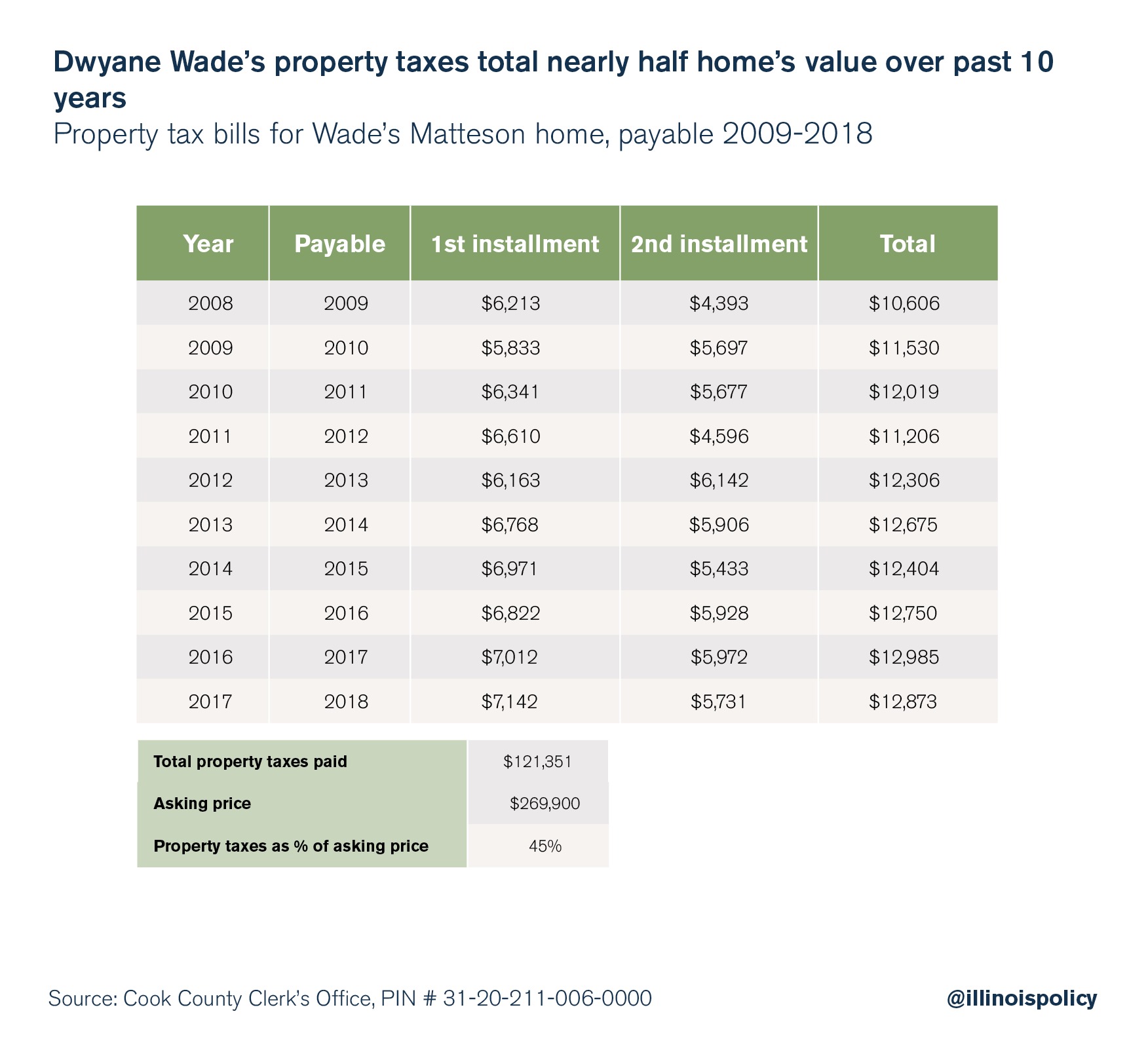

Ankle breaker: Dwyane Wade’s property taxes total nearly half home’s value over past 10 years

Dwyane Wade’s Matteson home has been on the market since May. At its current 5 percent effective property tax rate, the buyer would pay for it again in property taxes within 20 years.

Three-time NBA champion Dwyane Wade is looking to sell his property in the south Chicago suburb of Matteson, which he purchased new in 2006 for $390,000.

But despite dropping the asking price to $269,900, buyers still aren’t biting on the four-bedroom, three-bath, 2,280-square-foot home. Wade’s house has been on the market since May, when it was first listed at $290,000, according to the Chicago Tribune.

Why hasn’t a buyer jumped at the opportunity to acquire property owned by an NBA superstar? The answer may be property taxes.

According to data from the Cook County Clerk’s Office, Wade was charged more than $121,300 in property taxes on the home over the past 10 years. The property’s 2017 tax bill alone was $12,873. Since the home was assessed at $245,880 in 2017, this means its effective property tax rate was 5.2 percent that year. By comparison, the average effective property tax rate in Florida, Wade’s primary state of residence, is 1 percent.

Wade has ties to the area: He was born in Chicago, went to high school in suburban Oak Lawn, attended Marquette University for college and played for the Chicago Bulls during the 2016-17 NBA season. But while Wade can afford an extreme property tax bill, many other south suburban residents cannot.

These sky-high property tax bills may be scaring off potential buyers. At the home’s current 5 percent effective tax rate, the buyer would pay for it all over again in property taxes within 20 years.

Illinois’ property taxes are among the highest in the nation, pushing families out of the state and raising red flags for potential residents looking for a place to plant roots.

Illinois is in need of meaningful structural changes – especially in regard to pension reform. Lawmakers should address the cause of rising property tax bills, rather than saddling residents with constant tax increases.