Chicagoans could pay nearly $1 per gallon in taxes alone under Pritzker capital plan

Drivers filling up in Chicago could see an effective per-gallon gas tax burden of 39% under Gov. J.B. Pritzker’s proposed capital spending plan.

Gov. J.B. Pritzker is pushing for a $41.5 billion capital plan over six years, which relies on $2.4 billion in new tax and fee revenues.

The preliminary capital plan shows Pritzker seeks to double the state gas tax to 38 cents from 19 cents per gallon, effective July 1. The $1.2 billion tax hike would push Illinois’ total gas tax burden to the second-highest in the nation.

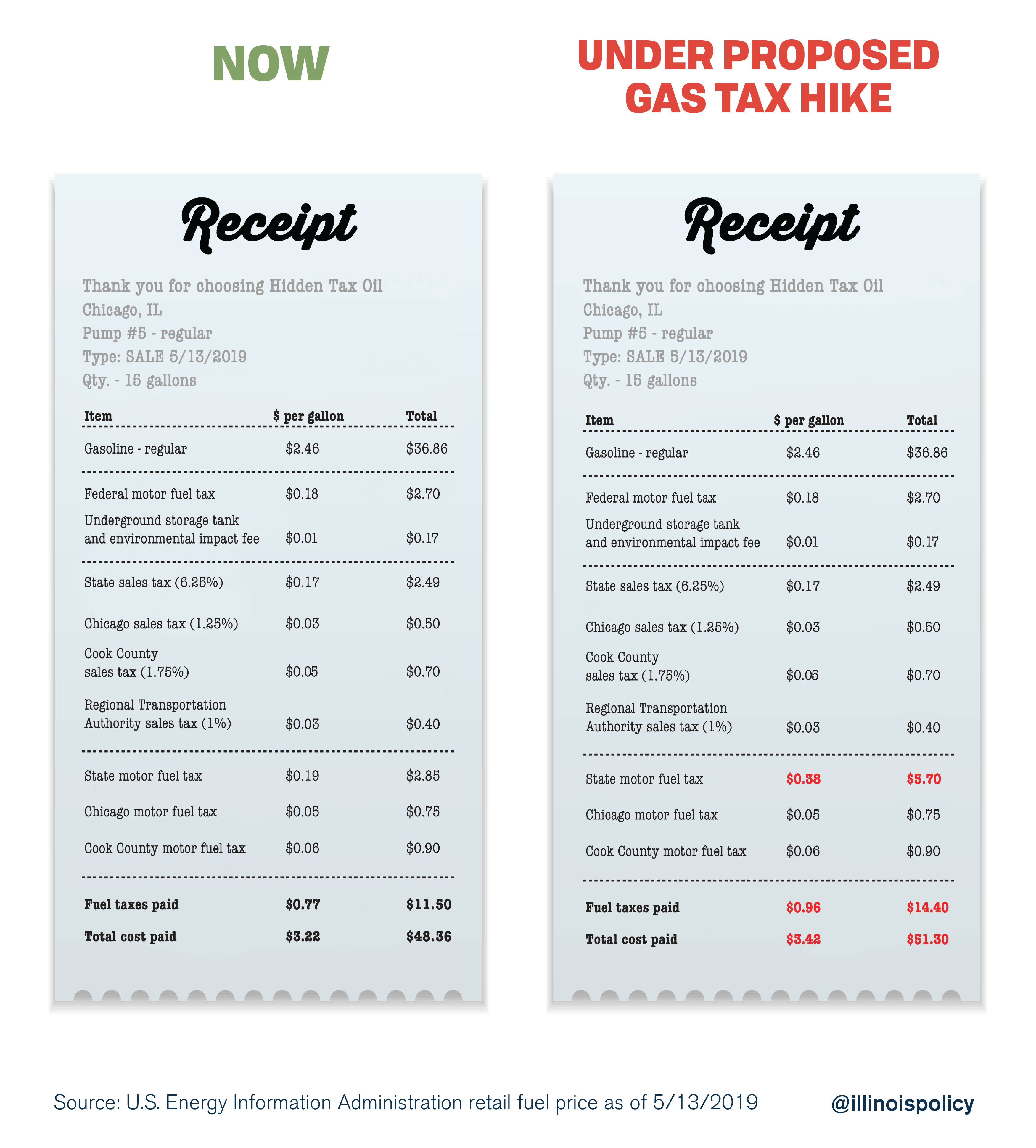

Those filling up in Chicago would get hit hardest under the proposal. As of May 13, the wholesale price of gasoline in Chicago was $2.46 per gallon. At that price, drivers at Chicago filling stations would pay 96 cents in taxes and fees on each gallon of gasoline – an effective tax burden of 39%.

A draft of Pritzker’s capital plan makes the misleading claim that “Illinois currently has one of the lowest motor fuel taxes in the nation.” Illinois is one of just seven states where drivers pay general state and local sales taxes on top of gas taxes. Drivers also pay underground storage and environmental fees of just over 1.1 cents per gallon, along with various local charges.

Taken together, Illinoisans currently pay the 10th-highest overall gas tax burden in the nation on average, according to the Tax Foundation.

How these taxes and fees are structured matters in calculating what drivers ultimately pay at the pump. For example, the federal motor fuel tax applies to the base price of gas, as does the underground storage and environmental impact fee. Then, each layer of sales tax is applied to that new total, not just the original base price of gasoline. In Chicago, this would include the state sales tax (6.25%), Chicago sales tax (1.25%), Cook County sales tax (1.75%) and an additional 1% tax for the Regional Transportation Authority.

Finally, state and local gas taxes are tacked on. This includes the 19-cent state motor fuel tax, along with additional 5-cent and 6-cent gas taxes levied by Chicago and Cook County, respectively.

But that isn’t the only gas tax hike on offer in Springfield: A separate proposal in the General Assembly would more than double the state’s gas tax. While Pritzker seeks to double the gas tax to 38 cents, an amendment to House Bill 391 would hike it to 44 cents per gallon, effective July 1, followed by annual increases pegged to inflation after July 2020. On May 9, the Illinois House Revenue & Finance Committee approved that amendment by a 9-6 vote.

HB 391 would push Illinois’ total gas tax burden to the highest in the nation, causing even more pain at the pump, with drivers in Chicago paying an effective rate even higher than the 39% they’d pay under Pritzker’s proposal.

What’s more, hiking the state gas tax would come on top of Pritzker’s 18 other proposed tax and fee increases.

Lawmakers should instead consider a solution that would not require a string of new and increased taxes. The Illinois Policy Institute has outlined a plan showing how Illinois could finance $10 billion in new capital spending without tax hikes.

Illinois could achieve this by focusing on maintenance infrastructure, reforming costly prevailing wage mandates and a more efficient prioritization of projects, while dedicating revenue from legalized sports betting and sales taxes on gasoline to transportation infrastructure. Total state and local spending on infrastructure could reach nearly $28 billion through reforms such as these.

Lawmakers should reject any proposal that calls for a massive gas tax hike. Illinoisans can voice their opposition to hiking the state’s gas tax by signing the petition below and contacting their lawmaker.

Sign the petition

Repeal Pritzker's gas tax hike

Sign the petition to tell your lawmaker to repeal Pritzker's gas tax.

Learn More >