Chicago pension reform ruled unconstitutional

The Illinois Supreme Court’s precedent has made it impossible for Chicago to stave off bankruptcy by making even the most meager reforms to government-worker pensions.

A Cook County judge today overturned Chicago’s modest attempts at pension reform, calling the plan “unconstitutional and void.”

The reforms, which came in the form of a bill pushed through the Illinois General Assembly in 2014 by Chicago Mayor Rahm Emanuel, were meant to prop up two of Chicago’s four city-run pension funds: the Municipal Employees’ Annuity and Benefit Fund and the Laborers’ and Retirement Board Employees’ Annuity and Benefit Fund. The law struck down by the courts did not cover the police and firefighter funds, nor did it include changes to the Chicago Teachers Pension Fund.

Earlier in 2015, the Illinois Supreme Court struck down the state’s own reform effort, Senate Bill 1, declaring that pension benefits cannot be “diminished or impaired.” That ruling set the stage for Chicago’s pension-reform law to fail in the courts.

The Illinois Supreme Court’s precedent has made it impossible for Chicago to stave off bankruptcy by making even the most meager reforms to government-worker pensions. Because of the court’s ruling, Chicago can’t make the changes necessary to ensure city workers aren’t left with nothing when they retire. And it can’t fix a broken system that’s swallowing up tax dollars at the expense of schools, public safety and the city’s infrastructure.

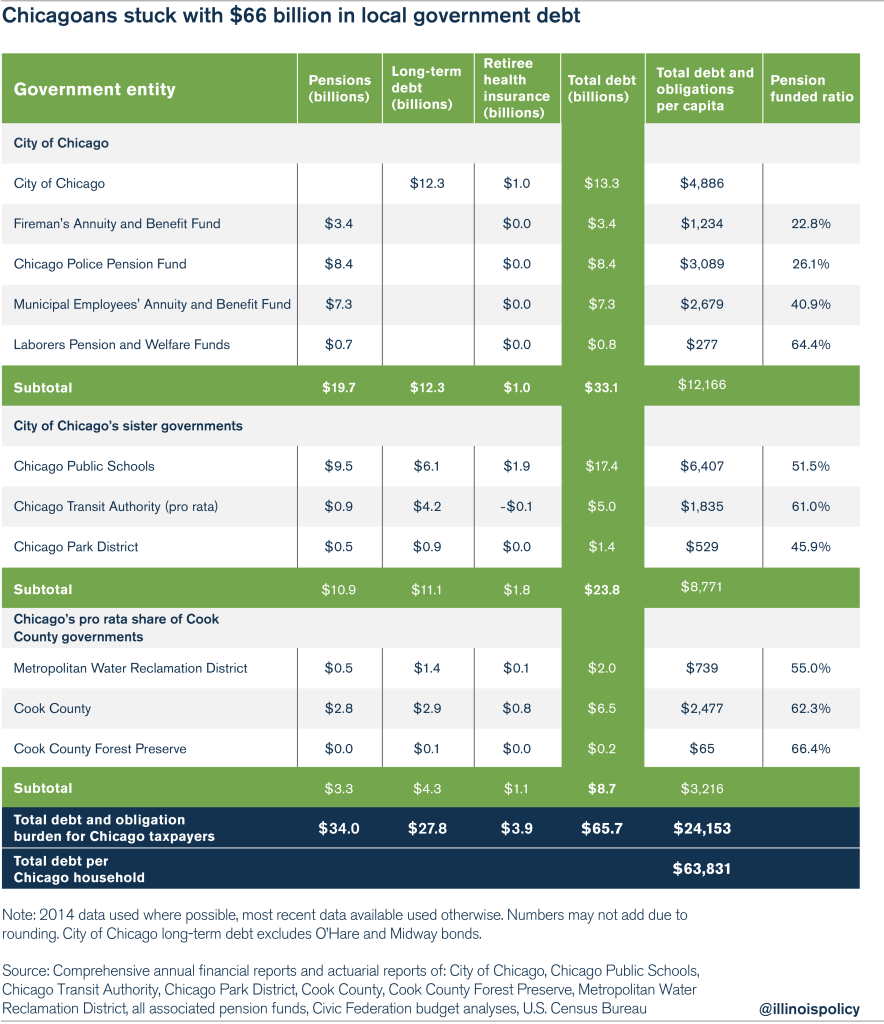

Chicago faces billions in pension debt that threatens to bring city government to its knees. Chicago households are each stuck with $33,500 in pension shortfalls from the four city-run pension systems and other overlapping governments, including Cook County, which add up to more than $34 billion. The city’s budget is under tremendous strain from deficits of up to $1 billion next year – due in large part to a huge increase in required police and fire pension payments.

With the July 24 ruling, Chicago and other governments will be back at square one in building a model for pension reform. And Chicago will be on the hook for larger and larger contributions to the municipal and laborers’ pension funds in the coming years – that’s on top of the coming police and fire pension contributions that have already thrown the city into crisis.

Financial institutions have already demonstrated their deep concerns about Chicago’s financial future. Moody’s Investors Service has downgraded the city four times since 2013, knocking it down seven spots to junk status. As things get worse, Chicagoans can expect to see the city and its sister governments’ credit ratings crumble even further.

The city may be able to muddle through in the short term with more borrowing, increased taxes and service cuts, but without real reforms, all of Chicago’s broken pension systems are headed toward insolvency.

The end result will be massive property-tax hikes to pay for pensions and more residents than ever fleeing Chicago for greener pastures – be they in the suburbs or other states altogether.