All Illinois metro areas saw population shrink in 2018

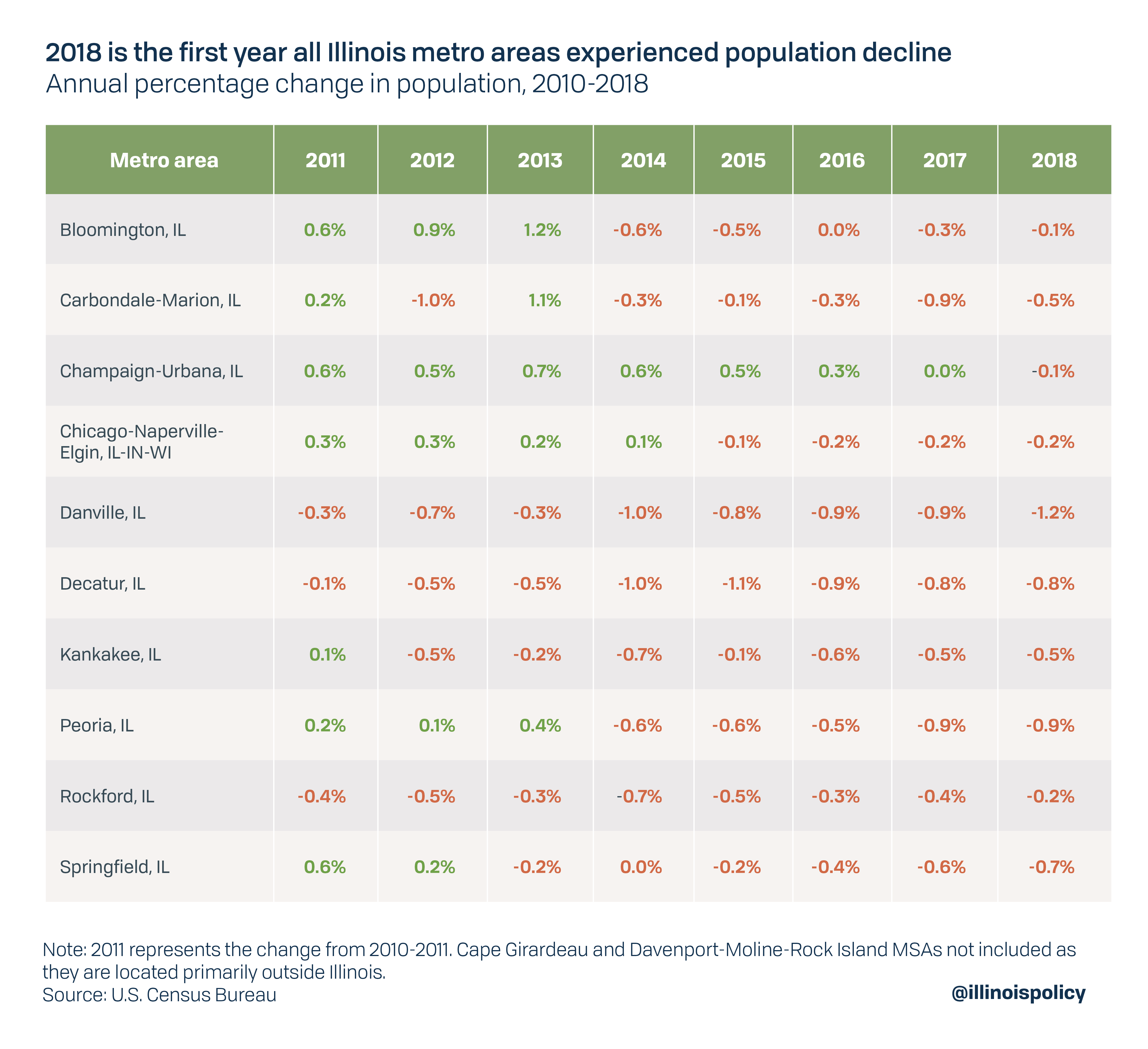

New Census data reveal that for the first time on record, all 10 metro areas based primarily in Illinois experienced population decline.

Illinoisans received their 5th consecutive year of bad news at the end of 2018, with U.S. Census Bureau data showing the state suffered a record fifth year of worsening population decline.

New census data released April 18 show that for the first time on record, this population loss occurred in every metropolitan area across the state.

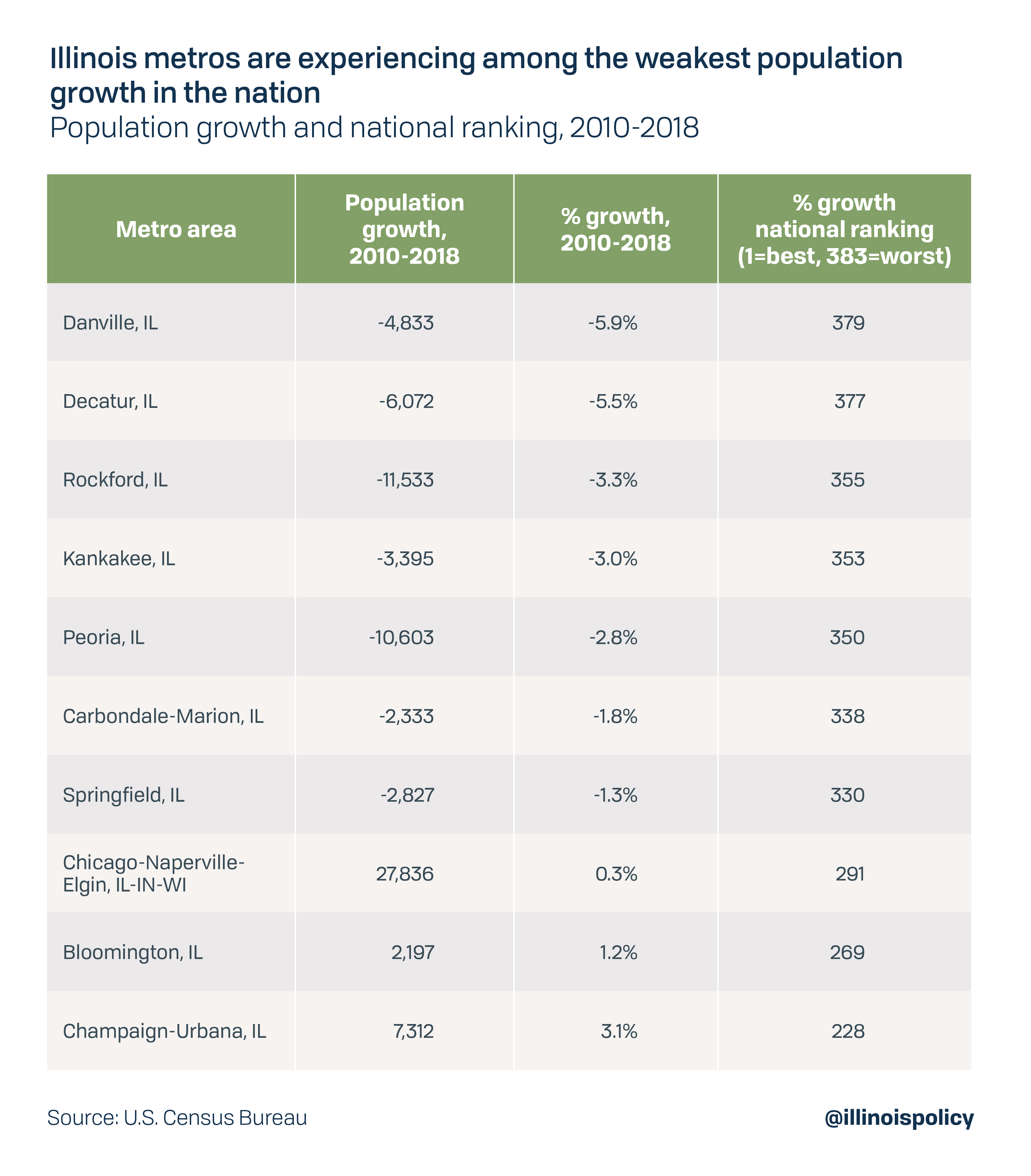

There are 383 Metropolitan Statistical Areas, or MSAs, nationwide. Illinois is the primary home of 10 of them: Bloomington, Carbondale-Marion, Champaign-Urbana, Chicago-Naperville-Elgin, Danville, Decatur, Kankakee, Peoria, Rockford and Springfield. All 10 saw population loss from July 2017 to July 2018.

This is the first release of local-level population data covering the time period after Illinois’ record-breaking income tax hike in 2017.

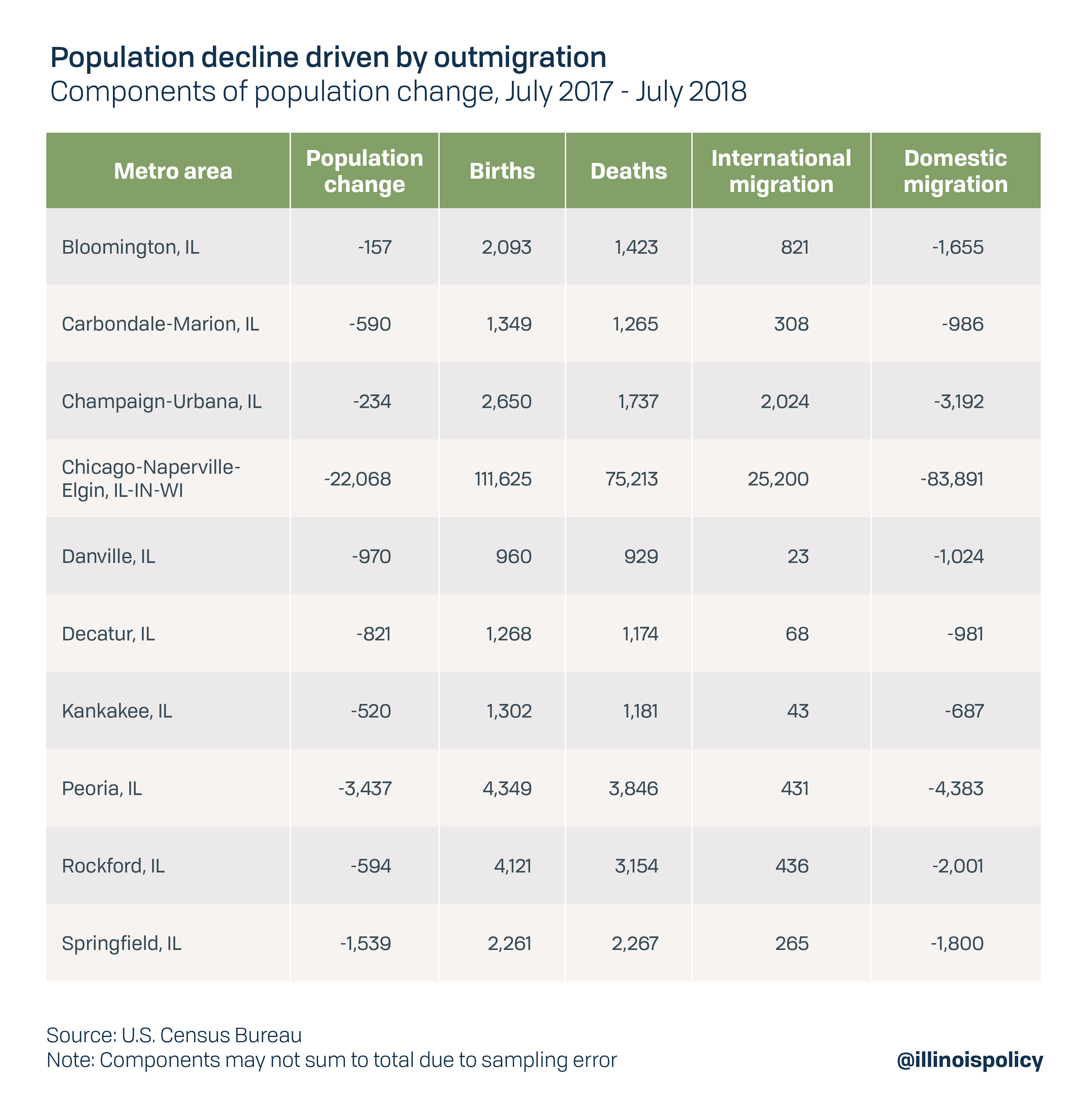

The Chicago MSA saw the largest raw decline in population of any metro area in the nation over the year, shrinking by more than 22,000 residents.

Three MSAs – Cape Girardeau, St. Louis and Davenport-Moline-Rock Island – include parts of Illinois but are based in Missouri and Iowa, respectively. Cape Girardeau saw an increase of 109 residents while St. Louis saw a decline of 385 residents. Davenport-Moline-Rock-Island lost more than 400 over the year.

Population growth since the end of the Great Recession has been alarmingly weak across Illinois’ metro areas, with all of them seeing below-average growth compared with metro areas nationwide. Danville and Decatur rank among the 10 worst metro areas in the nation for population growth since 2010, in percentage terms.

The population decline across Illinois’ metro areas was caused almost entirely by out-migration of Illinoisans to other places.

How are other U.S. metro areas faring?

Many areas in the U.S. are doing well, with some of the largest and fastest growth coming from parts of Texas, Arizona, Florida, North Carolina, South Carolina, Utah and Colorado.

While many urban areas are growing – some at a very rapid pace – there are areas of the nation that are struggling. Manufacturing centers such as Illinois, Ohio and Pennsylvania have witnessed population decline. At the same time, the nation’s largest urban areas are the ones seeing the largest population decline. Chicago, New York and Los Angeles experienced the largest population decline of all MSAs.

The main difference between growing and shrinking areas is domestic migration. The MSA-level results come as no surprise, as the areas that are growing the most tend to be in states experiencing strong jobs growth while the areas shrinking the most tend to be located in states where labor markets have faltered. Preliminary Bureau of Labor Statistics data from earlier this year revealed Illinois was 46th out of 50 states in private sector job creation in 2018.

Illinois’ glaring people problem raises three crucial questions for state lawmakers:

Who’s leaving? Why are they leaving? And what can leaders do to fix it?

Who’s leaving?

The primary demographic behind Illinois’ outmigration crisis is prime working-age residents (ages 25-54) seeking opportunity.

An analysis of the most recent government data reveal migrants tend to be more highly educated than non-migrants, and that Illinois’ people problem has led to a shrinking of both the skilled and unskilled population in the state. This is a bad sign for Illinois’ already weak labor market.

Those college-educated migrants who leave the state make on average 14 percent more in wages and salaries than non-migrants and 18 percent more than the migrants moving into the state. This signals that Illinois is continuing to experience significant wealth flight. The data also reveal Illinois is shedding migrants who are in the labor force and seeking a job, while attracting migrants who are less likely to be labor force participants.

Why are they leaving?

When analyzing Illinois’ people problem, it’s important to understand why people move.

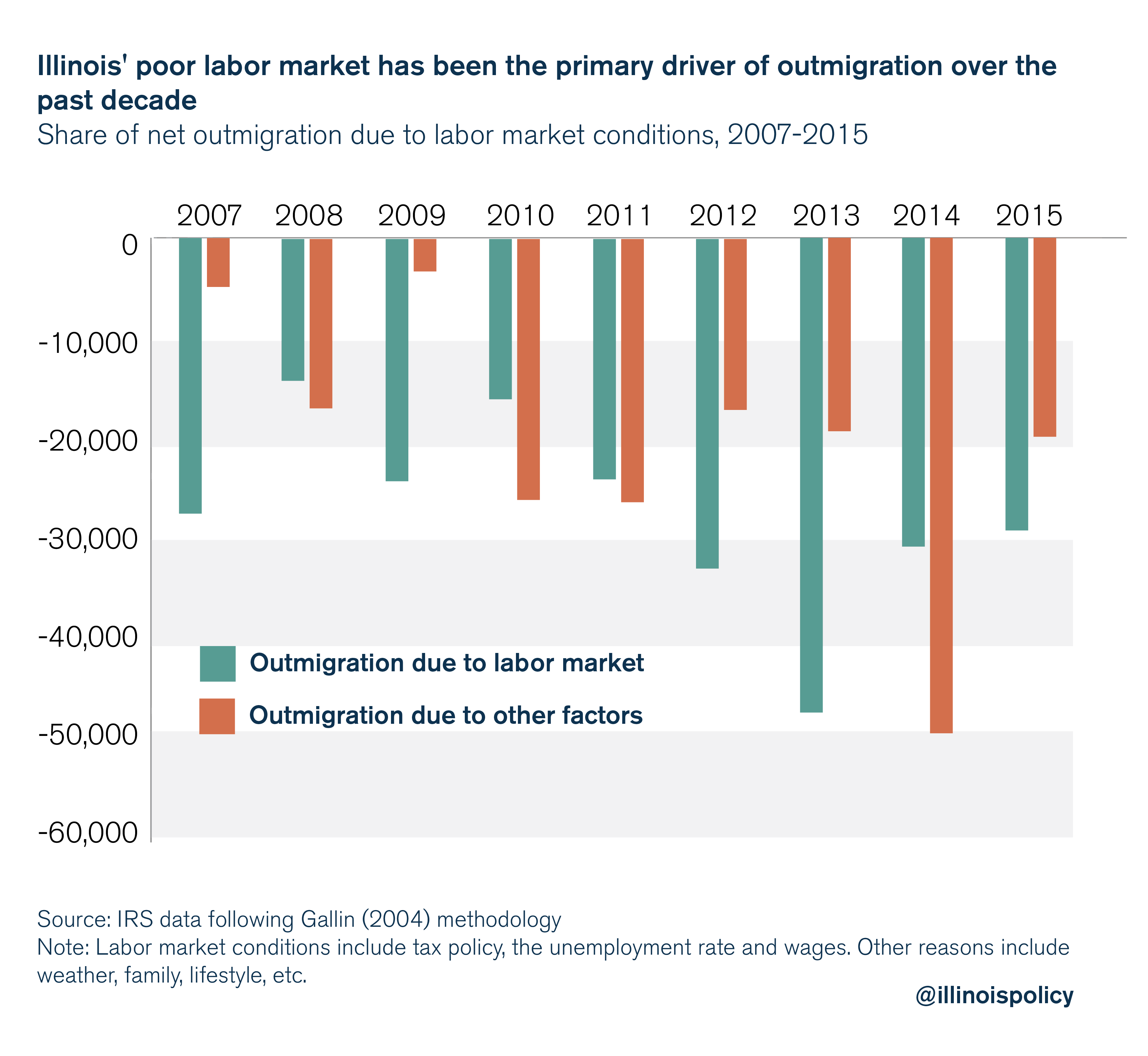

Yes, warmer states have been attracting more people, especially retirees, as America’s population ages. But people also move because of taxes and labor market conditions. And Illinois’ population decline is driven primarily by prime working-age Illinoisans, not retirees.

The most important factor in Illinois’ migration problem is the labor market, which has been crushed by the state’s unfriendly tax policy and business climate.

Following the methods of Federal Reserve economist Joshua Gallin (2004), which take into account the effects of climate, age and labor market conditions on migration decisions, IRS data reveal Illinois’ poor labor market has been the primary driver of outmigration since 2006, accounting for 57 percent of Illinois’ net migration losses to other states (see Appendix A).

The state’s lackluster economy is directly responsible for the loss of most migrants in the past decade. In other words, had the state fostered a healthy labor market, Illinois’ population would have continued to grow in 2014 and 2015 instead of experiencing persistent declines.

Unfortunately, the state’s shrinking may get even worse, as the 2017 tax hike will continue to have harmful effects on the Illinois economy. By costing the state thousands of jobs and billions of dollars in economic activity, the recent tax hike made the state less attractive for families looking to plant roots. State lawmakers cannot continue to rely on tax hikes if they want families to bet on Illinois.

Reversing the trend: Illinois should rein in spending while protecting core services, not hike taxes

Illinois state lawmakers have the opportunity to put the state on a path toward a more prosperous future through policy reform. But what kind of reform should a shrinking state pursue?

One clear mistake, given the state’s people problem, would be scrapping Illinois’ constitutionally protected flat income tax.

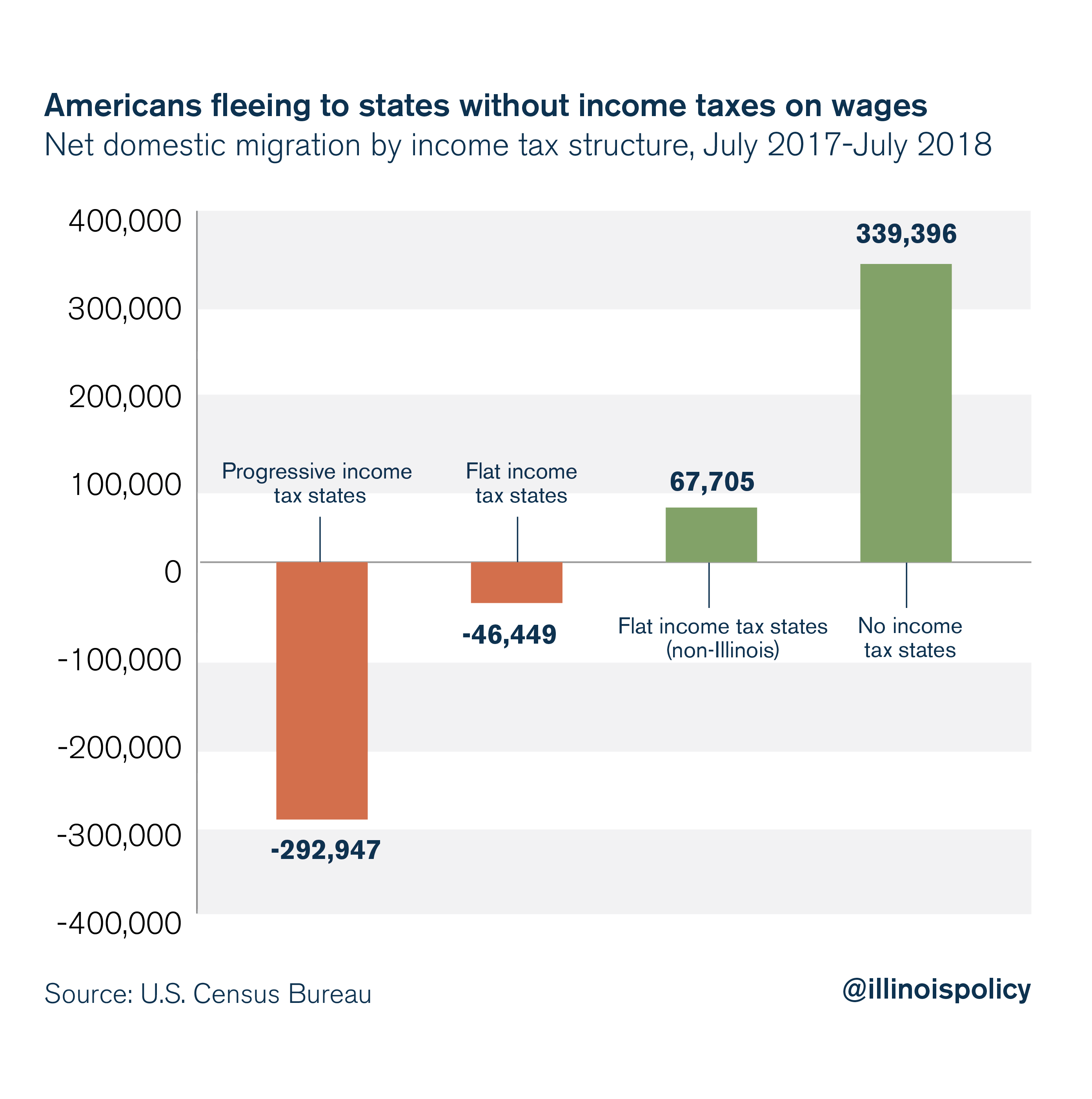

Americans are fleeing high-tax, progressive income tax states for more competitive tax environments. These states have also been the most successful at creating jobs, which has been a sore spot for the Illinois economy.

A progressive income tax will only aggravate Illinois’ outmigration crisis. Illinoisans – and particularly those who Pritzker wants to raise taxes on – are already leaving at a record pace.

Pritzker’s proposal will raise taxes on small businesses, subjecting them to one of the highest tax rates in the nation, and will make it harder for struggling Illinoisans to find a job. When this happens, it won’t just be the wealthy who head for the exit – middle-class job-seekers will continue their exodus, too.

Instead, lawmakers should focus on reining in government spending through a spending cap to provide certainty about future government spending and help avoid tax hikes to balance the budget. A spending cap constitutional amendment has already earned support from Senate Democrats this year.

Controlling pension costs is a critical component of holding down spending. Pension obligations, which official estimates put at $133 billion and other analyses peg at as much as $250 billion, are one of the largest cost drivers of government spending and now eat up more than a quarter of the state budget. This means Illinoisans are paying more for government worker retirement costs, and fewer dollars are available for core services. And despite paying billions of dollars a year into the state retirement systems, these funds are becoming less solvent over time, as returns on investment are frequently below their projected targets and 3 percent compounding benefit increases outpace inflation.

An amendment to the Illinois Constitution that protects already-earned pension benefits, but allows for a slower growth in accrual of future benefits – such as a true cost of living adjustment tied to inflation – would help to reduce the state’s pension debt. This amendment is part of the Illinois Policy Institute’s five-year plan to balance the state budget, pay down debts and provide a path to tax relief.

Instead of further tax hikes on Illinois families and businesses, as Gov. J.B. Pritzker is proposing, state lawmakers must bring spending down to a level taxpayers can afford. Only then can Illinois foster a friendlier business environment that encourages investment and job creation – making the state a more attractive state for families to plant roots.