Budget deal should include repealing Illinois’ economic loss leaders

Illinois’ death tax, corporate franchise tax and LLC fees cause disproportionate economic harm compared to how much tax revenue they generate.

After a spring legislative session that contained more theatrics than content, Gov. Bruce Rauner vetoed the unconstitutional, unbalanced budget the General Assembly’s majority Democrats passed. That means the legislative session will continue until both sides agree on how to balance revenues and expenditures for the first time in more than a decade. Passing a balanced budget will be a responsible action in itself, and the extended summer session creates more opportunity for reform.

When lawmakers craft a final budget, they should do it without including revenues from Illinois’ economic loss leaders: the death tax, corporate franchise tax and LLC fees. These are loss leaders because they cause disproportionate economic harm compared with how much tax revenue they generate. A major budget deal creates the perfect environment for correcting these mistakes.

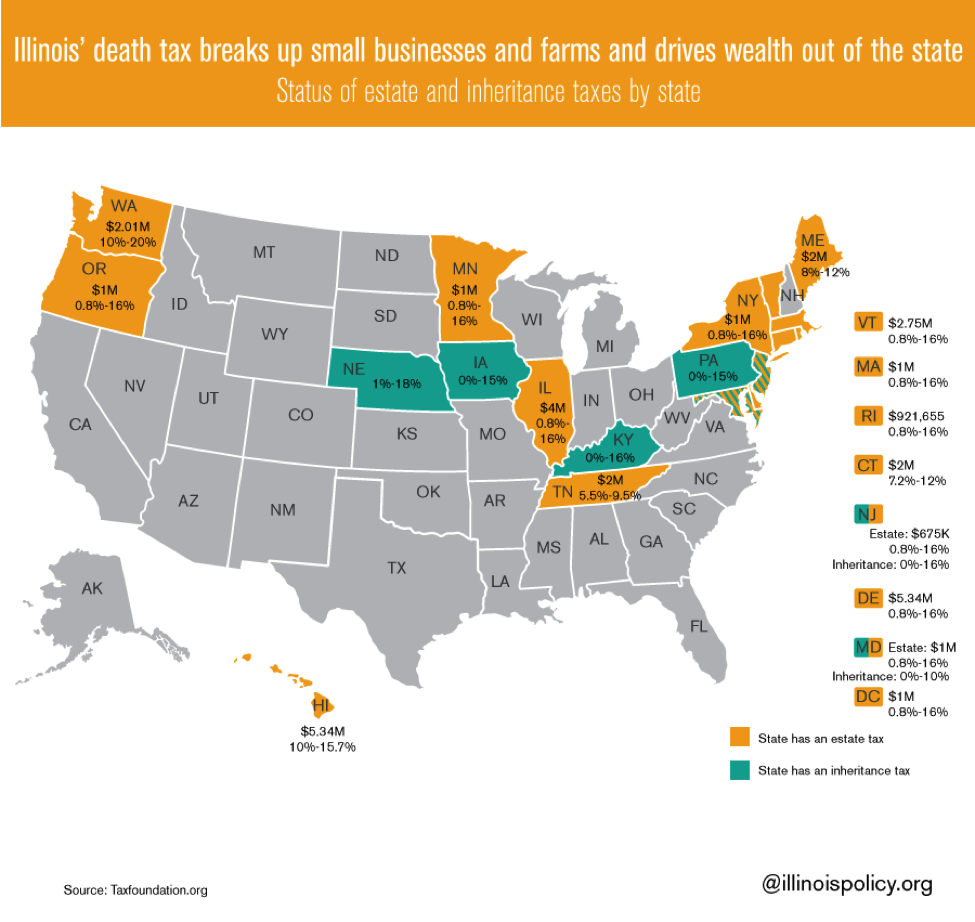

Illinois’ first economic loss leader is the death tax, also known as the estate tax. This is a tax that takes farmland and machinery from farmers when they pass on the family farm, and forces businesses to sell off assets when being transferred from a parent to child. The tax is levied on the property of successful parents when they pass away, so that their children are forced to pay a tax on a percentage of the business they inherited. Blindly taxing investments, businesses and capital is harmful enough. And given that most other states have repealed their death taxes, the Illinois death tax creates a major incentive for successful Illinoisans to leave the state and take their business with them.

House Bill 434, sponsored by Rep. Ed Sullivan, would repeal Illinois’ death tax. This bill can be included in the budgeting process to fix the tax code, increase jobs growth and decrease Illinois’ out-migration crisis.

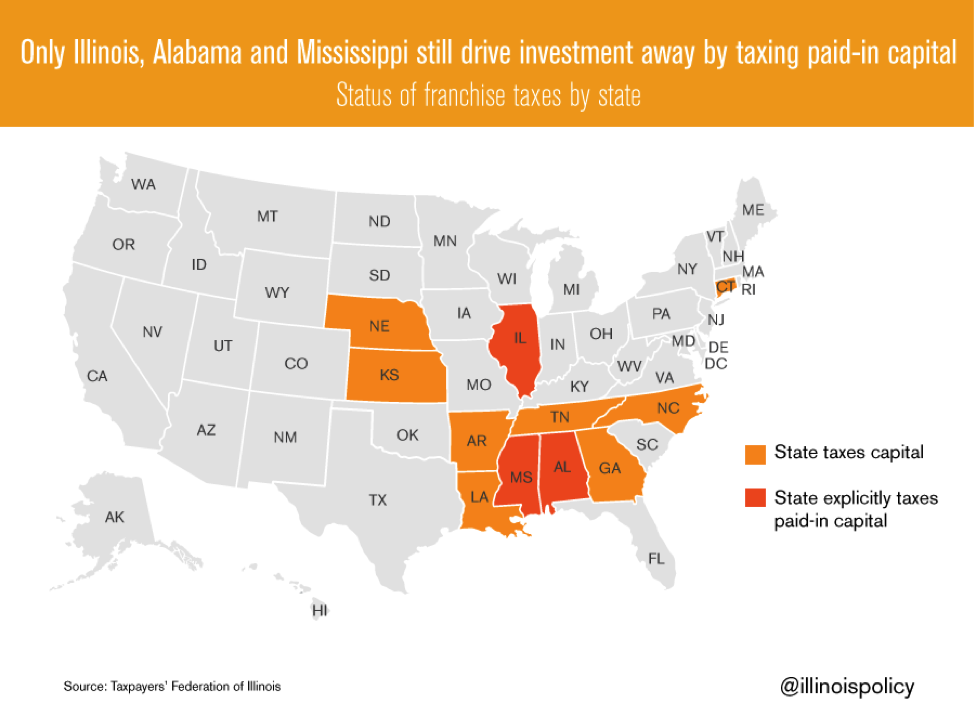

Another way to fix the tax code is by repealing the corporate franchise tax. The franchise tax was crafted in the 1800s before there was such thing as income taxation. The franchise tax is levied directly on the capital of corporations – arguably the most economically harmful way to levy a tax. This tax discourages corporations from investing and developing a capital base in Illinois.

The corporate franchise tax is also extremely inefficient when it comes to gathering revenue. The complicated formula for calculating a corporation’s franchise-tax liability can take hours to figure out. Ninety-five percent of Illinois corporations are liable for less than $100 per year from the franchise tax. That makes it especially painful for new businesses that are unfamiliar with the tax formula and don’t have a team of attorneys and accountants to figure it out for them. The franchise tax is an outdated and anti-entrepreneur tax that should be repealed with the new budget. State Rep David Harris’ House Bill 391 would repeal the franchise tax. Most states have completely repealed any type of franchise tax, and Alabama and Mississippi are the only two other states to apply the tax to “paid-in capital” like Illinois does.

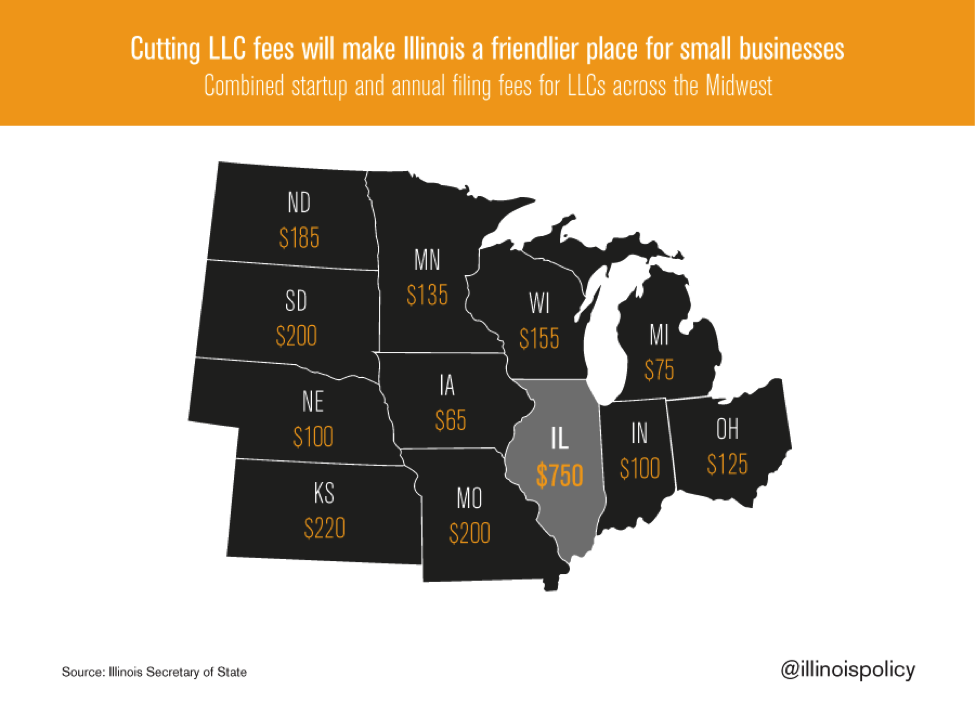

Illinois’ third loss-leader is the state’s ridiculously high fees to start a small business. Illinoisans who start a new Limited Liability Company have to pay the state $500 just to file startup papers, the highest fee in the entire U.S. Illinois entrepreneurs are then hit up for $250 per year to file a simple annual report. These combined fees are the highest in the Midwest, and far out of line with all surrounding states.

State Rep. Carol Sente’s House Bill 325 would reduce the fees from $500 to startup and $250 for filing an annual report down to $150 and $75, respectively.

Though the spring session has been peppered with acrimony, the extension into summer provides more opportunities to engage in serious reform. Rauner is pushing for major political and economic reforms. The governor wants term-limits and fair map redistricting, both of which are wildly popular with voters. Rauner also supports fixing the state’s workers’ compensation system, freezing the nation’s second-highest property taxes and addressing Illinois’ anti-growth lawsuit climate with tort reforms.

Repealing Illinois’ loss leaders would affect barely more than 1 percent of the state’s General Revenue budget, and would unleash an outsized impact on economic growth, job opportunities and tax fairness.

The governor’s agenda touches on the leading reforms needed to get Illinois’ economy rolling again. Repealing the corporate franchise tax, the death tax and reducing LLC fees would provide complimentary reforms that will help Illinois grow again and make it easier for entrepreneurs to succeed in the Land of Lincoln. If this summer ends with real reform, then the overtime legislative session will have been time well spent for the people of Illinois.