Chicago suburbs eye new dining, alcohol taxes

Suburbs such as Downers Grove make dining out costlier through tax hikes.

Eating out in Downers Grove, Illinois, will take a little more out of diners’ wallets next year, as the village passed a new tax on prepared food and beverages July 18. The new tax will take effect Jan. 1, 2018.

The suburb 20 miles west of Chicago will collect 1 percent of revenues earned from sales of prepared food purchases in stores, and alcohol and food bought at restaurants, according to Patch.com.

Downers Grove trustees approved the new tax intending to make up for declining revenues in general sales taxes, 2 percent of which go to the village.

In addition to the general sales tax and the new prepared food and beverage tax, Downers Grove takes 1 percent of the 1.75 percent tax levied on certain food and drugs.

Nearby Geneva, Illinois, has been flirting with a similar tax.

In October 2016, Geneva passed a 2 percent tax on “places for eating,” which was scheduled to take effect Jan. 1, 2017. Reasoning for the tax and information about where the revenue was to be allocated were unclear, especially considering Geneva boasts a balanced budget and a reserves rate of 25 percent, according to the Daily Herald.

Following protests from local restaurants, Geneva aldermen decided to delay implementation until May 1.

Before April ended, however, the aldermen changed their minds and abandoned the tax altogether. They have discussed proposing a general sales tax hike from its current combined rate of 7.5 percent.

Three of the six aldermen who voted to drop the “places for eating” tax no longer serve on the Geneva City Council, and the mayor has hinted that aldermen could resurrect the matter.

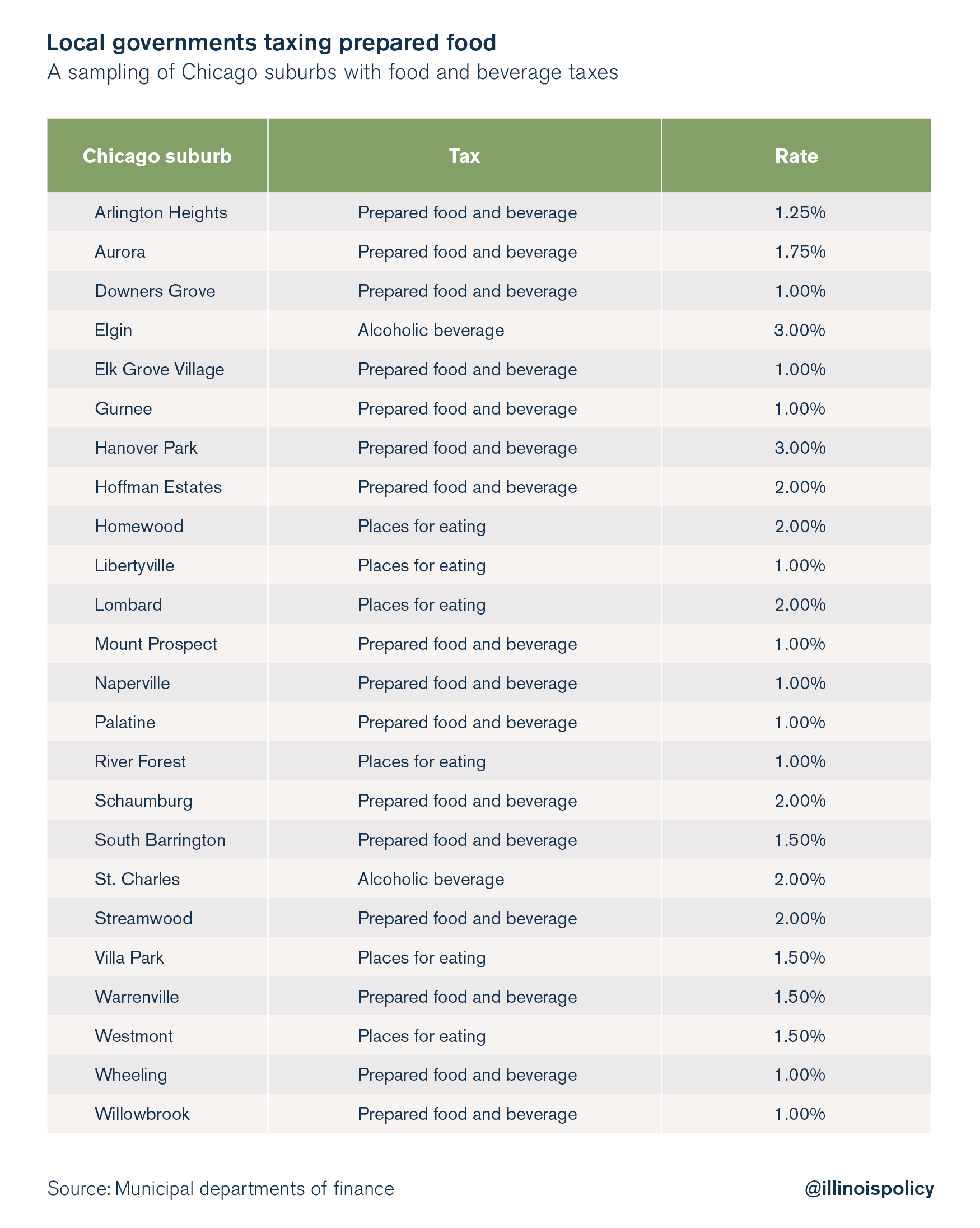

About 25 suburbs currently tax prepared meals and beverages, according to an analysis by the Daily Herald, and Chicago itself taxes purchases at restaurants. The list includes: