Bad accounting hides true size of Illinois’ budget deficits

Poor accounting practices prevent true financial transparency in Illinois state government.

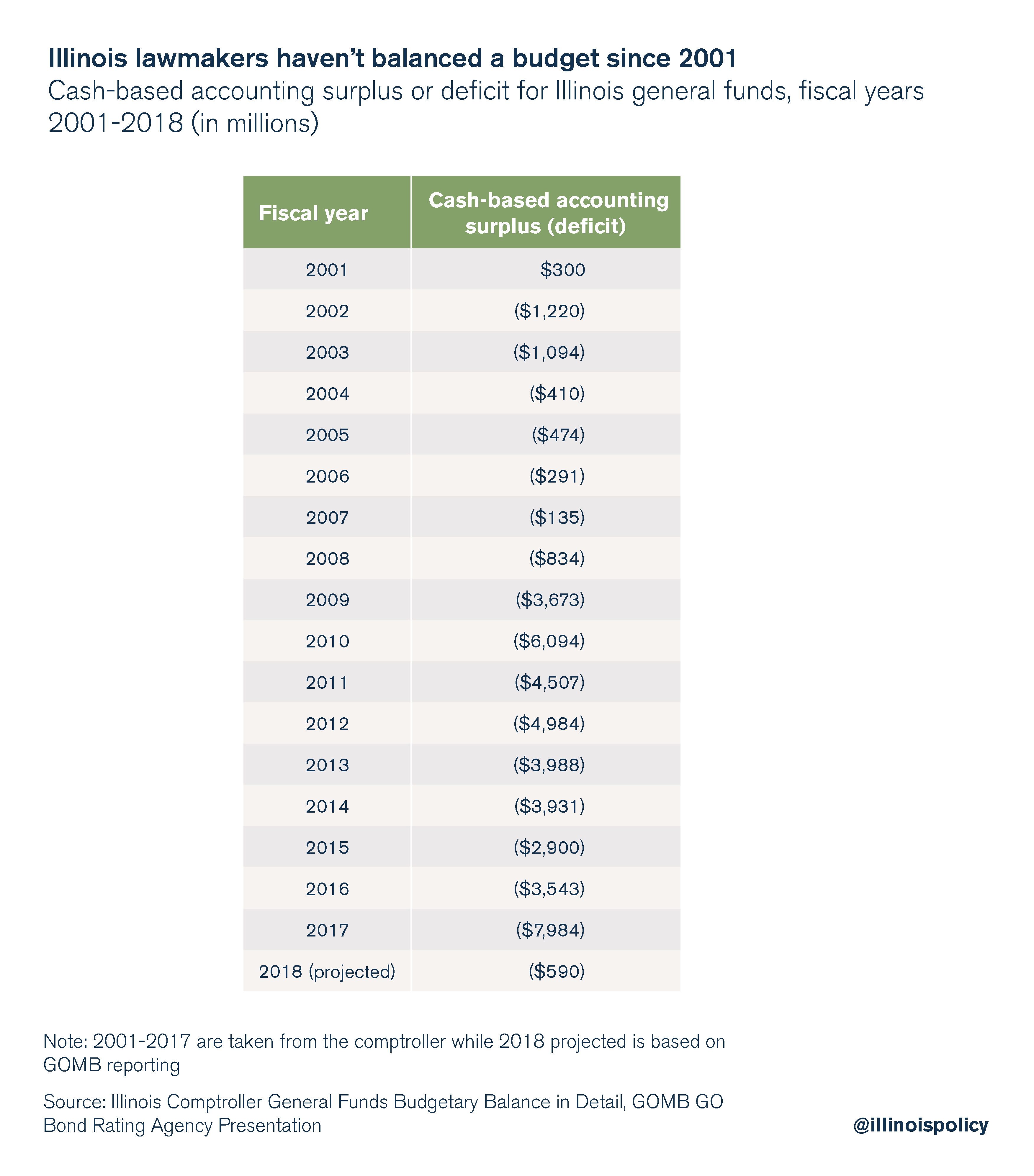

The Illinois Constitution requires a balanced budget. Despite that fact, money going out of state funds has exceeded the money coming in every year since 2001.

What many Illinoisans may not know, however, is that the true size of Illinois’ budget deficit each year is even larger than it seems. Through what’s called “cash-based” accounting, lawmakers are able hide spending by waiting to pay their bills, thus pushing costs onto future generations.

Under this system, revenues are counted in the year they are received. Meanwhile, expenses are counted only in the year they are paid, not the year they are incurred.

Imagine if a household magically “balanced” its budget each month by not paying the electric bill. That’s the type of behavior cash-based budgeting hides in state government.

The true size of Illinois’ deficits

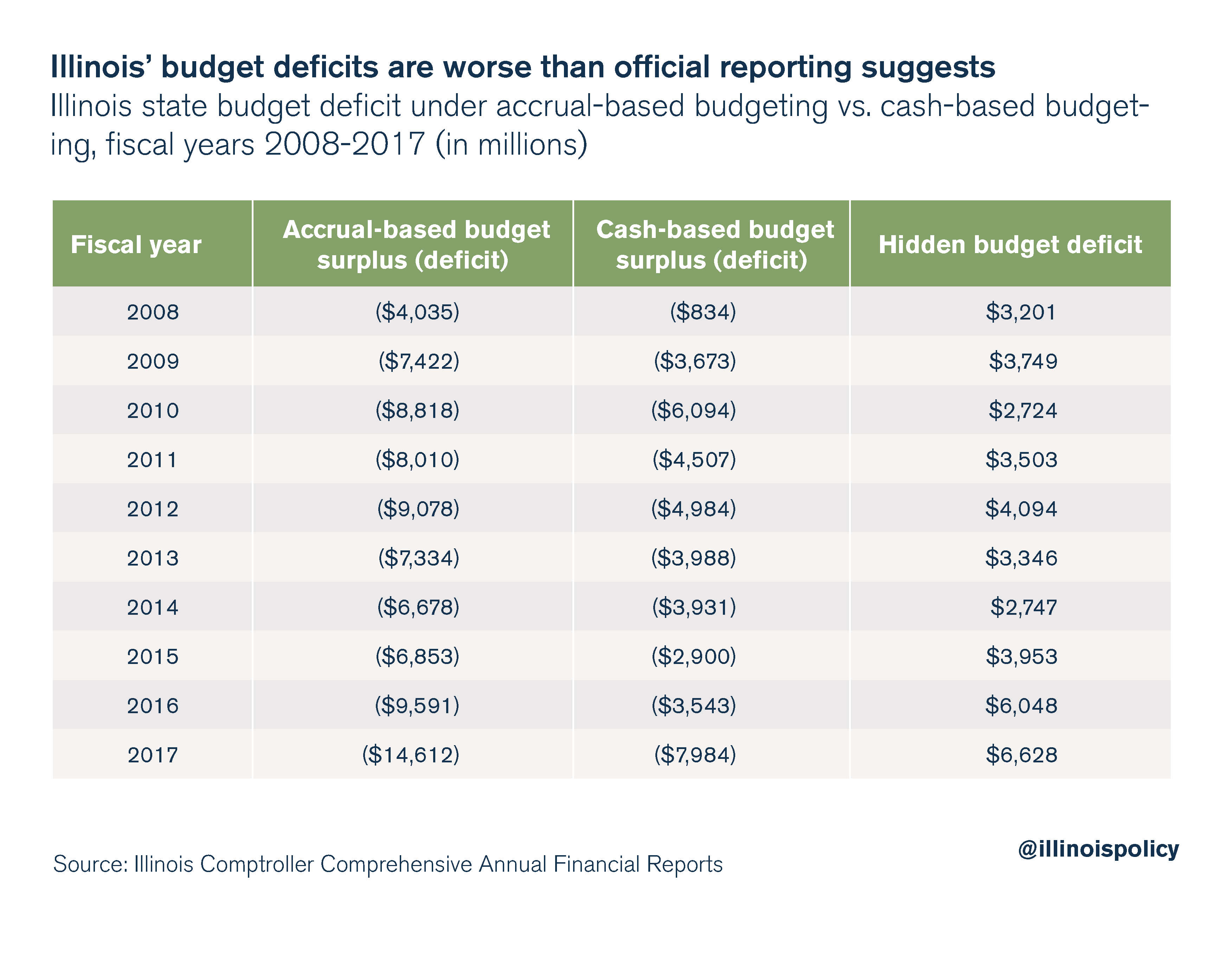

The extent to which this accounting gimmick hides the true cost of Illinois government spending can be seen by comparing Illinois’ cash-based accounting to a system using generally accepted accounting principles, or GAAP. The crucial difference between these two methods is that GAAP includes what’s called “accrual-based” accounting.

When comparing cash-based accounting to accrual-based accounting, it’s clear the state has underreported its true budget deficit by billions of dollars each year. The true budget deficit for fiscal year 2017 alone was at least $6.6 billion worse than official reporting, and lawmakers’ assumptions, suggest.

In addition to the traditional reporting lawmakers use when planning the budget each year, the Illinois comptroller releases a Comprehensive Annual Financial Report, or CAFR, which uses accrual-based accounting. The problem is that the CAFR doesn’t come out until months after the fiscal year ends, making it useless for the budget planning process.

National and state policy groups including the Volcker Alliance, the Better Government Association, the Fiscal Futures Project and Truth in Accounting have all suggested Illinois switch to an accrual-based system for budgeting, meaning spending would be counted in the year it was incurred, not the year the bill is paid. The Governmental Accounting Standards Board, which establishes accounting and financial reporting standards for U.S. state and local governments, has also long recommended accrual-based accounting.

While Illinois lawmakers have not adopted this standard for themselves, they have passed laws mandating the use of generally accepted accounting principles for some private entities.

Despite a record $5 billion permanent income tax increase, the spending plan passed by the General Assembly for fiscal year 2018 is likely to be billions of dollars out of balance.1 Cash-based accounting, meanwhile, shows a deficit of only $590 million.

Along with a flawed process for estimating revenue, the bad budgeting of Illinois’ cash-based system adds to the uncertainty around the budget process and denies taxpayers the transparency they deserve. Budget uncertainty is a leading cause of Illinois’ poor credit rating.

Illinois should immediately adopt responsible budgeting practices – such as accrual-based accounting, a spending cap and more – to finally give taxpayers the balanced, sustainable state budget they deserve.

1 Because the Comprehensive Annual Financial Report is not released by the comptroller until months after the fiscal year ends, the exact size of the fiscal year 2018 budget deficit on an accrual basis is impossible to determine at this time.