Illinois retirees file lawsuit over biased ballot language on progressive tax

The lawsuit challenges the language that will appear on the Nov. 3 ballot asking whether voters want to scrap Illinois’ constitutional flat tax guarantee – opening the door to a retirement tax.

Chicagoan Don Wojtowicz worked for nearly 50 years in public service in hopes of a decent retirement. But for Don and more than 2 million retirement-age Illinoisans like him, a progressive income tax constitutional amendment up for a vote Nov. 3 threatens that retirement security.

Making matters worse: extremely biased language on the ballot that deprives Illinoisans of a fair, informed vote on the progressive tax question.

Don joined the Illinois Policy Institute and two more retired Illinoisans in a lawsuit filed Oct. 5 to challenge that language in court.

“I try to stay out of political conversations,” Don said, “But this is how I feel about it and I don’t know how anyone could feel different when you’re getting taxed and taxed, and the politicians keep lying.”

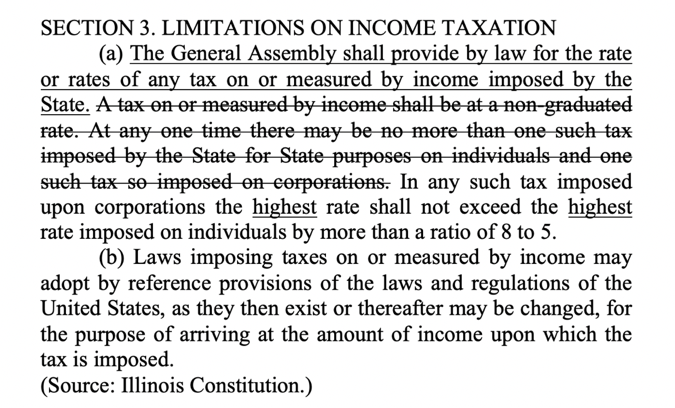

The case challenges what is supposed to be a neutral summary on every ballot, explaining what the progressive tax constitutional amendment does. That shouldn’t be difficult, because the amendment itself is straightforward:

But voters will not see that plain text on their ballot. Instead, the General Assembly passed summary language that reads like a TV ad in favor of it, which supporters have dubbed the “fair tax”. The summary language is as follows:

“The proposed amendment grants the State authority to impose higher income tax rates on higher income levels, which is how the federal government and a majority of other states do it. The amendment would remove the portion of the Revenue Article of the Illinois Constitution that is sometimes referred to as the “flat tax,” that requires all taxes on income to be at the same rate. The amendment does not itself change tax rates. It gives the State the ability to impose higher tax rates on those with higher income levels and lower income tax rates on those with middle or lower income levels. You are asked to decide whether the proposed amendment should become a part of the Illinois Constitution.”

The most misleading part of the summary is that it suggests the progressive tax amendment only grants lawmakers the ability to “impose higher income tax rates on higher income levels.” But the amendment does not guarantee taxes only go up on higher income earners (interestingly, a previous version did, but it was changed before passage).

The amendment simply removes the state’s flat income tax protection, which means Illinois lawmakers for the first time would have the ability to raise taxes on certain segments of the population based on income – including retirees.

The plaintiffs are especially concerned that the progressive tax amendment opens the door to a retirement income tax in Illinois. While retirement income is currently exempt from taxation, this constitutional amendment would give lawmakers the power to tax retirement income at a different rate from other forms of income – a fact left unmentioned in the ballot language.

In fact, all 32 states with a progressive tax system also tax retirement income in some form.

Joining Wojtowicz and the Institute as co-plaintiffs in the lawsuit are Barbara McGann and John Sutherland. Wojtowicz, age 84, is a former police officer and lifelong Chicagoan who retired from the Chicago Police Department in 1990 after serving 25 years – then worked another 24 years at the Chicago Department of Aviation. McGann, 83, is a retired Orland Park resident who worked as an administrative assistance at a South Holland auto body shop for 25 years. Sutherland is a former firefighter and Chicagoan who retired from the Chicago Fire Department after 20 years of service.

Don says he would like to leave a better and more affordable Illinois for his children and grandchildren. “But how could there not be further tax hikes down the road, when you look at how deep the state is in the hole, already? How do you think they’ll get that money?” he asked. “They’re going to take it out of my pocket, your pocket and everyone else’s pocket.”

His fear of a retirement tax in Illinois is justified.

“One thing a progressive tax would do is make clear you can have graduated rates when you are taxing retirement income,” said Illinois Treasurer Michael Frerichs in June while speaking at an event hosted by the Des Plaines Chamber of Commerce. “And, I think that’s something that’s worth discussion.” Former Illinois state senator, Democratic gubernatorial candidate and progressive tax advocate Daniel Biss has also floated taxing retirees. “I would only consider taxing income once we’ve amended the Illinois Constitution to allow for a progressive income tax,” Biss said. The Chicago Sun-Times, which has endorsed the progressive income tax amendment, has also called for taxing retirement income.

Seeking a correction on misleading ballot language is not without precedent in Illinois. In 2008, a judge declared ballot language on a question regarding whether voters should approve a constitutional convention to be misleading and inaccurate, following a challenge by the Chicago Bar Association. The judge ordered corrective action – including revised information handouts at polling places.

For the first time in 50 years, Illinois voters will have the opportunity to choose how their income is taxed. They deserve to know the full truth before casting their ballot.