Absent pension crisis, Illinois could afford ‘free’ college

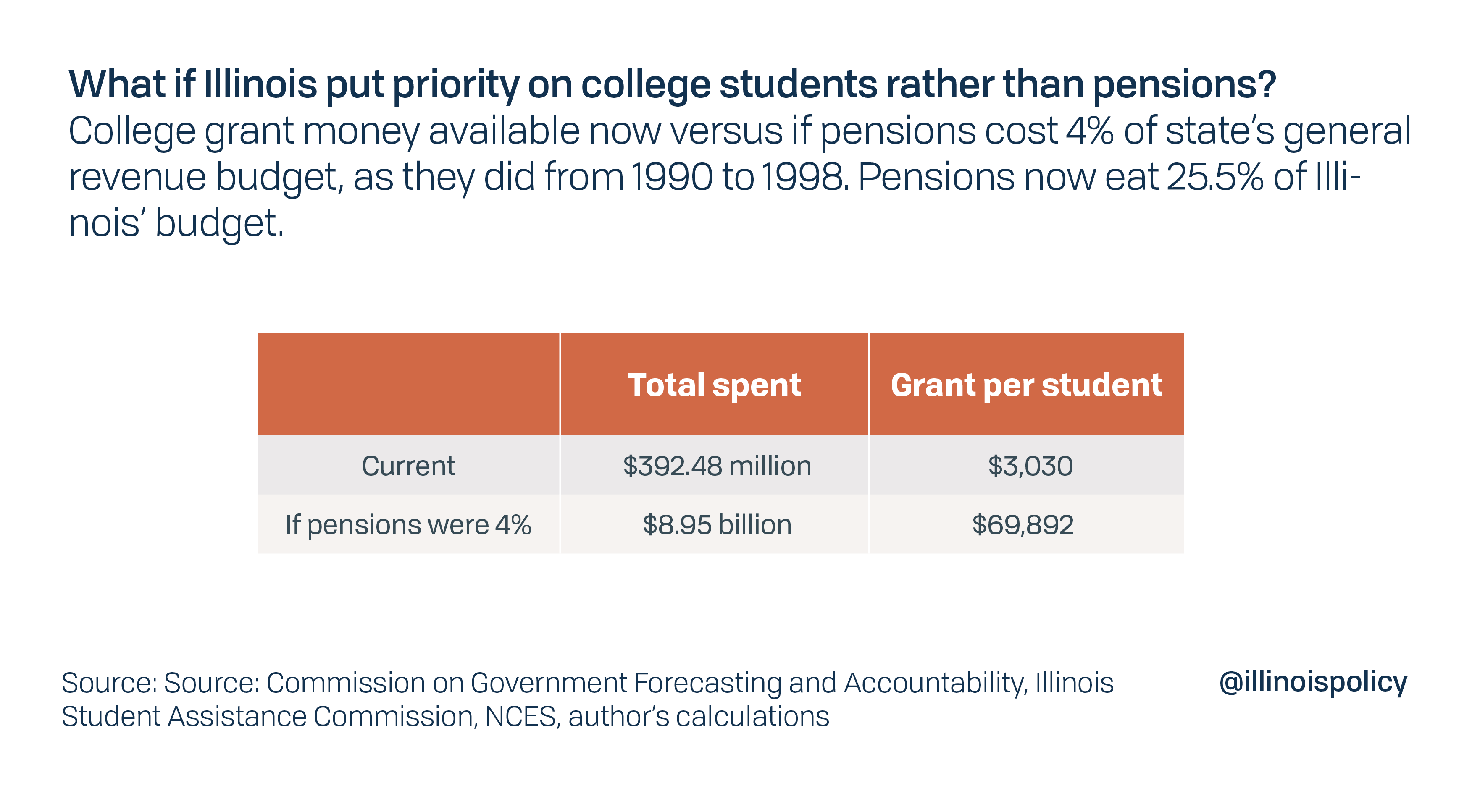

Illinois could give every undergraduate in public college nearly $70k a year if it spent the same 4% of its budget on pensions as it did throughout the 90s, rather than the 25% it spends today.

If Illinois had a healthy pension system, it would spend 84% less this year, a savings of $8.95 billion.

What could that money buy?

For one, you could give each of the 122,439 undergraduate students enrolled in Illinois public universities $69,892 to pay for college – about double what they’d need. Tuition, room and board, plus books and other expenses for in-state students at the University of Illinois, the state’s priciest public university, total $36,394.

By comparison, the state currently provides an average of $3,030 per student. Of the state’s 750,000 undergrads, grad and community college students, about 130,000 of them share a total of $392.5 million.

Here are the numbers.

From 1990 to 1998, the state spent less than 4% of its General Revenue Fund dollars on pensions. If the pension system had been appropriately managed and designed for sustainability, and as a result the state still spent 4% this year, pensions would cost the state $1.61 billion.

Instead, the state will spend 25.5% of its revenue on pensions and related costs this year, totaling $10.2 billion.

In reality, not all of the savings of having a healthy pension system would go to higher education. Illinois could pay for a whole range of core government services that have been crowded out by pensions, including budgets for the state police and the Department of Children and Family Services. Spending on core services is down nearly one-third in real terms since 2000, while spending on pensions has risen more than 500%. Some of the programs that have suffered include those aimed at helping the developmentally disabled transition out of assisted living, offering child immunizations, investigating infant mortality cases, and funding the state’s MAP grant program for low-income college students. Some of the savings would lower the overall tax burden instead of making taxpayers face yet another demand to pay more.

Knowing that Illinois’ excess spending on pensions could make college essentially free for most or all public university students in Illinois shows just how bad the pension crisis really is.

Here’s the bottom line: The way governments spend money reflects their true priorities. In Illinois, politicians prioritize pensions over everything else.

To learn more about how pensions are crowding out core government services, click here.