When Illinois politicians call taxes ‘temporary’ or ‘fair,’ they won’t be

Illinois lawmakers make many promises about tax increases. Then they break those promises.

State politicians have repeatedly reduced backlash from tax hikes by calling them temporary. That’s what they did in 1989 and 2011 but voted later to break their promises and make the increases permanent.

In 1989, former Republican Gov. Jim Thompson was pushing for a permanent 40% tax increase. Thompson lacked support from Democrats and reached a compromise with Speaker of the House Michael Madigan to temporarily raise taxes by 18% for the next two years by raising the rate from 2.5% to 3%.

At the time, Madigan said Illinois did not need more tax revenue. Thompson disagreed, saying it was necessary to address concerns over school funding and property taxes. He said a temporary hike just pushed the problems to the future.

Two years later, lawmakers again voted to extend the temporary increase. In 1993, the General Assembly made it permanent.

Following the Great Recession in 2011, former Gov. Pat Quinn and state lawmakers jacked taxes up from 3% to 5%, again with the promise it would be temporary. Quinn said the increase was to help the state pay the bills and regain sound financial footing. Former Senate President John Cullerton promised it would help pay for pensions without borrowing.

“The point of this income tax increase is not to expand programs, not to do brand new things in Illinois state government, it is only intended to pay our old bills and deal with the structural deficit,” said former House Majority Leader Barbara Flynn Currie.

Lawmakers planned to partially sunset the tax to 3.75% in 2014 and 3.25% in 2025. The decrease did happen in 2014, but it was short lived.

The General Assembly passed the largest tax increase in Illinois history in 2017 by raising rates back up to 4.95%.

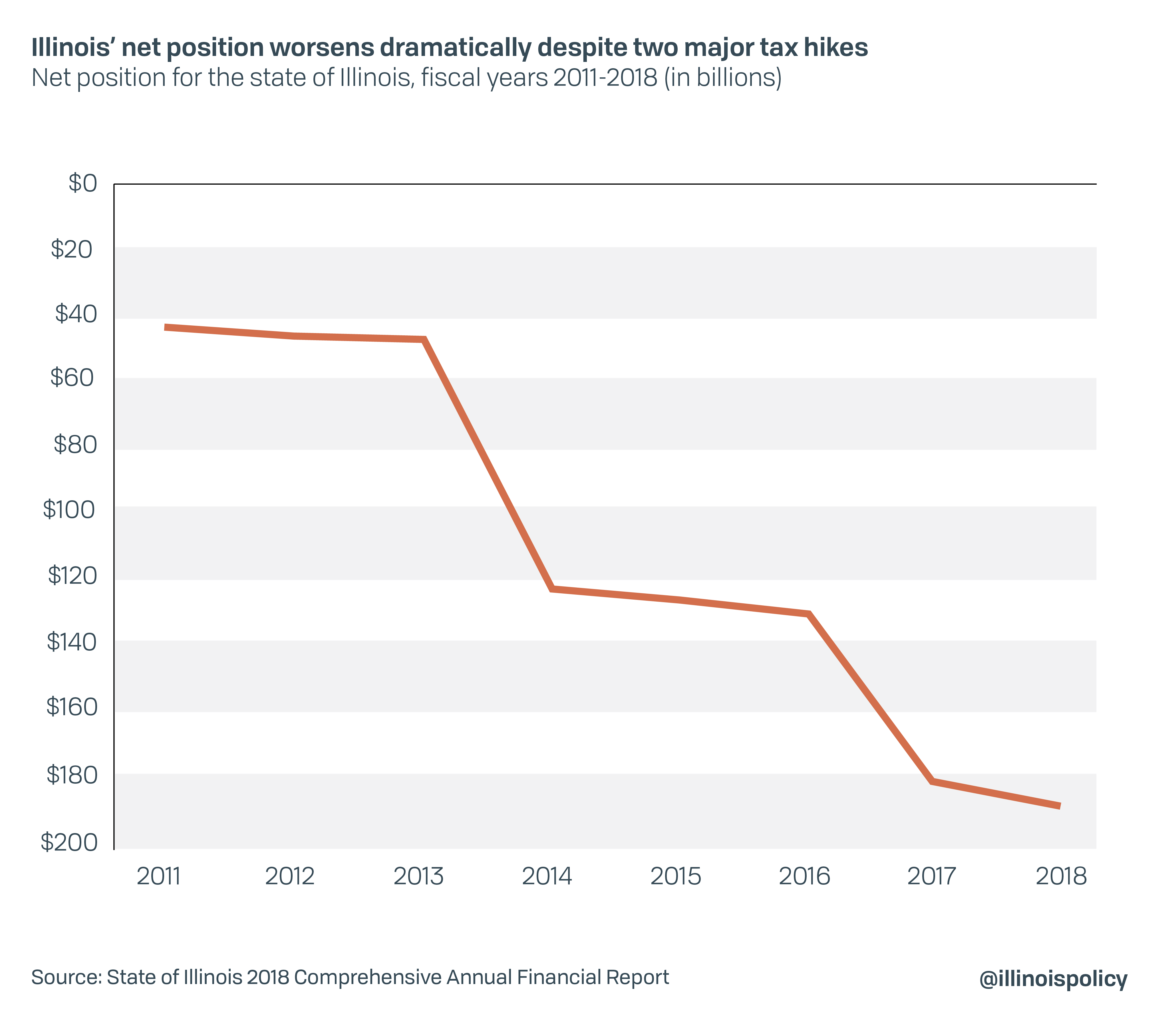

The temporary 2011 hike solved few problems for Illinois and the 2017 increase has been no better. The state still struggles with the nation’s worst pension crisis and the deficit has quadrupled since 2011.

Gov. J.B. Pritzker is now asking taxpayers to play this game again with a progressive income tax structure. He wants a small percentage of Illinois taxpayers to pay more in taxes to bail out the state’s financial mismanagement.

However, the governor’s revenue projection falls short. Pritzker says a progressive income tax will net the state an additional $3.4 billion. Analysis by the Illinois Policy Institute found it would only generate $1.4 billion more.

There is no possible way Pritzker can fulfill all of his spending promises, pay down billions in debt and still cut taxes for 97% of Illinoisans, as his proposal claims. Eventually, lawmakers will be back seeking another tax increase but with greater power to put unfair burdens on smaller groups of taxpayers, including taxing retirement income like every state with a progressive tax.

The Illinois Constitution contains a flat tax protection, meaning you pay more when you make more and pay less when you make less – but everyone pays the same rate. Lawmakers pay a political price when they raise everyone’s taxes, as happened in 2017 when resignations and voter backlash cleared out the General Assembly.

Giving the General Assembly a progressive income tax would be equivalent to handing them a blank check. They will be able to spend however much they want and selectively target different segments of the population for more taxes, reducing the number of angry taxpayers at any one time.

Illinois voters for the first time in 50 years have a chance Nov. 3 to tell Springfield what they think about tax increases. Lawmakers need to fix basics, such as pension growth and 20 years of deficit spending, before making another promise to taxpayers that history shows is bound to be broken.