Illinois Tollway shows how political promises are easily broken

Illinois tolls were supposed to be temporary. A progressive tax is only supposed to hurt 3% of Illinoisans. Political promises mean little in Illinois.

“Toll free in ’73.” That was the campaign slogan over five decades ago that promised tolls on Illinois interstates would be a temporary revenue sources. Today, the tolls are higher and the tollway authority is more permanent than ever.

Lawmakers promised tolls would help fund 186 miles of interstate construction and would be removed when the roads were paid off. After that, highway maintenance would be funded by the gas tax. In 1968, the General Assembly made the Illinois Toll Highway Authority permanent.

What started at just 10 cents at the exits and 25 cents at the plazas has grown to cost drivers $1.50 for each I-Pass scan. Since 2009, the Illinois Tollway has hiked toll fares four times.

It’s also become an easy way to employ the politically connected and hand out patronage jobs. Governors since the 1980’s have had tollway scandals. Political hires and contracts with friends of politicians from both sides of the aisle have been common at the authority.

So has unwarranted growth.

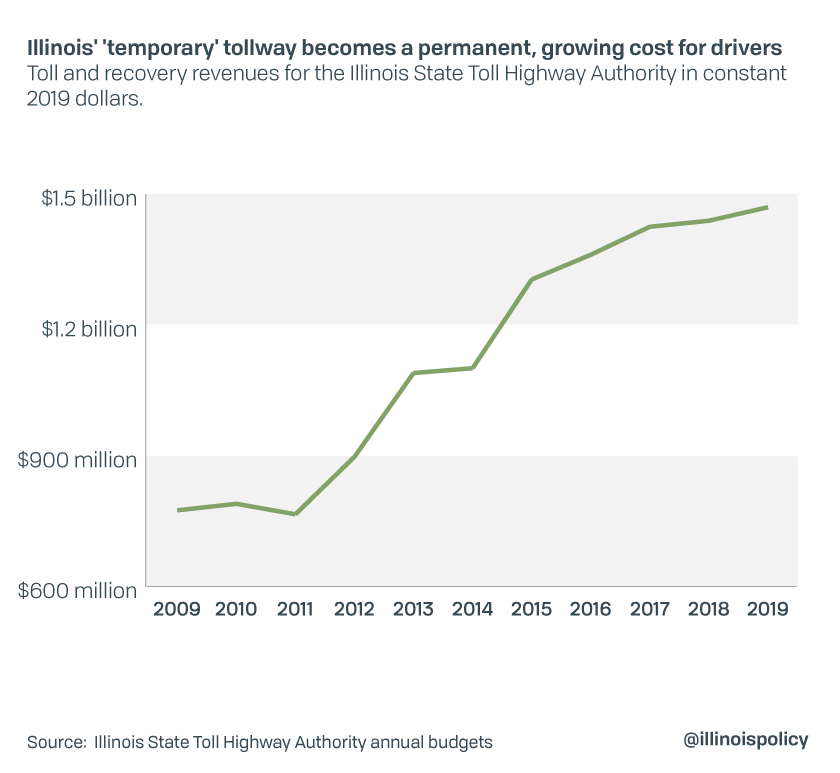

The Illinois Tollway’s budget for fiscal year 2019 was $1.5 billion. That’s more than double the $680 million budgeted in 2009. A look at the tollway’s revenues during the past decade, adjusted for inflation, shows just how costly the now-permanent agency has become for Illinois drivers. Revenues collected from tolls and fines for missed tolls have gone up 90% in just 10 years.

In 1999, Gov. George Ryan again pledged to get rid of the tolls. It didn’t happen.

Illinois voters can expect the same broken promises from Gov. J.B. Pritzker’s “fair tax” proposal. While he promises taxpayers only Illinois’ wealthiest 3% will see a tax increase, there is nothing in the amendment that keeps such a promise. In fact, a progressive income tax structure will make it easier for lawmakers to raise taxes.

Lawmakers could raise taxes on select groups at different rates without the political backlash that comes from a statewide increase as the Illinois Constitution’s flat tax protection now mandates. Retirees are a likely target, as the Illinois Treasurer already indicated and as is the case in every state with a progressive tax.

Moreover, asking taxpayers to pay just a little bit more in taxes to allow the state to keep spending is Illinois’ most famous broken promise. Only with the “fair tax,” lawmakers would gain the ability to break promises to smaller groups at a time so they could keep increasing taxes without paying the political price.