Boeing latest Fortune 100 company to offer 401(k) retirement plans

The International Association of Machinists rejected an eight-year contract offer from Boeing Co. yesterday, according to the Chicago Tribune. The contract extension would’ve ensured that production of Boeing’s 777X plane would continue in Washington state – in exchange for several cost-cutting measures, including moving employees to a 401(k)-style retirement plan by 2016. If all had...

The International Association of Machinists rejected an eight-year contract offer from Boeing Co. yesterday, according to the Chicago Tribune.

The contract extension would’ve ensured that production of Boeing’s 777X plane would continue in Washington state – in exchange for several cost-cutting measures, including moving employees to a 401(k)-style retirement plan by 2016.

If all had gone well with the contract vote yesterday, Boeing Co. would have become the latest Fortune 100 company to move to a 401(k) retirement plan for its employees.

With no deal reached, Boeing will consider building key parts of the 777X, including the wings, in non-union U.S. states or in Japan, where it has already received an offer, the Chicago Tribune reported. The 777X is likely the only model plane the company will develop in the next 15 years.

According to the Chicago Tribune:

Even though the union’s 31,000 workers gave up their chance for those jobs, they considered the giveaways in the contract too grave to accept.

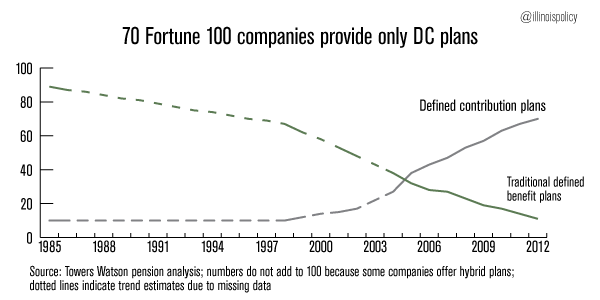

Boeing is just the latest example in a long trend of private sector companies transferring – or attempting to transfer – their employees to defined-contribution retirement plans.

Seven in 10 Fortune 100 companies provide only defined contribution, 401(k)-style retirement plans to new employees today. This trend is in line with the private sector overall, where nearly 85 percent of employees are enrolled in 401(k)-style retirement plans.

Most of those companies, such as Boeing, have realized that defined benefit plans are unsustainable — Boeing itself has a companywide pension liability of about $76 billion that is currently underfunded by about $20 billion, with Boeing contributions varying anywhere from $500 million to $3 billion annually.

The core problem with defined benefit plans is that they are unmanageable — regardless of whether it’s a state or a private company in charge.

Illinois’ hasn’t learned that lesson yet.

Its latest pension “fix” for the Chicago Park District – which has $1.4 billion in official debt – the state continues to depend on borrowing and higher taxes to prop up its failed defined benefit systems.

If Illinois politicians want to avoid the fiscal disaster that’s headed its way, they should follow the lead of Fortune 100 companies and implement 401(k)-style retirement plans for its employees.