As other states repeal, Illinois death tax remains

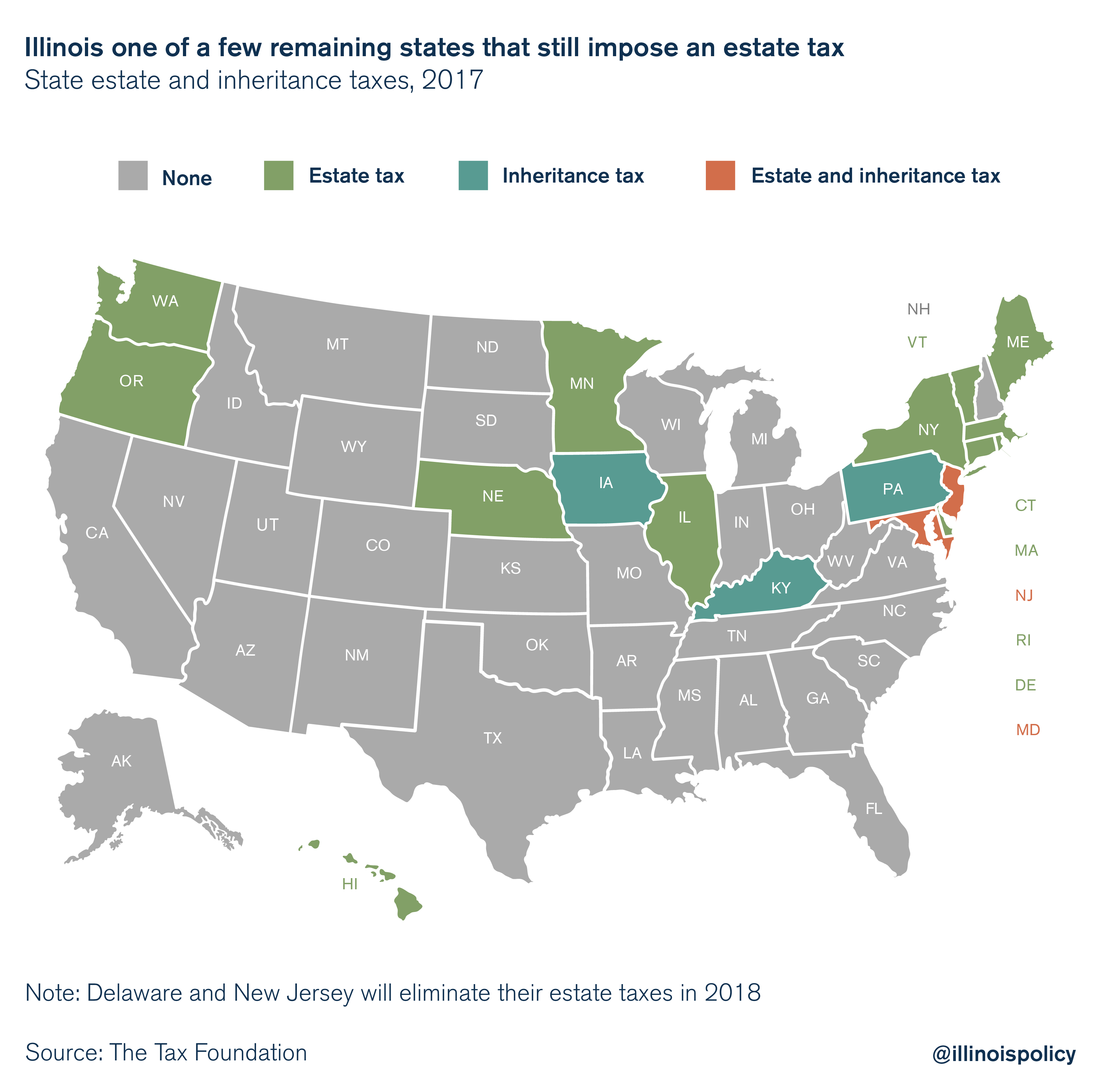

Both Delaware and New Jersey have joined a growing trend away from estate taxes at the state level.

In July, Delaware’s Democratic Gov. John Carney signed a bill repealing the state’s estate tax, effective in 2018. And pursuant to a bipartisan agreement reached in October 2016, New Jersey’s repeal of its estate tax will take effect in 2018.

While New Jersey will retain its inheritance tax, both states are just the latest in a nationwide trend to repeal death taxes at the state level. Illinois, however, still levies an estate tax, and it’s hurting the state’s already sluggish economy by exacerbating Illinois’ wealth flight.

In 2001, all 50 states had either an estate tax or an inheritance tax – and in some cases, both. But by 2018, that number will have dropped to only 17, according to reporting by Stateline and research by the Tax Foundation.

The estate tax, commonly called the death tax, is a tax applied on wealth transfers from estates after death. The federal government applies an estate tax that as of 2017 applies to estates worth $5.49 million or more. However, current tax reform legislation could change that, as the U.S. House of Representatives Committee on Ways and Means has released a tax package that would phase out the estate tax by 2024, according to an article in Forbes.

The repeal of the estate tax at the federal level would make Illinois stick out like a sore thumb.

The Land of Lincoln applies 20 separate estate tax brackets, ranging from 0.8 percent to 16 percent, starting at $4 million of assets transferred. This might seem like a lot, but the $4 million threshold means an Illinois farm of just over 500 acres is potentially subject to the state’s death tax, and that’s only considering the value of the land.

The estate tax is especially hard on farmers not only because they tend to be asset-rich and cash-poor, but also because they are attached to Illinois and can’t avoid the tax. Meanwhile, business owners in industries like finance can more easily move their residences and assets to other states to avoid the tax.

And it’s not just a partisan issue. In 2007, then-Virginia Gov. Tim Kaine signed a proposal that put Virginia’s estate tax out to pasture.

So why have so many states moved away from levying estate taxes?

For one, according to the Tax Foundation, “[e]state and inheritance taxes have large compliance costs, have been shown to suppress entrepreneurship, and are among the most harmful taxes to economic growth.”

Another reason is a change to the federal tax code. In 2005, the federal government got rid of a credit against federal estate tax liability for state inheritance and estate taxes paid, according to the Tax Foundation. The credit shielded residents of states that imposed their own inheritance and estate taxes. Since the elimination of that credit, an increasing number of states have ended their state estate and inheritance taxes.

Unfortunately, Illinois is not among them.

Having a state-levied estate tax makes Illinois even less competitive for investment. Illinois already has a wealth-flight problem, and cannot afford to be left even farther behind.

The estate tax is an additional burden on family farmers and small businesses, an impediment to investment and economic growth, and a driver of out-migration. It’s time lawmakers repealed Illinois’ estate tax.