Chicagoans paying 50% tax rate on raw price of gas

While gas prices have dropped to a 12-year low in Illinois, Chicagoans pay $0.32 more per gallon than the state average due to multiple layers of city, county and state taxation.

Chicago area gas prices may have fallen to 12-year lows, but the average price per-gallon in the city is still $0.32 higher than the state average – and that’s because one-third of a Chicago driver’s gas bill is taxes.

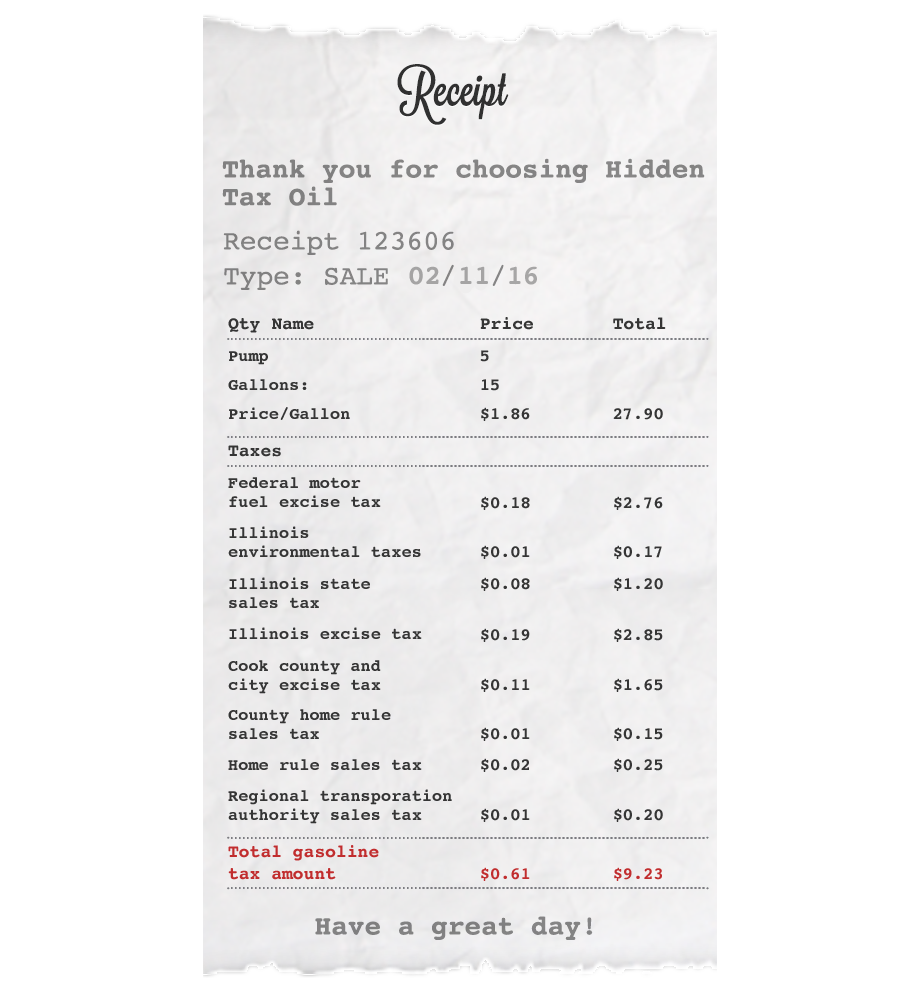

The average price per gallon of gas in Chicago is a little over $1.85: $1.24 comes from the raw price of gas and $0.61 comes from local, state and federal taxes.

No matter how low prices go, drivers in Chicago and Illinois will always be stuck with a hefty gas sales-tax burden.

Traditional motor fuel taxes are a fixed amount per gallon. These federal and state taxes generally pay for road maintenance and other transportation expenses – motorists in all states pay these taxes. Illinois, however, is one of only a handful of states that tack on additional gas taxes beyond the motor fuel taxes. Most consumers don’t realize that, because these costs don’t show up on their receipts – these taxes are built into the advertised price.

Combined, all federal, state, county and Chicago taxes total $0.61 per gallon at Feb. 11’s price. Of this, only $0.37 comprise federal and state excise taxes. The remaining $0.24 is composed of: Illinois’ 6.25 percent sales tax, the county and city excise tax, an Illinois environmental tax, additional county and other home-rule sales taxes, and a Regional Transportation Authority tax.

And unlike most states, where gas-tax dollars fund roads and transportation services, the revenue Illinois’ sales taxes generate goes to the state’s General Fund.

Even at a time when gas prices are plummeting for drivers across the Midwest, Chicagoans will always be stuck with higher bills thanks to multiple layers of city, county and state taxation.