Illinois gas station owners fight Pritzker mandate with gas tax signs

The Illinois Fuel & Retail Association has agreed to post signage notifying drivers of the delayed gas tax hike, and an explanation of why gas in Illinois is so expensive.

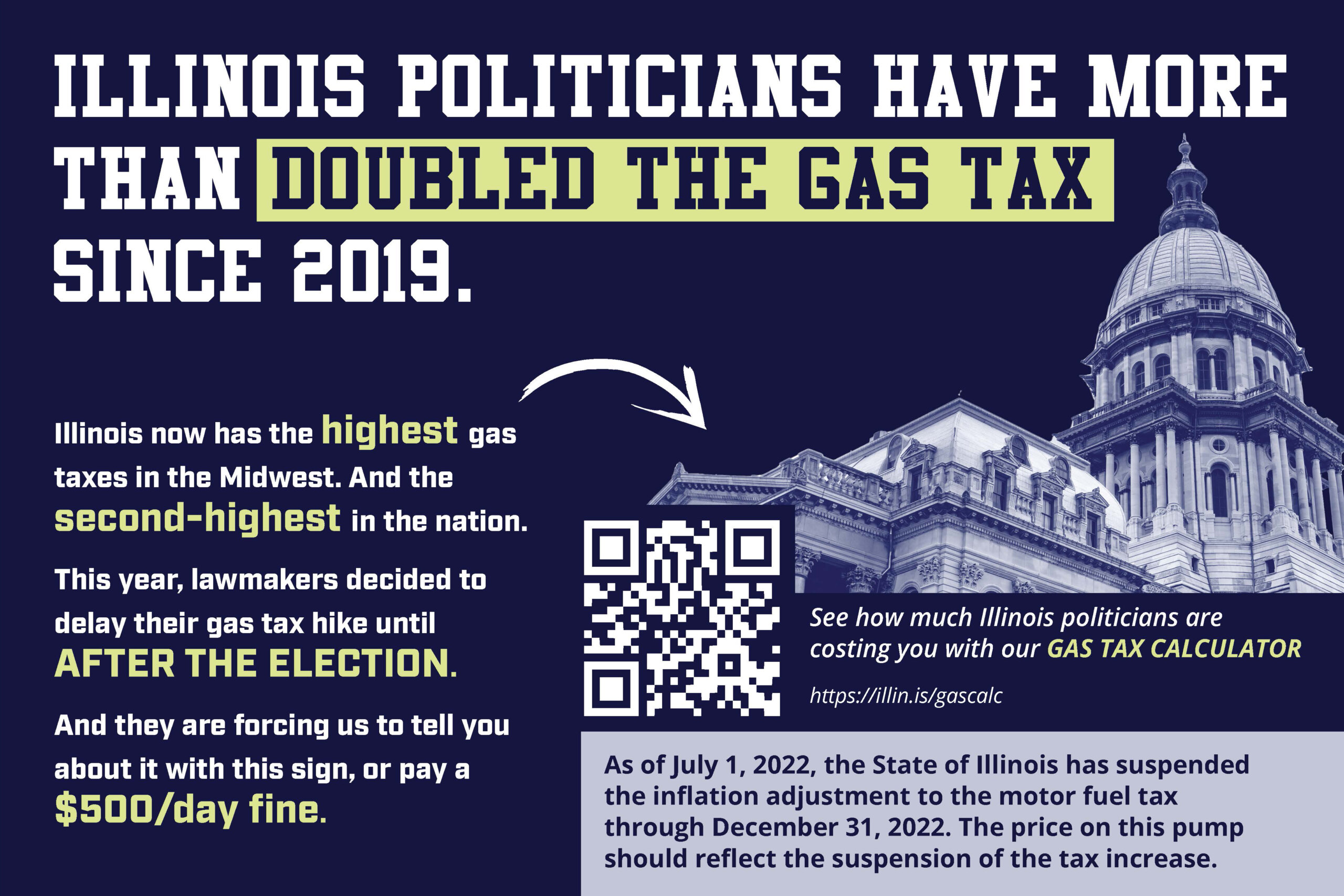

The Illinois Fuel and Retail Association is giving Gov. J.B. Pritzker the gas pump signs he demanded, but they added some truth about state gas taxes and who is responsible for them being so high.

And the Illinois Policy Institute added a QR code that takes drivers to a gas tax calculator that tells them just how much of their fill-up goes to taxes.

Come July 1, gas station owners are legally required to post signs about a delay in the next automatic gas tax hike. Pritzker and state lawmakers added the signs, plus $500 per day fines for station owners, to the new budget. The law states the four-inch by eight-inch signs must state, in bold: “As of July 1, 2022, the State of Illinois has suspended the inflation adjustment to the motor fuel tax through December 31, 2022. The price on this pump should reflect the suspension of the tax increase.”

The IFRA is in a legal battle with the state over the mandate. The association sees the signs as forced political speech that amount to political ads for incumbent lawmakers just before an election. The case is expected to be heard June 24 in federal court.

The association is adding text to Pritzker’s version of the signs stating Illinois has the second-highest gas taxes in the nation, that the gas taxes were doubled by state leaders in 2019, that the hike is only being temporarily delayed and that they are being forced to post the notice under threat of $500 per day fines. If the IFRA loses in court, gas stations will post the required signage, but their CEO Josh Sharp said drivers will get the full context.

“We will follow the law and post the signs if the courts require us to do so,” Sharp said. “But we are going to make sure our customers understand the whole story about our state’s gas tax, not just the part some of the lawmakers in Springfield want to talk about.”

When the state doubled the gas tax to 38 cents from 19 cents in 2019, Pritzker approved an automatic inflation increase every July 1. Delaying the July 1 increase means drivers will see two increases in 2023: the delayed one that hits on Jan. 1, and the regular July 1 increase expected to take the excise tax to 45.2 cents per gallon.

“Here is the truth; delaying a tax increase does not equal a tax cut, and there are now TWO gas tax increases scheduled for 2023,” Sharp said.

Not on the signs is that Illinois also applies sales tax in addition to the excise tax on gas. That means drivers are taxed on the taxes they are paying.

Signs include the legally required language along with a gas tax calculator developed by the Illinois Policy Institute. A QR code opens a calculator to show motorists how much of their gas money goes to taxes.

Gas taxes are not the only threat drivers’ wallets face. The same government union leaders who advocated for annual gas tax hikes are now pushing a constitutional amendment in November 2022. Amendment 1, masquerading as a “workers rights amendment,” would guarantee a $2,100 property tax hike for the typical Illinois homeowner.

Illinois gas taxes and property taxes both rank among the nation’s highest. Springfield leaders need to read the writing on the pump.

Sign the petition

Repeal Pritzker's gas tax hike

Sign the petition to tell your lawmaker to repeal Pritzker's gas tax.

Learn More >