on additional taxes. As that bottle is rung up at the register, city and county alcohol taxes, along with state and local sales taxes, hike the total price of the liquor to $25.27.

According to the nonpartisan Tax Foundation, the combined state and local sales tax burden foisted on Chicagoans is the highest in the nation among U.S. cities with populations over 200,000 – tied with Long Beach, California, at 10.25 percent. At a Chicago liquor store, this means an additional $2.25 on a 750-milliliter bottle of liquor.

Alcohol taxes have made Chicago’s excise tax load heavier and heavier. Most recently, Cook County passed a 50 percent alcohol tax hike in 2011. This came on the heels of a statewide tax increase on alcohol in 2009, and a citywide liquor tax spike two years prior to that.

And a distaste for hard liquor isn’t enough to dodge the taxes. Among Illinois’ surrounding states, Tax Foundation research shows the Land of Lincoln has the second-highest beer taxes per gallon, after Kentucky, as of January 2017. However, it’s worth noting the Tax Foundation analysis excludes sales taxes. Kentucky’s largest city, Louisville, has a combined state and local sales tax rate of 6 percent, just less than two-thirds of Chicago’s 10.25 percent combined rate. And although Illinois’ beer tax sits near the median nationwide, if you opt for wine in the Prairie State, you’ll pay the 11th-highest wine taxes in the country. In Chicago, this levy is compounded by local alcohol taxes, heaped atop onerous sales taxes.

In a state with one of the highest overall tax burdens in the country, the already-overtaxed residents of Cook County will only allow themselves to be nickel-and-dimed for so long. Amid the backlash that led to the repeal of the soda tax, the popularity of its chief proponent has plummeted. Lawmakers should take note. Illinoisans – and Chicagoans in particular – are past the point of tax fatigue. Now, they’re starting to fight off the hangover.