Chicago Park District pension reform ruled unconstitutional

The ruling will likely mean higher taxes for Chicagoans.

In a move likely to lead to future tax increases, a circuit court judge on March 1 struck down Chicago Park District pension reform as unconstitutional. Service Employees International Union Local 73 brought the lawsuit on behalf of park district employees.

The pension reform ruled unconstitutional was Public Act 98-0622, which was designed to stabilize the Park Employees’ Annuity and Benefit Fund and save taxpayer dollars. Signed by then-Gov. Pat Quinn in 2014, the act made the following changes to the system:

- Raised the retirement age to 58 from 50 for certain employees who were under the age 45 as of Jan, 1, 2015.

- Reduced future annual cost of living adjustments, or COLAs, to the lesser of 3 percent or half of the consumer price index, instead of a guaranteed 3 percent.

- Suspended annual COLA increases for 2015, 2017 and 2019.

- Reduced future disability payouts to 72 percent of salary from 75 percent of salary, over a period of four years.

- Increased contribution levels for both employees and the employer.

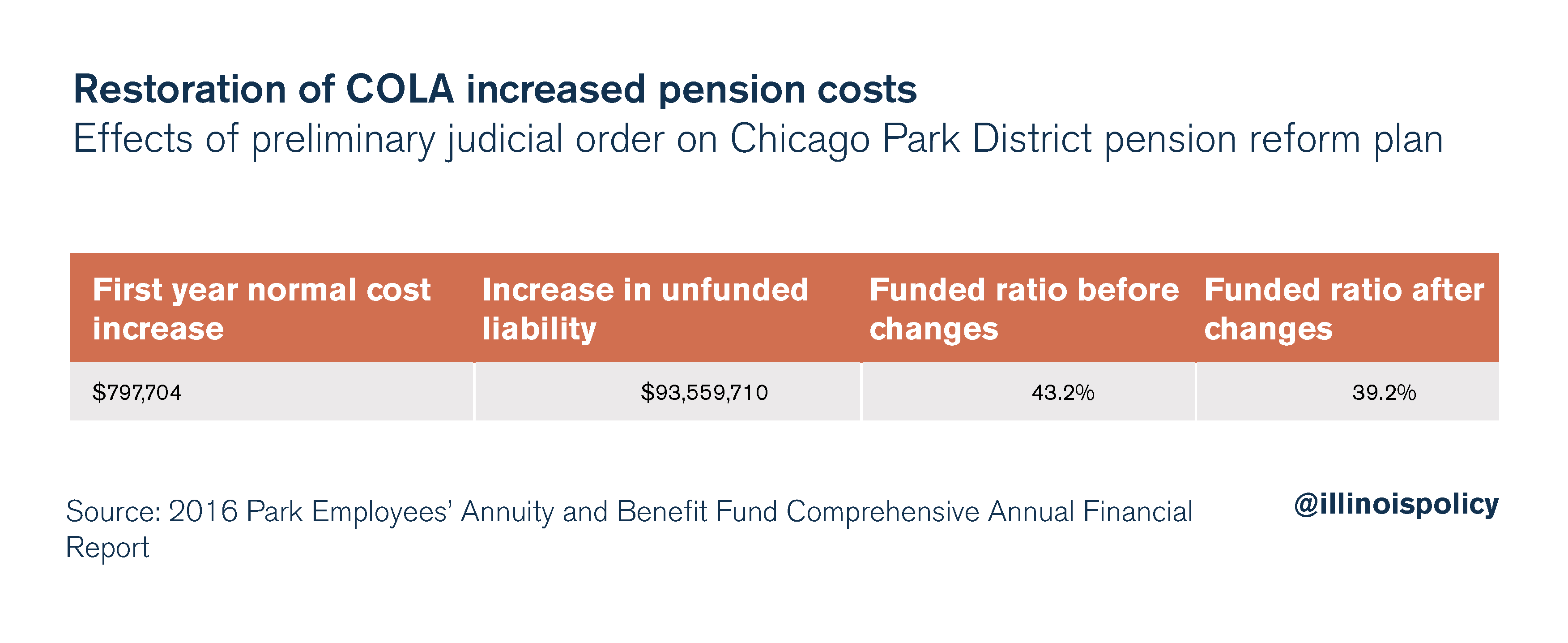

On Oct. 19, 2016, the Cook County Circuit Court issued a preliminary ruling providing interim relief to union members. Under the terms of that order, former employees would be entitled to the full original COLA and current employees would continue to contribute at the higher rates under the new act, until a final order was issued.

Judge Neil Cohen eventually ruled that all of the act’s changes violated the pension protection clause of the Illinois Constitution. The clause states that pensions are “an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

The Illinois Supreme Court has previously struck down pension reform for state employees, holding that the pension protection clause protects even unearned future benefits. A subsequent ruling striking down changes to Chicago city-worker pensions left some hope that if government officials negotiated changes with employees, those reforms could pass constitutional muster.

Now Chicago taxpayers are stuck with another pension bill they can’t afford, much like the state of Illinois as a whole.

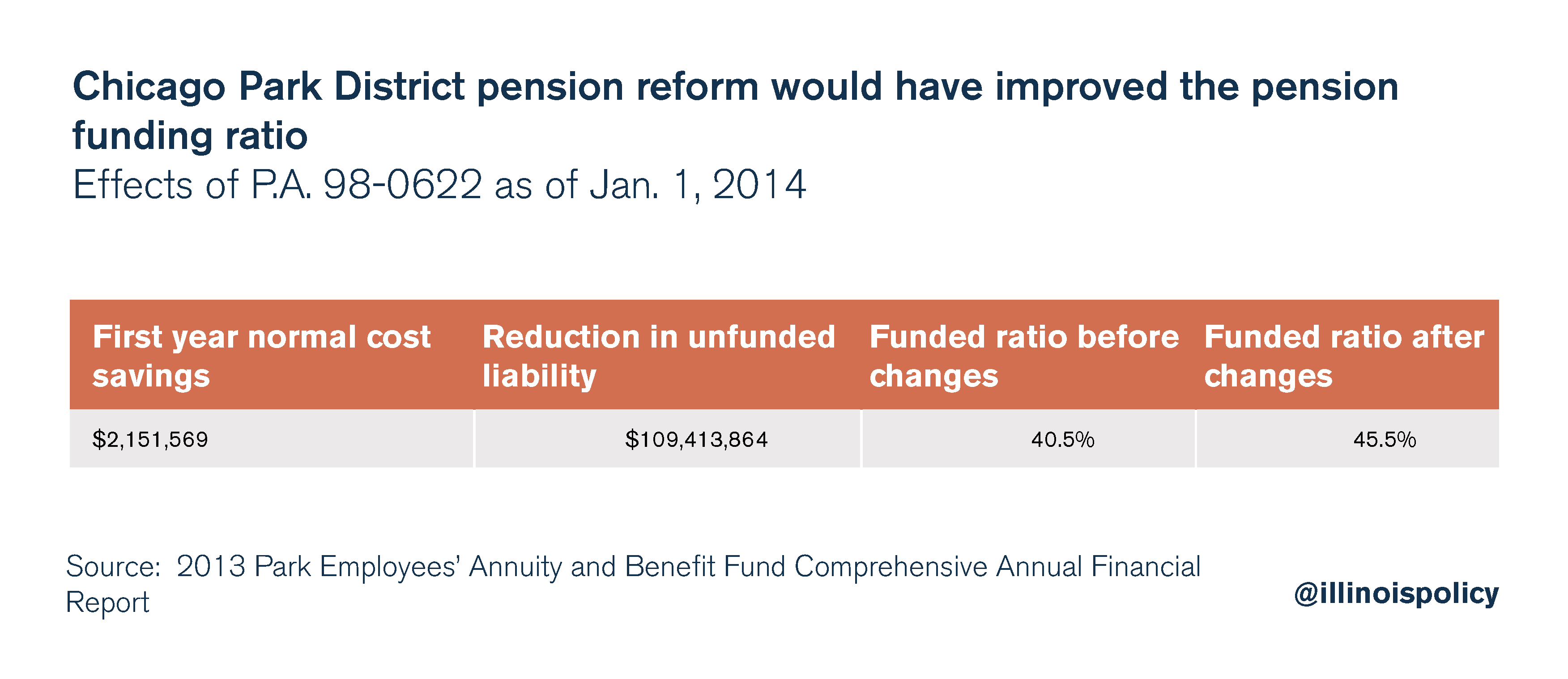

Even without extensively overhauling the pension system, the reforms that have been ruled unconstitutional would have made significant improvements in the unfunded liability of the Chicago Park District pension fund.

The reforms were projected to save Chicago taxpayers more than $2 million in new employer costs, or normal costs, in the first year alone, and were estimated to reduce the pension debt, or unfunded liability, by nearly $110 million. After a preliminary order restored COLA increases pending a final ruling of the court, these savings already started to disappear.

With just the restoration of a guaranteed 3 percent annual increase, Segal Consulting, the plan’s actuarial consultant, predicted the pension system would become insolvent by 2055. Now, due to Cohen’s order, the park district pension fund will have to refund increased employee contributions, with interest, and restore all benefits to their prior levels. The cost of the refunds is at least $4 million. The previous unfunded liability of over $600 million will increase even more.

While the ruling also means saying goodbye to a property-tax levy increase meant to pay for the higher employer contributions, taxpayers can be sure that in the future they will be asked to pay for higher benefits resulting from the ruling.

Fitch Ratings previously signaled that if the pension reform was struck down, it could have a negative impact on the credit rating of the Chicago Park District. And for park district employees, the ruling threatens their long-term retirement security. Prior to the changes, the retirement fund was expected to be insolvent by 2023.

Once again, Illinois courts have made clear that they will not allow pension reform to affect even future pension benefits. The only constitutional way to protect taxpayers from future tax hikes and ensure a stable retirement for government workers is to move away from defined benefit pensions and toward self-managed 401(k)-style plans.