Illinois personal income tax revenue could fall up to $6.6 billion from COVID-19 lockdown

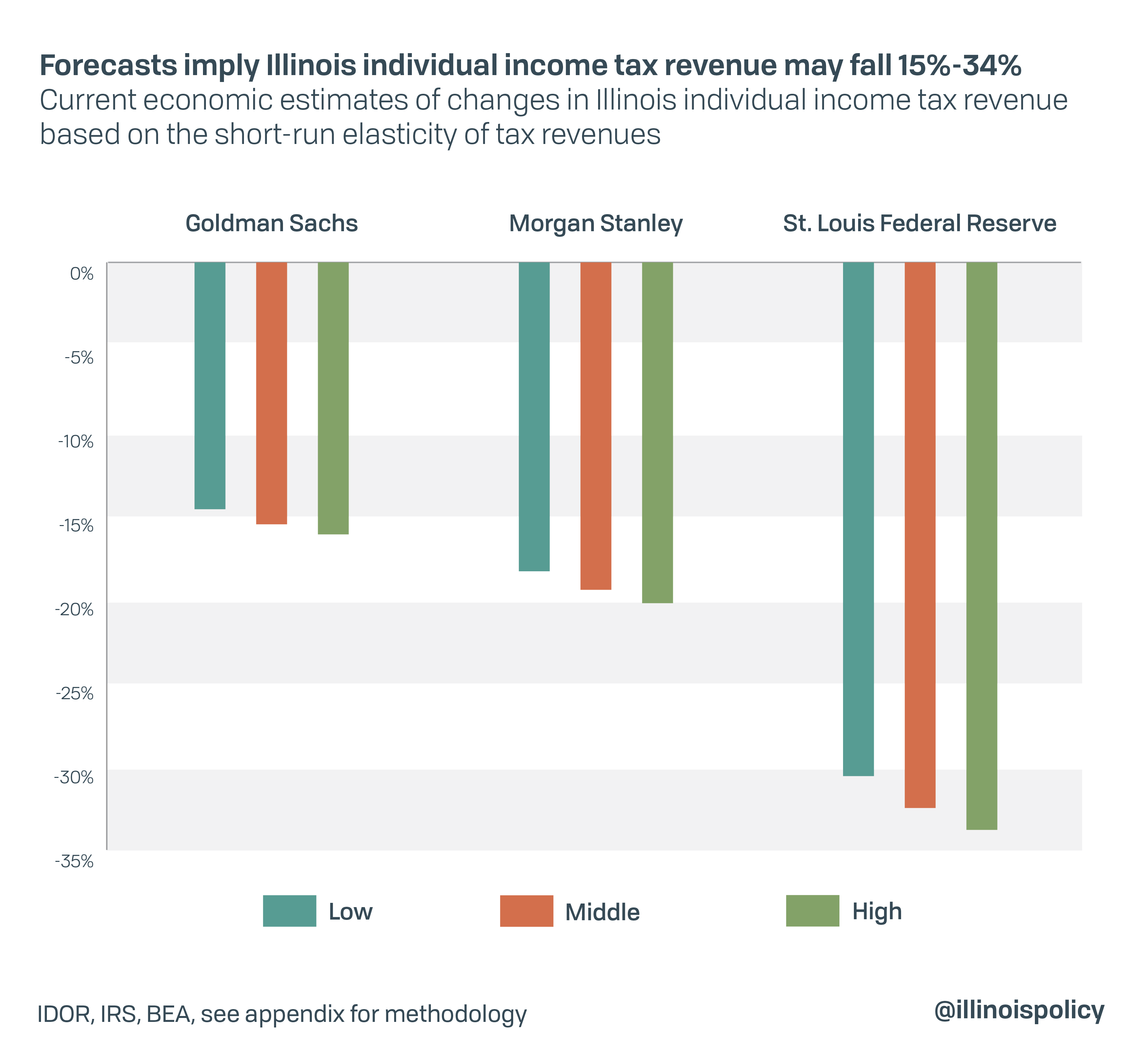

The severe economic downturn brought on by the coronavirus outbreak and measures taken to contain it could cause state personal income tax revenues to fall by 14.7% to 33.8% this year.

The economic effects of the current COVID-19 outbreak and measures to contain it are massive. Experts are predicting national declines in gross domestic product ranging from 24% to 50% in the second quarter of 2020, which would translate to a contraction between $54 billion and $113 billion for the state of Illinois.

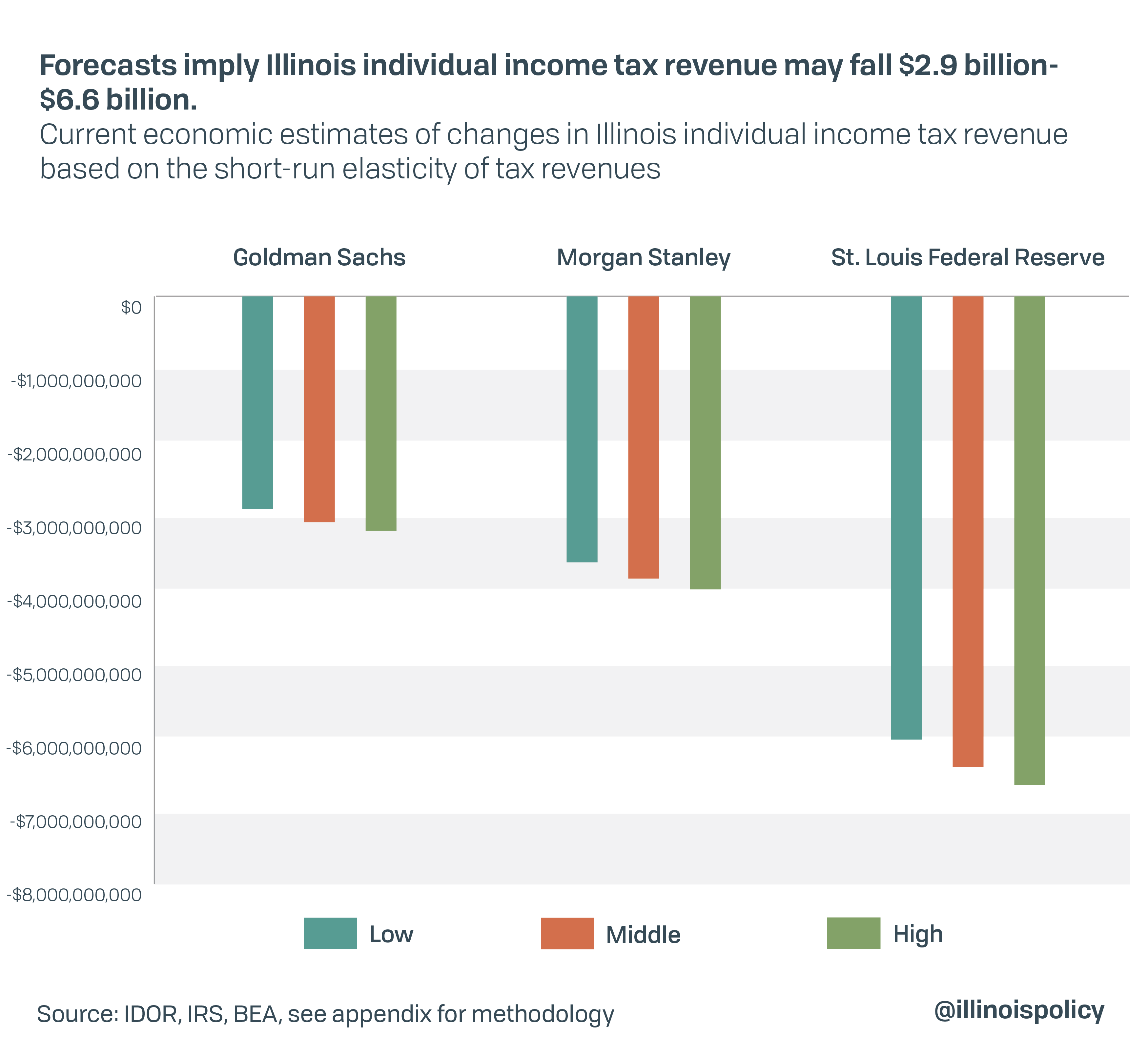

The massive reduction in economic activity and skyrocketing number of Illinoisans who now find themselves unemployed will also put a massive dent in income tax revenue for the state. In fiscal year 2020, Illinois collected $19.7 billion in individual income taxes, its largest source of tax revenue. However, if current projections hold, Illinois could see a reduction in income tax revenues ranging from $2.9 billion to $6.6 billion (see Appendix).

Historically in Illinois, a 1% change in GDP has been associated with a 2.4% to 2.7% change in taxable income. Current economic projections indicate the severe contraction expected in the second quarter of 2020 to translate into a 6% to 12.5% decline in GDP for the year. This decline in GDP would indicate Illinois taxable income, and therefore income tax collections, would drop anywhere from 14.7% to 33.8%.

Total revenue decline

Illinois was already facing a $1.7 billion budget shortfall for the upcoming fiscal year, prior to the onset of the COVID-19 pandemic. Now that large swaths of the economy have been shut down, revenues are expected to fall drastically, with researchers at the University of Illinois’ Institute of Government and Public Affairs estimating total revenues could decline anywhere from $4.3 billion in one year to $28.4 billion over three years, depending on the severity and duration of the downturn and the subsequent recovery.

Normally when states experience sudden downturns in revenue, they use their budget stabilization, or “rainy-day,” funds to cover budget shortfalls. Experts recommend states take advantage of economic expansions to maintain reserves that could cover state expenses for about a month.

Unfortunately, Illinois has virtually no rainy-day fund. The state’s budget stabilization fund currently has $1.19 million, enough to cover just over 15 minutes of state spending. The state has also become increasingly reliant on volatile sources of revenue in recent years, making the state budget more susceptible to downturns.

The current administration’s progressive income tax proposal could not offset the coming decline in personal income tax revenues

A large reason for why the state is likely to suffer such a massive dip in revenues is the heavy reliance on income taxes. Federal Reserve Bank economists have pointed out that income taxes are often subject to the largest swings, offering robust growth during good times but also severely contracting during downturns. Meanwhile, consumption-based taxes generally provide both growth in tax revenues and stability.

As noted by economists and observed during the last recession, income taxes tend to be the most volatile source of revenue. An increase in the income tax, while bringing in greater revenues, would also mean larger dips in revenue during economic downturns. The increase in Illinois income taxes during the past decade is already one of the reasons revenues are more volatile now than in the past.

Not only would increasing the state’s reliance on income taxes threaten the stability of tax revenues, but changing the income tax from flat to progressive would generate added volatility. Progressive income taxes are more volatile than flat income taxes because they rely on smaller segments of the population for large portions of revenue, and the income for these earners is far less stable than most. Had Illinois had a progressive income tax during the last downturn, income tax revenue would have fallen by $613 million more than it did under the state’s flat tax, generating a total decline of $2.16 billion in income tax revenue.

While it remains to be seen what the final effects of the COVID-19 outbreak will be on GDP and therefore income tax collections, one thing is certain: the decline in revenue would have been larger if the state had a progressive income tax. As the state stares down a massive budget hole, it is important to recognize that (1) adopting a progressive income tax means larger swings in state income tax revenue and (2) the governor’s estimated revenues from the proposed progressive income tax – barring any changes in revenue forecasts because of the downturn – would cover less than half of the current projected budget deficit.

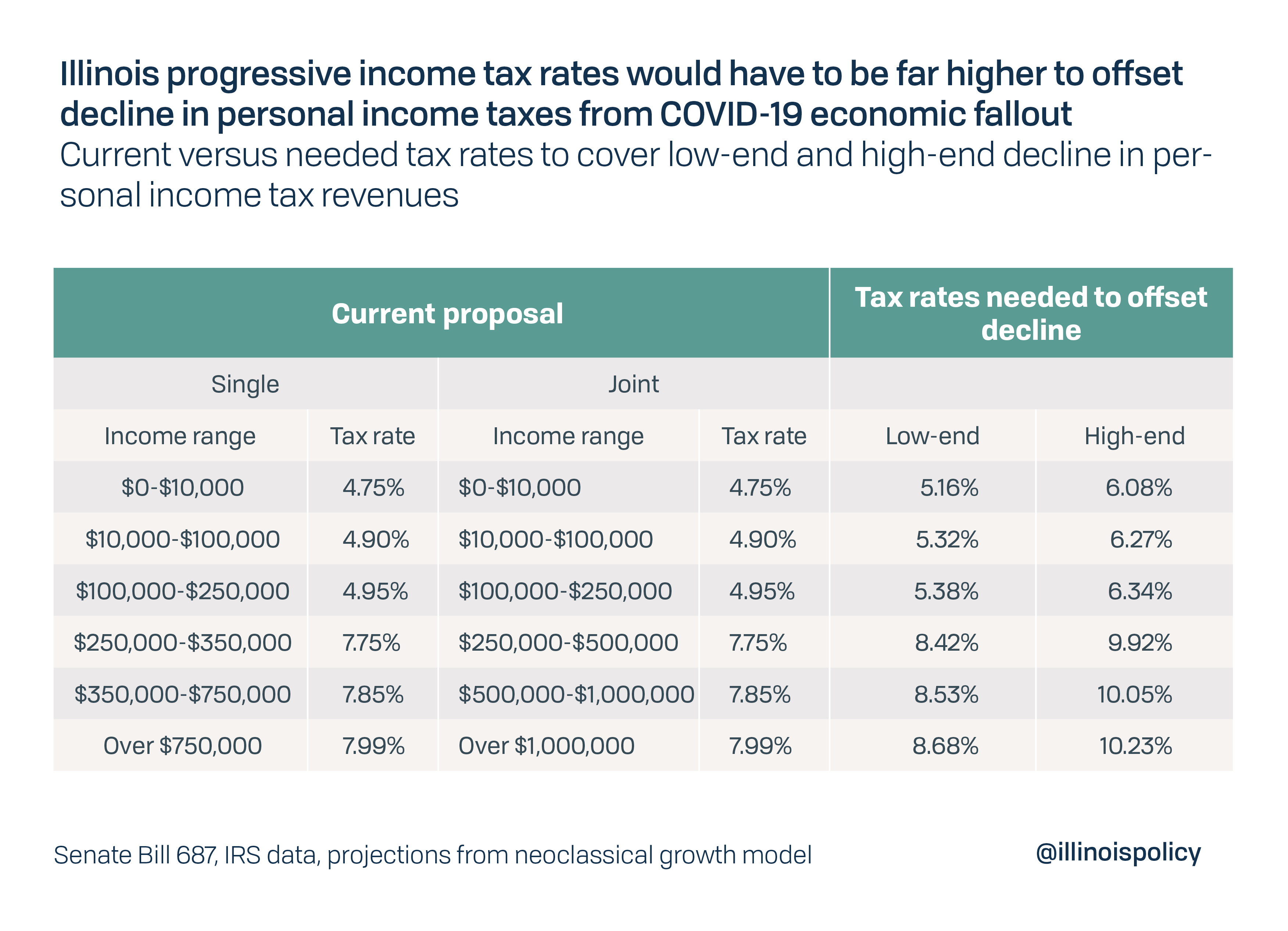

If the proposed progressive tax amendment is not withdrawn by the General Assembly, voters approve it on Nov. 3 and the progressive income tax rates already passed by the legislature take effect, Illinoisans will face income tax rates ranging from 4.75% to 7.99% starting Jan. 1, 2021.

While state leaders previously estimated this plan would bring in an additional $3.7 billion in income tax revenue, their estimates were not factoring in an economic contraction of the current magnitude. The currently proposed rates are not even enough to offset the anticipated decline in income tax revenues. In order for the progressive income tax, as it is currently structured, to offset the decline in personal income tax revenue, tax rates would have to be far higher for all Illinoisans (see Appendix B).

Marginal income tax rates would have to range from 5.16% to 8.68% in order for the progressive income tax to offset the low-end estimate for the decline in income tax revenue. In the worst-case scenario, tax rates would have to be far higher, ranging from 6.08% to 10.23%. This tax increase would represent a $286 to $1,056 income tax hike for the typical Illinois family, who made $81,313 in 2018.

In any scenario, using the progressive income tax to offset the decline in personal income tax revenue would result in a tax hike for all Illinoisans. With the total decline in all tax revenues for the state potentially growing to over $28 billion, it is clear that a progressive income tax would not be able to solve the state’s budget woes.

As the state battles with economic fallout from COVID-19, the anticipated income tax revenue from the current progressive income tax would likely be far less, prompting the state to raise income tax rates to cover part – or all – of the shortfall. Instead of pushing a progressive income tax hike in the midst of an economic crisis, lawmakers should provide certainty and stability to taxpayers and remove the question from the ballot.