Illinoisans pay nearly a quarter of their wireless bills in taxes

Illinoisans pay nearly a quarter of their wireless bills in taxes, while Chicagoans pay more taxes on wireless service than residents of any other major city in the country.

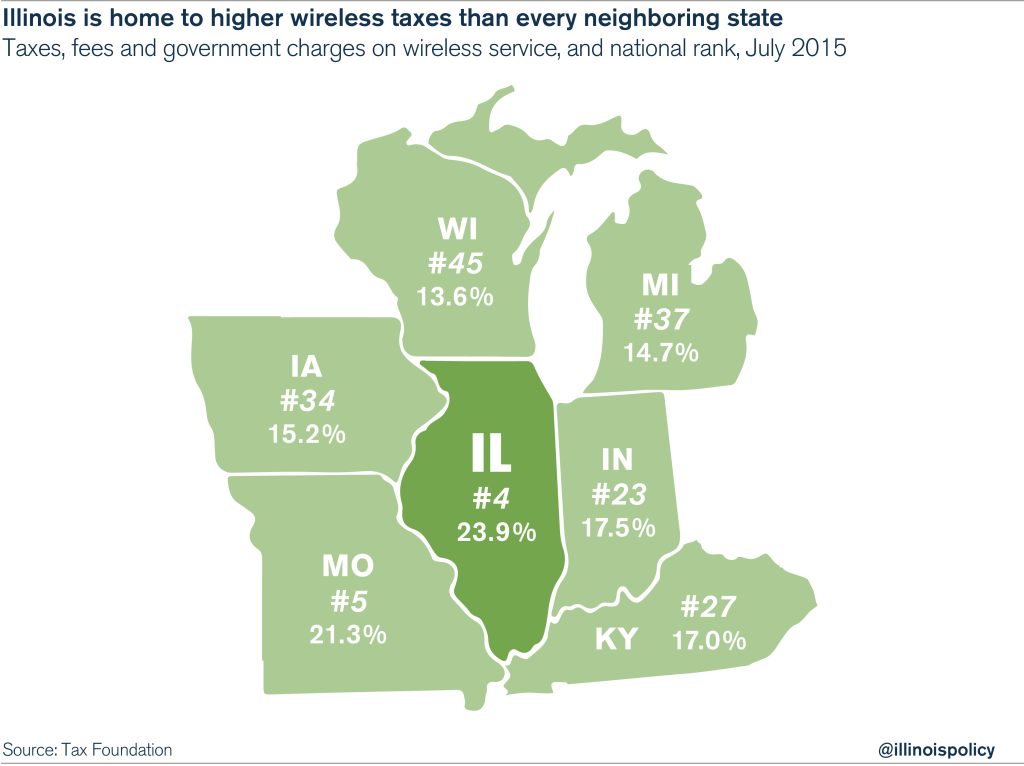

Illinoisans pay the fourth-highest wireless taxes in the country, according to a new report from the nonpartisan Tax Foundation.

With the combination of federal, state and local wireless taxes and fees, Illinoisans shoulder a 24 percent burden. Illinois ranks behind only Nebraska in the Midwest, and Illinois’ combined wireless taxes are nearly six percentage points higher than the national average.

As the Tax Foundation points out, Americans – especially those in low-income households – increasingly rely on wireless service as their sole means of communication and connectivity.

Nearly half of Illinois households are wireless-only consumers. And in 2014, nearly 60 percent of poor U.S. households relied on wireless service alone.

Illinois levies a state telecommunications tax of 7 percent, which municipalities other than Chicago can also levy at rates of up to 6 percent. And Chicago tacks on an additional 7 percent telecommunications tax at the city level.

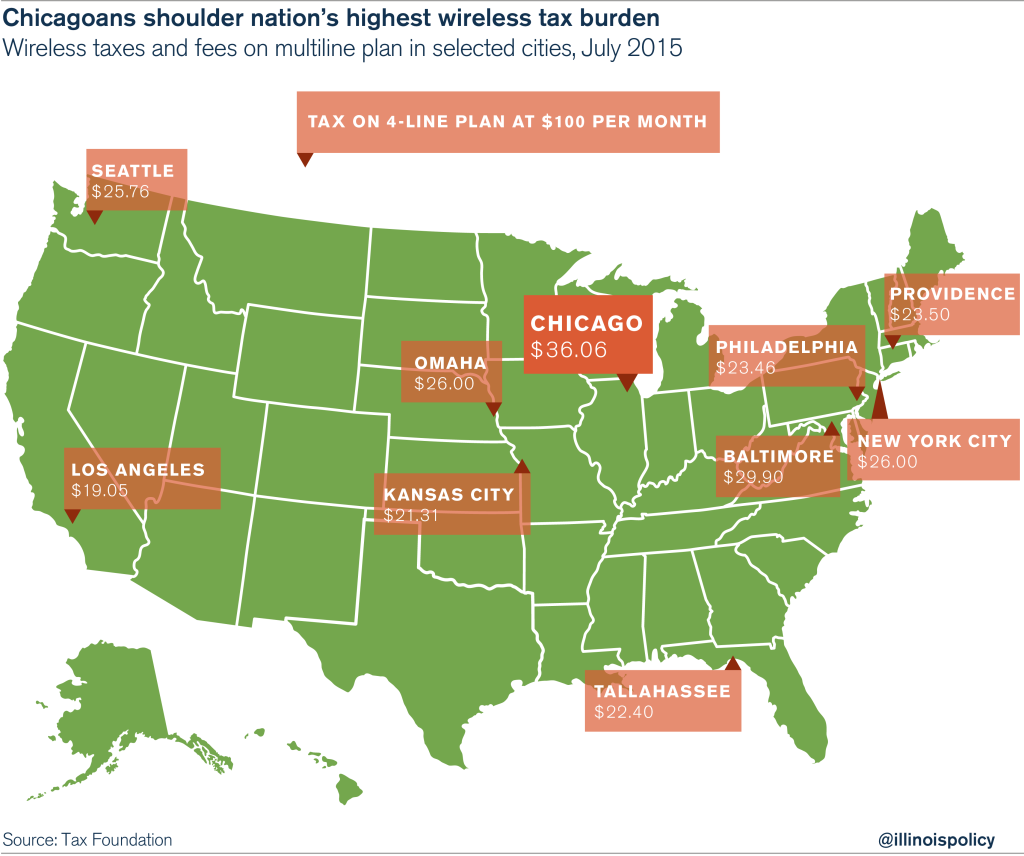

Chicagoans pay more taxes on wireless service than residents of any other major city in the country. A Windy City household with a four-line wireless plan costing $100 a month pays more than $36 in taxes on each bill, according to the Tax Foundation.

Under some payment plans, a Chicagoan can pay more in taxes on an additional line than on the line itself.

Illinois is one of only two states and Washington, D.C., to levy taxes on wireless service at higher state tax rates in lieu of the broad sales taxes that apply to most other purchases. Only Illinois and Florida levy state-level telecommunications taxes with local add-ons.